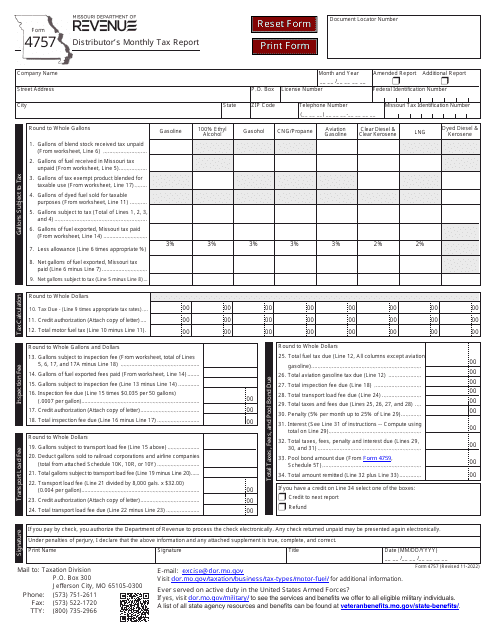

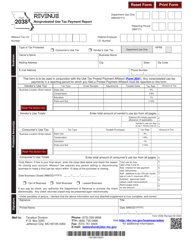

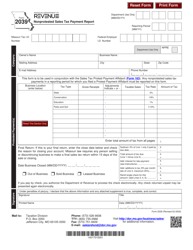

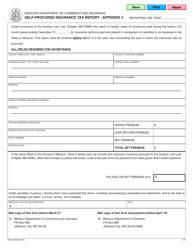

Form 4757 Distributor's Monthly Tax Report - Missouri

What Is Form 4757?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4757?

A: Form 4757 is the Distributor's Monthly Tax Report in Missouri.

Q: Who needs to file Form 4757?

A: Distributors in Missouri need to file Form 4757.

Q: What is the purpose of Form 4757?

A: The purpose of Form 4757 is to report and remit the monthly tax liability for distributors in Missouri.

Q: How often do you need to file Form 4757?

A: Form 4757 needs to be filed monthly by distributors in Missouri.

