This version of the form is not currently in use and is provided for reference only. Download this version of

Form D-10B

for the current year.

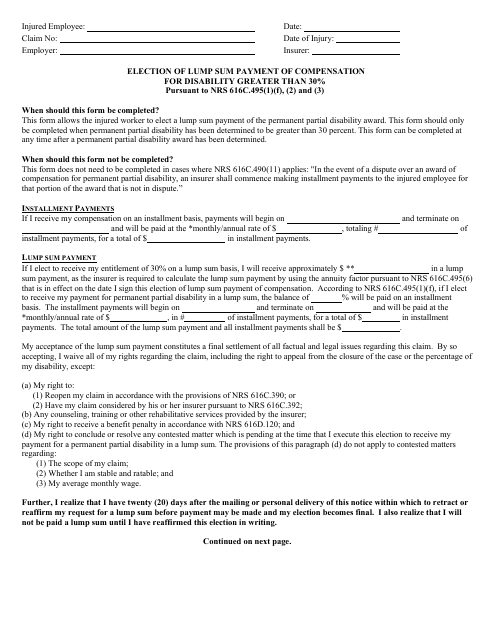

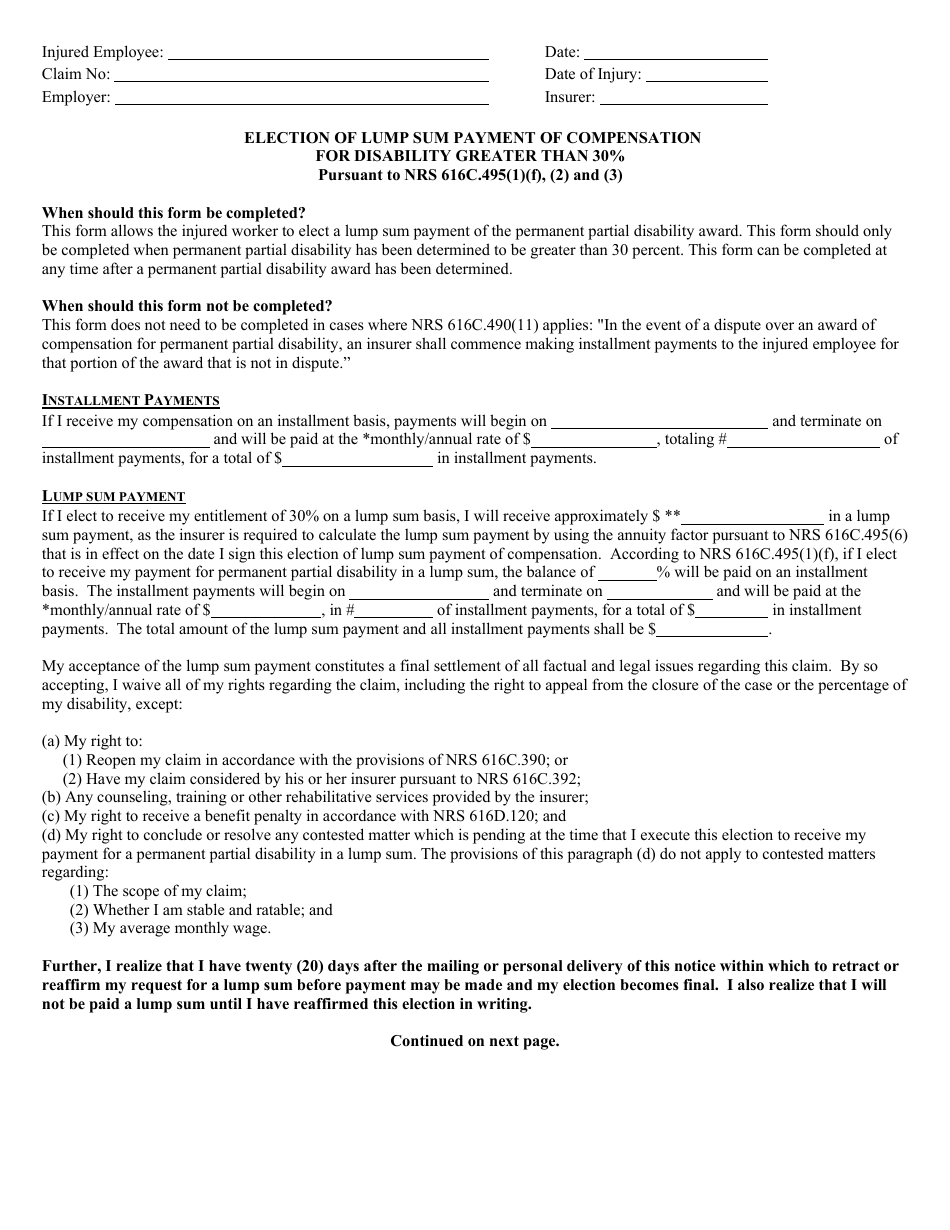

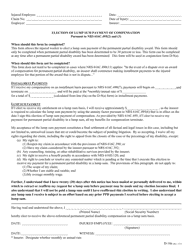

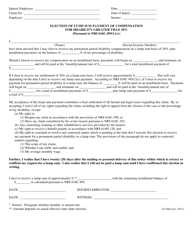

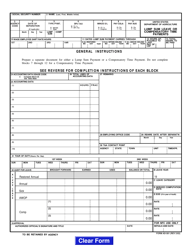

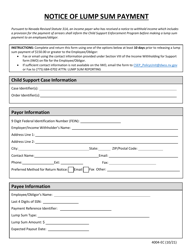

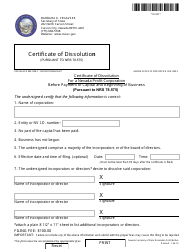

Form D-10B Election of Lump Sum Payment of Compensation for Disability Greater Than 30% Pursuant to Nrs 616c.495(1)(F), (2) and (3) - Nevada

What Is Form D-10B?

