This version of the form is not currently in use and is provided for reference only. Download this version of

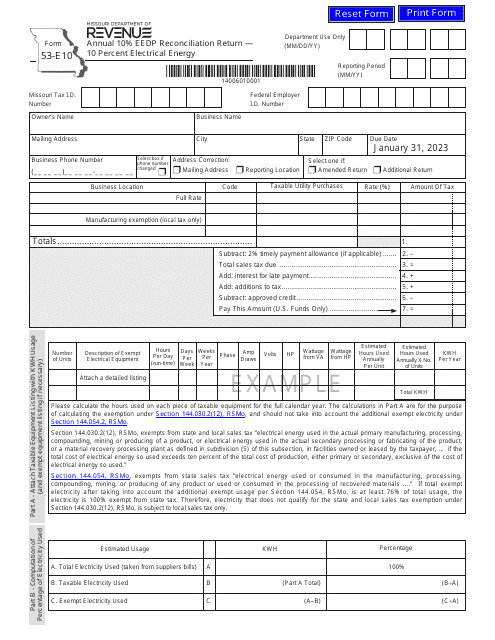

Form 53-E10

for the current year.

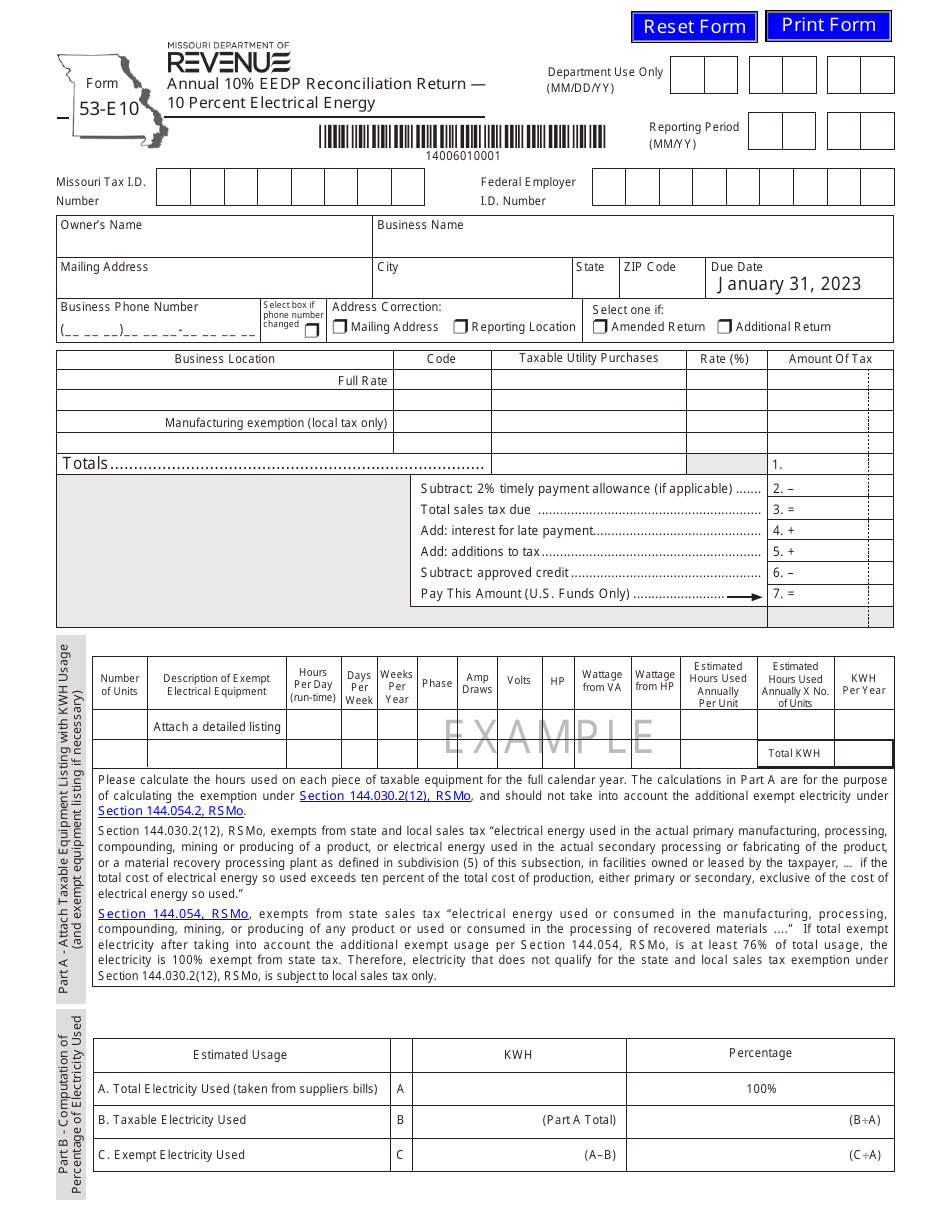

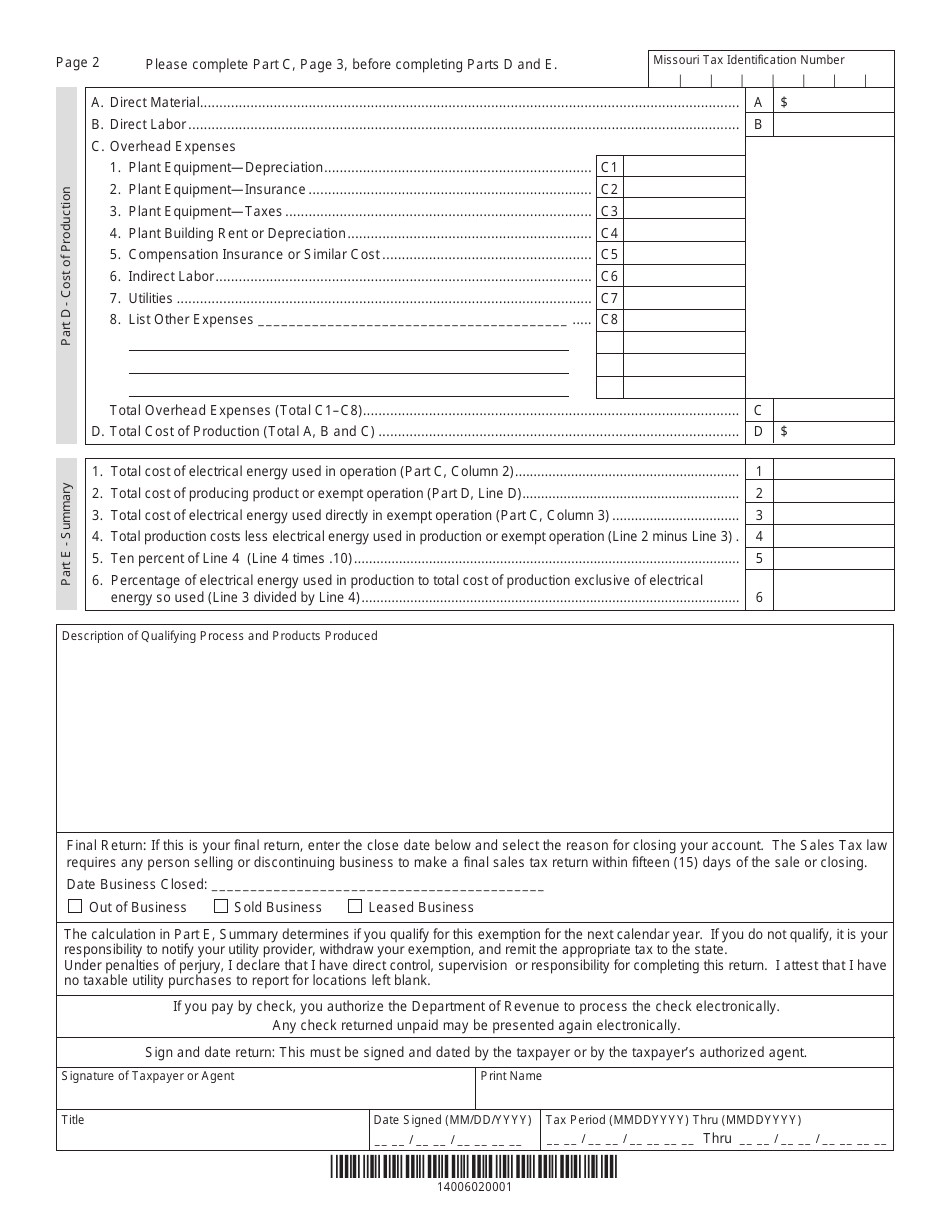

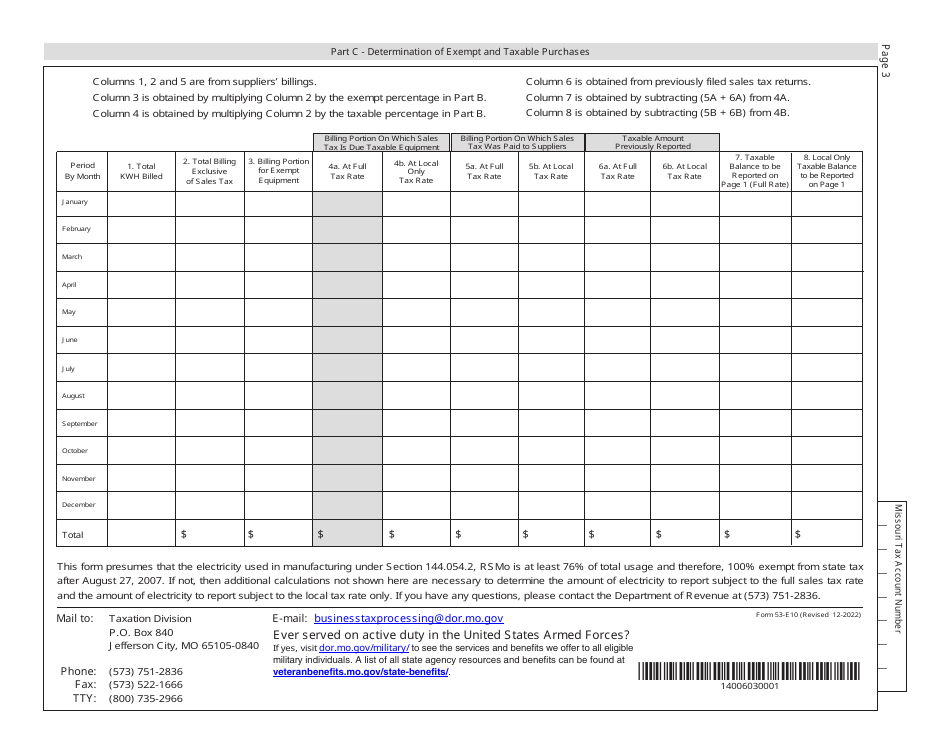

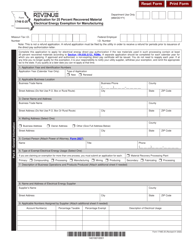

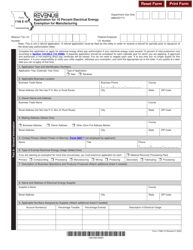

Form 53-E10 Annual 10% Eedp Reconciliation Return - 10 Percent Electrical Energy - Missouri

What Is Form 53-E10?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 53-E10?

