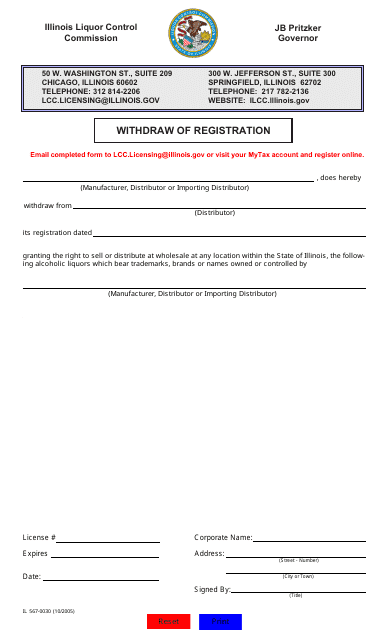

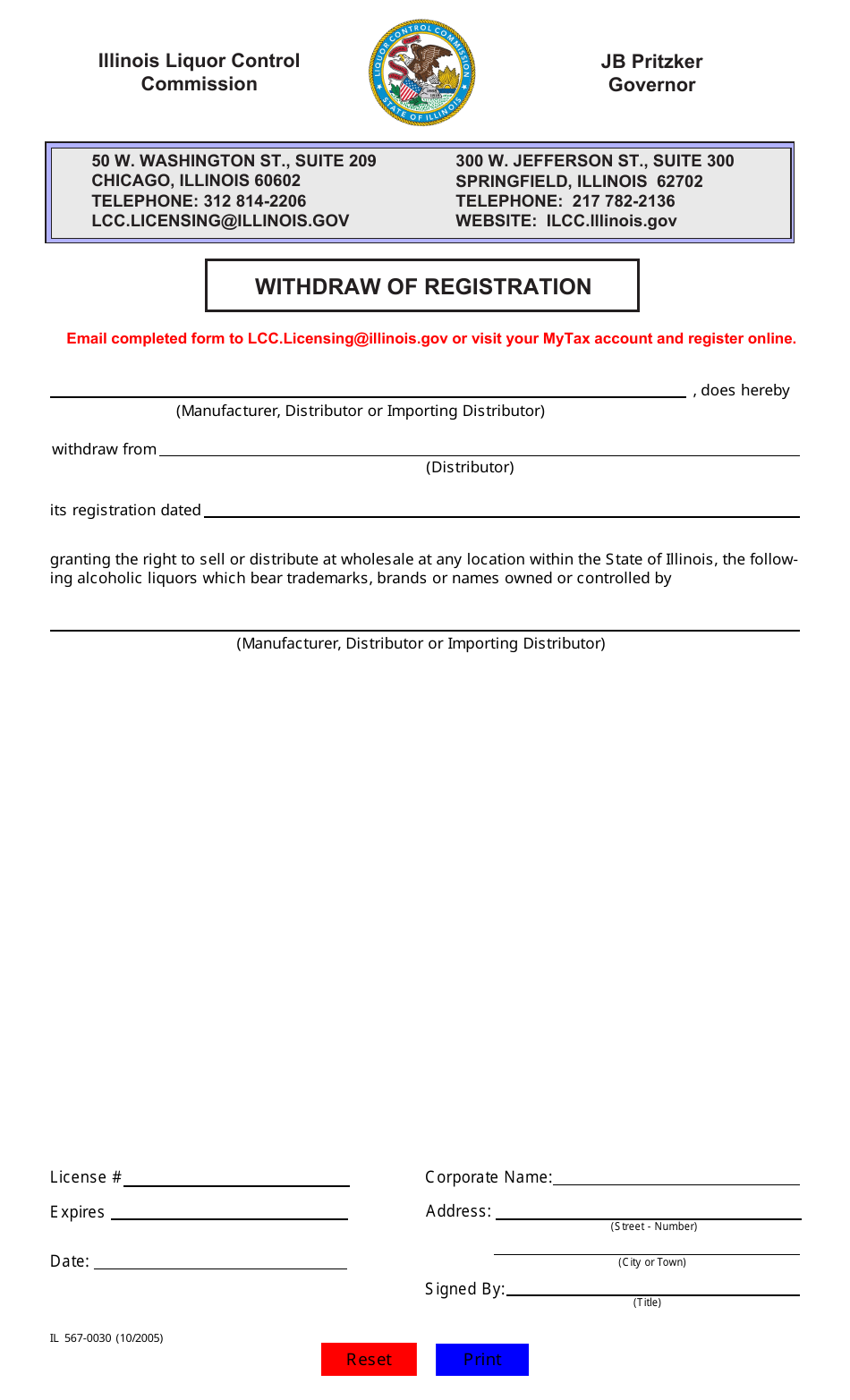

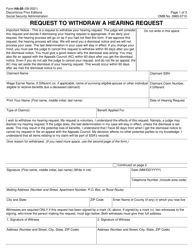

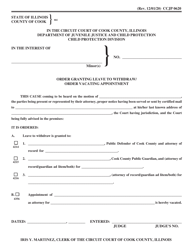

Form IL567-0030 Withdraw of Registration - Illinois

What Is Form IL567-0030?

This is a legal form that was released by the Illinois Liquor Control Commission - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL567-0030?

A: Form IL567-0030 is a form used to withdraw the registration of a business or entity in the state of Illinois.

Q: What is the purpose of Form IL567-0030?

A: The purpose of Form IL567-0030 is to officially notify the state of Illinois that a business or entity wishes to withdraw its registration.

Q: Who needs to file Form IL567-0030?

A: Any business or entity that is registered in the state of Illinois and wishes to withdraw its registration needs to file Form IL567-0030.

Q: Is there a fee for filing Form IL567-0030?

A: Yes, there is a fee associated with filing Form IL567-0030. The exact fee amount may vary, so it is best to check the current fee schedule provided by the Illinois Secretary of State.

Q: What information is required on Form IL567-0030?

A: Form IL567-0030 requires basic information about the business or entity, such as its name, address, and the reason for the withdrawal.

Q: What happens after I file Form IL567-0030?

A: After filing Form IL567-0030, the state of Illinois will process the withdrawal request and update the registration status of the business or entity.

Q: Are there any consequences for not filing Form IL567-0030?

A: Failure to file Form IL567-0030 to properly withdraw a registration in Illinois may result in ongoing obligations, penalties, or legal liability.

Q: Can I reinstate my registration after filing Form IL567-0030?

A: Yes, it is possible to reinstate a registration after filing Form IL567-0030. However, the process and requirements for reinstatement may vary depending on the specific circumstances.

Form Details:

- Released on October 1, 2005;

- The latest edition provided by the Illinois Liquor Control Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL567-0030 by clicking the link below or browse more documents and templates provided by the Illinois Liquor Control Commission.