This version of the form is not currently in use and is provided for reference only. Download this version of

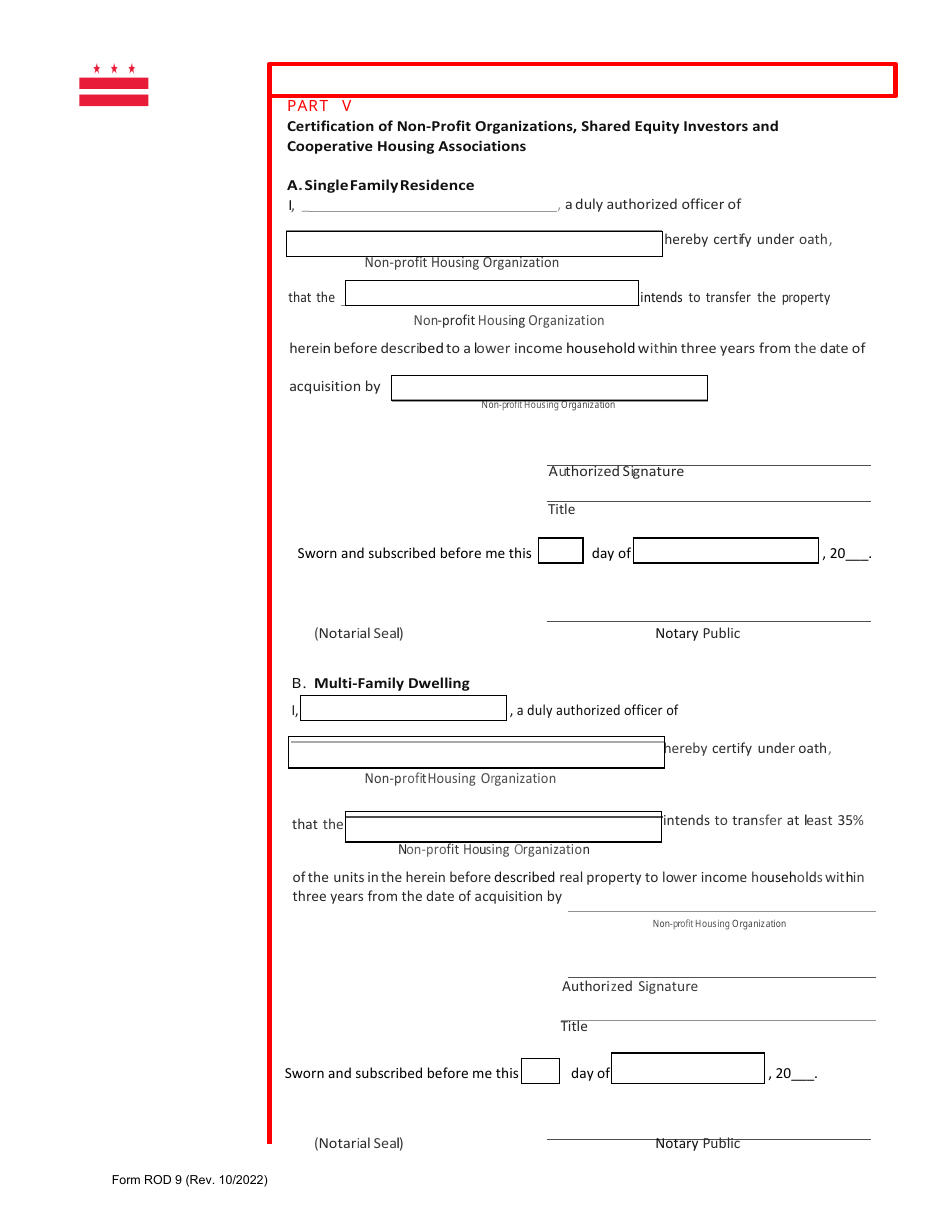

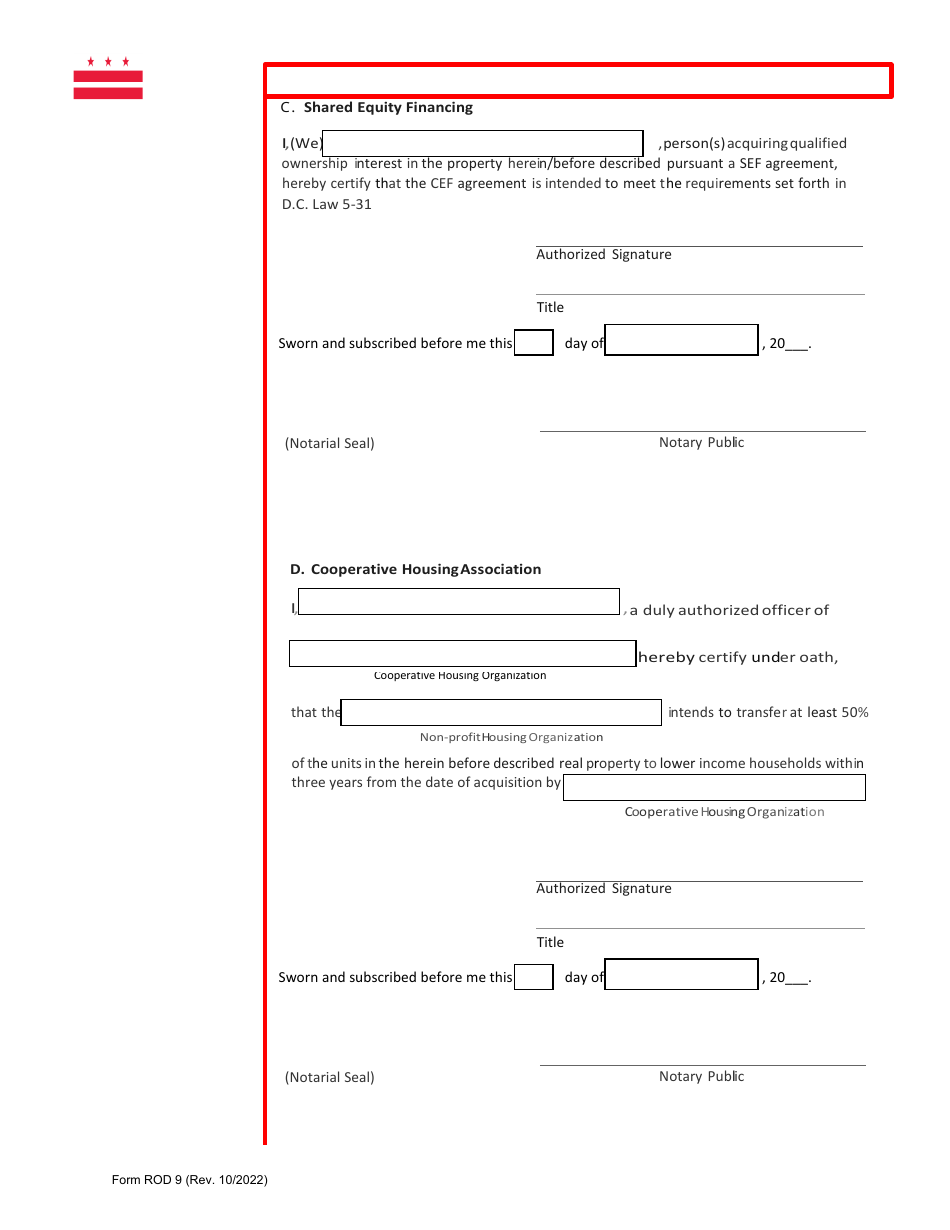

