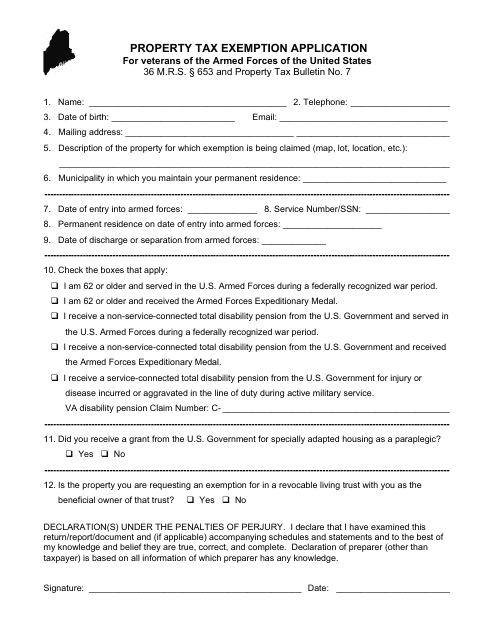

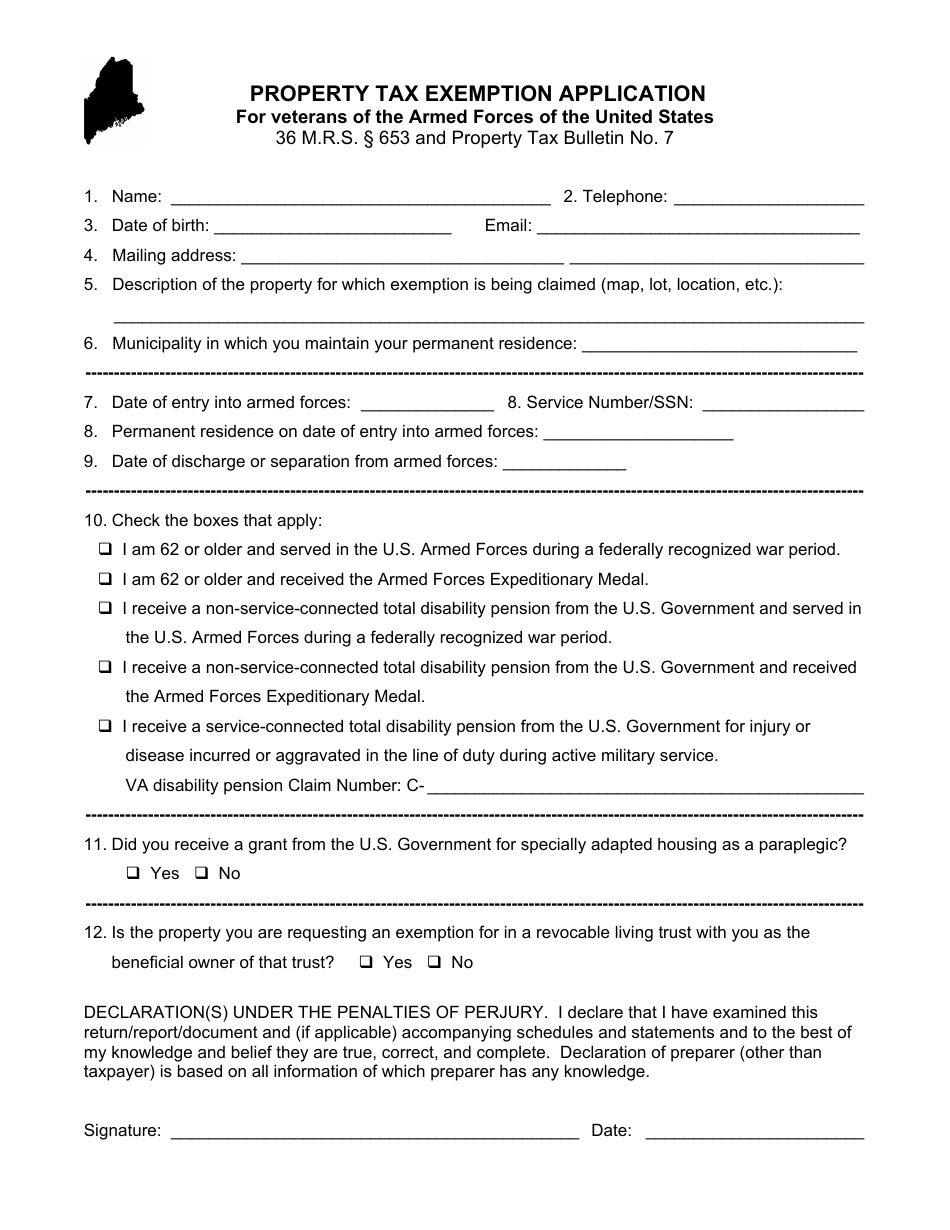

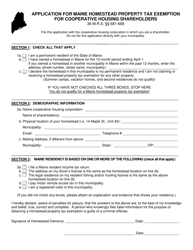

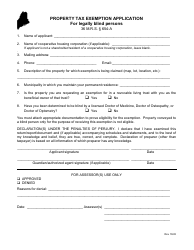

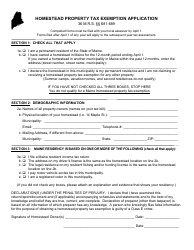

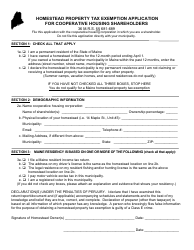

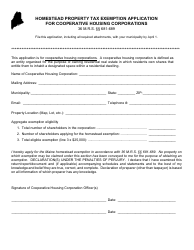

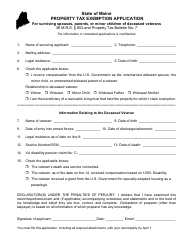

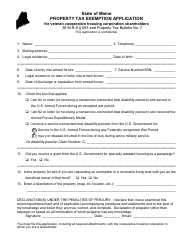

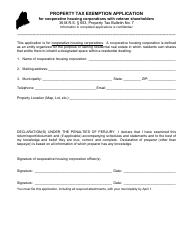

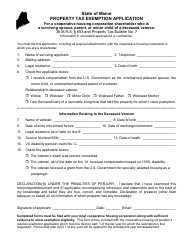

Property Tax Exemption Application for Veterans of the Armed Forces of the United States - Maine

Property Tax Exemption Application for Veterans of the Armed Forces of the United States is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

