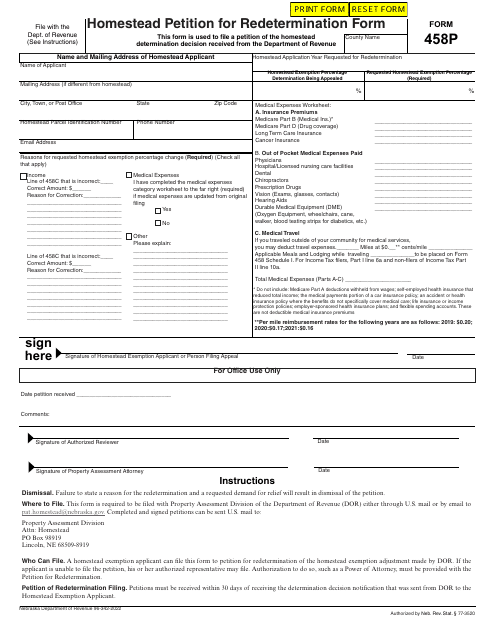

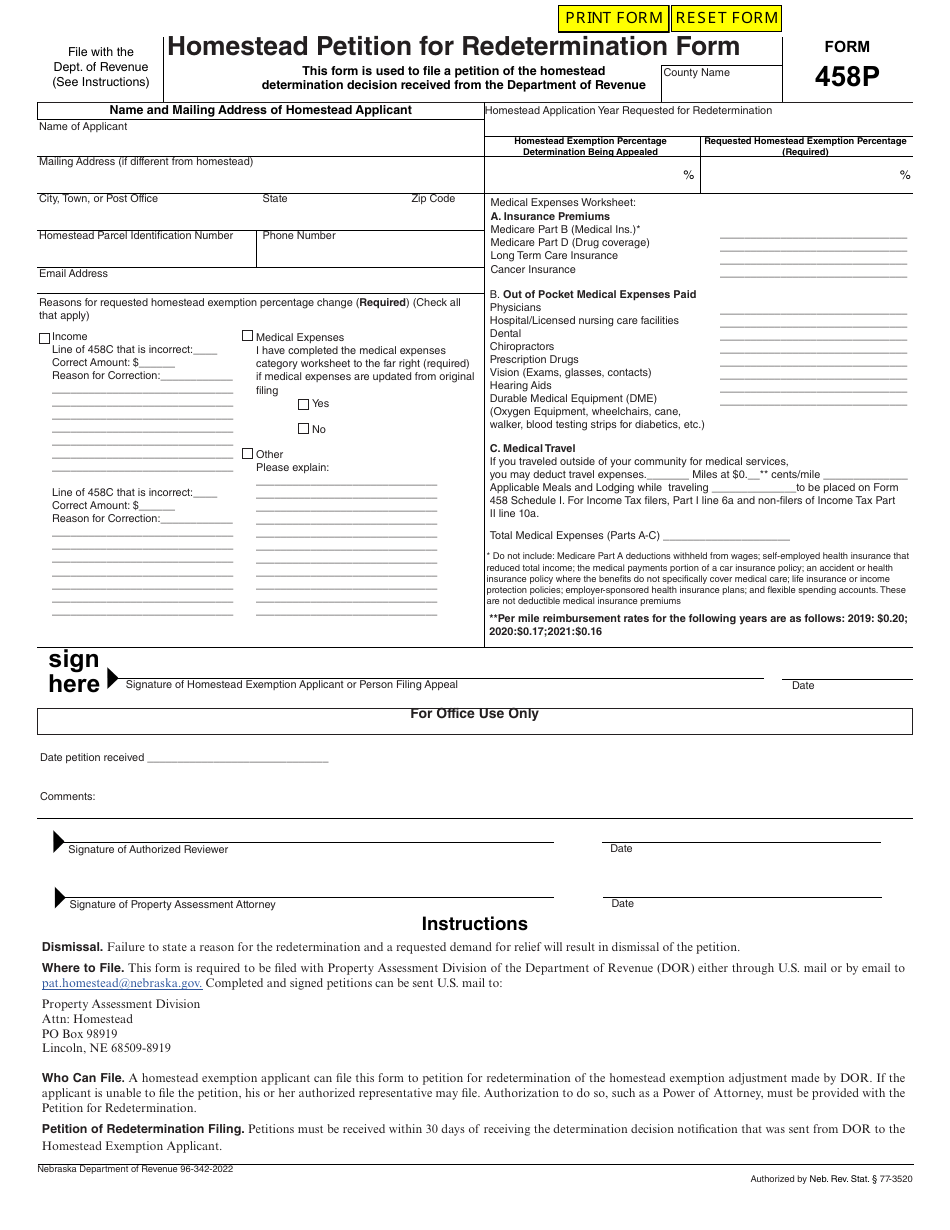

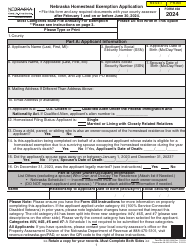

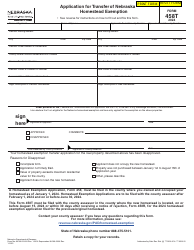

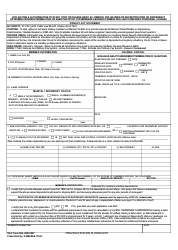

Form 458P Homestead Petition for Redetermination Form - Nebraska

What Is Form 458P?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 458P?

A: Form 458P is the Homestead Petition for Redetermination form.

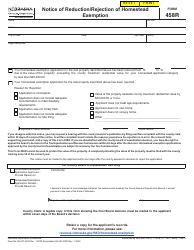

Q: What is the purpose of Form 458P?

A: The purpose of Form 458P is to request a redetermination of your property's homestead status in Nebraska.

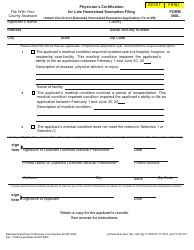

Q: Who is eligible to file Form 458P?

A: Any property owner in Nebraska who believes their property has been incorrectly classified for homestead purposes may file Form 458P.

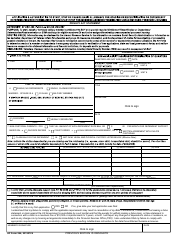

Q: What information do I need to provide on Form 458P?

A: You will need to provide your contact information, property details, and the reasons for your request for redetermination.

Q: Is there a deadline for filing Form 458P?

A: Yes, you must file Form 458P within 30 days of receiving your Notice of Homestead Status or by July 1st of the assessment year, whichever is later.

Q: What happens after I file Form 458P?

A: After you file Form 458P, the county board of equalization will review your request and make a determination. You will be notified of their decision in writing.

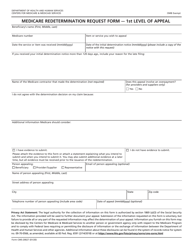

Q: Can I appeal the county board of equalization's decision?

A: Yes, if you disagree with the county board of equalization's decision, you can appeal to the Nebraska Tax Equalization and Review Commission.

Q: Is there a fee for filing Form 458P?

A: No, there is no fee for filing Form 458P.

Form Details:

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 458P by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.