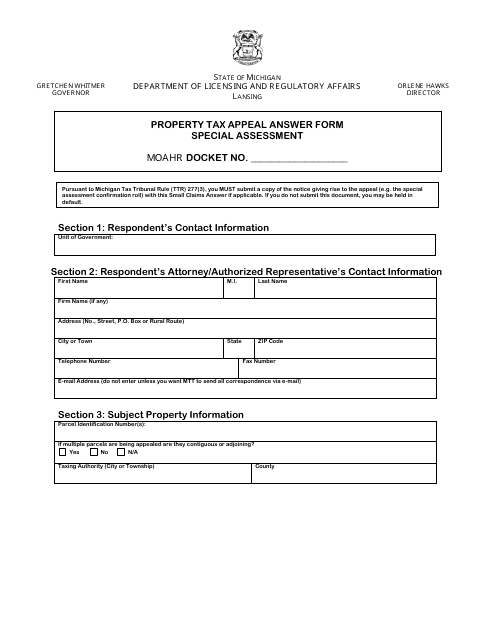

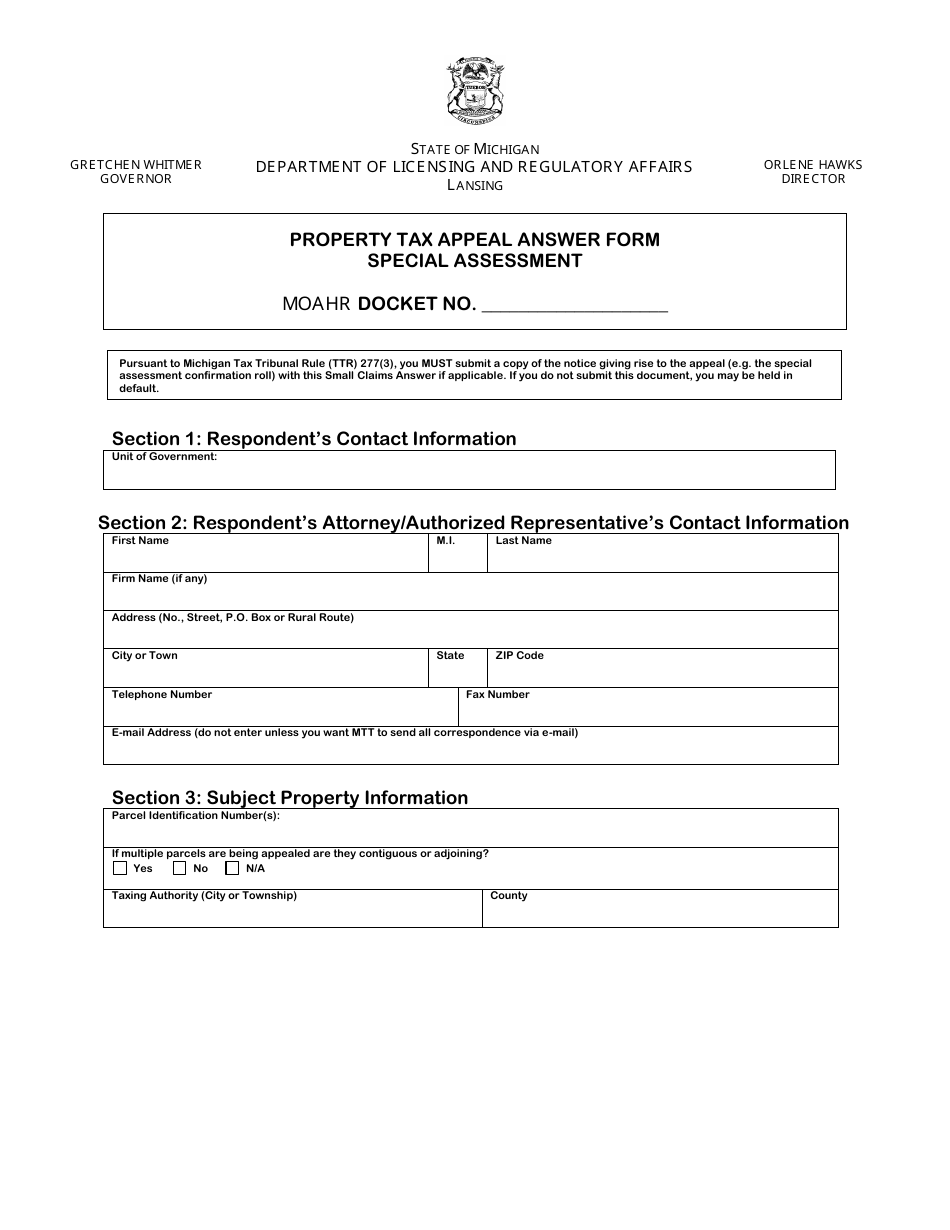

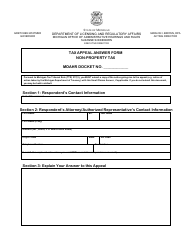

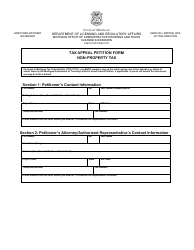

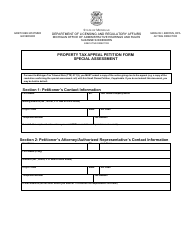

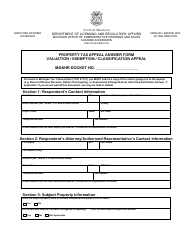

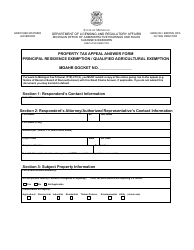

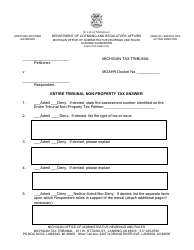

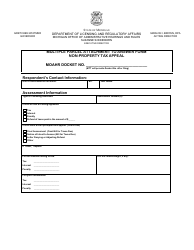

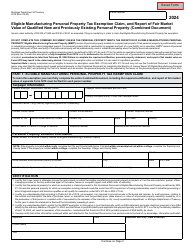

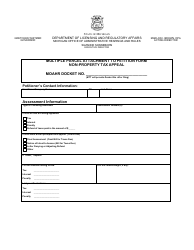

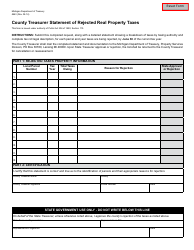

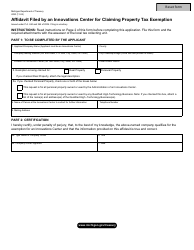

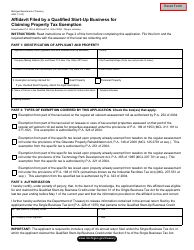

Property Tax Appeal Answer Form - Special Assessment - Michigan

