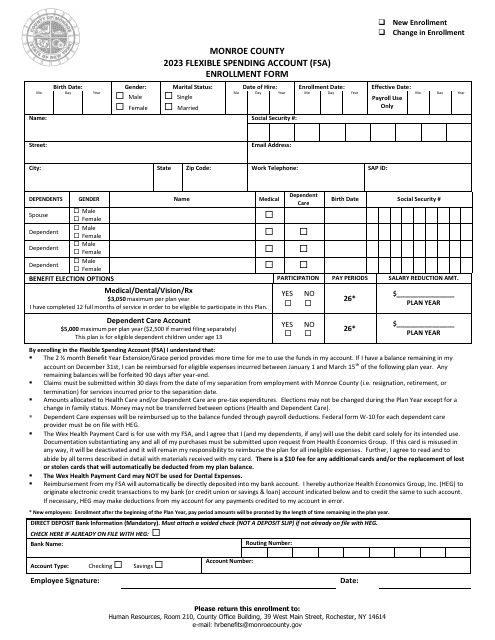

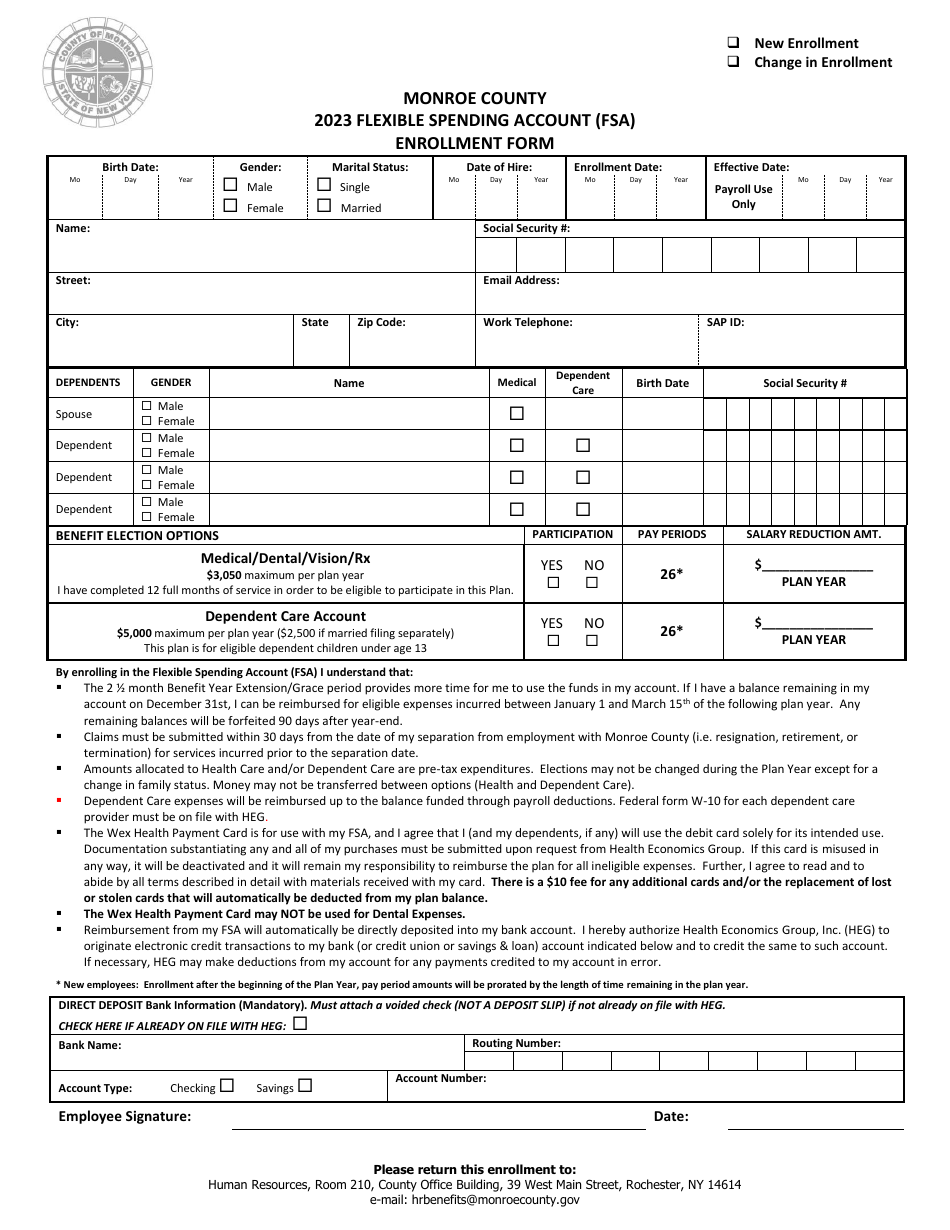

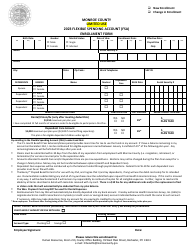

Flexible Spending Account (FSA) Enrollment Form - Monroe County, New York

Flexible Spending Account (FSA) Enrollment Form is a legal document that was released by the Department of Human Resources - Monroe County, New York - a government authority operating within New York. The form may be used strictly within Monroe County.

FAQ

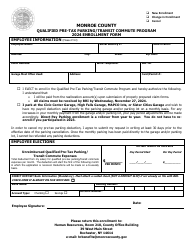

Q: What is a Flexible Spending Account (FSA)?

A: A Flexible Spending Account (FSA) is a benefit program that allows you to set aside pre-tax dollars for eligible healthcare and dependent care expenses.

Q: Who is eligible to enroll in a Flexible Spending Account (FSA)?

A: Eligibility to enroll in a Flexible Spending Account (FSA) depends on your employer and the specific plan they offer. You should check with your employer to determine if you are eligible.

Q: What expenses can be paid for using a Flexible Spending Account (FSA)?

A: A Flexible Spending Account (FSA) can be used to pay for eligible healthcare expenses, such as medical and dental expenses, as well as dependent care expenses, such as childcare or eldercare.

Q: How much money can I contribute to a Flexible Spending Account (FSA)?

A: The amount you can contribute to a Flexible Spending Account (FSA) is determined by your employer and the specific plan they offer. There are annual contribution limits set by the IRS for both healthcare and dependent care FSAs.

Q: What happens if I don't use all of the funds in my Flexible Spending Account (FSA) by the end of the plan year?

A: If you don't use all of the funds in your Flexible Spending Account (FSA) by the end of the plan year, you may lose that money. However, some plans may offer a grace period or a carryover option to give you more time to use the funds.

Form Details:

- The latest edition currently provided by the Department of Human Resources - Monroe County, New York;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Human Resources - Monroe County, New York.