Form ROD9

for the current year.

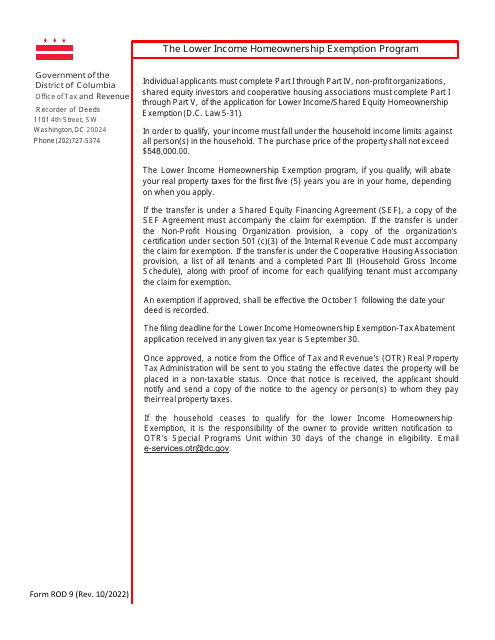

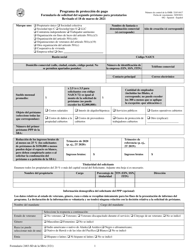

Form ROD9 Lower Income Homeownership Exemption Program Application - Washington, D.C.

