This version of the form is not currently in use and is provided for reference only. Download this version of

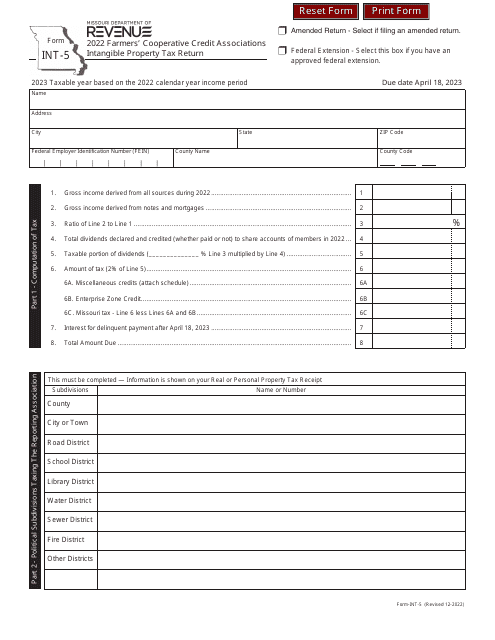

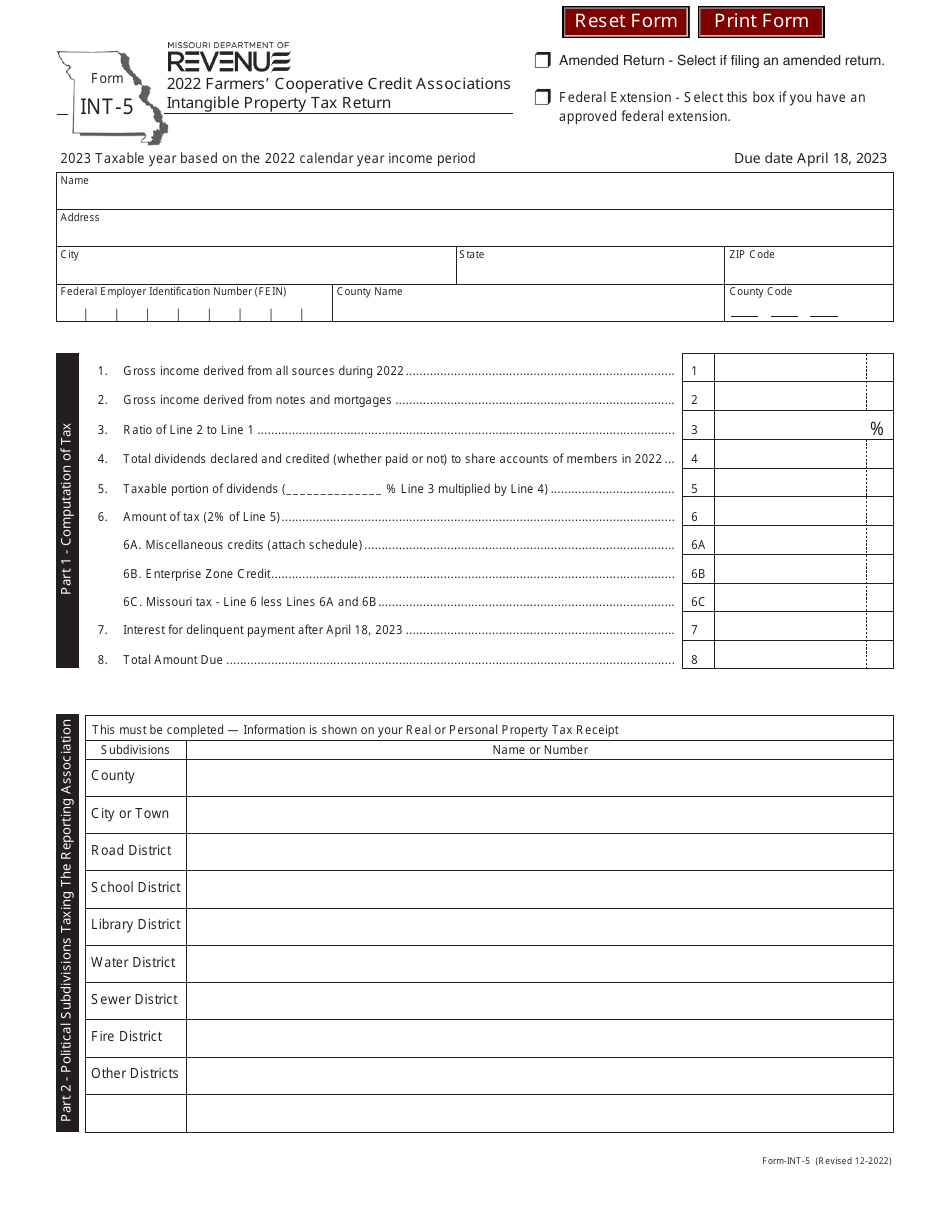

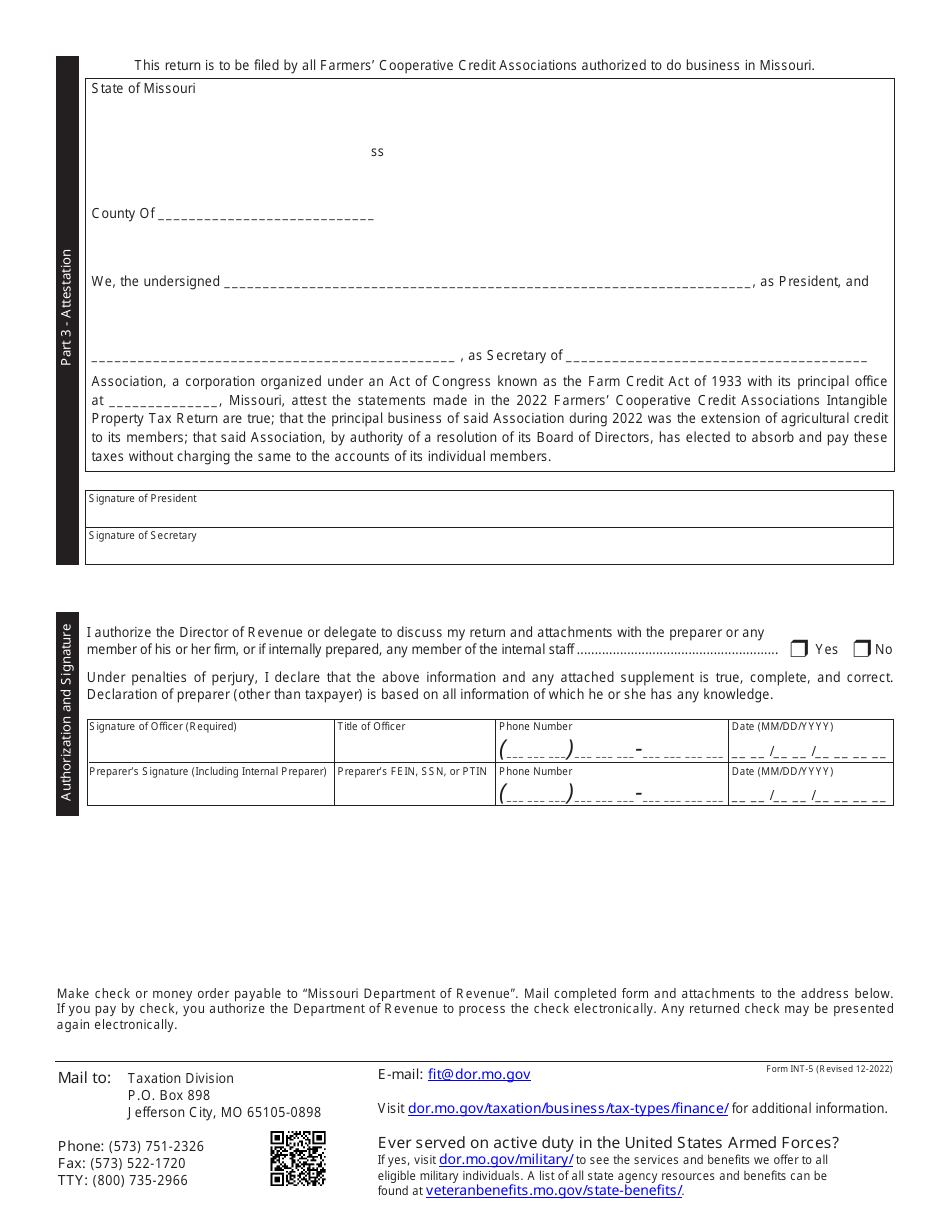

Form INT-5

for the current year.

Form INT-5 Farmers' Cooperative Credit Associations Intangible Property Tax Return - Missouri

What Is Form INT-5?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form INT-5?

A: Form INT-5 is the Farmers' Cooperative Credit Associations Intangible Property Tax Return in Missouri.

Q: Who needs to file Form INT-5?

A: Farmers' Cooperative Credit Associations in Missouri need to file Form INT-5.

Q: What is the purpose of Form INT-5?

A: The purpose of Form INT-5 is to report the intangible property of Farmers' Cooperative Credit Associations for tax assessment purposes.

Q: Is Form INT-5 specific to Missouri?

A: Yes, Form INT-5 is specific to Missouri.

Q: Is Form INT-5 an annual or a one-time filing?

A: Form INT-5 is an annual filing that needs to be submitted each year.

Q: Are there any filing deadlines for Form INT-5?

A: Yes, there are specific filing deadlines for Form INT-5. Please refer to the instructions provided with the form or contact the Missouri Department of Revenue for the current deadlines.

Q: Are there any fees associated with filing Form INT-5?

A: There may be fees associated with filing Form INT-5. Please check the instructions provided with the form or contact the Missouri Department of Revenue for more information.

Q: What information is required to complete Form INT-5?

A: Form INT-5 requires information about the Farmers' Cooperative Credit Association's intangible property, including assets and liabilities.

Q: Can Form INT-5 be filed electronically?

A: Yes, Form INT-5 can be filed electronically. Please check the instructions provided with the form for electronic filing options.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form INT-5 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.