Property Tax Appeal Answer Form - Special Assessment is a legal document that was released by the Michigan Department of Licensing and Regulatory Affairs - a government authority operating within Michigan.

FAQ

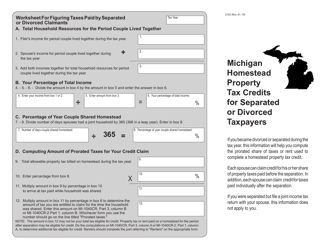

Q: What is a property tax appeal?

A: A property tax appeal is a process where you challenge the assessed value of your property in order to potentially lower your property taxes.

Q: What is a special assessment?

A: A special assessment is an additional charge imposed on property owners for specific public improvements or services, such as road repairs or street lighting.

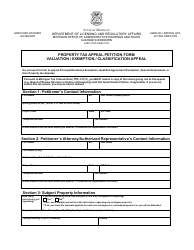

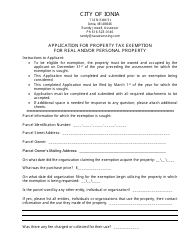

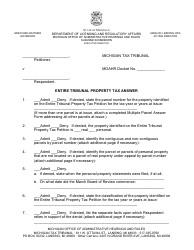

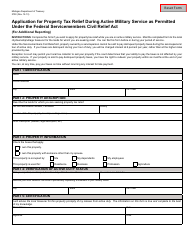

Q: How can I appeal a special assessment in Michigan?