This is a legal form that was released by the Nevada Department of Business and Industry - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form D-10B?

A: Form D-10B is a form used in Nevada for electing a lump sum payment of compensation for disabilities greater than 30%.

Q: What is the purpose of Form D-10B?

A: The purpose of Form D-10B is to provide a written request for a lump sum payment of compensation for disabilities greater than 30%.

Q: What is NRS 616C.495(1)(F), (2) and (3)?

A: NRS 616C.495(1)(F), (2) and (3) refers to the specific sections of the Nevada Revised Statutes that outline the eligibility criteria and process for electing a lump sum payment of compensation for disabilities greater than 30%.

Q: Who can use Form D-10B?

A: Form D-10B can be used by individuals in Nevada who have disabilities greater than 30% and want to elect a lump sum payment of compensation.

Q: Is Form D-10B specific to Nevada?

A: Yes, Form D-10B is specific to Nevada and is used for workers' compensation cases in the state.

Q: Can I request a lump sum payment of compensation for disabilities less than 30% using Form D-10B?

A: No, Form D-10B is specifically for disabilities greater than 30%.

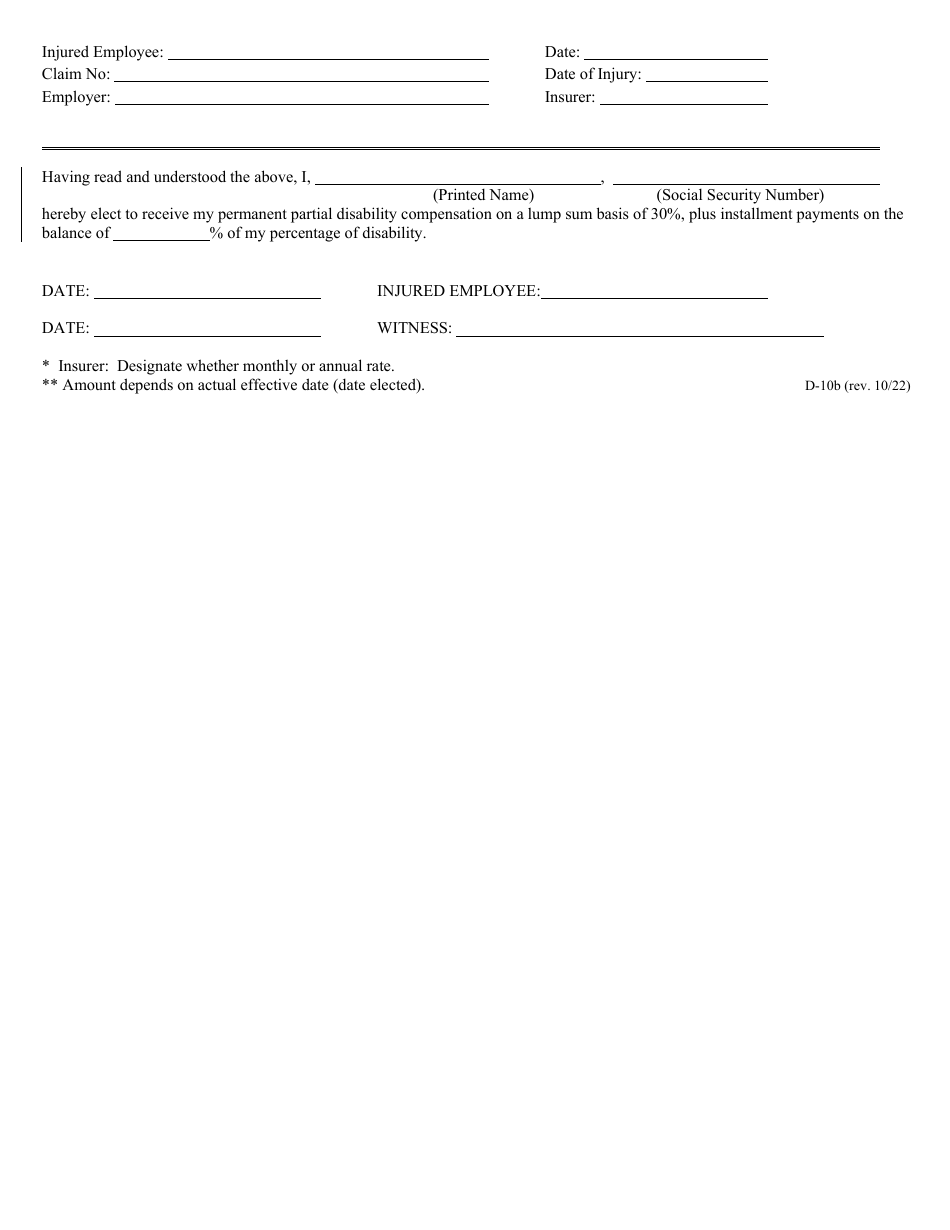

Q: What information is required on Form D-10B?

A: Form D-10B requires information such as the claimant's name, address, Social Security number, and details about the disability and the requested lump sum payment.

Q: Are there any deadlines for submitting Form D-10B?

A: Yes, Form D-10B must be submitted within 90 days from the date of the final decision regarding the claimant's compensation.

Q: Who should I contact if I have questions about Form D-10B?

A: For any questions about Form D-10B or the process of electing a lump sum payment of compensation, you should contact the Nevada Division of Industrial Relations.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Nevada Department of Business and Industry;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D-10B by clicking the link below or browse more documents and templates provided by the Nevada Department of Business and Industry.