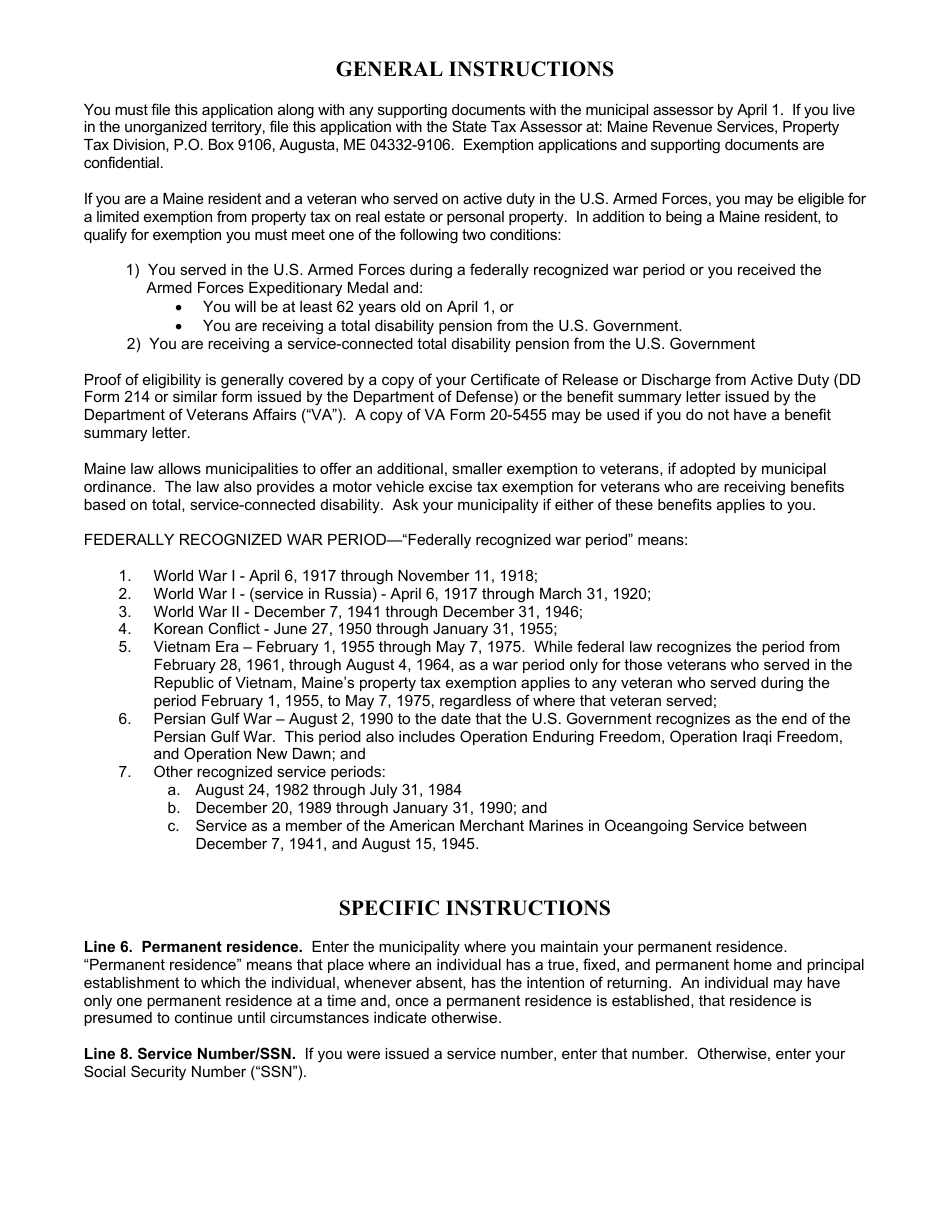

Q: Who is eligible for the property tax exemption?

A: Veterans of the Armed Forces of the United States.

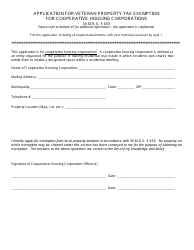

Q: What is the purpose of the exemption?

A: To provide a property tax exemption for eligible veterans.

Q: Which specific group of veterans is this application for?

A: Veterans of the Armed Forces of the United States in Maine.

Q: How can veterans apply for the exemption?

A: By filing a Property Tax Exemption Application for Veterans of the Armed Forces of the United States in Maine.

Q: What does the application provide?

A: A property tax exemption for eligible veterans.

Q: Is the exemption only applicable to primary residences?

A: No, it is also applicable to secondary residences owned by eligible veterans.

Q: Are there any income restrictions for the exemption?

A: Yes, eligible veterans must meet certain income requirements to qualify for the exemption.

Q: When is the deadline to submit the application?

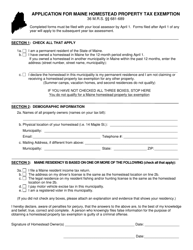

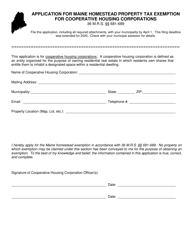

A: The application must be submitted by April 1st of each year.

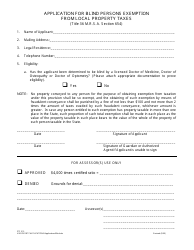

Q: Can disabled veterans also apply for the exemption?

