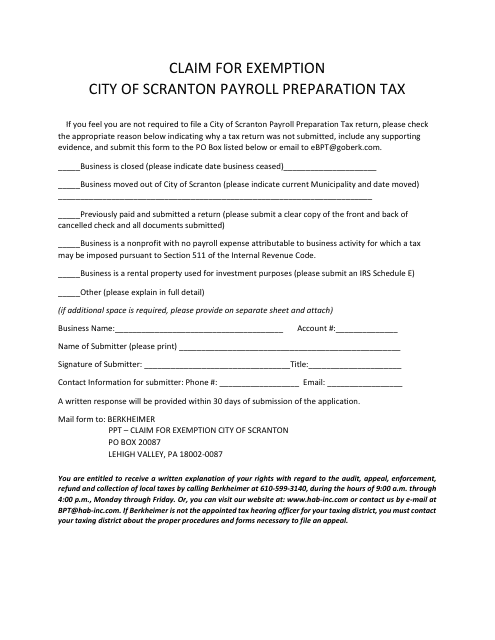

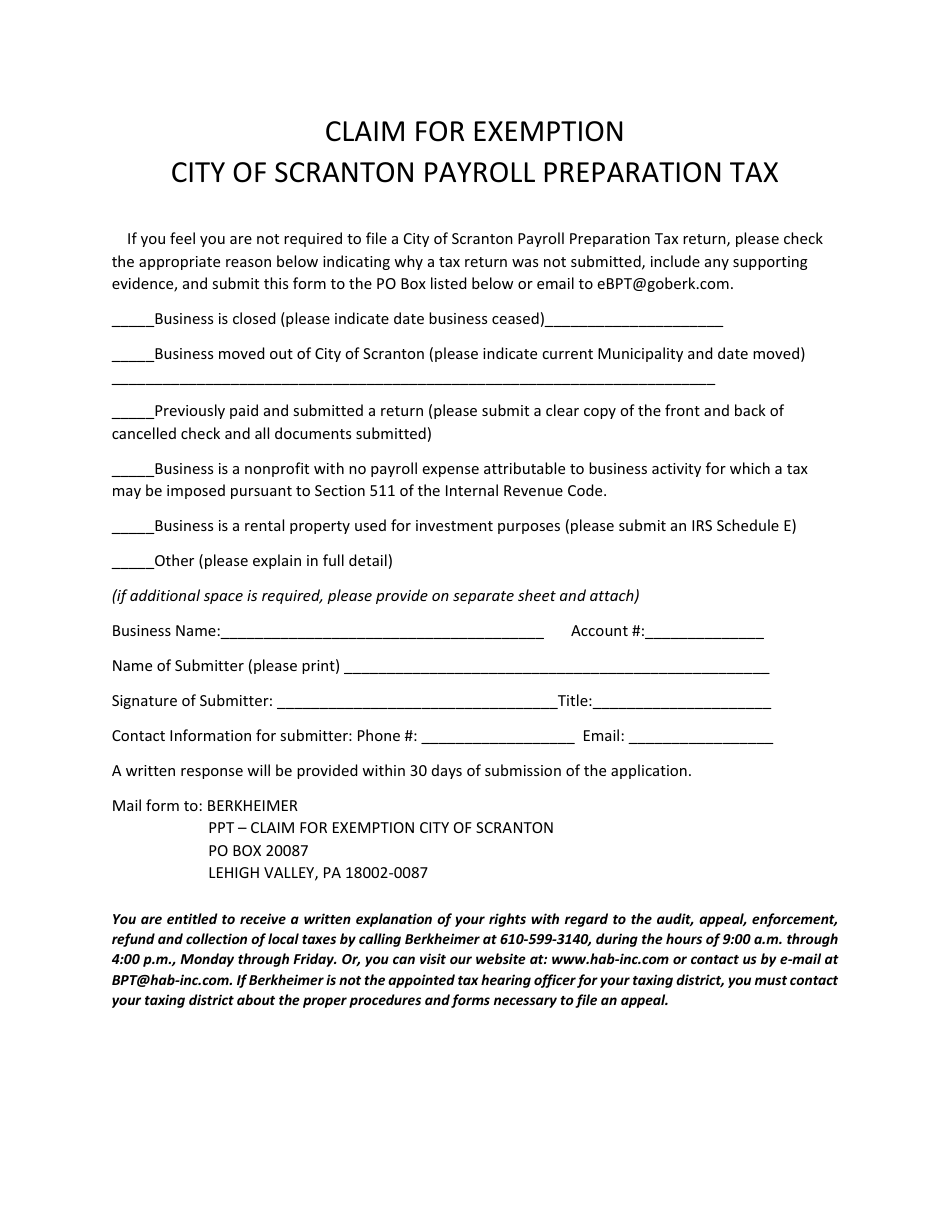

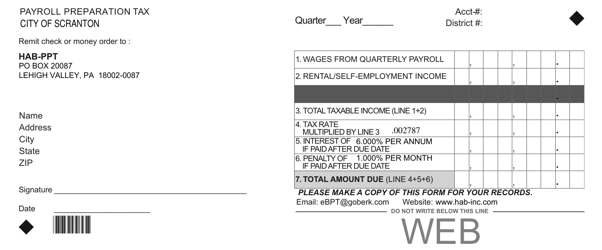

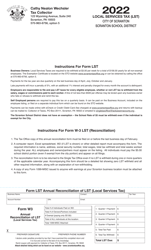

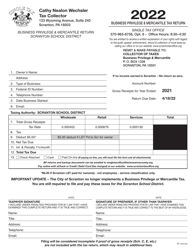

Claim for Exemption - City of Scranton Payroll Preparation Tax - Pennsylvania

Claim for Exemption - City of Scranton Payroll Preparation Tax is a legal document that was released by the Berkheimer Tax Administrator - a government authority operating within Pennsylvania.

FAQ

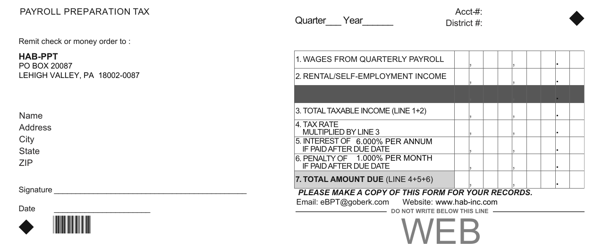

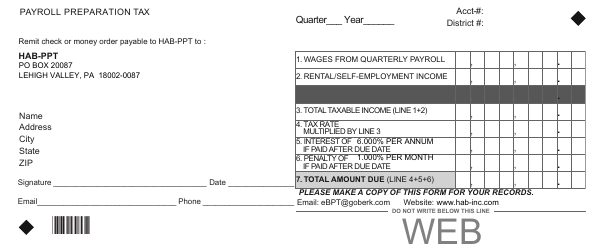

Q: What is the City of Scranton Payroll Preparation Tax?

A: The City of Scranton Payroll Preparation Tax is a tax imposed by the City of Scranton in Pennsylvania.

Q: Who is required to pay the City of Scranton Payroll Preparation Tax?

A: Employers who have employees working in Scranton, Pennsylvania are required to pay the City of Scranton Payroll Preparation Tax.

Q: What is the purpose of the City of Scranton Payroll Preparation Tax?

A: The City of Scranton Payroll Preparation Tax is used to fund various city services and programs in Scranton, Pennsylvania.

