This version of the form is not currently in use and is provided for reference only. Download this version of

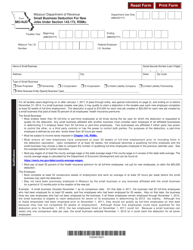

Form MO-C

for the current year.

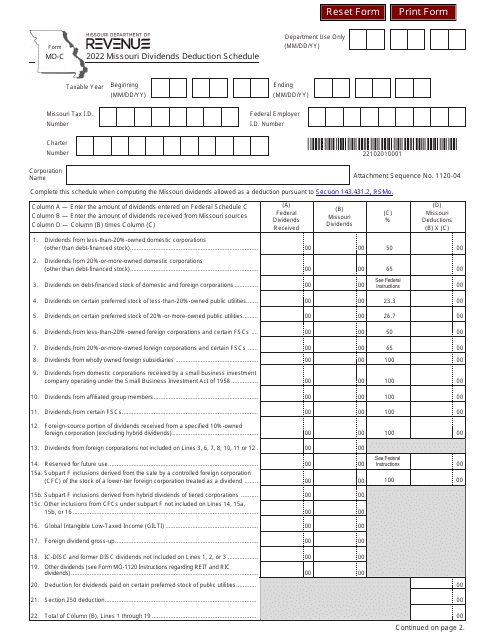

Form MO-C Missouri Dividends Deduction Schedule - Missouri

What Is Form MO-C?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

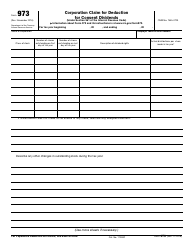

Q: What is the Form MO-C?

A: Form MO-C is the Missouri Dividends Deduction Schedule.

Q: What is the purpose of Form MO-C?

A: Form MO-C is used to calculate and claim the Missouri dividends deduction on your Missouri income tax return.

Q: Who needs to file Form MO-C?

A: You need to file Form MO-C if you are claiming the Missouri dividends deduction on your Missouri income tax return.

Q: What is the Missouri dividends deduction?

A: The Missouri dividends deduction allows individuals to deduct a portion of qualifying dividends received from certain Missouri corporations.

