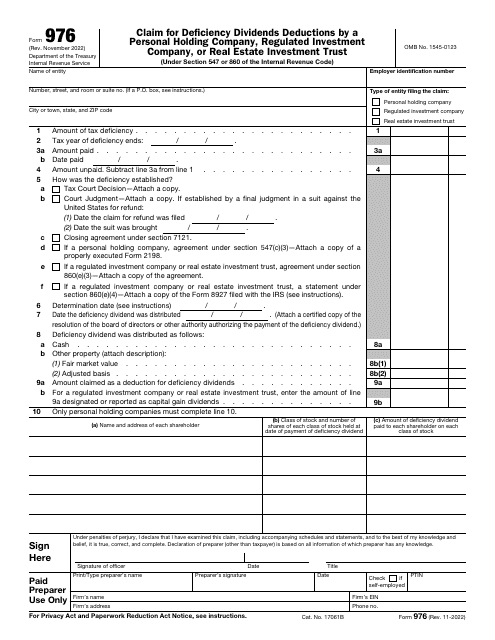

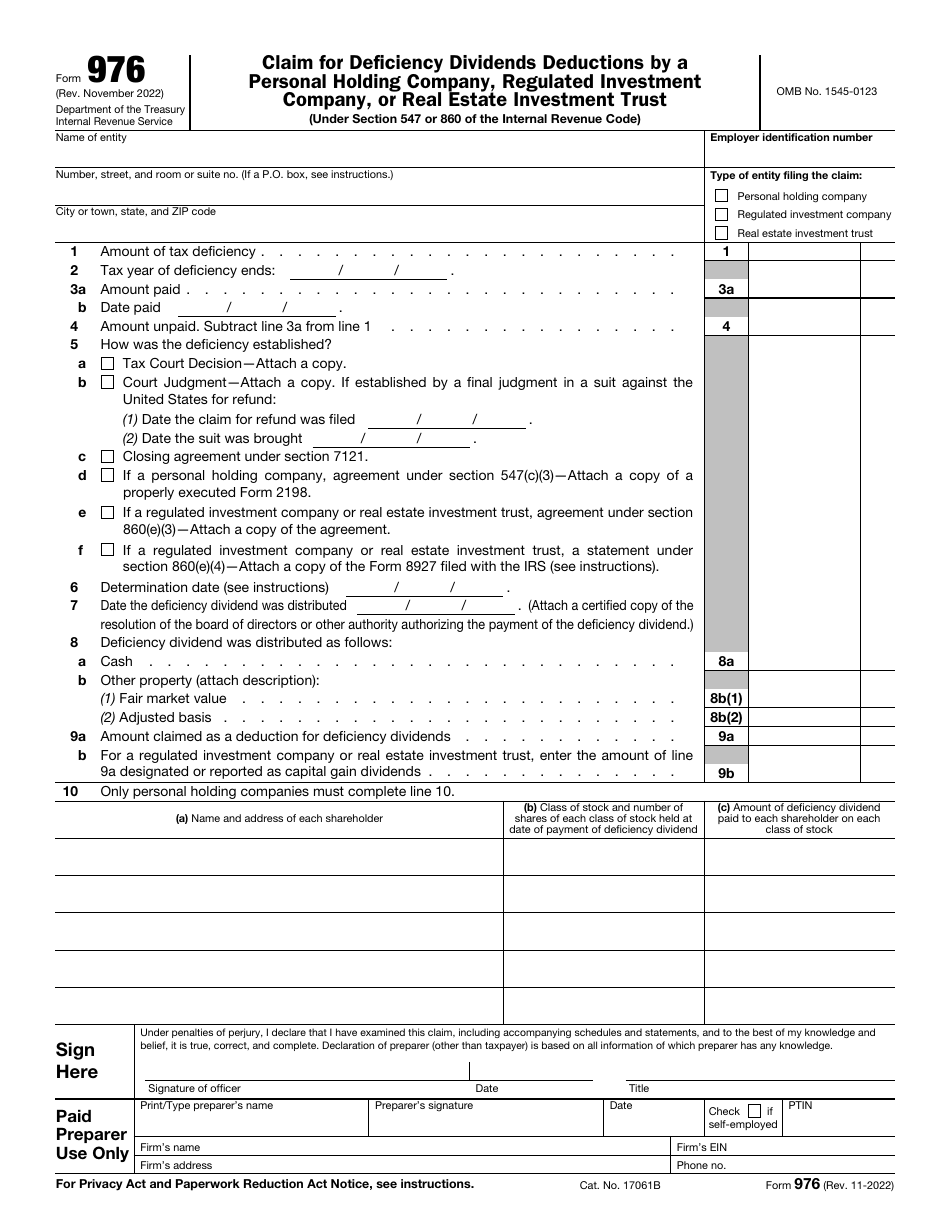

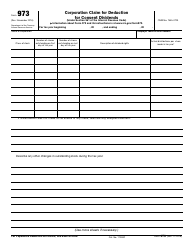

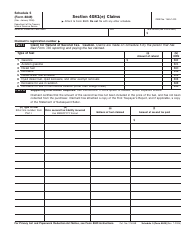

IRS Form 976 Claim for Deficiency Dividends Deductions by a Personal Holding Company, Regulated Investment Company, or Real Estate Investment Trust

