This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

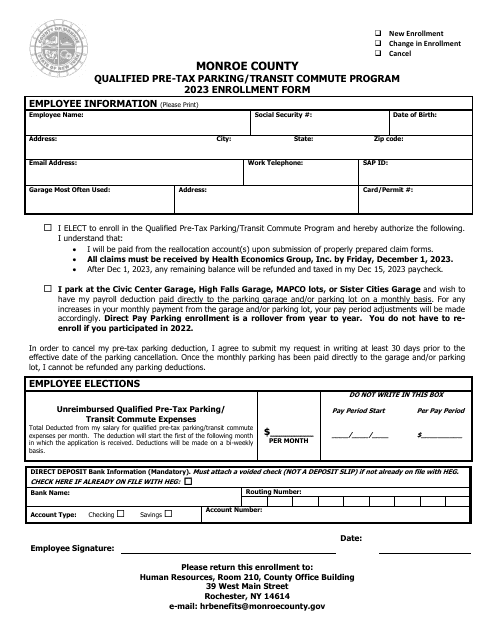

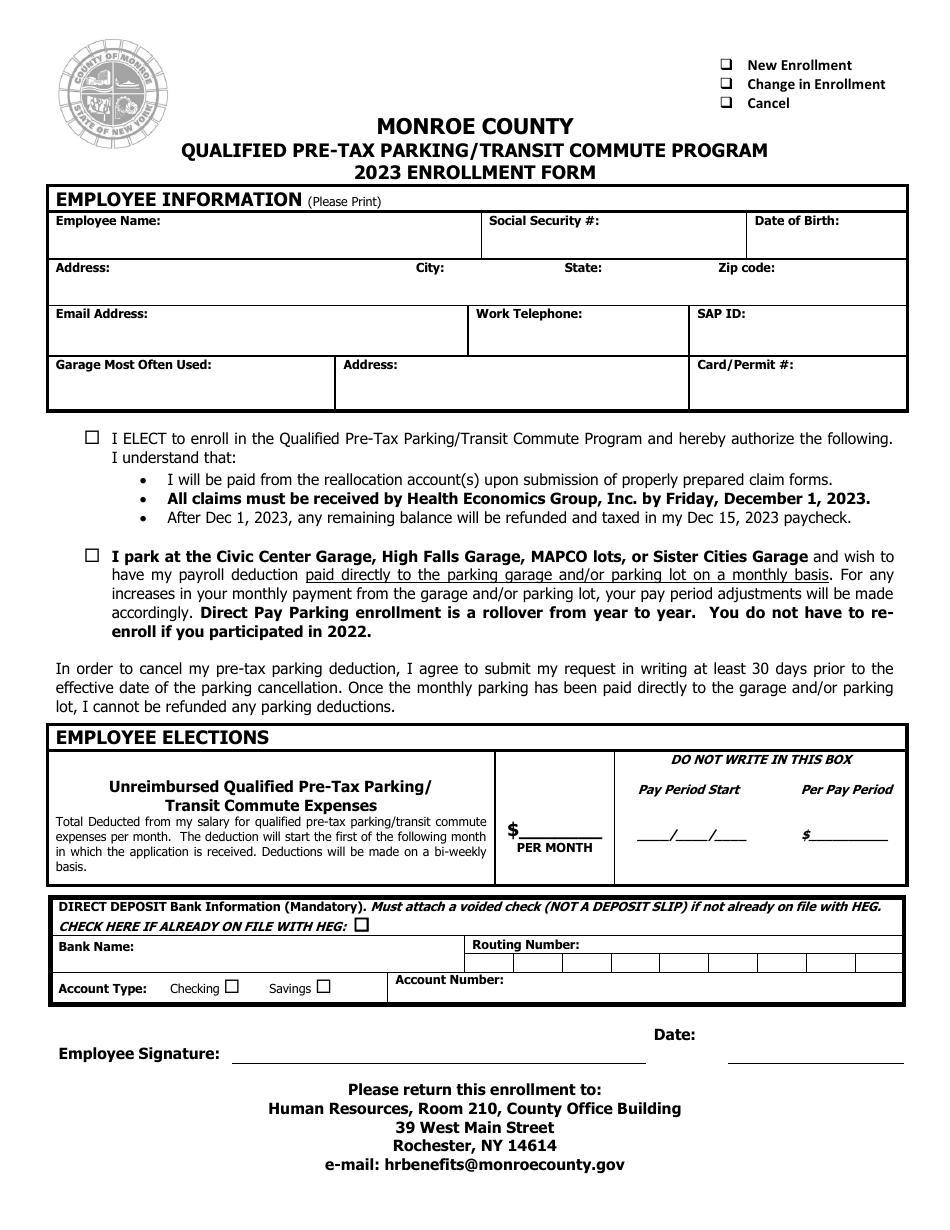

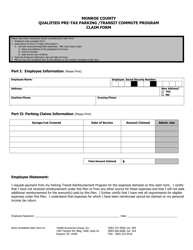

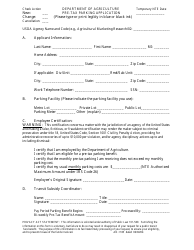

Qualified Pre-tax Parking / Transit Commute Program Enrollment Form - Monroe County, New York

Qualified Pre-tax Parking/Transit Commute Program Enrollment Form is a legal document that was released by the Department of Human Resources - Monroe County, New York - a government authority operating within New York. The form may be used strictly within Monroe County.

FAQ

Q: What is the Qualified Pre-tax Parking/Transit Commute Program?

A: The Qualified Pre-tax Parking/Transit Commute Program is a benefit program that allows employees to use pre-tax dollars to pay for qualified parking or transit expenses.

Q: Who is eligible to participate in the program?

A: Employees of Monroe County, New York are eligible to participate in the program.

Q: What expenses can be paid for with pre-tax dollars through the program?

A: The program allows employees to use pre-tax dollars to pay for qualified parking or transit expenses.

Q: How do I enroll in the program?

A: To enroll in the program, you will need to complete the enrollment form and submit it to the designated department or office.

Q: Is there a minimum or maximum amount that can be deducted from my pre-tax earnings?

A: There may be a minimum and/or maximum amount that can be deducted from your pre-tax earnings. Please refer to the program guidelines for more information.

Q: Can I change or cancel my enrollment in the program?

A: Yes, you can change or cancel your enrollment in the program. Contact the designated department or office for assistance.

Q: What are the benefits of participating in the program?

A: Participating in the program allows you to save money on qualified parking or transit expenses by using pre-tax dollars. This can result in lower taxable income and potentially reduce your overall tax liability.

Q: Are there any restrictions or limitations on the program?

A: There may be restrictions or limitations on the program, such as eligible expenses and enrollment periods. Refer to the program guidelines for detailed information.

Q: Can I participate in the program if I use alternative transportation methods such as biking or walking?

A: The program may only be applicable to qualified parking or transit expenses. Contact the designated department or office for more information.

Q: What happens if I no longer need to use the qualified parking or transit expenses?

A: If you no longer need to use the qualified parking or transit expenses, you can change or cancel your enrollment in the program. Contact the designated department or office for assistance.

Form Details:

- The latest edition currently provided by the Department of Human Resources - Monroe County, New York;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Human Resources - Monroe County, New York.