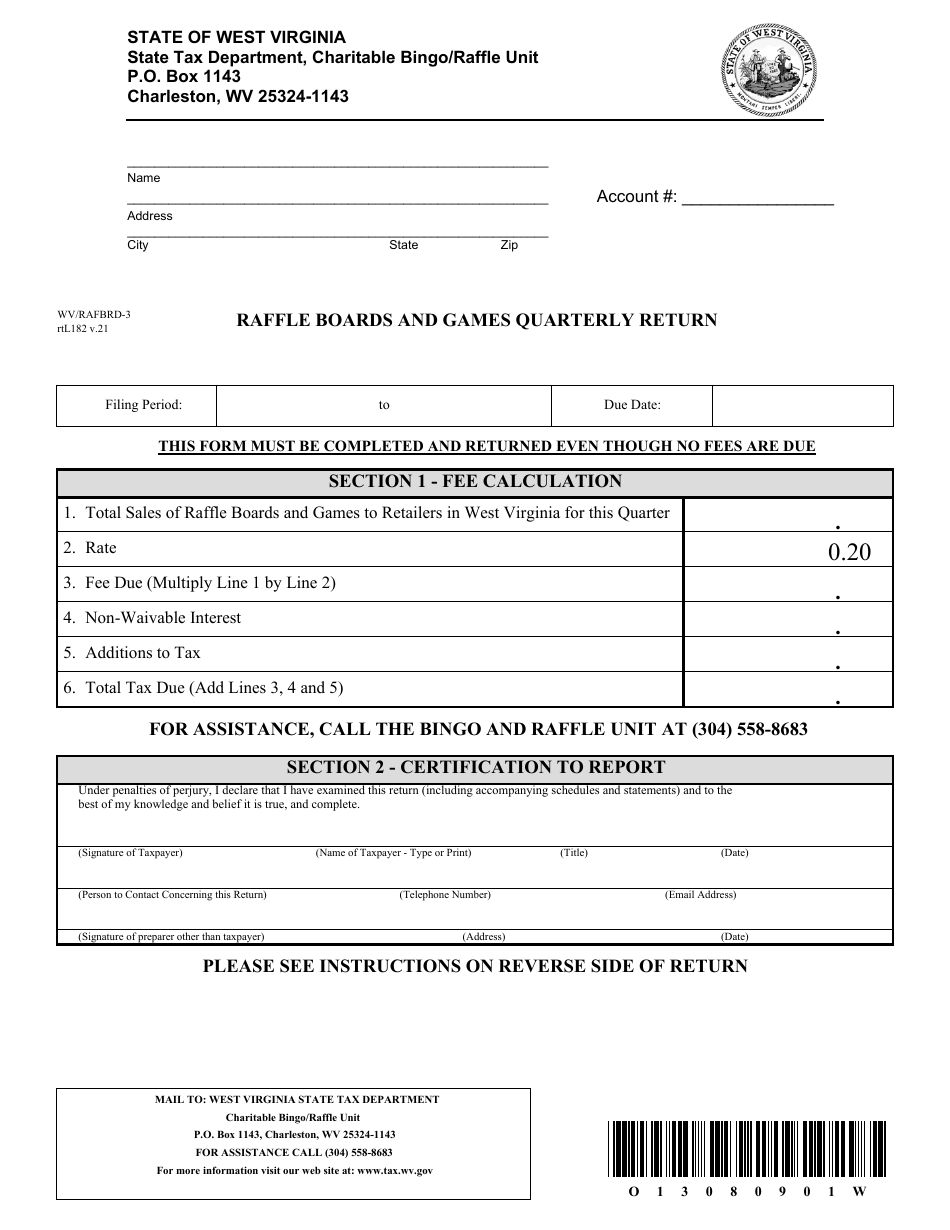

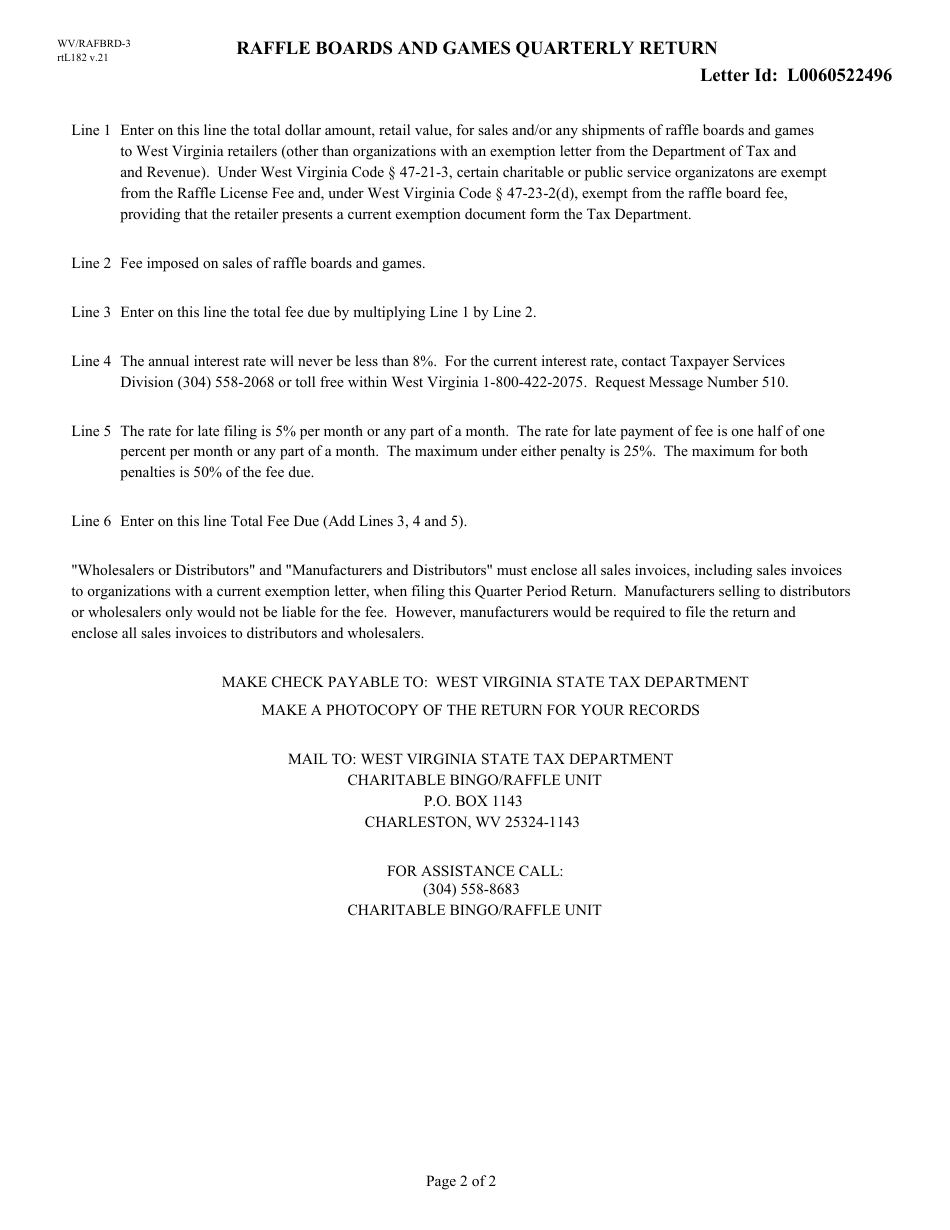

Form WV / RAFBRD-3 Raffle Boards and Games Quarterly Return - West Virginia

What Is Form WV/RAFBRD-3?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form WV/RAFBRD-3?

A: Form WV/RAFBRD-3 is the Raffle Boards and Games Quarterly Return for West Virginia.

Q: Who needs to file Form WV/RAFBRD-3?

A: Individuals or organizations conducting raffle boards and games in West Virginia must file Form WV/RAFBRD-3.

Q: What is the purpose of filing Form WV/RAFBRD-3?

A: The purpose of filing Form WV/RAFBRD-3 is to report the income, expenses, and other information related to raffle boards and games conducted in West Virginia.

Q: How often is Form WV/RAFBRD-3 filed?

A: Form WV/RAFBRD-3 is filed quarterly.

Q: Are there any filing fees for Form WV/RAFBRD-3?

A: No, there are no filing fees for Form WV/RAFBRD-3.

Q: When is the deadline to file Form WV/RAFBRD-3?

A: The deadline to file Form WV/RAFBRD-3 is the last day of the month following the end of the quarter.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/RAFBRD-3 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.