What Is Form ROD9?

This is a legal form that was released by the Washington DC Office of Tax and Revenue - a government authority operating within Washington, D.C.. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

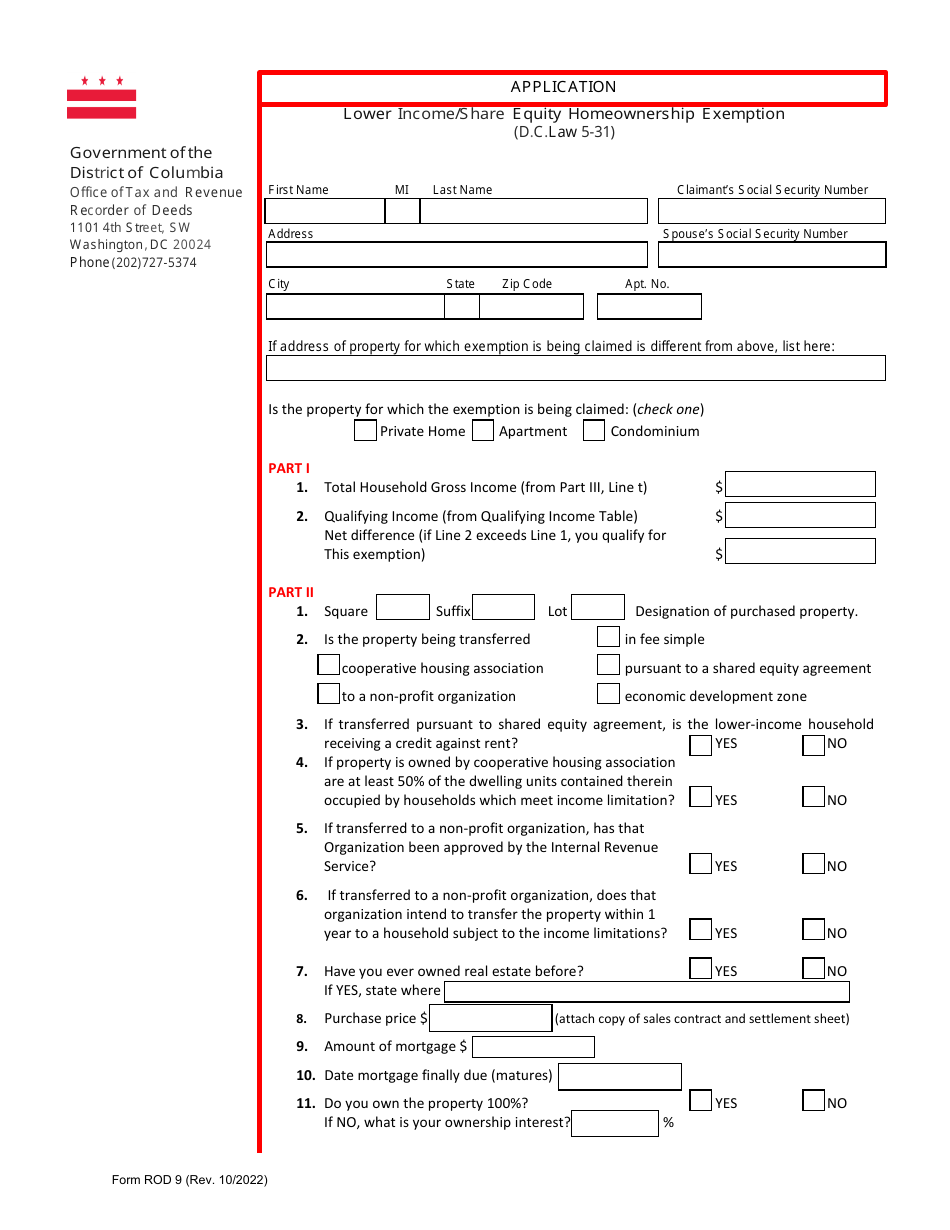

Q: What is the ROD9 Lower Income Homeownership Exemption Program Application?

