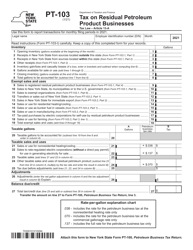

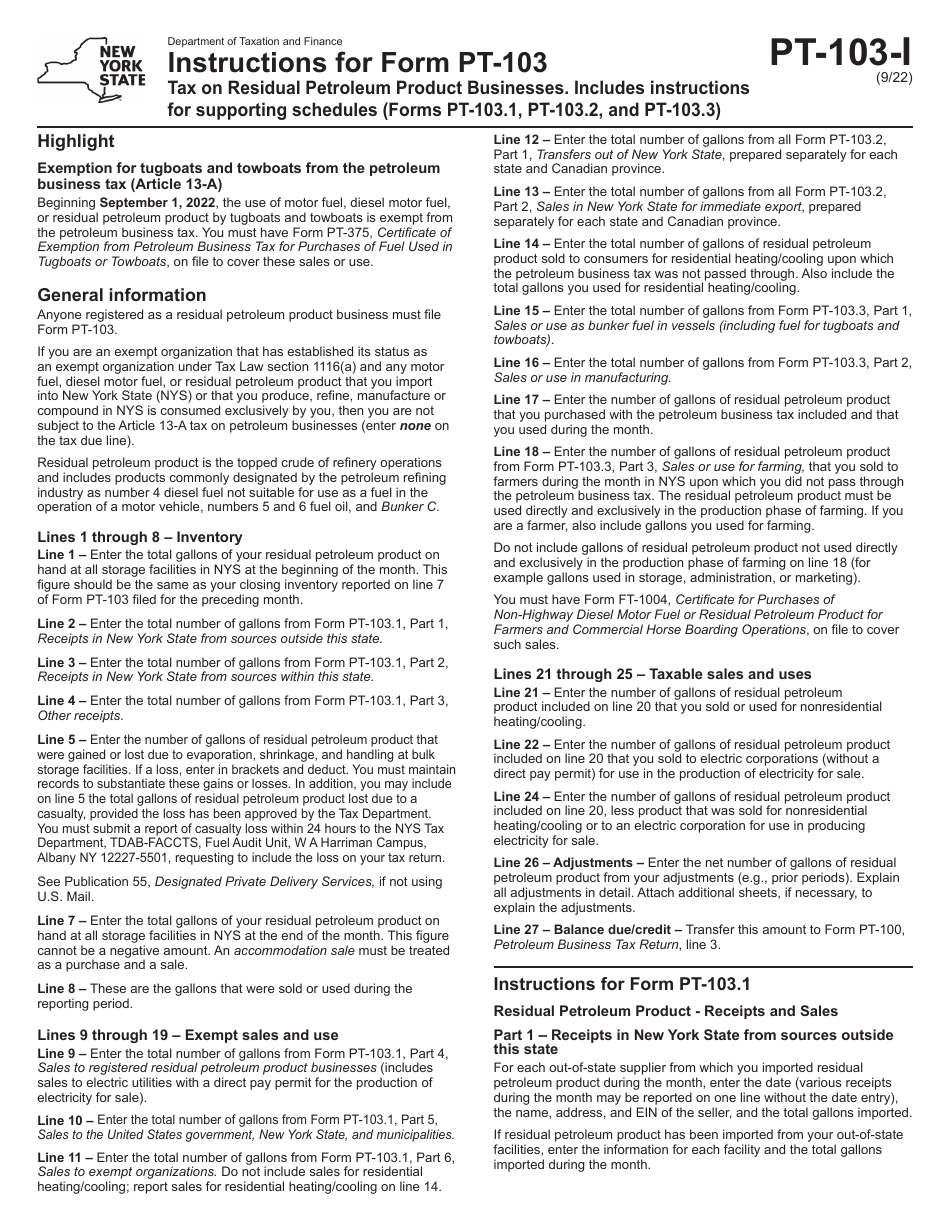

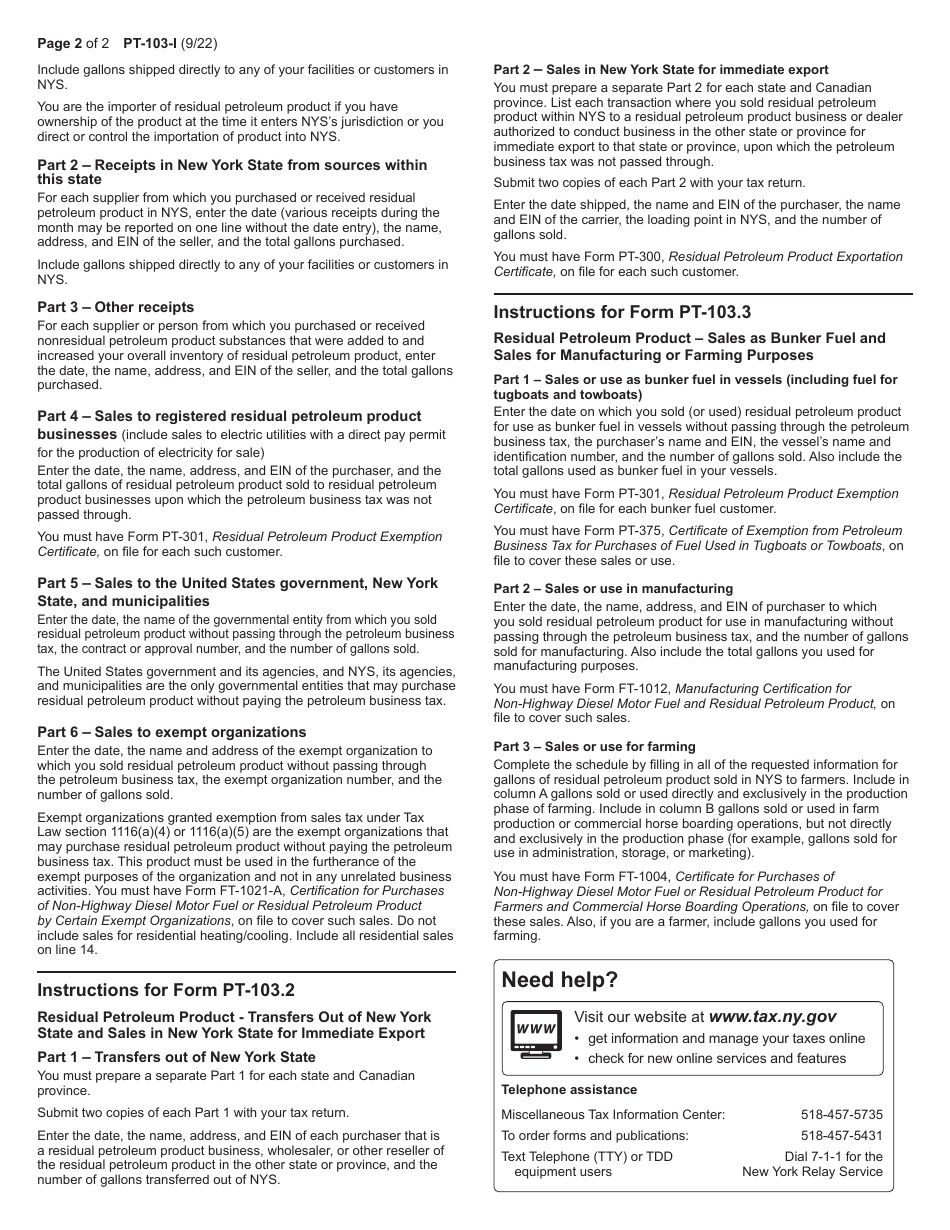

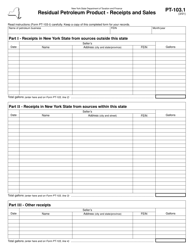

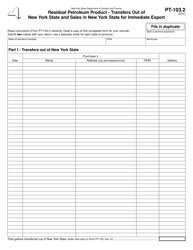

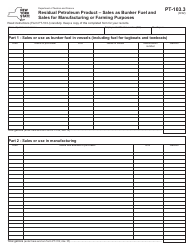

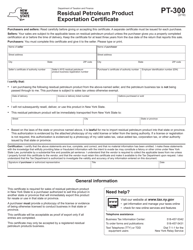

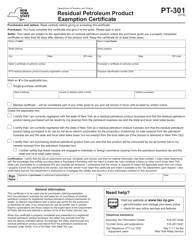

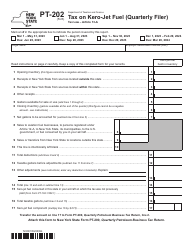

Instructions for Form PT-103 Tax on Residual Petroleum Product Businesses - New York

This document contains official instructions for Form PT-103 , Tax on Residual Petroleum Product Businesses - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form PT-103 is available for download through this link.

FAQ

Q: What is Form PT-103?

A: Form PT-103 is a tax form for reporting and paying taxes by residual petroleum product businesses in New York.

Q: Who needs to file Form PT-103?

A: Residual petroleum product businesses operating in New York need to file Form PT-103.

Q: What is the purpose of Form PT-103?

A: The purpose of Form PT-103 is to report and pay taxes on the sale of residual petroleum products in New York.

Q: How often do I need to file Form PT-103?

A: Form PT-103 must be filed on a quarterly basis.

Q: What information is required on Form PT-103?

A: Form PT-103 requires information such as gross receipts from sales, deductions, and tax due.

Q: What are the penalties for not filing Form PT-103?

A: Failure to file Form PT-103 can result in penalties and interest charges on the unpaid taxes.

Q: Are there any exceptions to filing Form PT-103?

A: There may be exceptions for small businesses with low sales volume, but it is best to consult with a tax professional or the Department of Taxation and Finance for specific details.

Q: When is the deadline for filing Form PT-103?

A: The deadline for filing Form PT-103 is the last day of the month following the end of each quarter.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.