This version of the form is not currently in use and is provided for reference only. Download this version of

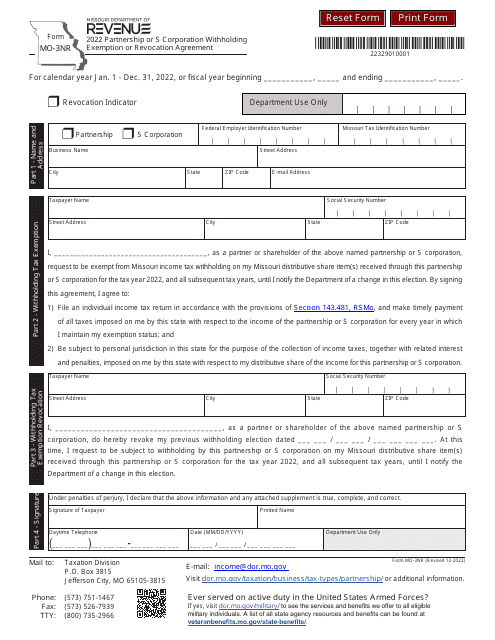

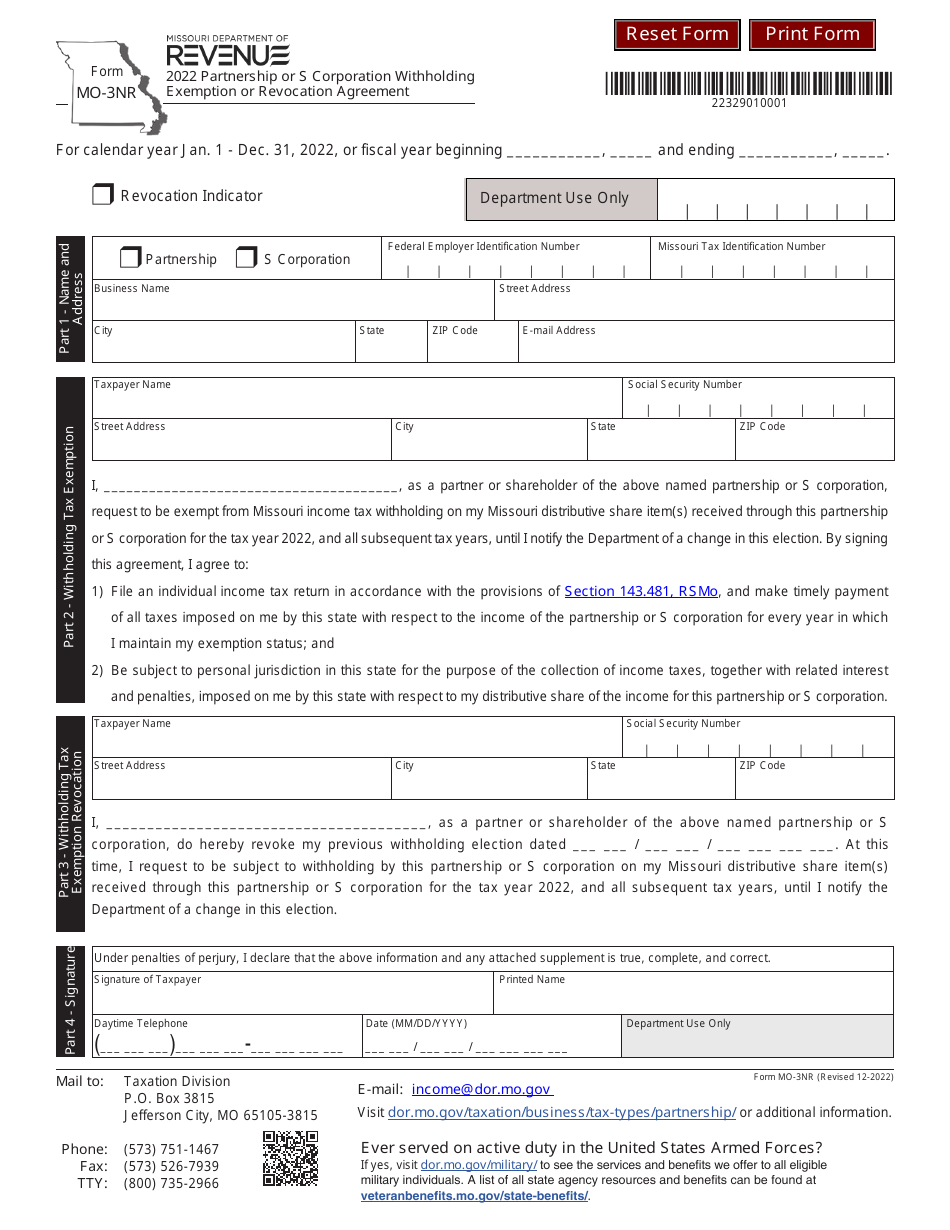

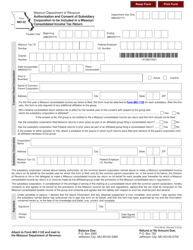

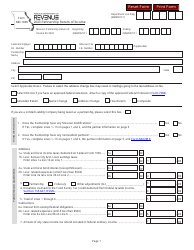

Form MO-3NR

for the current year.