A: Form 53-E10 is the Annual 10% Eedp Reconciliation Return for 10 Percent Electrical Energy.

Q: Who needs to file Form 53-E10?

A: Businesses that generate or sell 10 percent electrical energy in Missouri need to file Form 53-E10.

Q: What is the purpose of Form 53-E10?

A: The purpose of Form 53-E10 is to reconcile the amount of 10 percent electrical energy distributed or sold during the previous year.

Q: What is 10 percent electrical energy?

A: 10 percent electrical energy refers to electricity generated from renewable energy sources.

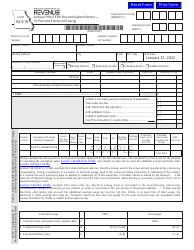

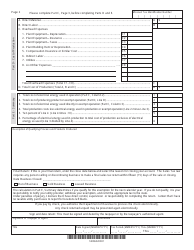

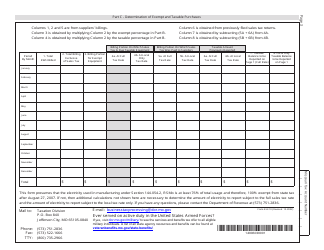

Q: What information is required on Form 53-E10?

A: Form 53-E10 requires information on the amount of 10 percent electrical energy generated, the amount sold, and any adjustments made.

Q: When is Form 53-E10 due?

A: Form 53-E10 is due on or before April 15th of each year.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 53-E10 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.