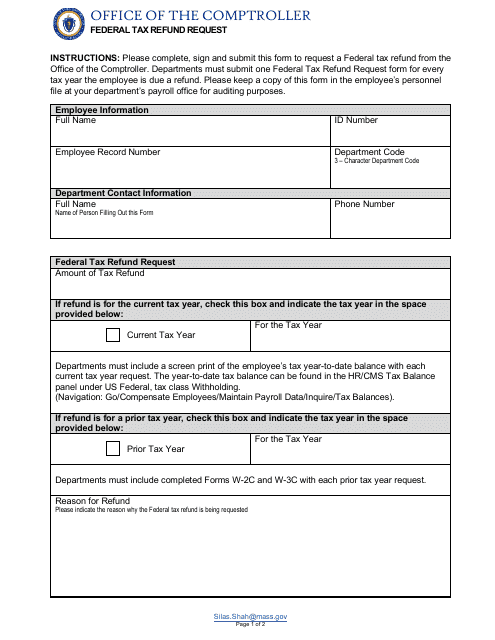

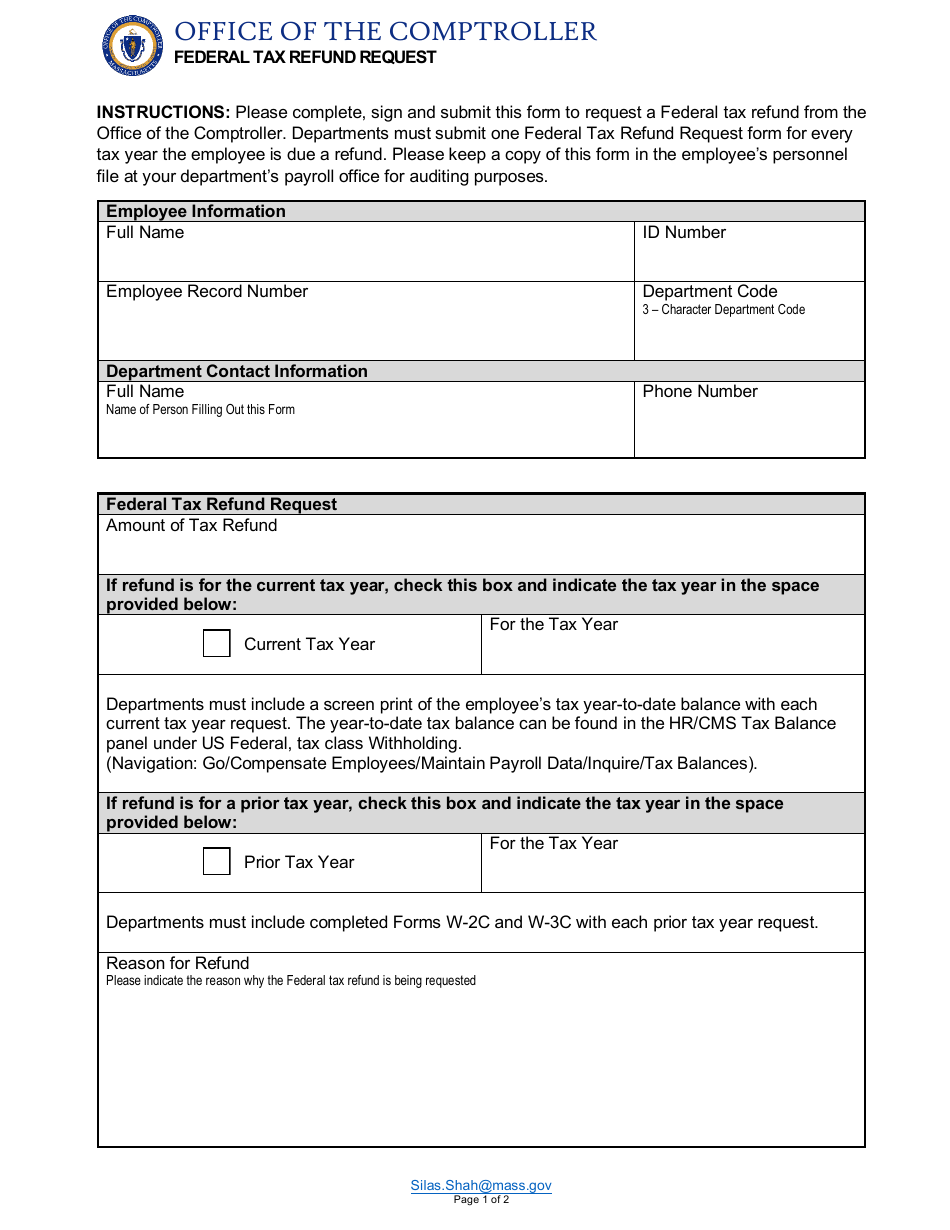

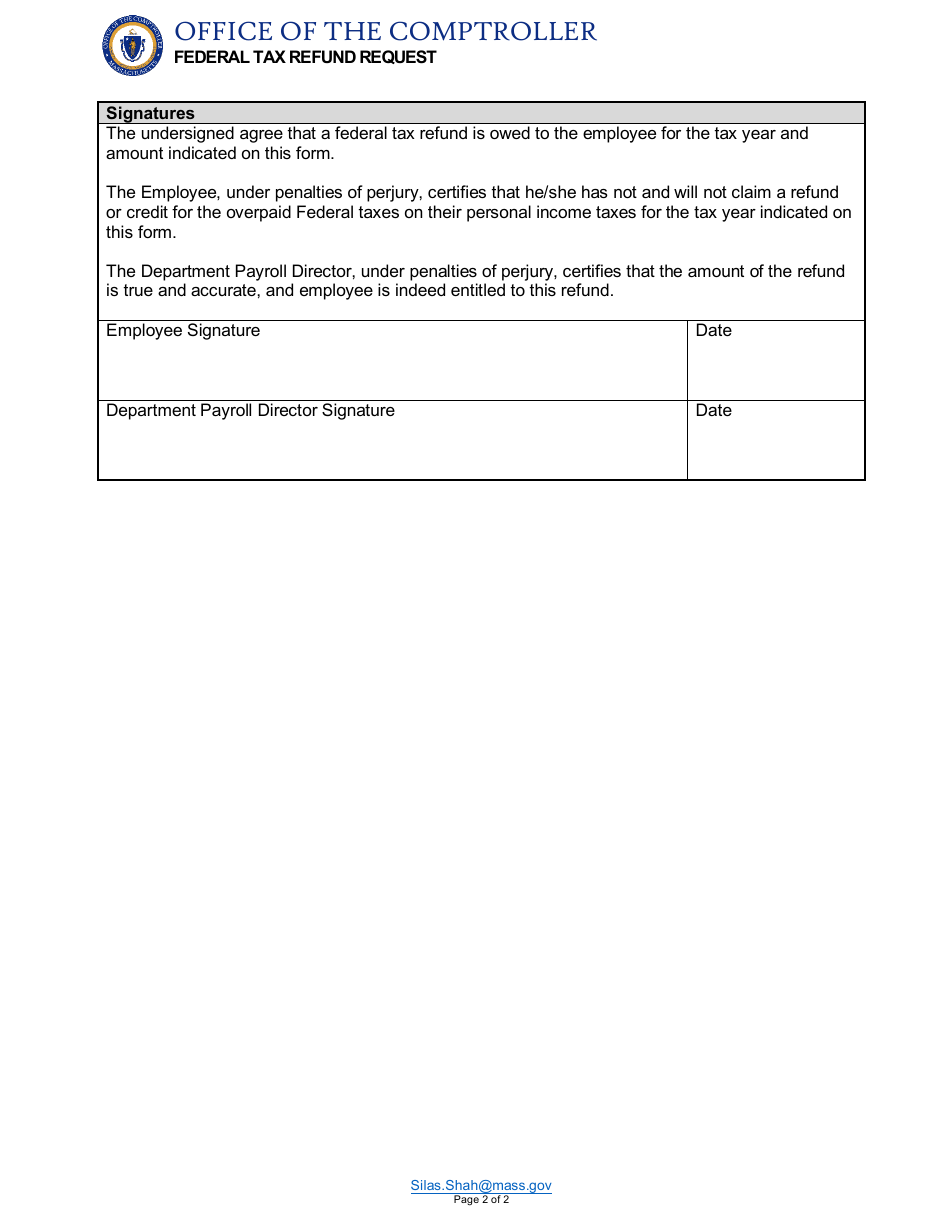

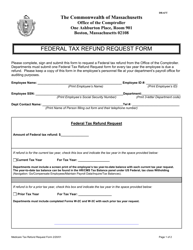

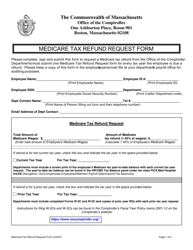

Federal Tax Refund Request - Massachusetts

Federal Tax Refund Request is a legal document that was released by the Comptroller of the Commonwealth of Massachusetts - a government authority operating within Massachusetts.

FAQ

Q: How can I request a federal tax refund?

A: To request a federal tax refund, you can file your income tax return with the IRS.

Q: Are federal tax refunds taxable?

A: No, federal tax refunds are generally not taxable.

Q: How long does it take to receive a federal tax refund?

A: It typically takes about three weeks to receive a federal tax refund if you e-file and choose direct deposit.

Q: What if I made a mistake on my federal tax return?

A: If you made a mistake on your federal tax return, you can file an amended return using Form 1040X.

Q: What happens if I don't file a federal tax return?

A: If you are required to file a federal tax return and fail to do so, you may face penalties and interest on any unpaid taxes.

Q: Can I get my federal tax refund as a direct deposit?

A: Yes, you can choose to have your federal tax refund directly deposited into your bank account.

Q: Do I need to include my state tax refund as income?

A: In most cases, you do not need to include your state tax refund as income on your federal tax return.

Q: Can I claim a federal tax refund for previous years?

A: Yes, you can claim a federal tax refund for previous years by filing an amended return within the applicable time limit.

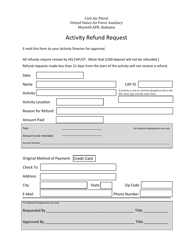

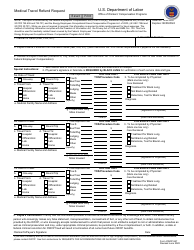

Form Details:

- The latest edition currently provided by the Comptroller of the Commonwealth of Massachusetts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Comptroller of the Commonwealth of Massachusetts.