A: The ROD9 Lower Income Homeownership Exemption Program Application is a form for applying for a property tax exemption in Washington, D.C.

Q: What is the purpose of the program?

A: The program aims to provide property tax relief for lower-income homeowners in Washington, D.C.

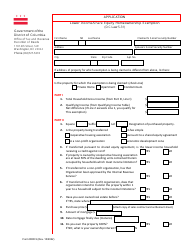

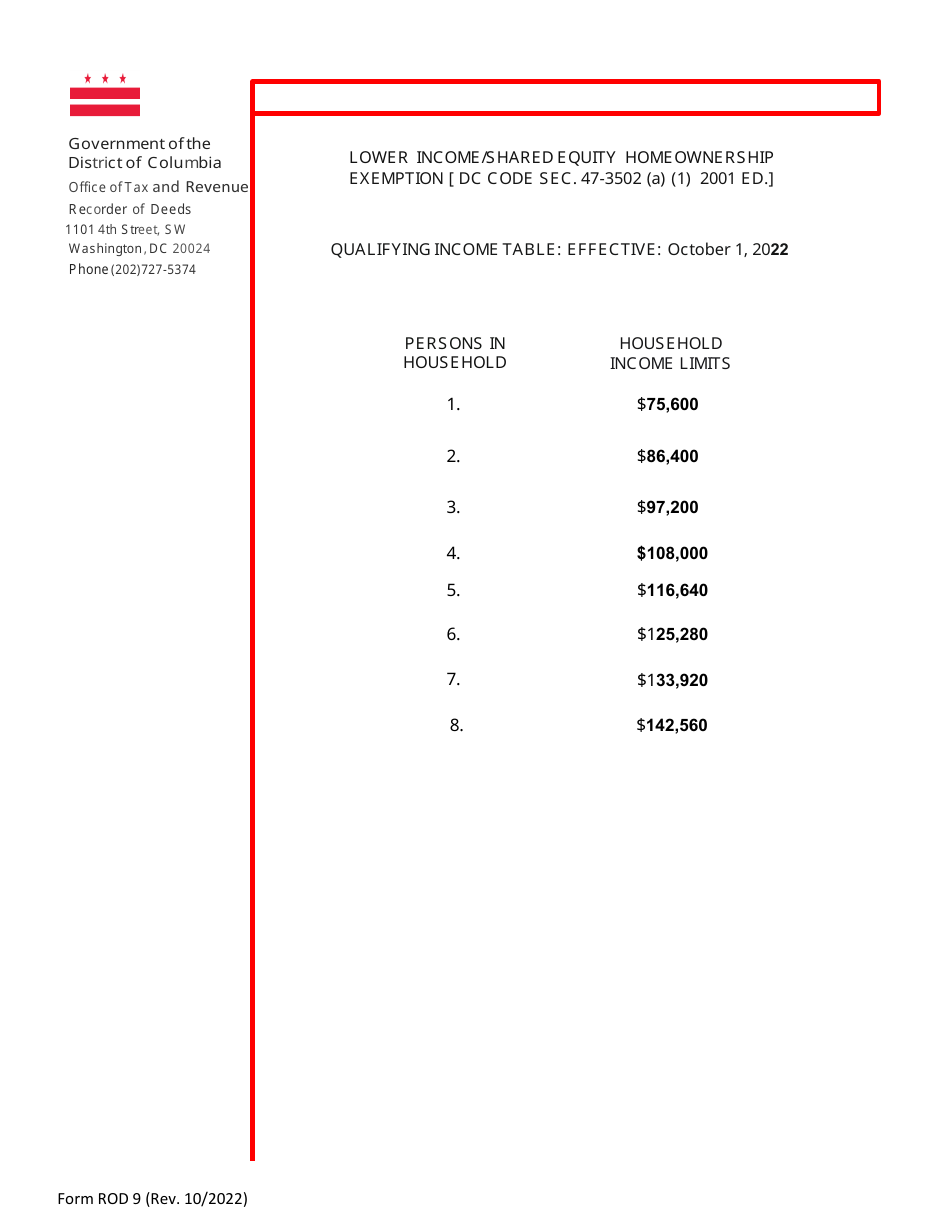

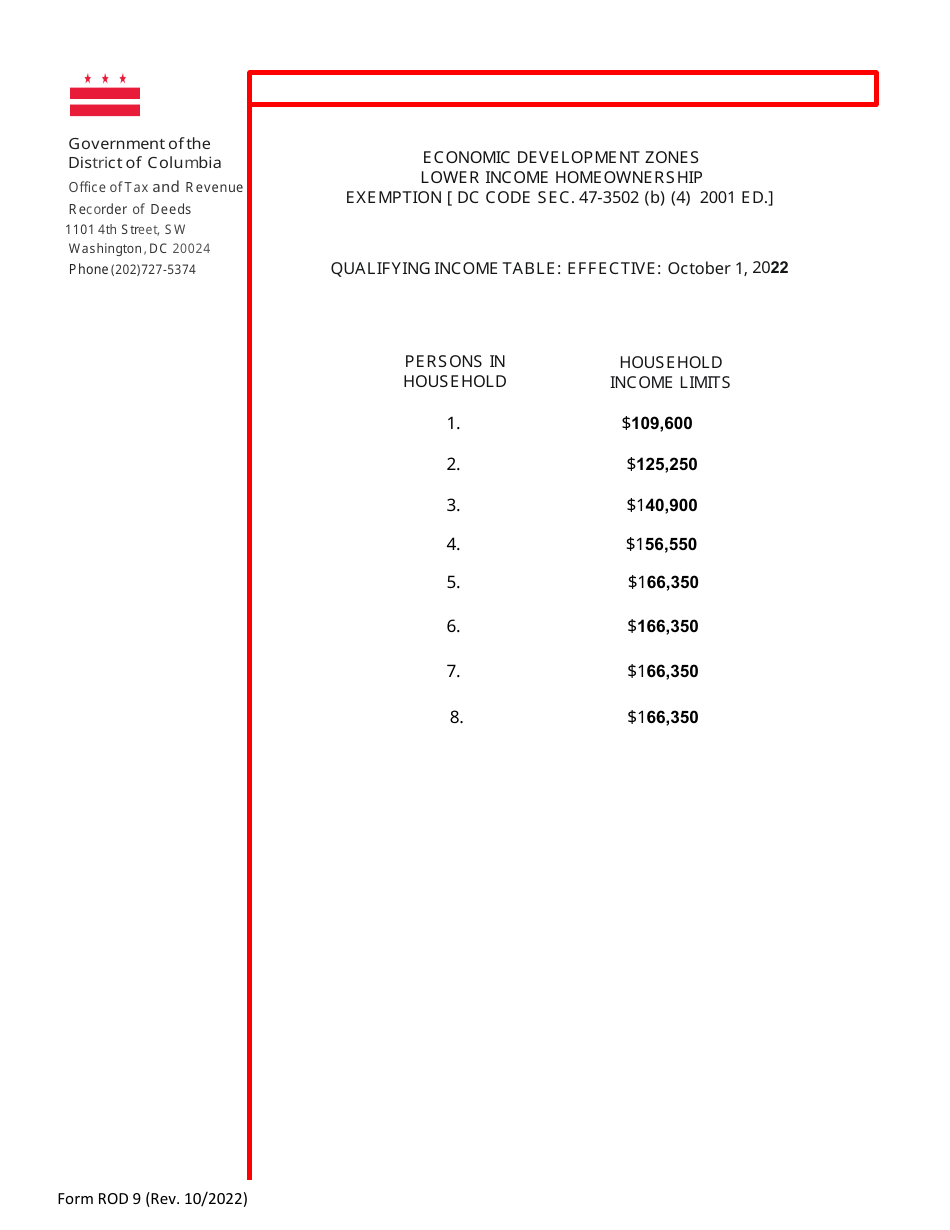

Q: Who is eligible for the program?

