This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 940

for the current year.

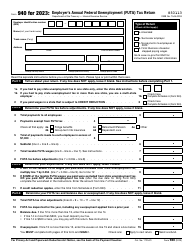

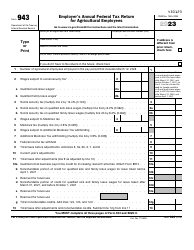

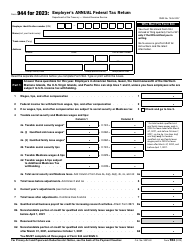

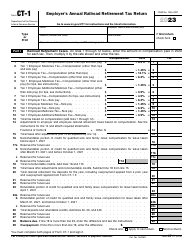

Instructions for IRS Form 940 Employer's Annual Federal Unemployment (Futa) Tax Return

This document contains official instructions for IRS Form 940 , Employer's Annual Federal Unemployment (Futa) Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 940 Schedule A is available for download through this link.

FAQ

Q: What is IRS Form 940?

A: IRS Form 940 is the Employer's Annual Federal Unemployment (FUTA) Tax Return.

Q: Who needs to file Form 940?

A: Employers who pay wages to employees and meet certain criteria for federal unemployment taxes need to file Form 940.

Q: What is the purpose of Form 940?

A: Form 940 is used to report and pay the federal unemployment tax owed to the IRS.

Q: When is Form 940 due?

A: Form 940 is due annually on January 31.

Q: Can Form 940 be filed electronically?

A: Yes, Form 940 can be filed electronically through the IRS's e-file system.

Q: What information is required for Form 940?

A: Form 940 requires information about the employer, wages paid to employees, and the amount of federal unemployment tax owed.

Q: Is Form 940 the only tax form employers need to file for unemployment taxes?

A: No, employers also need to file state unemployment tax forms based on their individual state requirements.

Q: What happens if an employer does not file Form 940?

A: Failure to file Form 940 or pay the required taxes may result in penalties and interest being charged by the IRS.

Q: Can I get help with filling out Form 940?

A: Yes, the IRS provides instructions for completing Form 940, and you can also seek assistance from a tax professional or accountant.

Instruction Details:

- This 15-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.