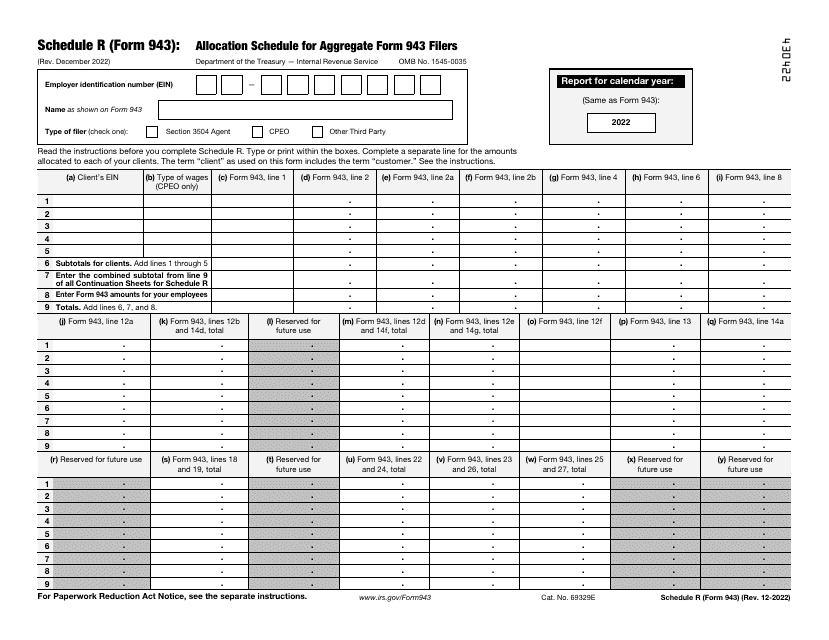

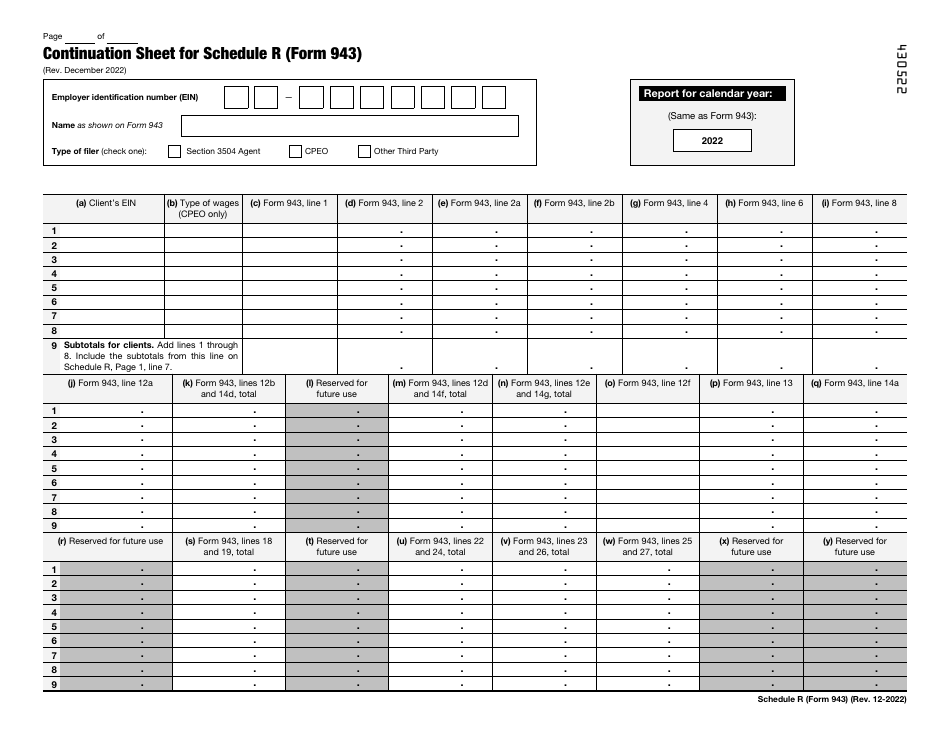

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 943 Schedule R

for the current year.