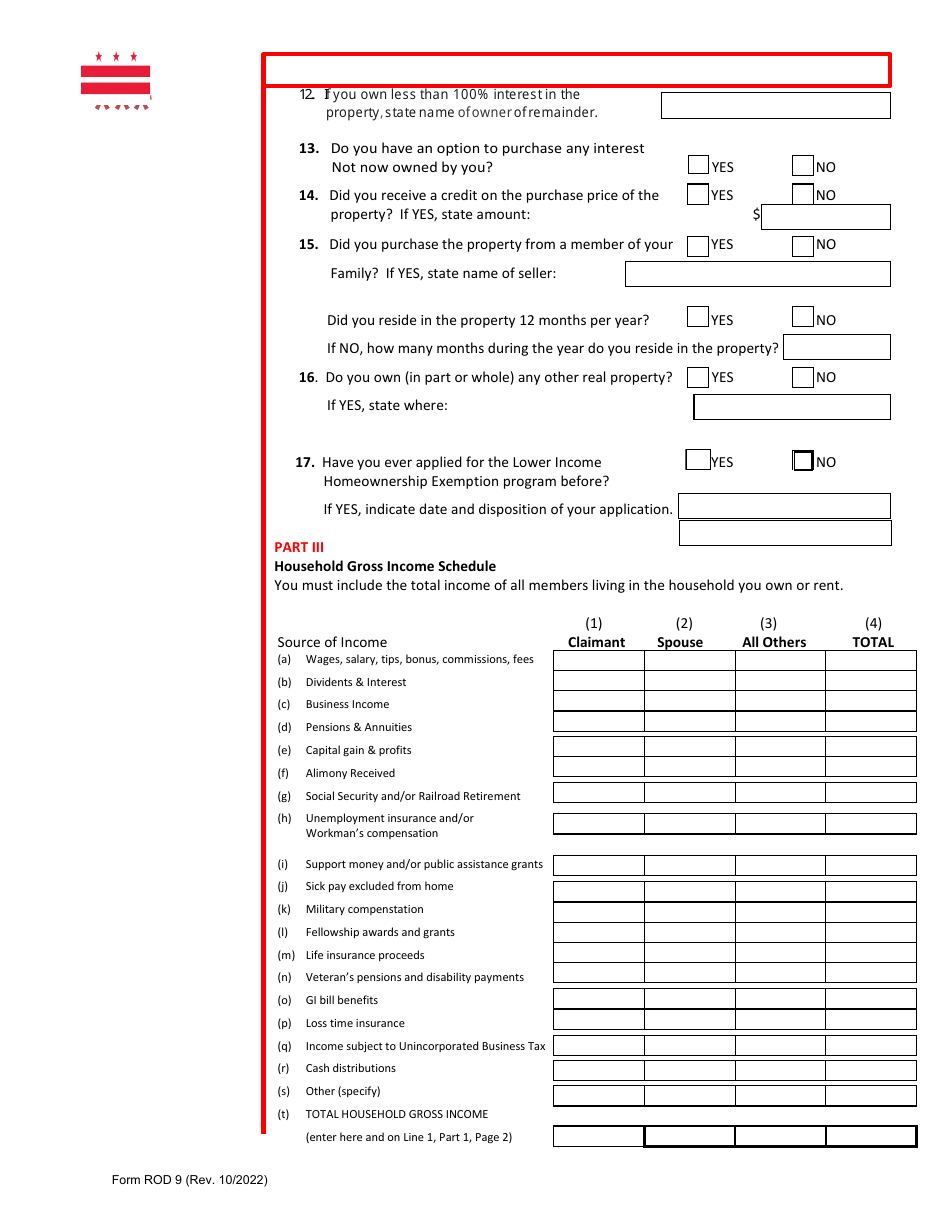

A: Eligibility is based on income and property value. Applicants must meet certain income requirements and have a property that meets the program criteria.

Q: Are there any fees to submit the application?

A: No, there are no fees to submit the application.

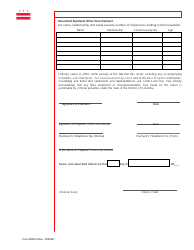

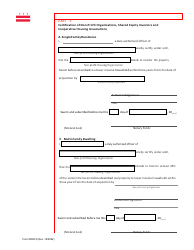

Q: What documents do I need to submit with the application?

