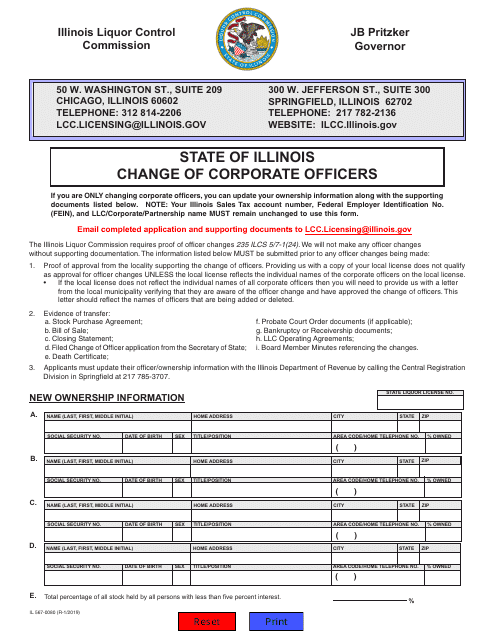

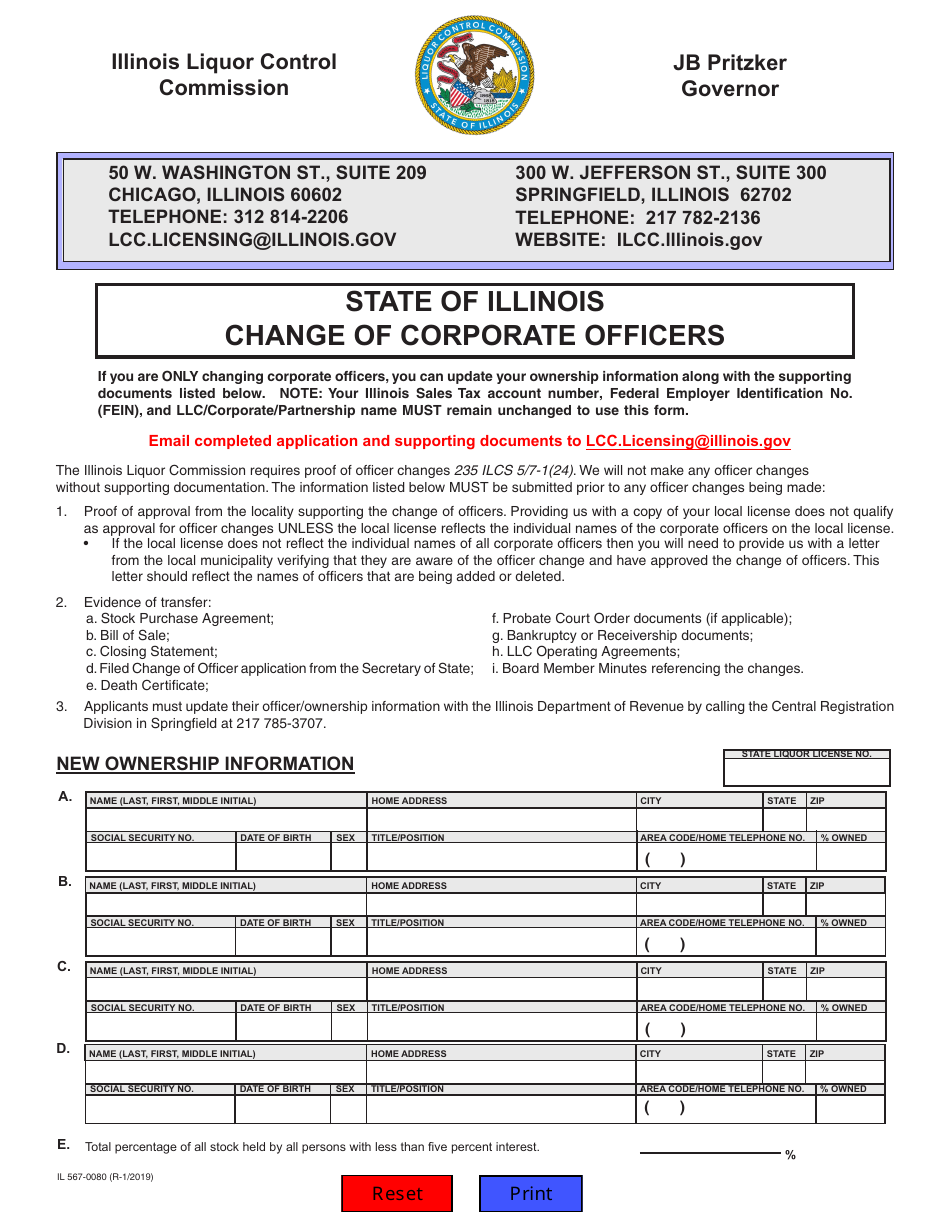

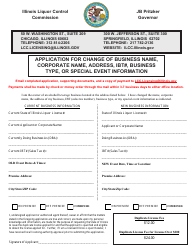

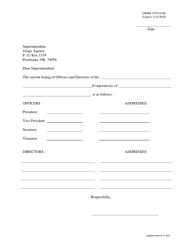

Form IL567-0080 Change of Corporate Officers - Illinois

What Is Form IL567-0080?

This is a legal form that was released by the Illinois Liquor Control Commission - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL567-0080?

A: Form IL567-0080 is a document used to report changes in corporate officers for businesses in Illinois.

Q: Who needs to use Form IL567-0080?

A: Form IL567-0080 is used by businesses in Illinois that need to report changes in their corporate officers.

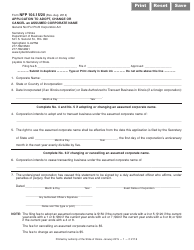

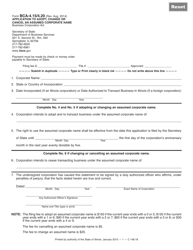

Q: What information is required on Form IL567-0080?

A: Form IL567-0080 requires the business's name, federal employer identification number (FEIN), the date of the officer change, and the details of the new officer(s) being appointed.

Q: Is there a filing fee for Form IL567-0080?

A: No, there is no filing fee for Form IL567-0080.

Q: When should Form IL567-0080 be filed?

A: Form IL567-0080 should be filed within 60 days of the officer change.

Q: Are there any consequences for not filing Form IL567-0080?

A: Failure to file Form IL567-0080 or filing it late may result in penalties or other legal consequences.

Q: Can I make changes to the form after filing it?

A: No, once Form IL567-0080 is filed, you cannot make changes to it. If there are errors, you will need to file a new form with the corrected information.

Q: Who should I contact if I have questions about Form IL567-0080?

A: If you have questions about Form IL567-0080, you can contact the Illinois Department of Revenue's office for assistance.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Illinois Liquor Control Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL567-0080 by clicking the link below or browse more documents and templates provided by the Illinois Liquor Control Commission.