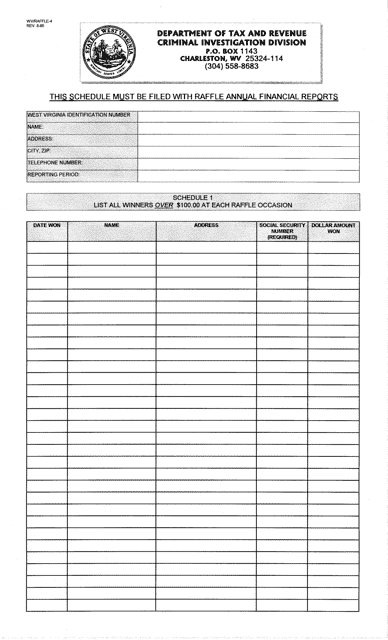

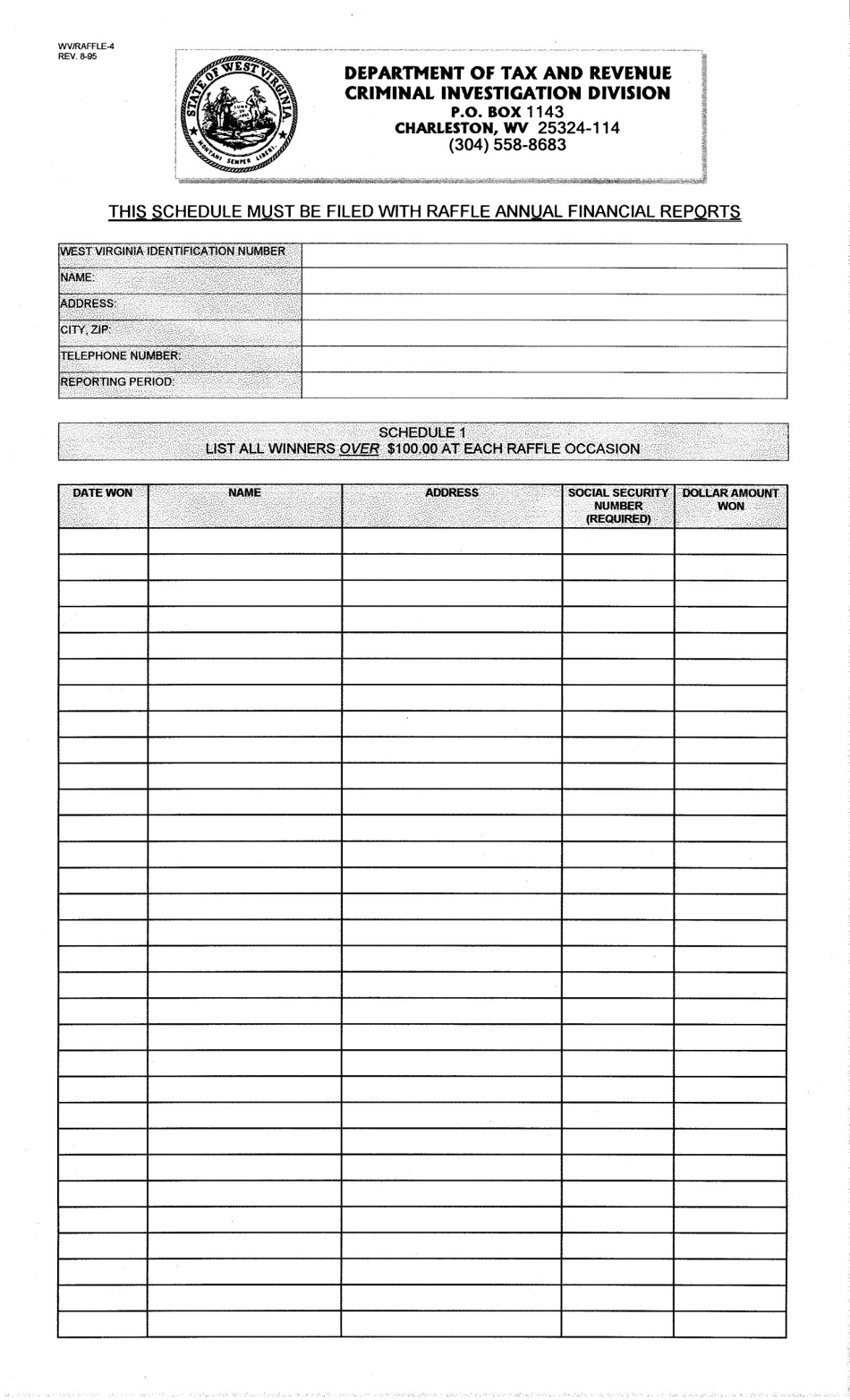

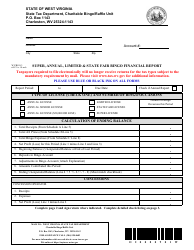

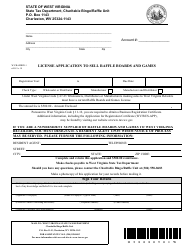

Form WV / RAFFLE-4 Raffle Annual Financial Report Schedule - West Virginia

What Is Form WV/RAFFLE-4?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WV/RAFFLE-4?

A: Form WV/RAFFLE-4 is the Raffle Annual Financial Report Schedule for West Virginia.

Q: What is the purpose of Form WV/RAFFLE-4?

A: The purpose of Form WV/RAFFLE-4 is to report the annual financial information of a raffle in West Virginia.

Q: Who needs to file Form WV/RAFFLE-4?

A: Organizations that conduct raffles in West Virginia are required to file Form WV/RAFFLE-4.

Q: When is Form WV/RAFFLE-4 due?

A: Form WV/RAFFLE-4 is due on or before the 15th day of the month following the end of the raffle event.

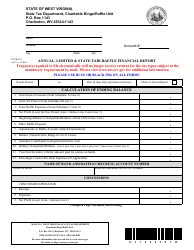

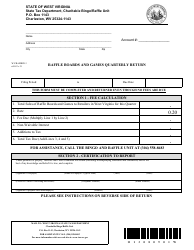

Q: What information needs to be included in Form WV/RAFFLE-4?

A: Form WV/RAFFLE-4 requires information about the gross receipts, expenses, and distribution of funds from the raffle.

Form Details:

- Released on August 1, 1995;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/RAFFLE-4 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.