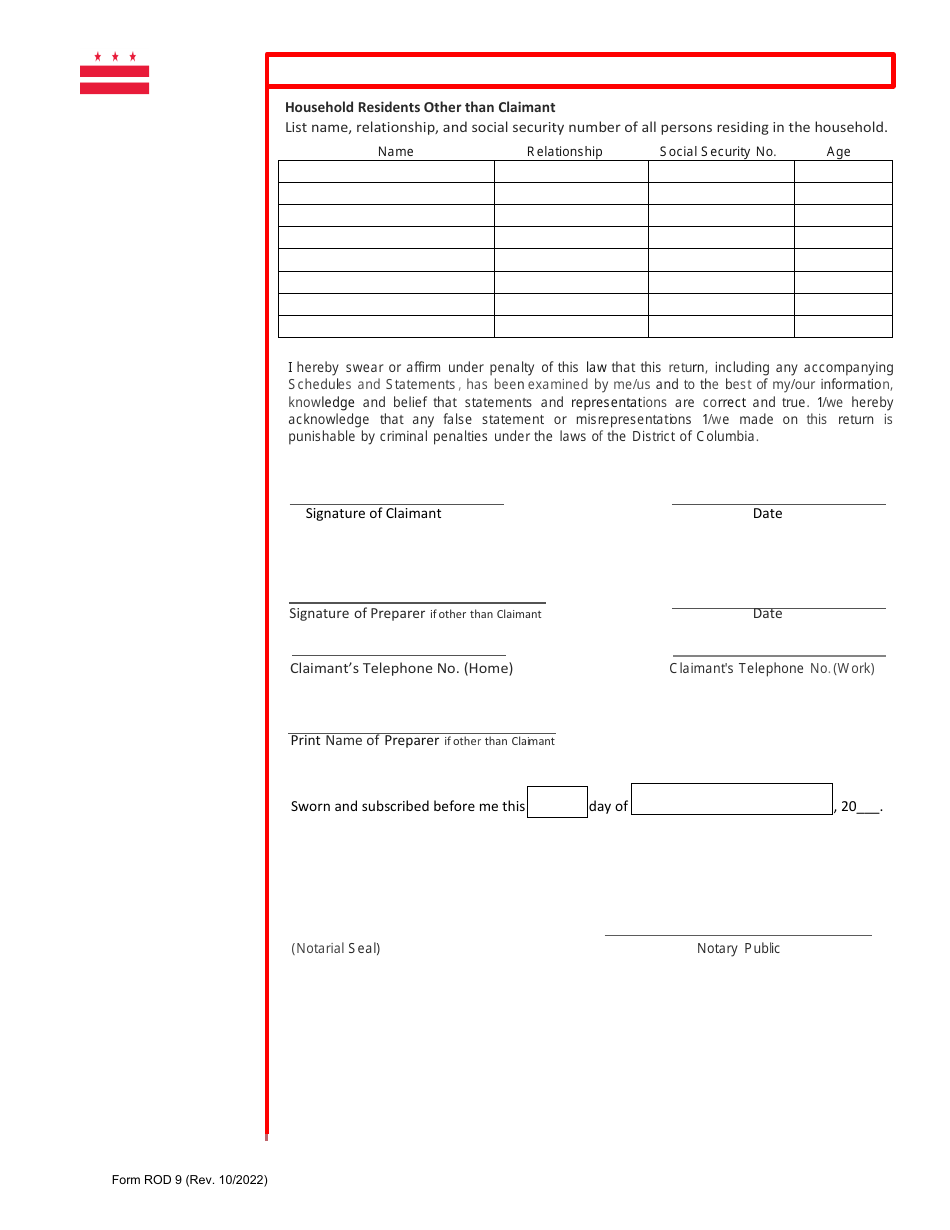

A: You may need to provide proof of income, property ownership, and any other supporting documentation as required by the application form.

Q: How long does it take to process the application?

A: Processing times may vary, but the application review process usually takes several weeks to several months.

Q: What happens if my application is approved?

A: If your application is approved, you will receive a property tax exemption for a certain period of time as determined by the program guidelines.

Q: What happens if my application is denied?

A: If your application is denied, you may be able to appeal the decision or explore other property tax relief options available in Washington, D.C.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Washington DC Office of Tax and Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ROD9 by clicking the link below or browse more documents and templates provided by the Washington DC Office of Tax and Revenue.