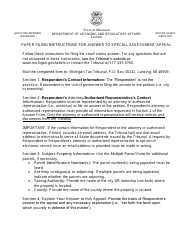

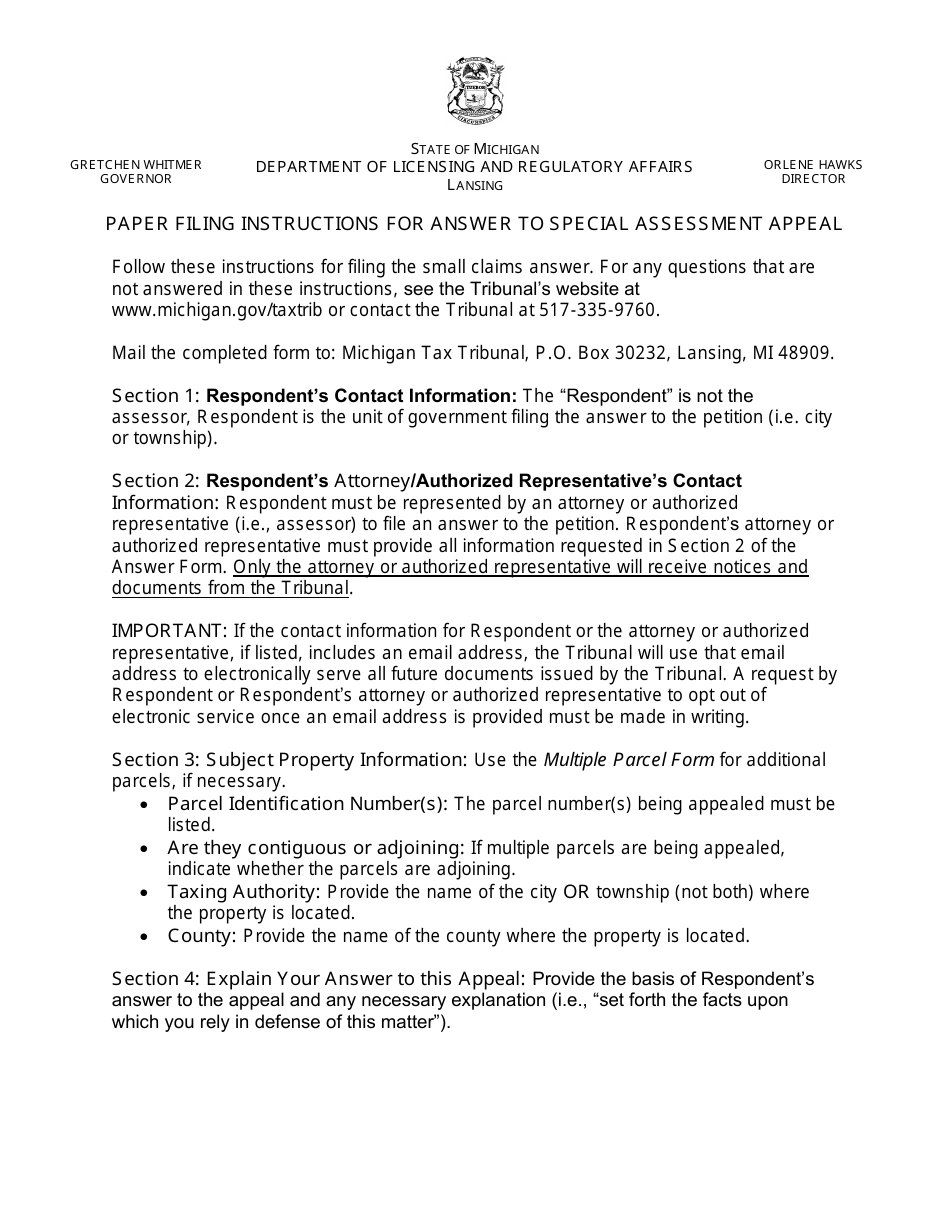

A: To appeal a special assessment in Michigan, you can complete and submit a Property Tax Appeal Answer Form specifically for special assessments.

Q: What information do I need to include in the Property Tax Appeal Answer Form?