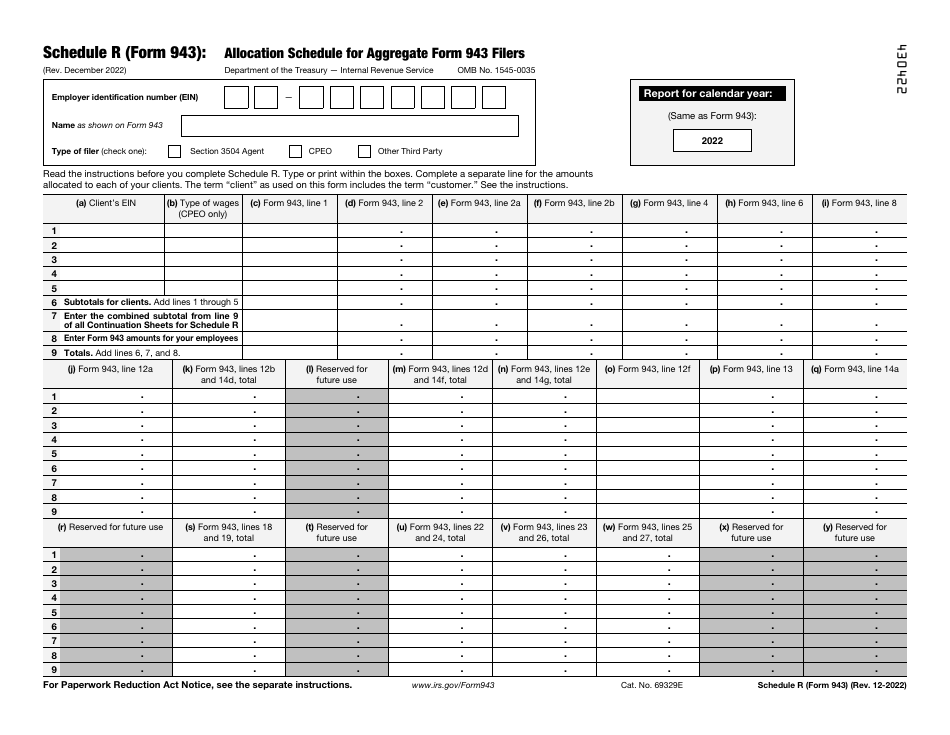

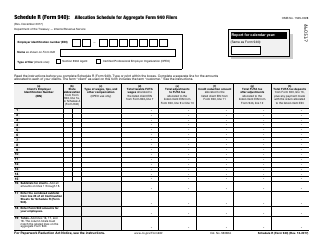

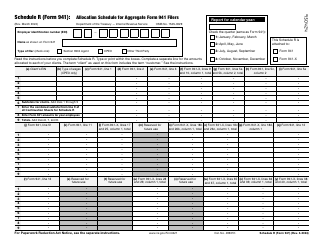

IRS Form 943 Schedule R Allocation Schedule for Aggregate Form 943 Filers

What Is IRS Form 943 Schedule R?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2022. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is Form 943?

A: Form 943 is a tax form used by employers to report wages and taxes for agricultural employees.

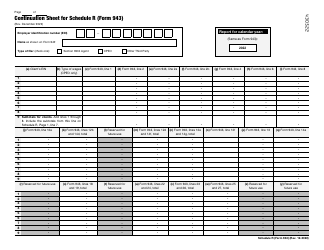

Q: What is Schedule R?

A: Schedule R is an allocation schedule used by employers who file Form 943 to allocate wages and taxes for agricultural employees among multiple locations or states.

Q: Who needs to file Form 943?

A: Employers who have paid wages to one or more agricultural employees and the total wages paid during the year exceed a certain threshold must file Form 943.

Q: What information is required on Schedule R?

A: Schedule R requires employers to provide detailed information about each agricultural employee, including their name, social security number, and wages.

Q: Can Schedule R be e-filed?

A: Yes, Schedule R can be filed electronically as part of the Form 943 filing.

Q: Is Schedule R required for all Form 943 filers?

A: No, Schedule R is only required for employers who need to allocate wages and taxes for agricultural employees among multiple locations or states.

Q: What is the deadline for filing Form 943 with Schedule R?

A: Form 943 with Schedule R must be filed by January 31 of the following year. However, if you made timely deposits in full payment of the taxes for the year, you may file Form 943 by February 10.

Q: Are there any penalties for late or incorrect filing of Form 943 with Schedule R?

A: Yes, there are penalties for late or incorrect filing of Form 943 and Schedule R. It is important to file accurately and on time to avoid any penalties or interest charges.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 943 Schedule R through the link below or browse more documents in our library of IRS Forms.