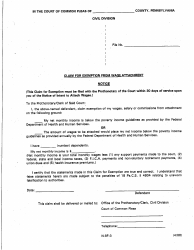

Q: Can I claim an exemption from the City of Scranton Payroll Preparation Tax?

A: Yes, certain employers may be eligible for exemption from the City of Scranton Payroll Preparation Tax.

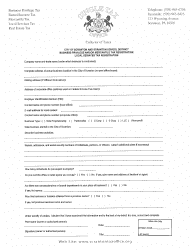

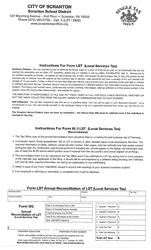

Q: How can I claim an exemption from the City of Scranton Payroll Preparation Tax?

A: To claim an exemption from the City of Scranton Payroll Preparation Tax, you will need to complete a claim form and submit it to the appropriate city department.

Q: What are the eligibility criteria for exemption from the City of Scranton Payroll Preparation Tax?

A: The eligibility criteria for exemption from the City of Scranton Payroll Preparation Tax vary and are determined by the city. It is best to consult the relevant city department for specific details.

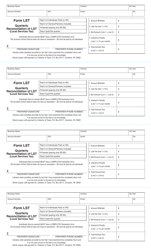

Form Details:

- The latest edition currently provided by the Berkheimer Tax Administrator;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Berkheimer Tax Administrator.