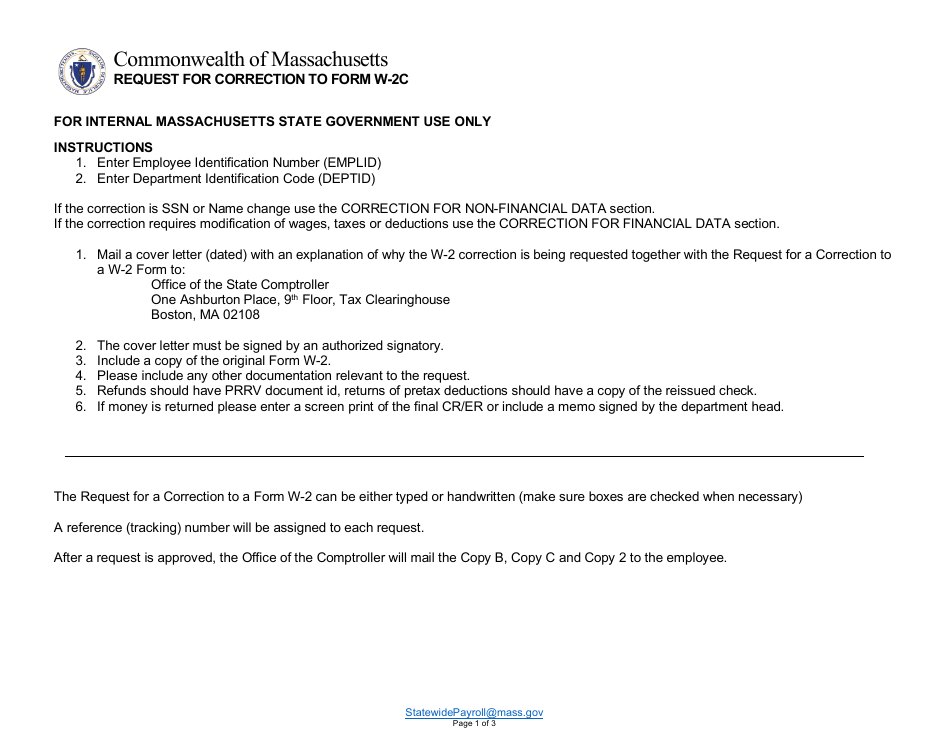

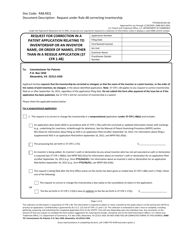

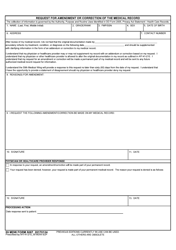

Request for Correction to Form W-2c - Massachusetts

Request for Correction to Form W-2c is a legal document that was released by the Comptroller of the Commonwealth of Massachusetts - a government authority operating within Massachusetts.

FAQ

Q: What is Form W-2c?

A: Form W-2c is a correction form for the W-2 wage and tax statement.

Q: What is the purpose of Form W-2c?

A: Form W-2c is used to correct errors on previously filed Forms W-2.

Q: Who needs to file Form W-2c?

A: Employers need to file Form W-2c when there are errors on previously filed Forms W-2.