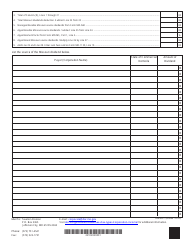

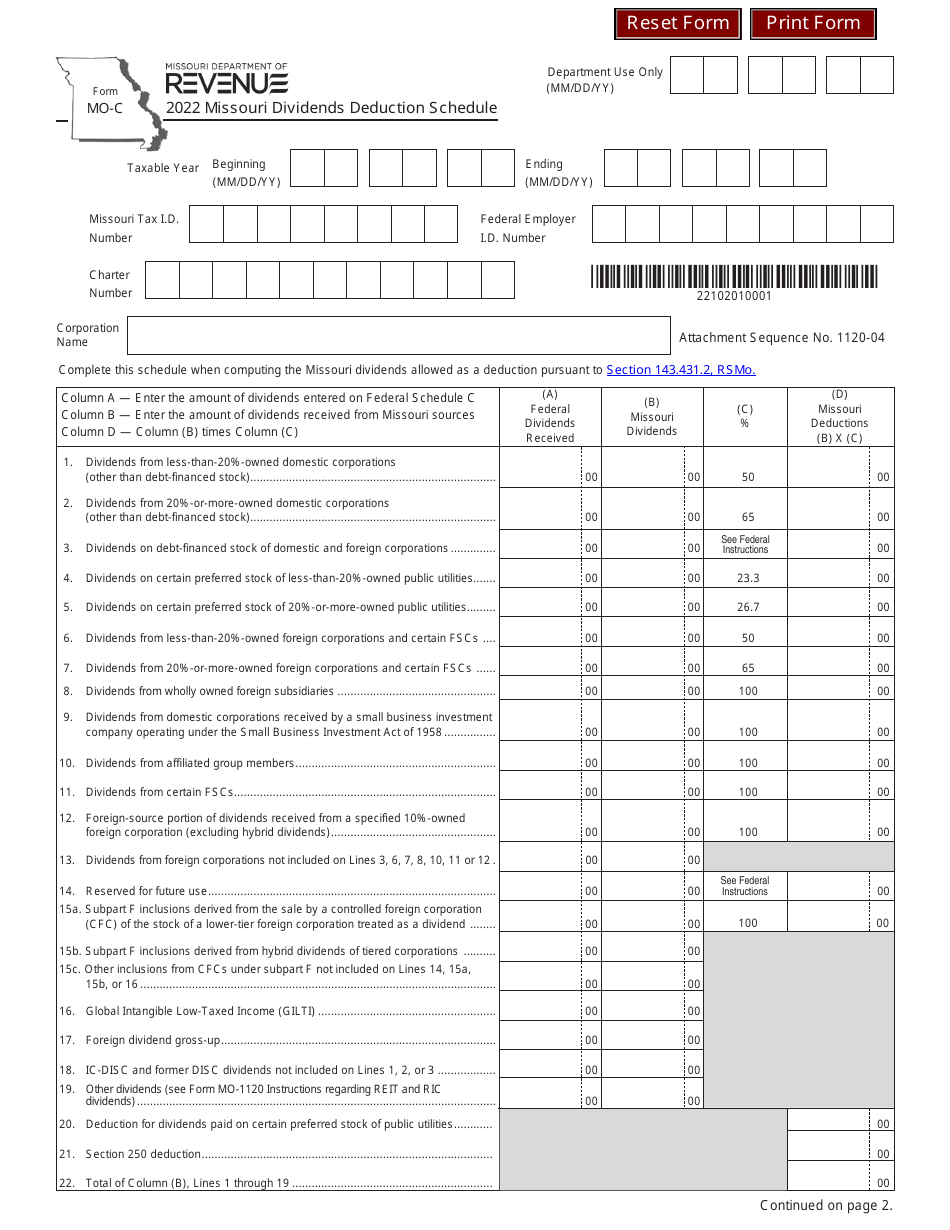

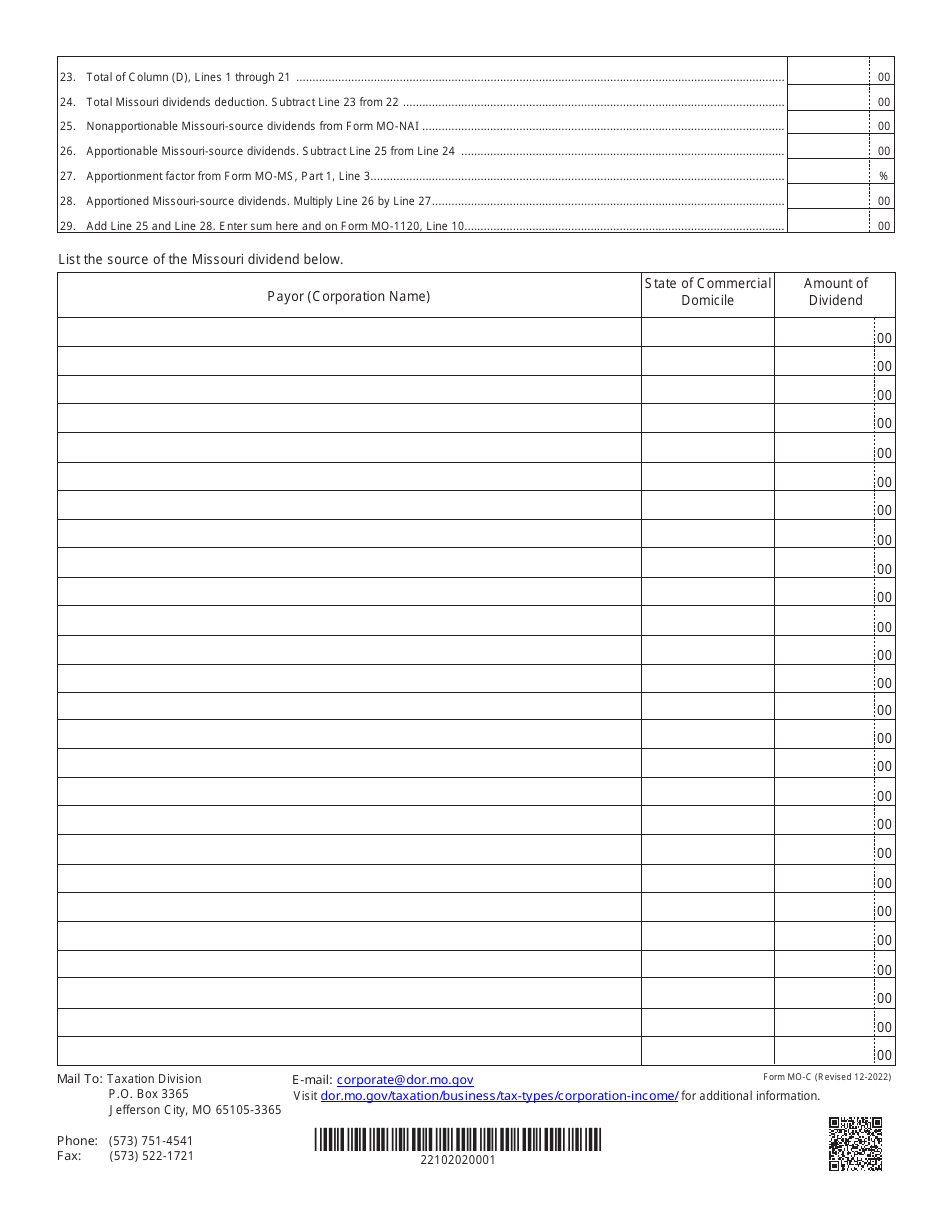

Q: How do I complete Form MO-C?

A: You will need to enter information about the qualifying dividends you received from Missouri corporations and calculate the deductible amount according to the instructions provided on the form.

Q: When is the deadline to file Form MO-C?

A: Form MO-C is generally due along with your Missouri income tax return by the tax filing deadline, which is usually April 15th.

Q: Is there a fee to file Form MO-C?

A: No, there is no fee to file Form MO-C.

Q: Can I file Form MO-C electronically?

A: Yes, you can file Form MO-C electronically if you are using an approved tax software or hire a tax professional.

Q: What should I do with Form MO-C after filing?

A: You should keep a copy of Form MO-C for your records and attach it to your Missouri income tax return when filing.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-C by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.