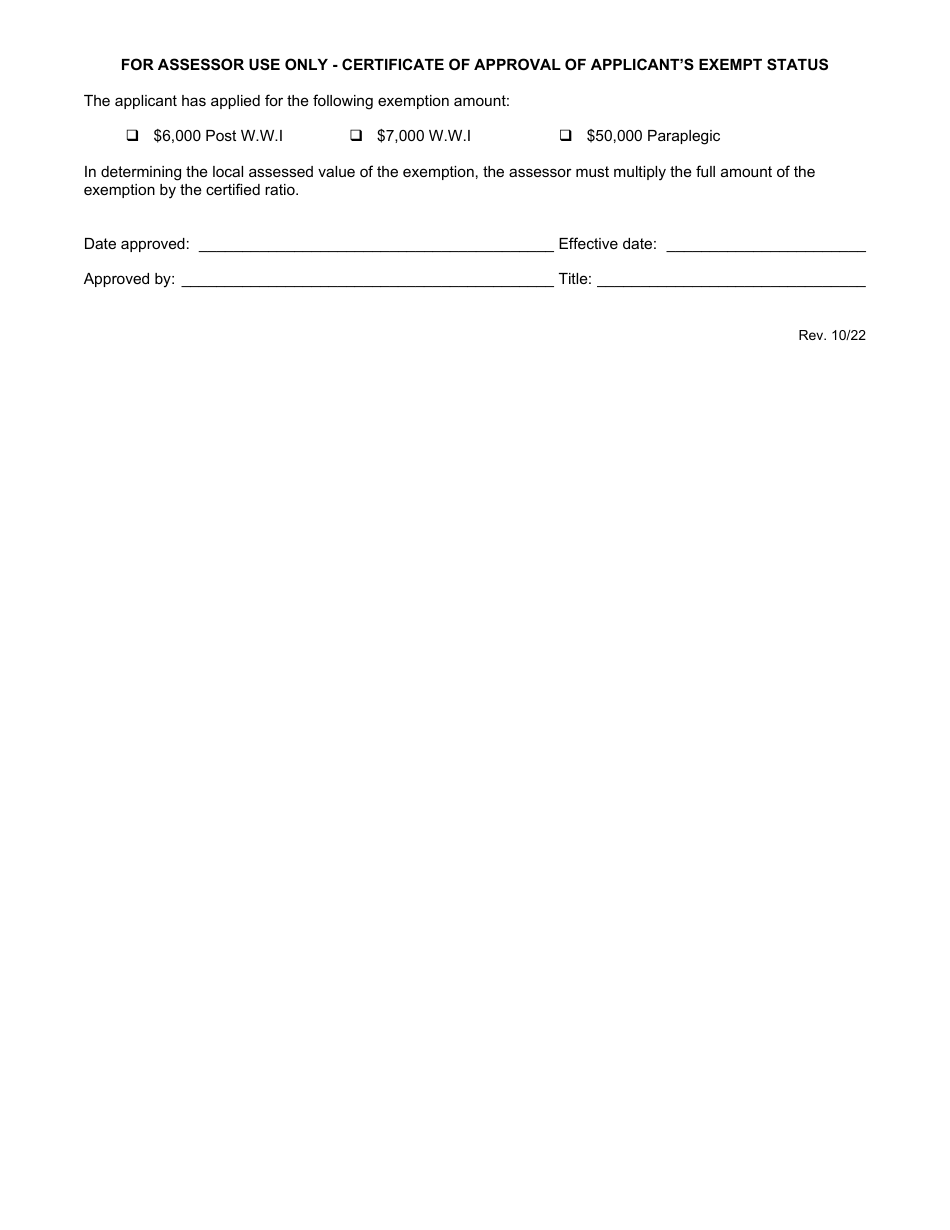

A: Yes, disabled veterans may be eligible for additional exemptions.

Form Details:

- Released on October 1, 2022;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.