This version of the form is not currently in use and is provided for reference only. Download this version of

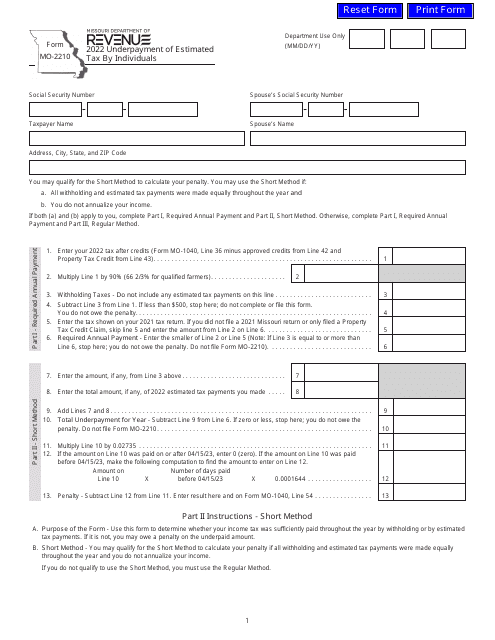

Form MO-2210

for the current year.

Form MO-2210 Underpayment of Estimated Tax by Individuals - Missouri

What Is Form MO-2210?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

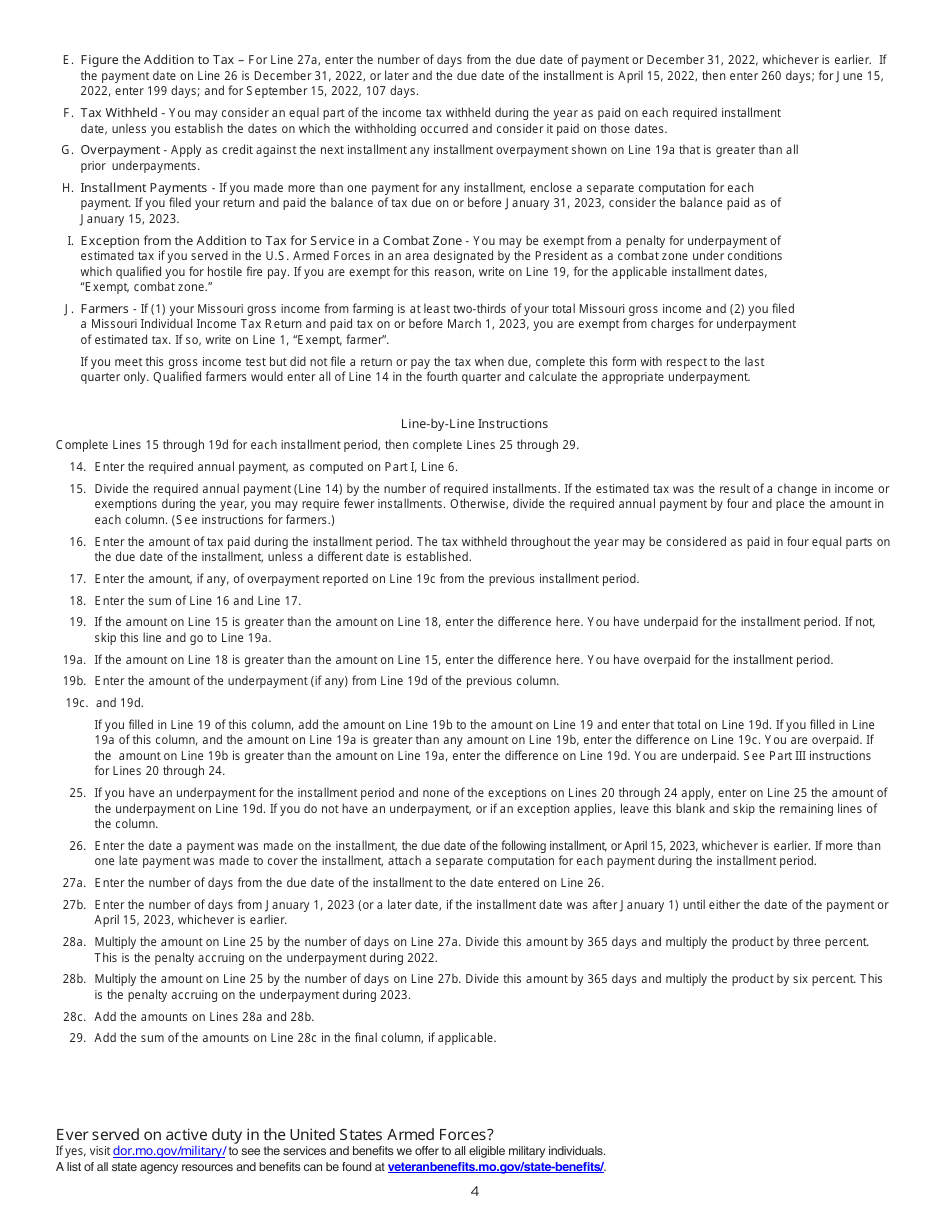

Q: What is Form MO-2210?

