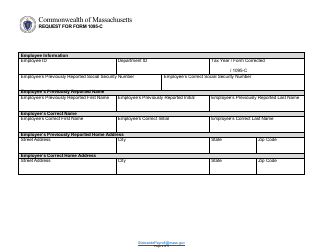

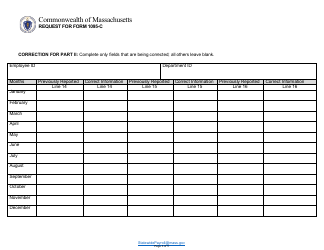

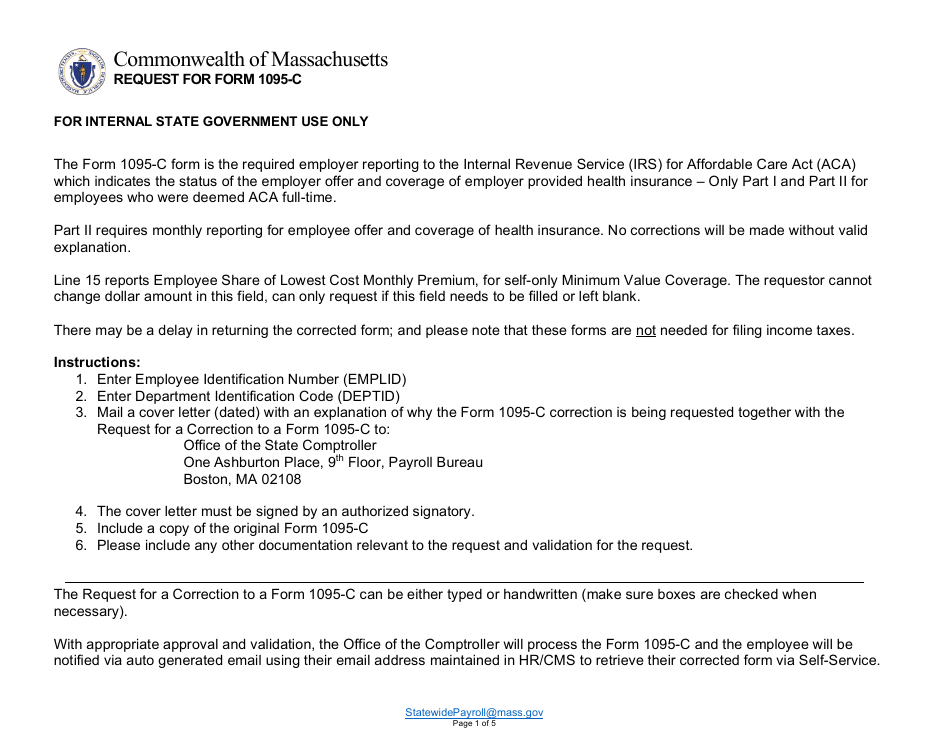

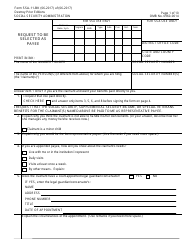

Request for Form 1095-c - Massachusetts

Request for Form 1095-c is a legal document that was released by the Comptroller of the Commonwealth of Massachusetts - a government authority operating within Massachusetts.

FAQ

Q: What is Form 1095-C?

A: Form 1095-C is a tax form used by employers to report information about health coverage offered to their employees.

Q: Do I need Form 1095-C to file my taxes?

A: No, you don't need Form 1095-C to file your taxes, but you should keep it for your records.

Q: Is Form 1095-C specific to Massachusetts?

A: No, Form 1095-C is a federal tax form used across the United States, not specific to Massachusetts.

Q: Who provides Form 1095-C?

A: Your employer will provide you with Form 1095-C.

Q: What information does Form 1095-C contain?

A: Form 1095-C contains information about the health coverage offered to you by your employer.

Q: What should I do if I haven't received Form 1095-C?

A: If you haven't received Form 1095-C, you should contact your employer to request it.

Q: Can I file my taxes without Form 1095-C?

A: Yes, you can still file your taxes without Form 1095-C. It is not required for tax filing, but you should keep it for your records.

Q: What should I do with Form 1095-C once I receive it?

A: Once you receive Form 1095-C, you should keep it for your records. It may be needed for documentation purposes in the future.

Form Details:

- The latest edition currently provided by the Comptroller of the Commonwealth of Massachusetts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Comptroller of the Commonwealth of Massachusetts.