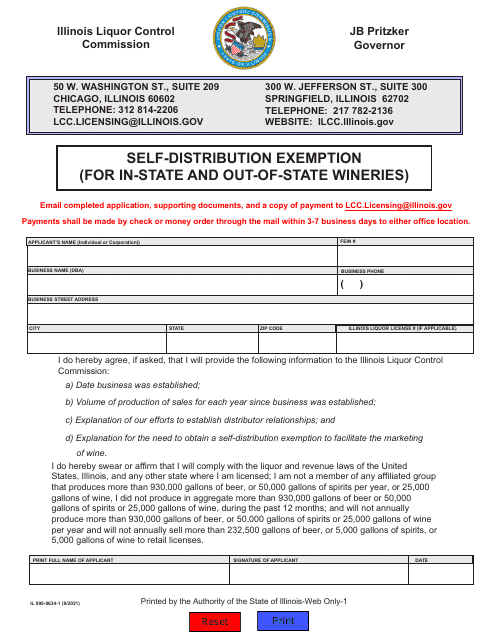

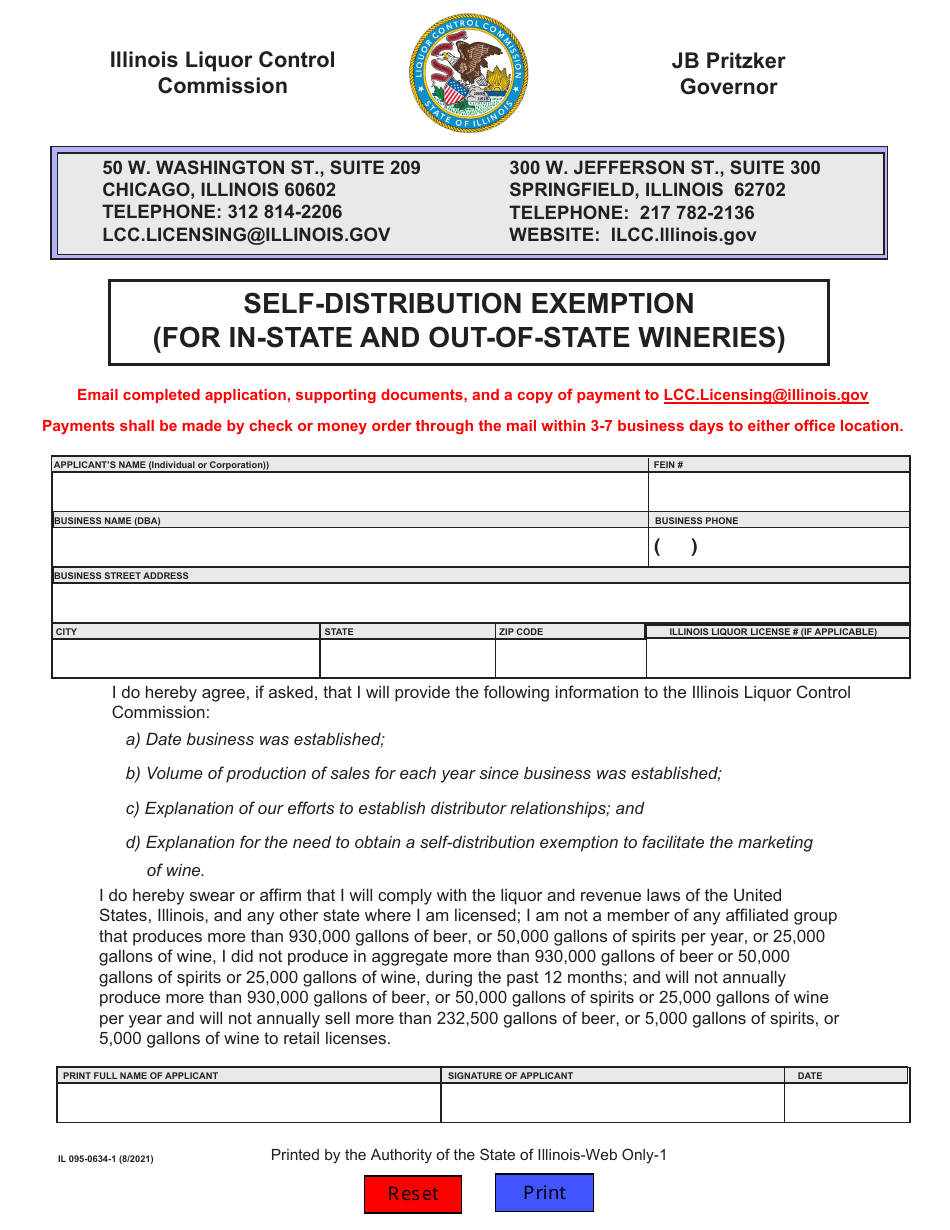

Form IL095-0634-1 Self-distribution Exemption (For in-State and Out-of-State Wineries) - Illinois

What Is Form IL095-0634-1?

This is a legal form that was released by the Illinois Liquor Control Commission - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL095-0634-1?

A: Form IL095-0634-1 is the Self-distribution Exemption form for in-state and out-of-state wineries in Illinois.

Q: Who is eligible to use Form IL095-0634-1?

A: Both in-state and out-of-state wineries are eligible to use Form IL095-0634-1.

Q: What is the purpose of Form IL095-0634-1?

A: The purpose of Form IL095-0634-1 is to apply for a self-distribution exemption for wineries in Illinois.

Q: What is a self-distribution exemption?

A: A self-distribution exemption allows wineries to distribute their own products directly to retailers in Illinois without using a licensed distributor.

Q: Are there any requirements to qualify for a self-distribution exemption?

A: Yes, wineries must meet certain production limits and other requirements to qualify for a self-distribution exemption.

Q: Is there a fee to submit Form IL095-0634-1?

A: No, there is no fee to submit Form IL095-0634-1.

Q: What happens after I submit Form IL095-0634-1?

A: The Illinois Department of Revenue will review your application and notify you of their decision.

Q: How long does it take to process Form IL095-0634-1?

A: The processing time for Form IL095-0634-1 may vary, but you should receive a response from the Illinois Department of Revenue within a reasonable time frame.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Illinois Liquor Control Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL095-0634-1 by clicking the link below or browse more documents and templates provided by the Illinois Liquor Control Commission.