A: Form MO-2210 is used by individuals in Missouri to calculate and report any underpayment of estimated taxes.

Q: Who needs to file Form MO-2210?

A: Any individual in Missouri who had underpaid their estimated taxes during the tax year needs to file Form MO-2210.

Q: When is Form MO-2210 due?

A: Form MO-2210 is due on April 15th of the year following the tax year.

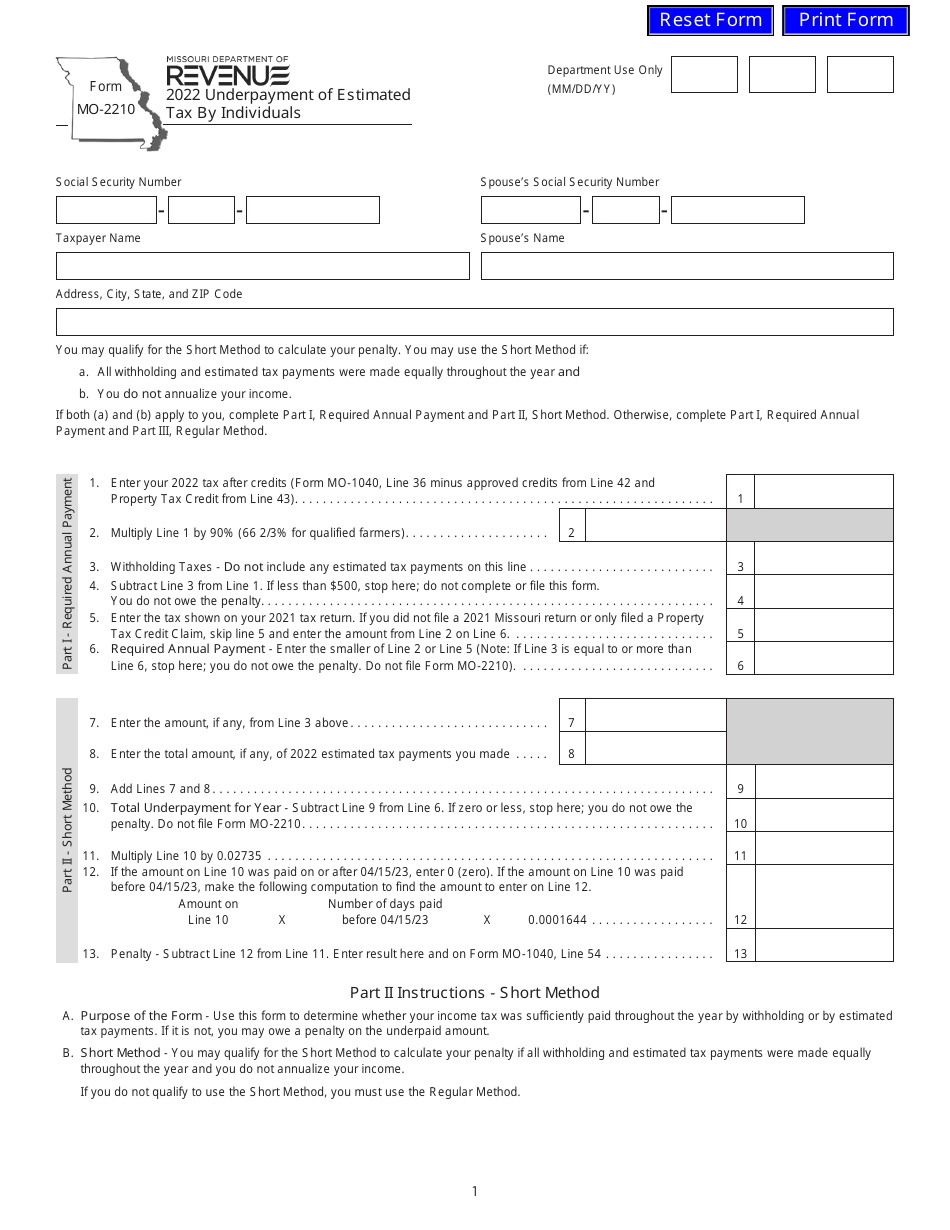

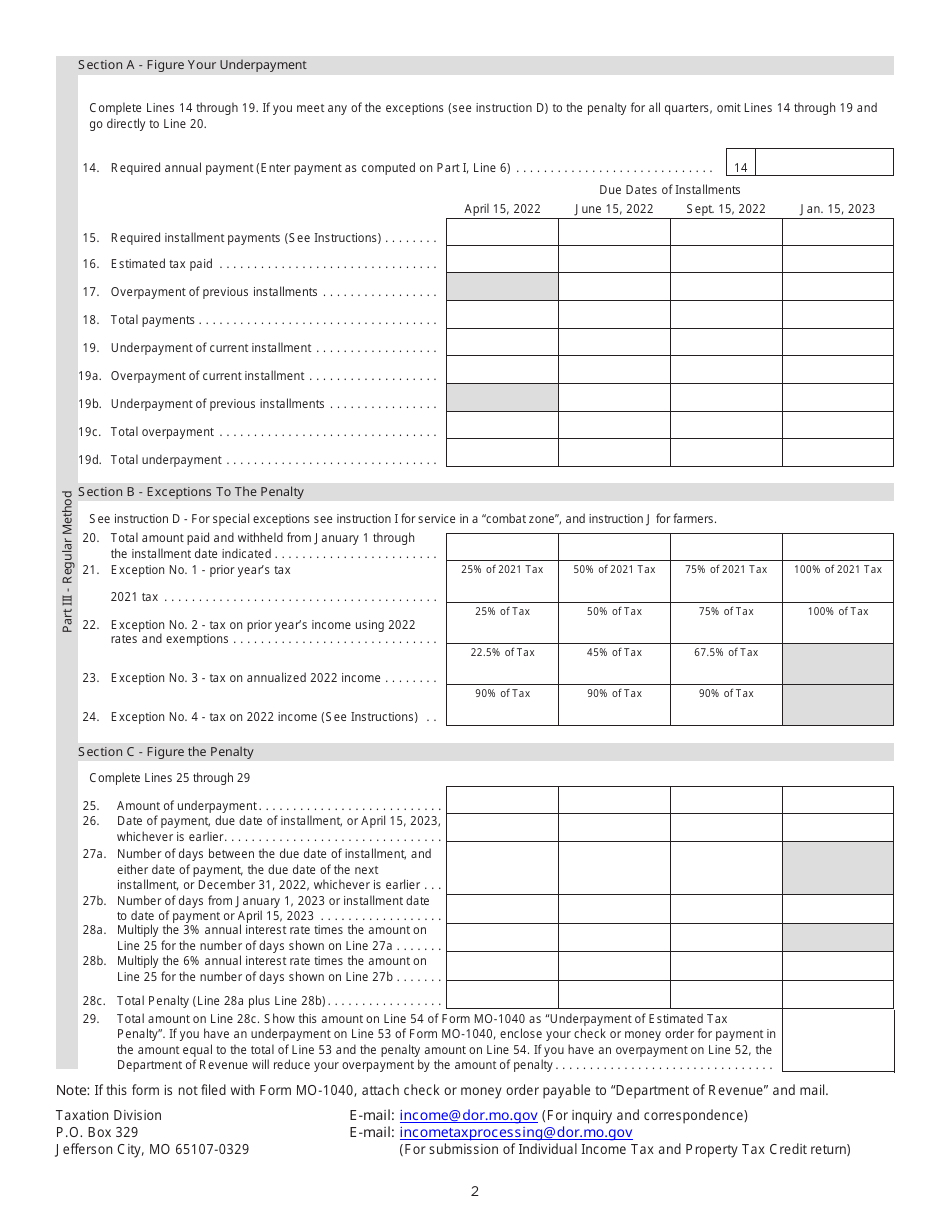

Q: How do I calculate the underpayment penalty?

A: The underpayment penalty is calculated based on the amount of underpayment and the number of days it remained unpaid.

Q: Is there an exemption from the underpayment penalty?

A: Yes, there are certain exemptions available for individuals who meet certain criteria, such as having a smaller tax liability in the previous year.

Form Details:

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-2210 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.