Fill PDF Online

Fill out online for free

without registration or credit card

What Is IRS Form 976?

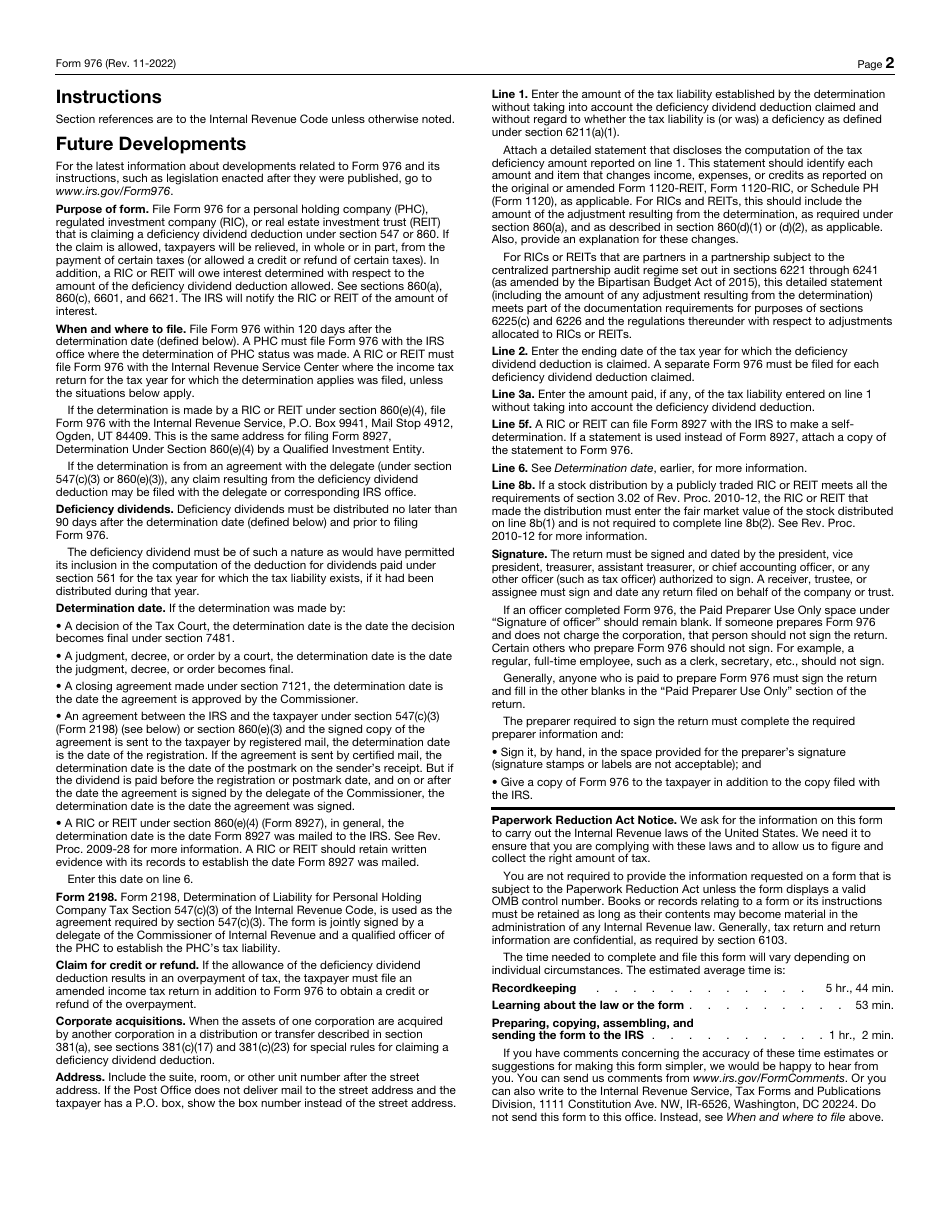

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2022. As of today, no separate filing guidelines for the form are provided by the IRS.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Additional instructions and information can be found on page 2 of the document;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 976 through the link below or browse more documents in our library of IRS Forms.