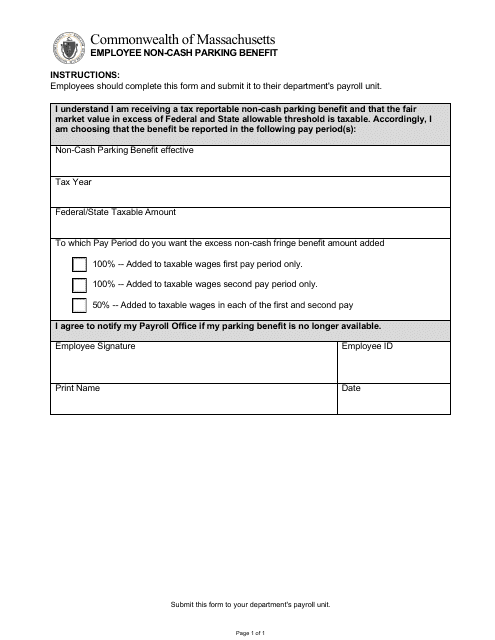

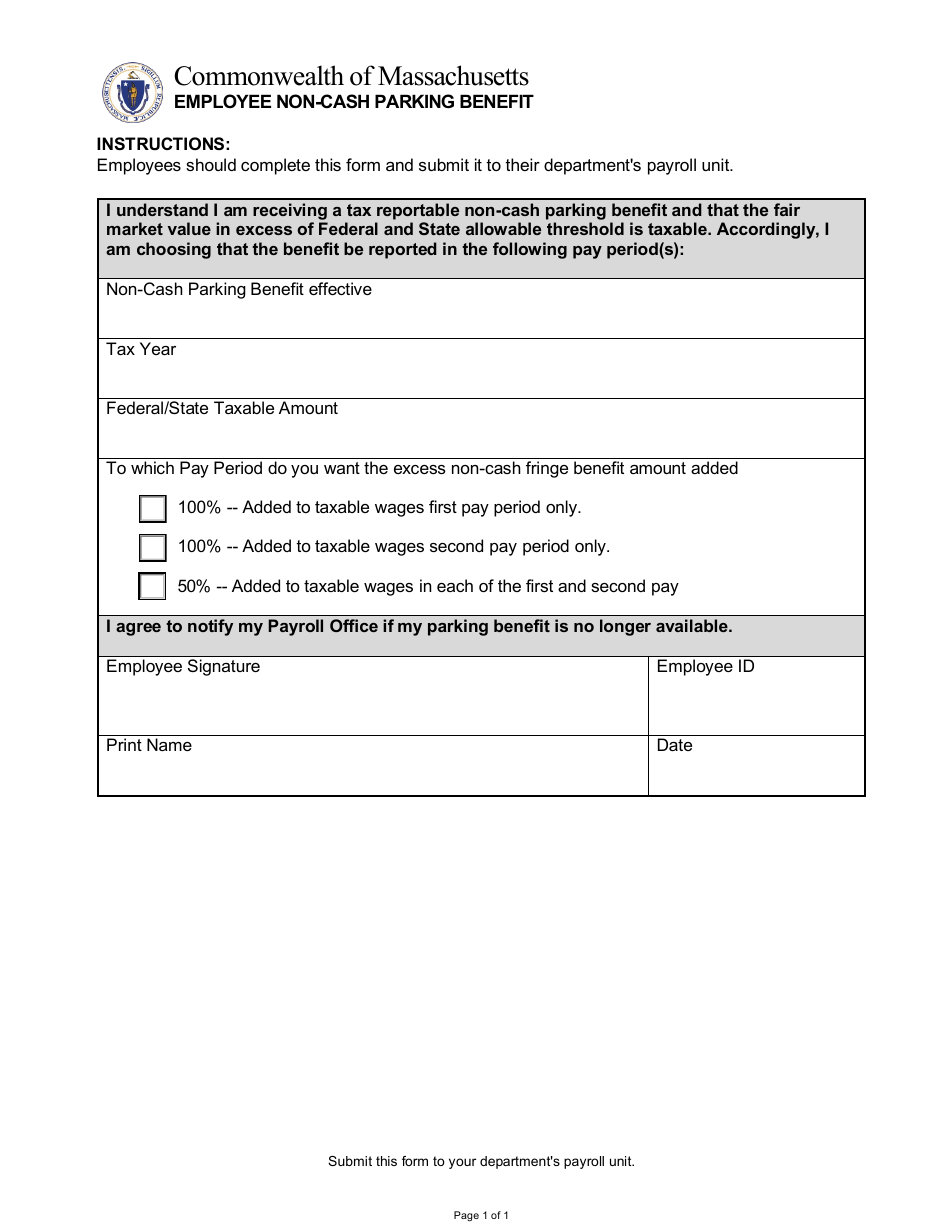

Employee Non-cash Parking Benefit - Massachusetts

Employee Non-cash Parking Benefit is a legal document that was released by the Comptroller of the Commonwealth of Massachusetts - a government authority operating within Massachusetts.

FAQ

Q: What is an employee non-cash parking benefit in Massachusetts?

A: An employee non-cash parking benefit in Massachusetts refers to the provision of parking facilities or arrangements to employees as a form of compensation, without the employee actually receiving any cash.

Q: Is an employee non-cash parking benefit taxable in Massachusetts?

A: Yes, an employee non-cash parking benefit is generally taxable in Massachusetts.

Q: How is an employee non-cash parking benefit taxed in Massachusetts?

A: The value of the non-cash parking benefit is considered taxable income and must be included in the employee's wages for tax purposes.

Q: Are there any exemptions or exclusions for employee non-cash parking benefits in Massachusetts?

A: There may be certain exemptions or exclusions available for employee non-cash parking benefits in Massachusetts. It is advisable to consult a tax professional or refer to the relevant tax laws for specific details.

Form Details:

- The latest edition currently provided by the Comptroller of the Commonwealth of Massachusetts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Comptroller of the Commonwealth of Massachusetts.