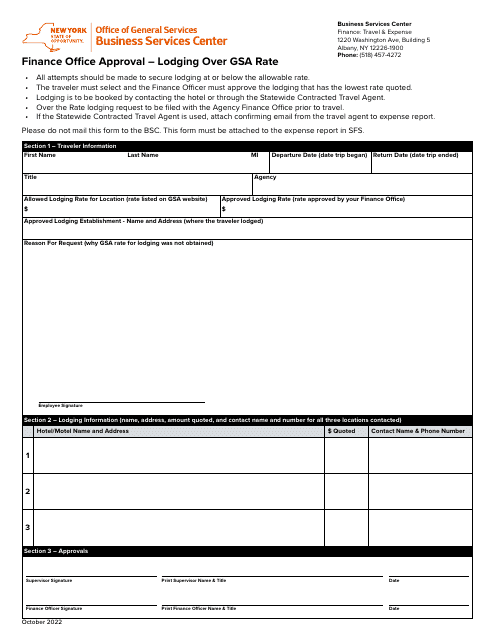

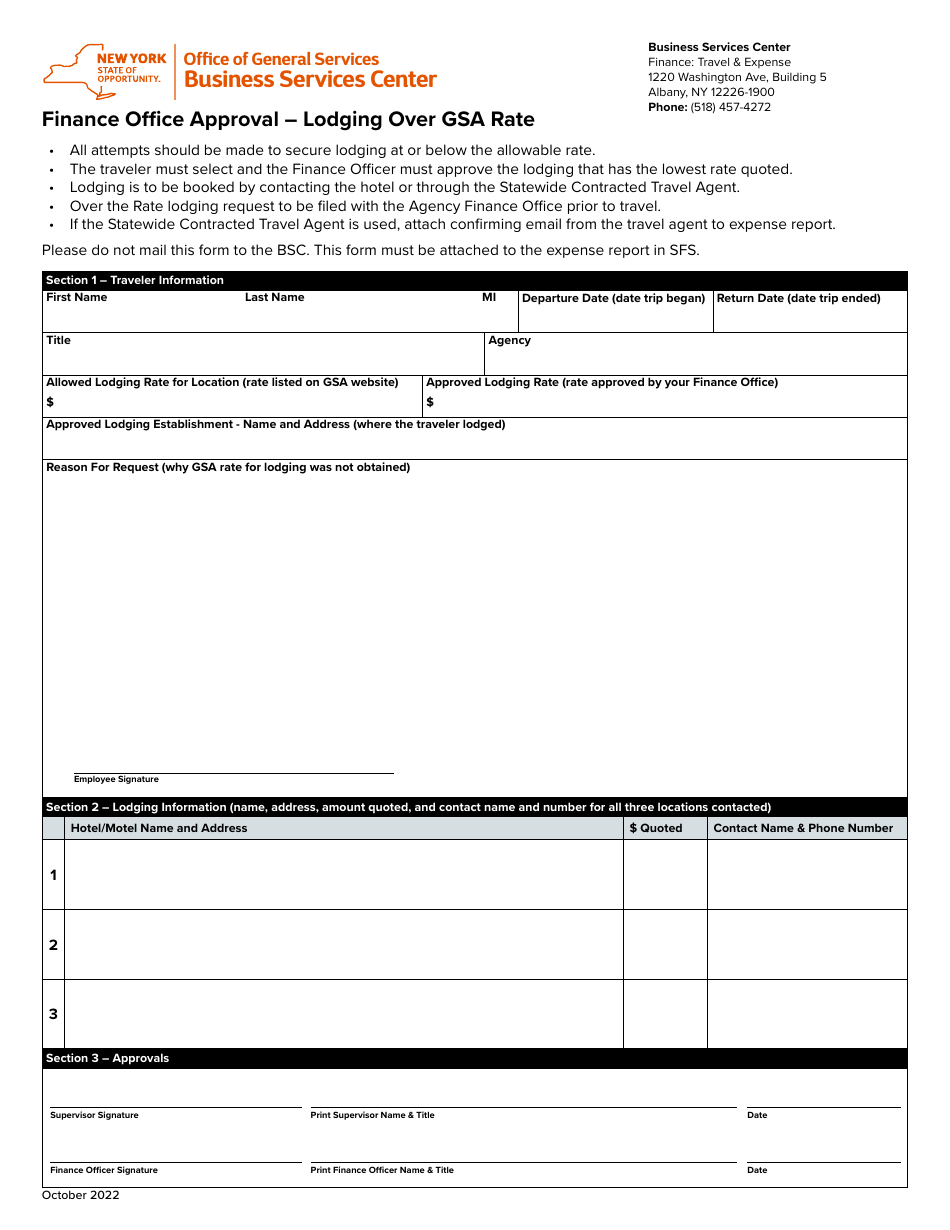

Finance Office Approval - Lodging Over GSA Rate - New York

Finance Office Approval - Lodging Over GSA Rate is a legal document that was released by the New York State Office of General Services - a government authority operating within New York.

FAQ

Q: What is GSA rate?

A: GSA rate refers to the maximum amount allowed to be reimbursed for lodging expenses.

Q: What happens if lodging expenses exceed the GSA rate?

A: If lodging expenses exceed the GSA rate, it may require additional approval.

Q: What is the process for obtaining approval for lodging over the GSA rate?

A: To obtain approval, you need to contact the Finance Office and explain the circumstances.

Q: Is approval for lodging over the GSA rate guaranteed?

A: Approval for lodging over the GSA rate is not guaranteed and depends on the justification provided.

Q: Can you provide an example of when lodging over the GSA rate might be approved?

A: Lodging over the GSA rate might be approved if there are no available lodging options within the GSA rate or if there are extenuating circumstances.

Form Details:

- Released on October 1, 2022;

- The latest edition currently provided by the New York State Office of General Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New York State Office of General Services.