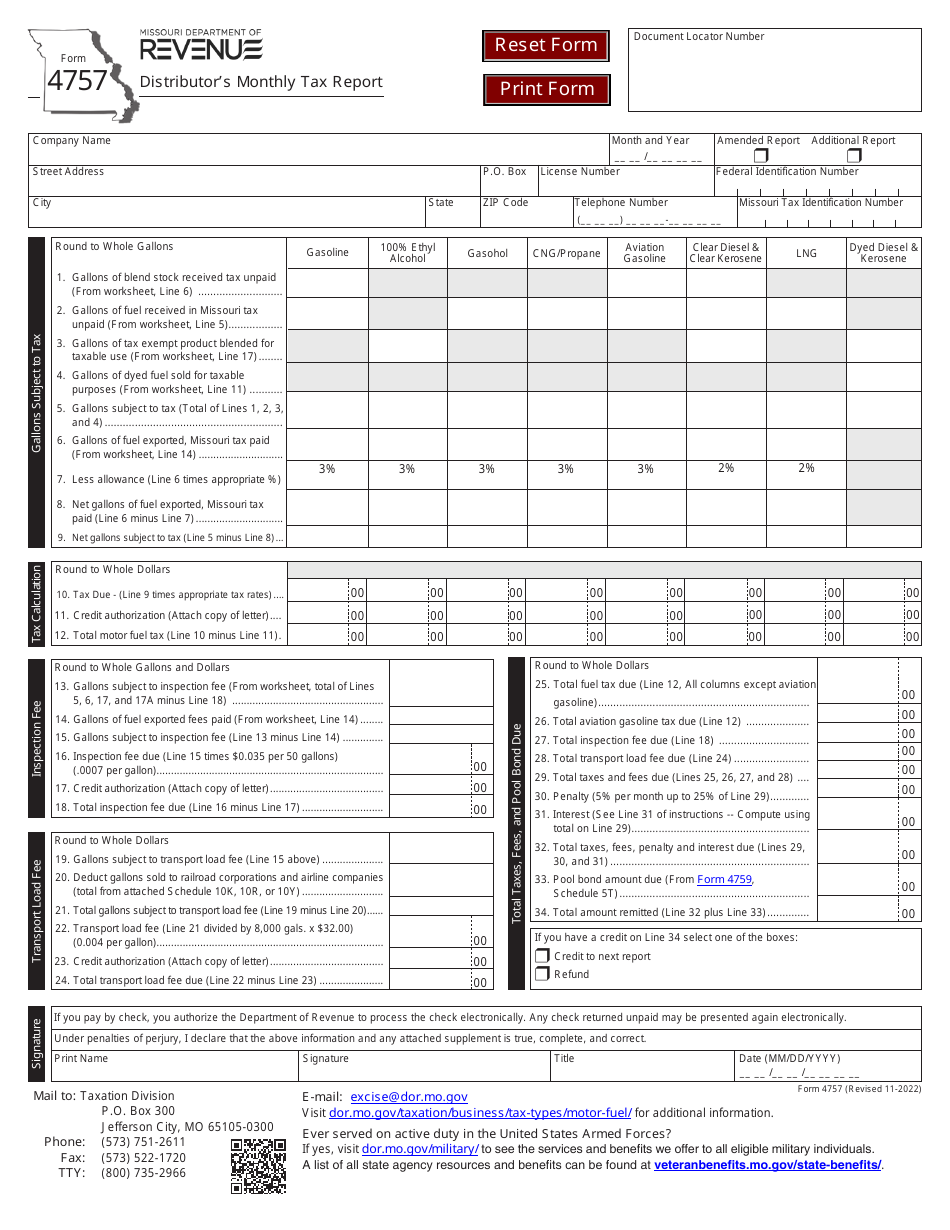

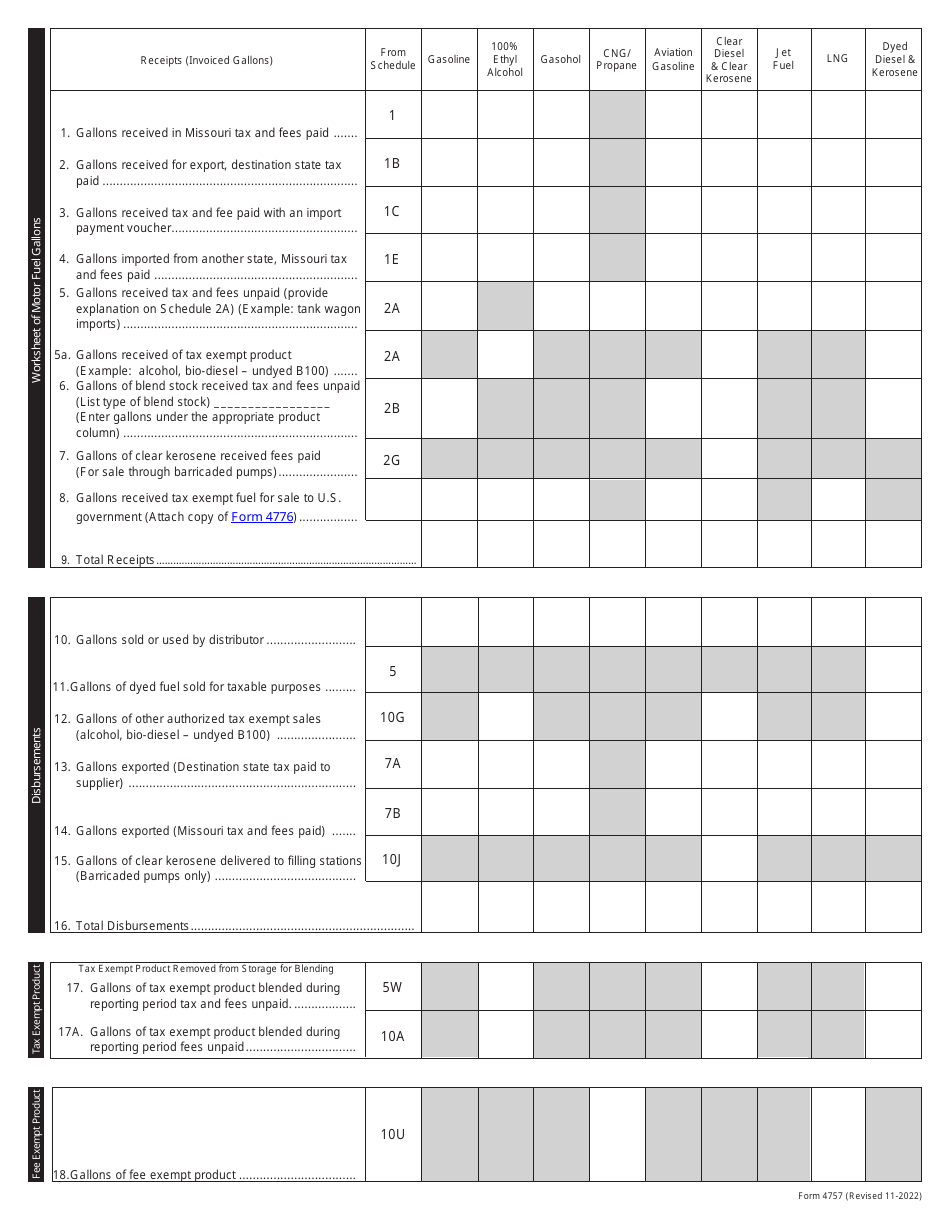

Q: What information is required on Form 4757?

A: Form 4757 requires distributors to provide information such as gross sales, taxable sales, and tax due.

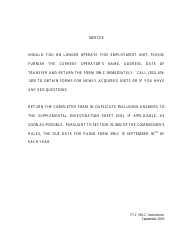

Q: Are there any penalties for not filing Form 4757?

A: Yes, there are penalties for not filing Form 4757, including late filing penalties and interest on unpaid taxes.

Q: When is the due date for Form 4757?

A: The due date for Form 4757 is the last day of the month following the reporting period.

Q: Is there a minimum tax liability for filing Form 4757?

A: Yes, distributors with a tax liability of $100 or more per month are required to file Form 4757.

Form Details:

- Released on November 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4757 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.