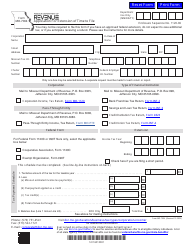

This version of the form is not currently in use and is provided for reference only. Download this version of

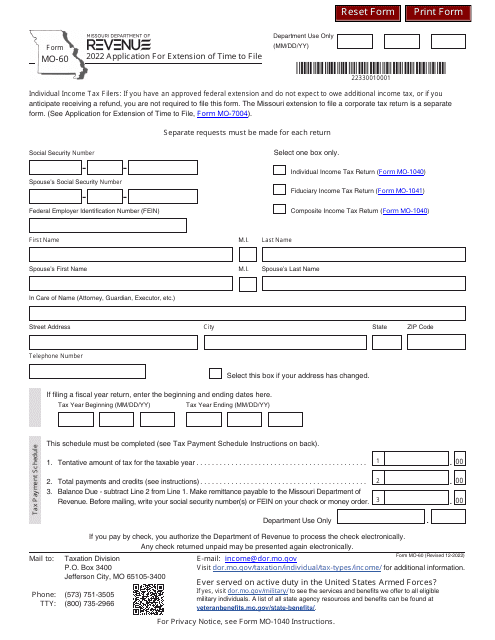

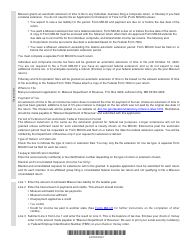

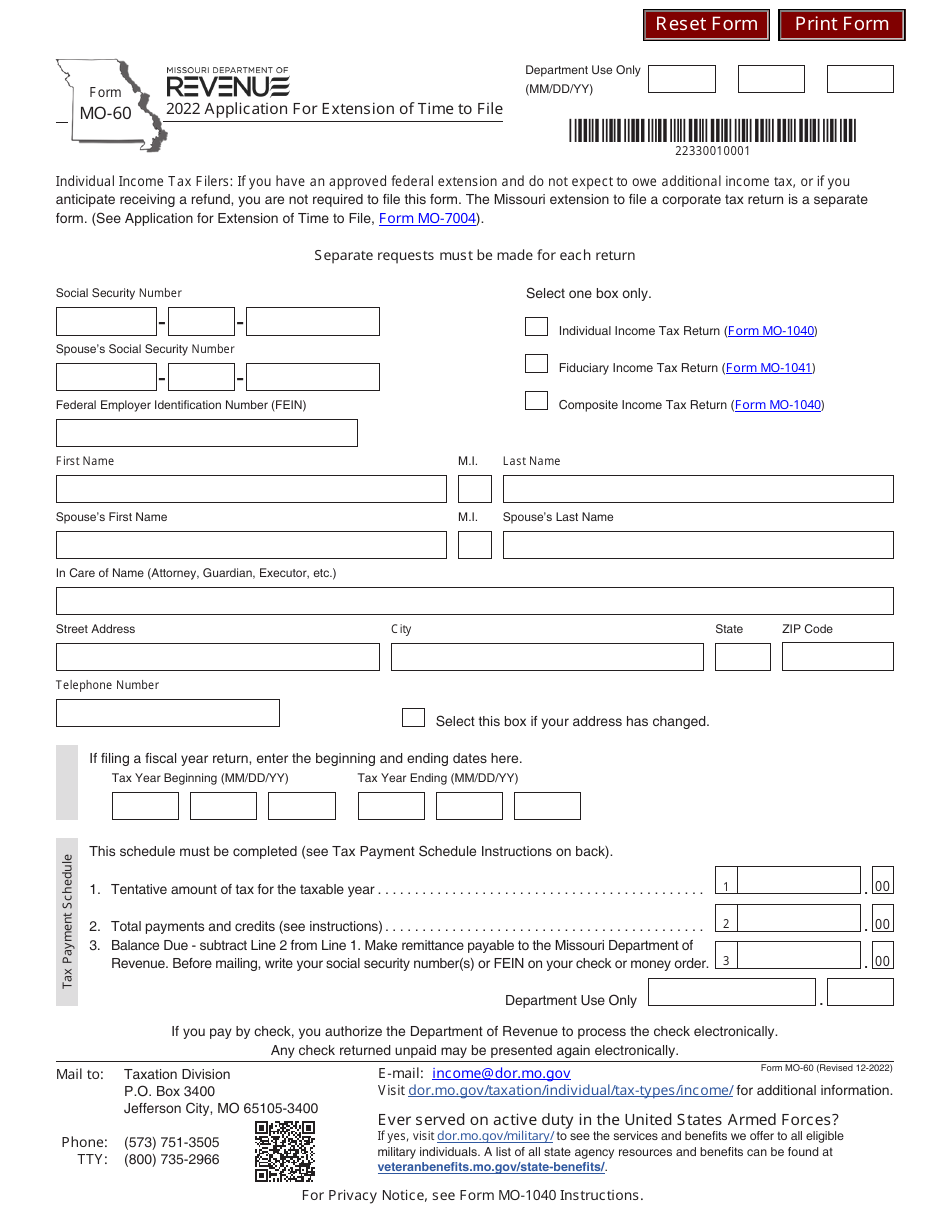

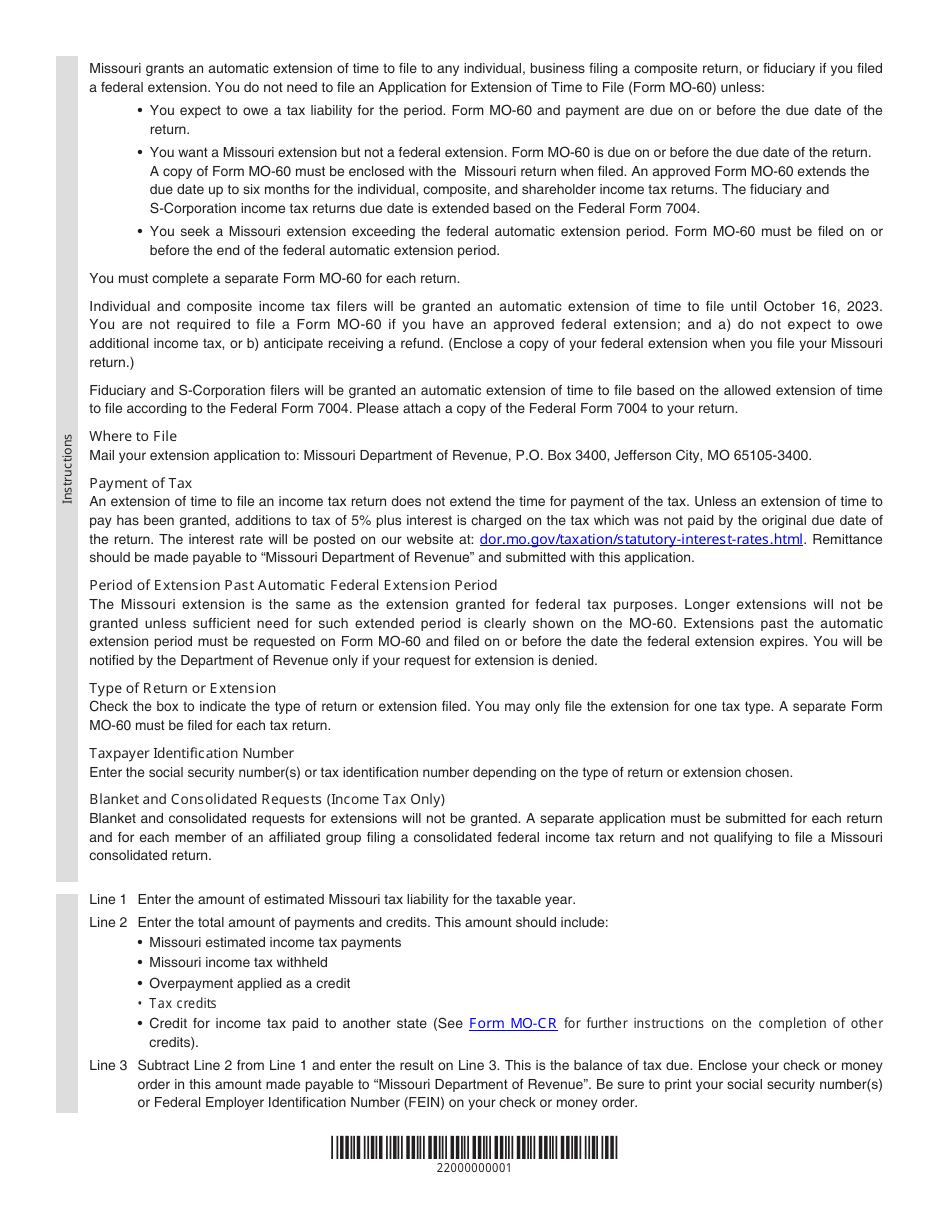

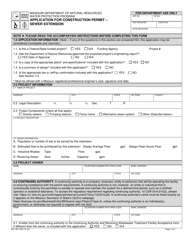

Form MO-60

for the current year.

Form MO-60 Application for Extension of Time to File - Missouri

What Is Form MO-60?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO-60?

A: Form MO-60 is the Application for Extension of Time to File in Missouri.

Q: What is the purpose of Form MO-60?

A: The purpose of Form MO-60 is to request an extension of time to file your Missouri state tax return.

Q: Who can use Form MO-60?

A: Form MO-60 can be used by individuals, partnerships, corporations, and fiduciaries who need more time to file their Missouri state tax return.

Q: When is Form MO-60 due?

A: Form MO-60 is due on or before the original due date of your Missouri state tax return.

Q: Is there a fee to file Form MO-60?

A: No, there is no fee to file Form MO-60.

Q: How long of an extension does Form MO-60 grant?

A: Form MO-60 grants an extension of time to file for up to six months.

Q: What happens if I file Form MO-60 but don't pay my taxes by the original due date?

A: If you file Form MO-60 but do not pay your taxes by the original due date, you may be subject to penalties and interest on the unpaid amount.

Q: Can I request an extension for my federal tax return using Form MO-60?

A: No, Form MO-60 is specific to requesting an extension for your Missouri state tax return. You must file a separate extension request for your federal tax return, if needed.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-60 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.