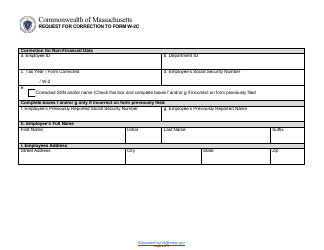

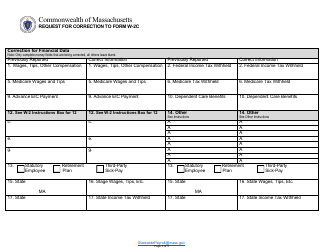

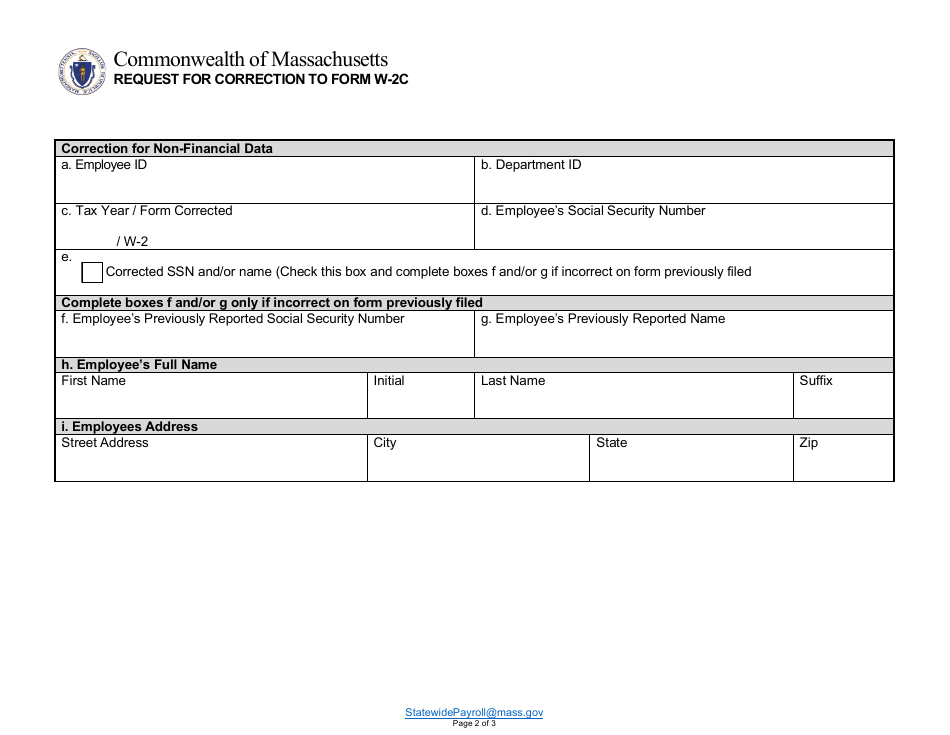

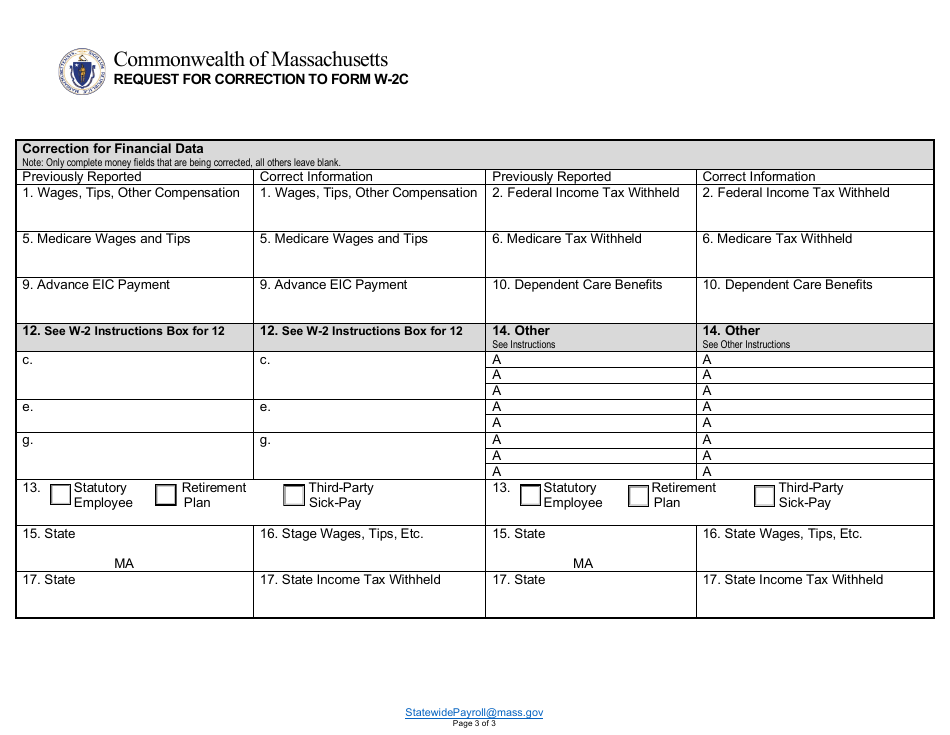

Q: What information needs to be corrected on Form W-2c?

A: Form W-2c is used to correct errors in wages, taxes, or both.

Q: How do I request a correction to Form W-2c in Massachusetts?

A: To request a correction to Form W-2c in Massachusetts, you need to contact the Massachusetts Department of Revenue.

Q: What is the deadline for filing Form W-2c in Massachusetts?

A: The deadline for filing Form W-2c in Massachusetts is the same as the deadline for filing the original Forms W-2, which is January 31.

Q: Are there any penalties for not filing Form W-2c in Massachusetts?

A: Yes, there may be penalties for not filing Form W-2c in Massachusetts. It is important to timely correct any errors on Forms W-2 to avoid penalties.

Form Details:

- The latest edition currently provided by the Comptroller of the Commonwealth of Massachusetts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Comptroller of the Commonwealth of Massachusetts.