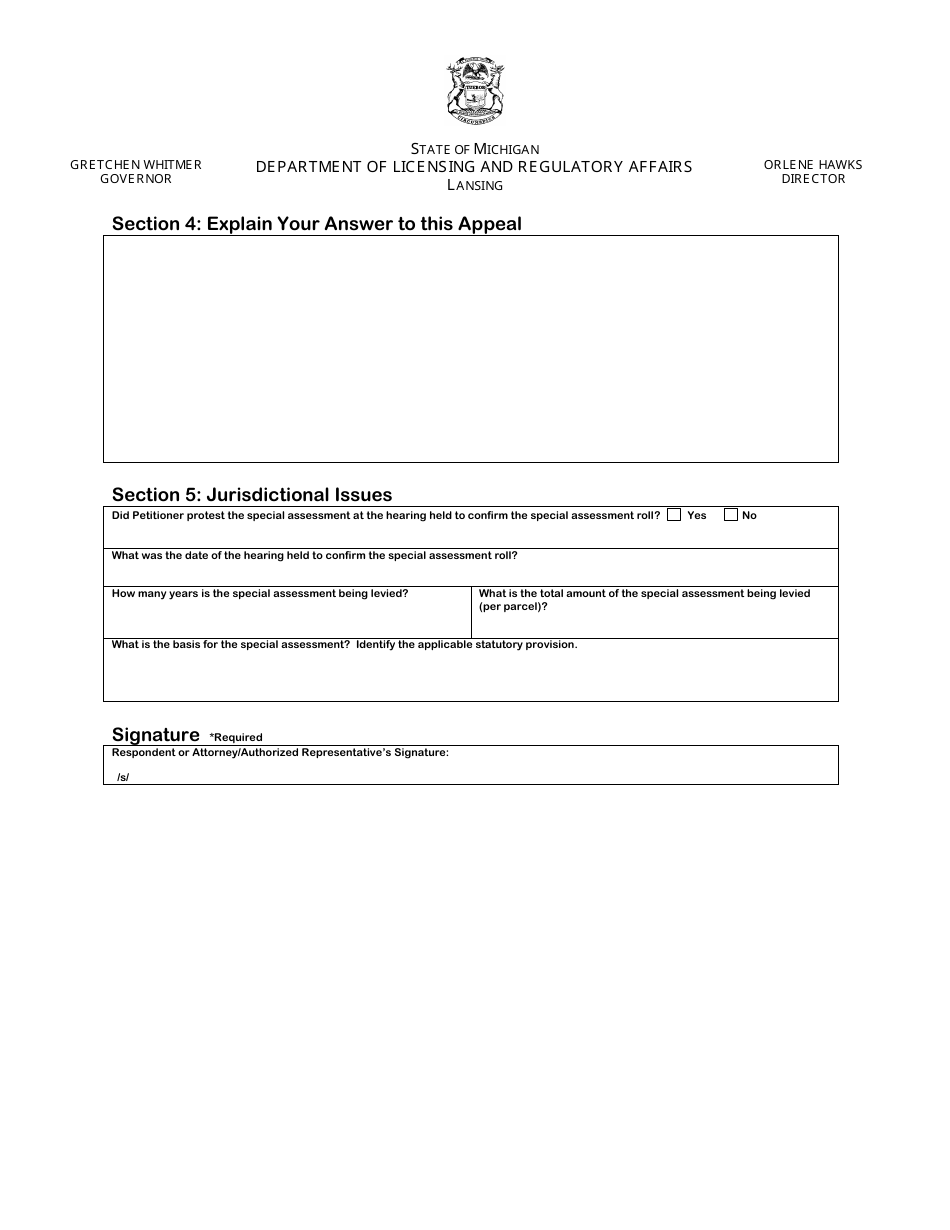

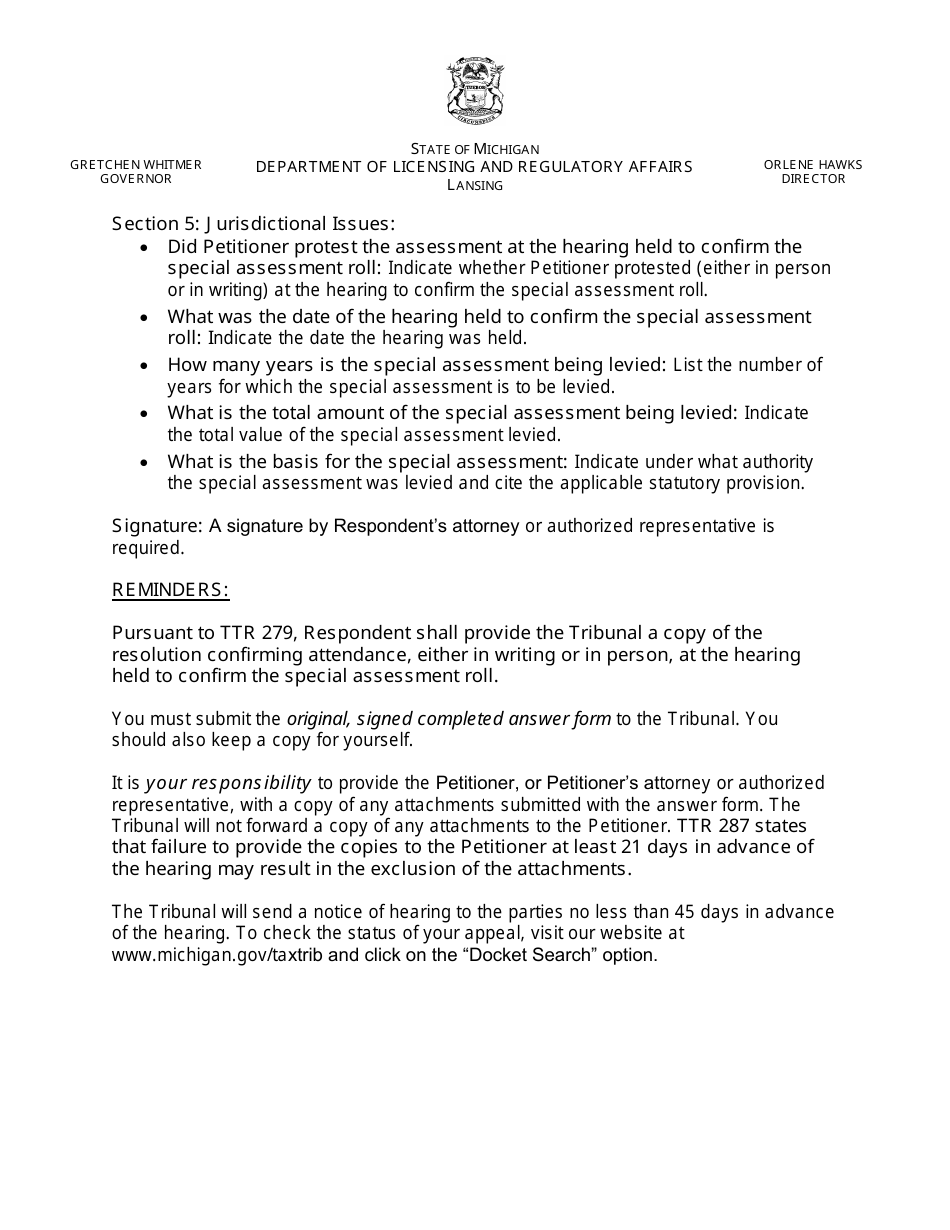

A: You will need to provide your property information, the reasons for your appeal, and any supporting evidence or documentation.

Q: What happens after I submit the Property Tax Appeal Answer Form?

A: After you submit the form, your appeal will be reviewed by the appropriate authorities, and you will be notified of the outcome.

Q: Can I hire a professional to help with my property tax appeal?

A: Yes, you have the option to hire a professional, such as a tax assessor or attorney, to assist you with your property tax appeal.

Q: What if my property tax appeal is denied?

A: If your property tax appeal is denied, you may have the option to further appeal the decision through the Michigan Tax Tribunal or other relevant authorities.

Q: Are there any fees associated with filing a property tax appeal?

A: There may be filing fees or costs associated with filing a property tax appeal, which vary depending on the jurisdiction. It is advisable to check with the local assessor's office for more information.

Form Details:

- The latest edition currently provided by the Michigan Department of Licensing and Regulatory Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Michigan Department of Licensing and Regulatory Affairs.