This version of the form is not currently in use and is provided for reference only. Download this version of

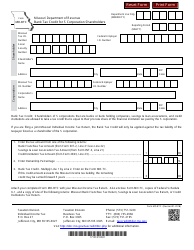

Form MO-2220

for the current year.

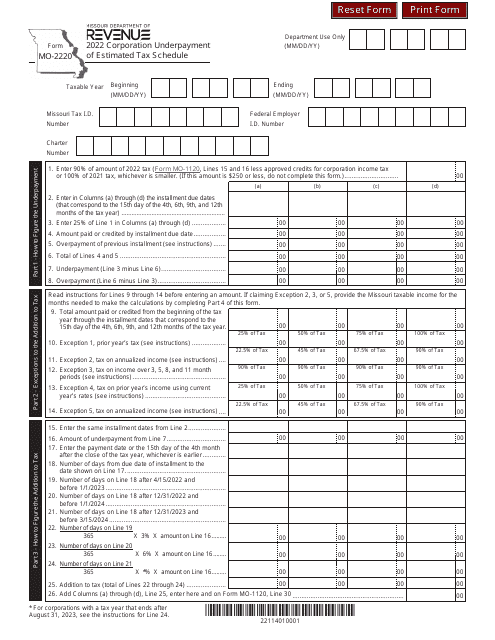

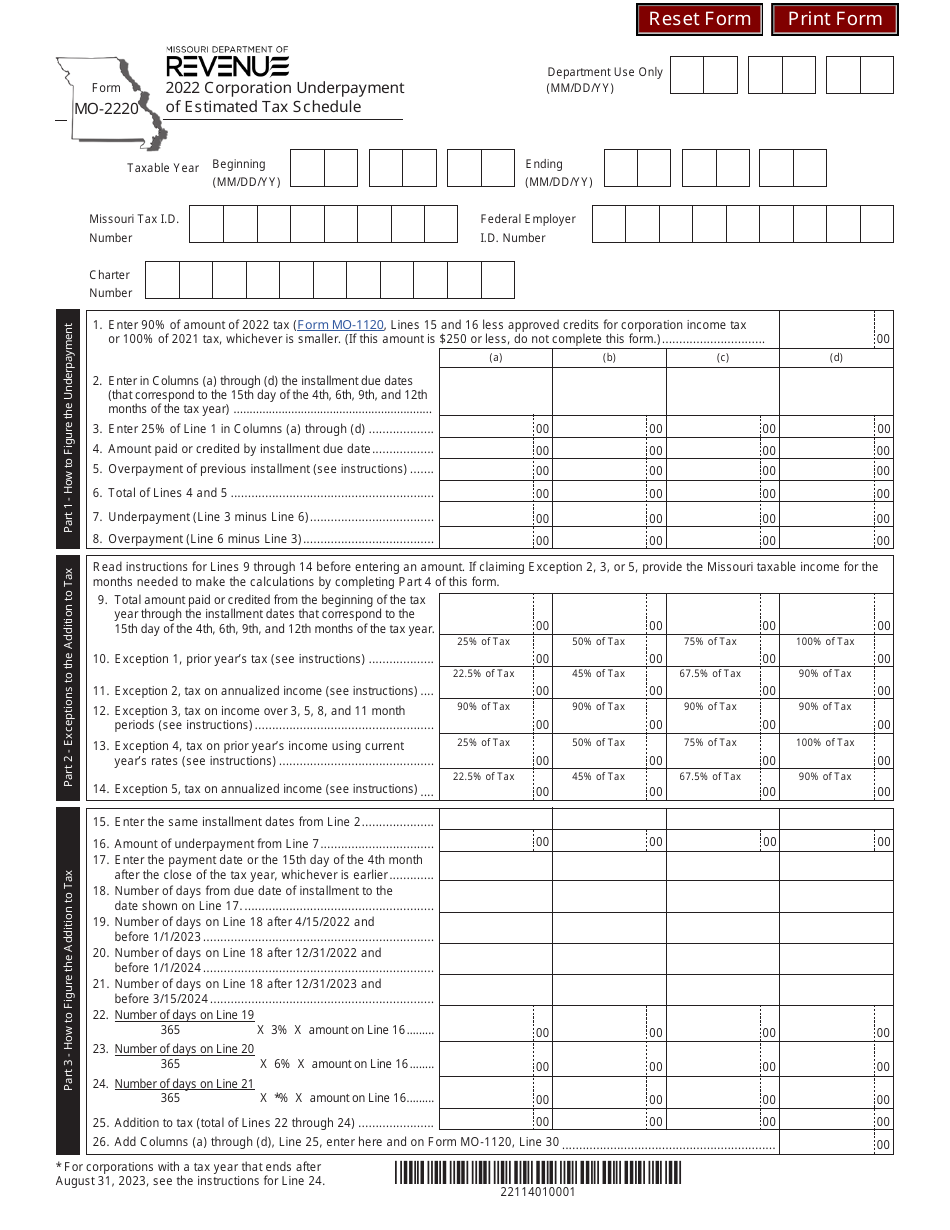

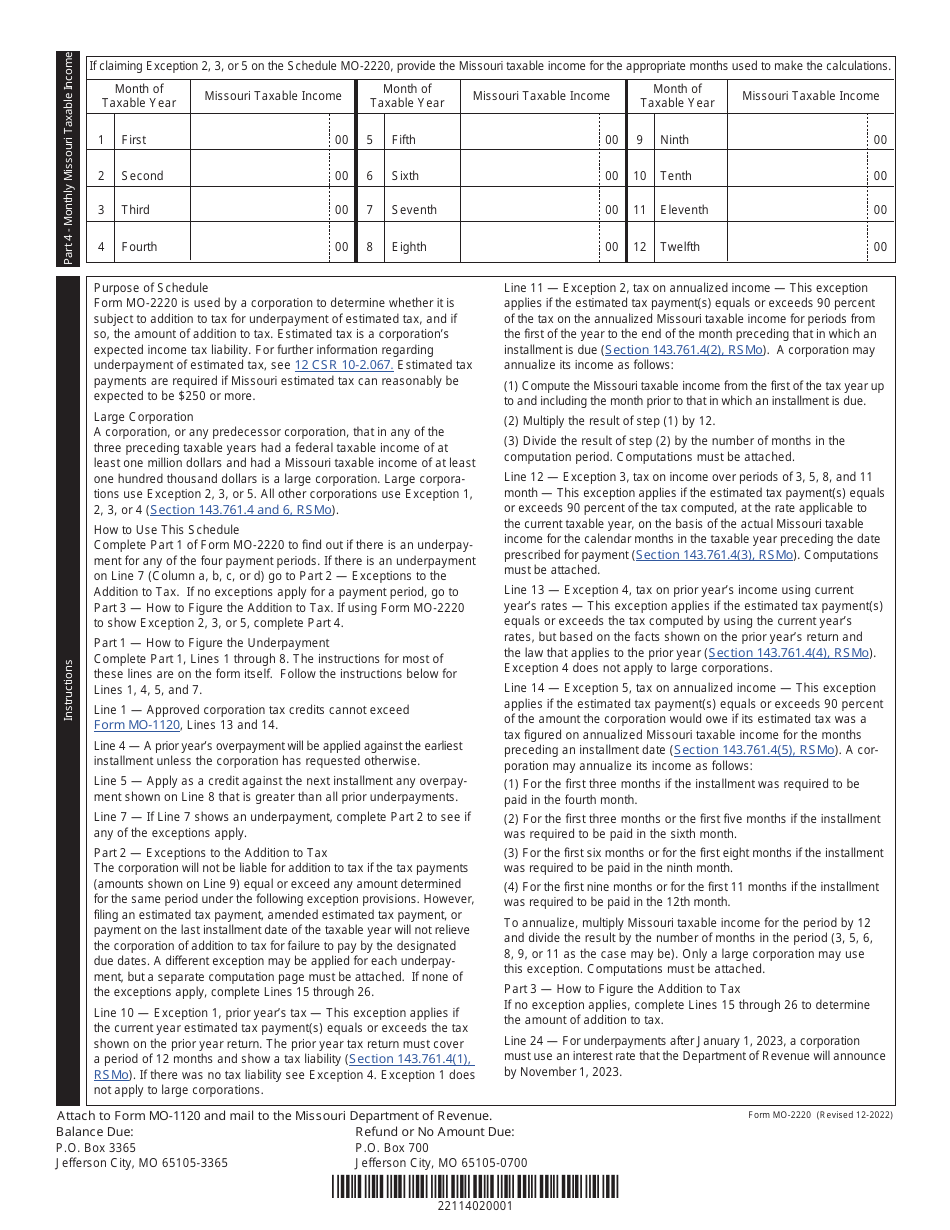

Form MO-2220 Corporation Underpayment of Estimated Tax Schedule - Missouri

What Is Form MO-2220?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO-2220?

A: Form MO-2220 is a schedule used by corporations in Missouri to calculate and report underpayment of estimated tax.

Q: Who is required to file Form MO-2220?

A: Corporations in Missouri are required to file Form MO-2220 if they have underpaid their estimated tax liability.

Q: What is the purpose of Form MO-2220?

A: The purpose of Form MO-2220 is to calculate the amount of underpayment of estimated tax by corporations in Missouri.

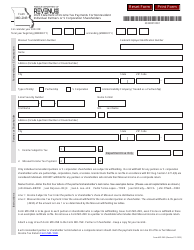

Q: How do I fill out Form MO-2220?

A: You need to provide information about your corporation's estimated tax payments and calculate the penalties for underpayment.

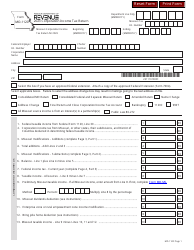

Q: When is the deadline to file Form MO-2220?

A: The deadline to file Form MO-2220 is the same as the deadline for filing your corporate income tax return in Missouri.

Q: Are there any penalties for not filing Form MO-2220?

A: Yes, if you fail to file Form MO-2220 or if you underpay your estimated tax, you may be subject to penalties and interest.

Q: Do I need to attach any documents with Form MO-2220?

A: You may need to attach supporting documentation, such as a calculation of your estimated tax liability and payment vouchers.

Q: What should I do if I made a mistake on my Form MO-2220?

A: If you made a mistake on your Form MO-2220, you should file an amended form as soon as possible to correct the error.

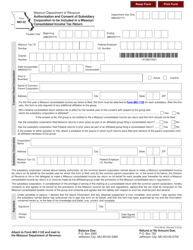

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-2220 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.