Form MO-3NR Partnership or S Corporation Withholding Exemption or Revocation Agreement - Missouri

What Is Form MO-3NR?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form MO-3NR?

A: Form MO-3NR is an agreement for partnership or S Corporation withholding exemption or revocation in the state of Missouri.

Q: Who needs to file the Form MO-3NR?

A: Partnerships and S Corporations in Missouri that want to claim an exemption from withholding or revoke a previously claimed exemption need to file the Form MO-3NR.

Q: What is the purpose of the Form MO-3NR?

A: The purpose of the Form MO-3NR is to allow partnerships and S Corporations to claim an exemption from withholding on behalf of nonresident partners or shareholders.

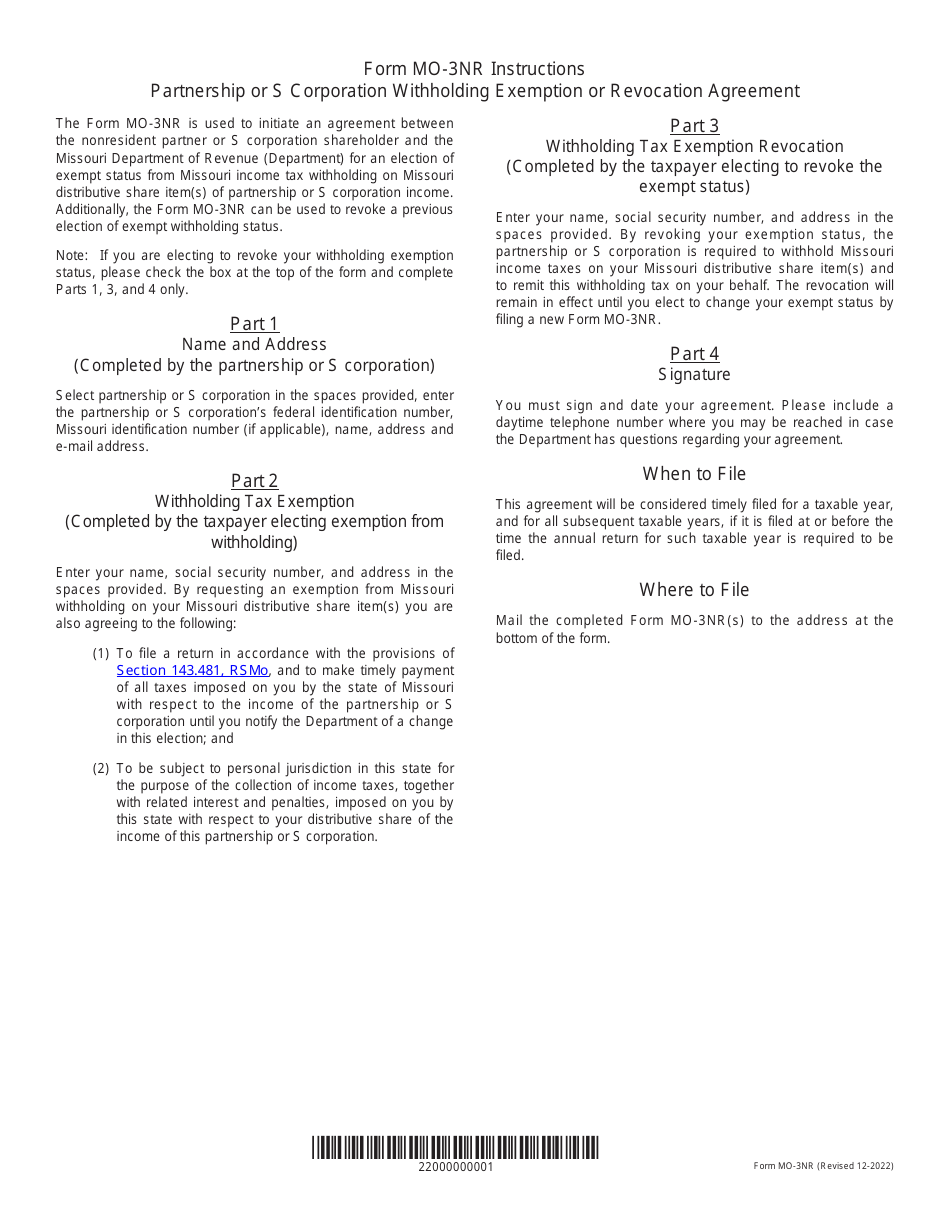

Q: What information is required on the Form MO-3NR?

A: The Form MO-3NR requires information such as the partnership or S Corporation's name, federal employer identification number (FEIN), contact information, and the names and addresses of nonresident partners or shareholders.

Q: Is there a deadline for filing the Form MO-3NR?

A: Yes, the Form MO-3NR must be filed by the due date of the partnership or S Corporation's income tax return for the year in which the exemption is being claimed or revoked.

Q: Can I claim an exemption for all nonresident partners or shareholders?

A: No, the Form MO-3NR allows for exemption claims on a case-by-case basis. Each nonresident partner or shareholder must meet certain criteria to qualify for the exemption.

Q: What if I need to revoke a previously claimed exemption?

A: If you need to revoke a previously claimed exemption, you must file a new Form MO-3NR indicating the revocation.

Q: Are there any fees associated with filing the Form MO-3NR?

A: No, there are no fees for filing the Form MO-3NR.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-3NR by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.