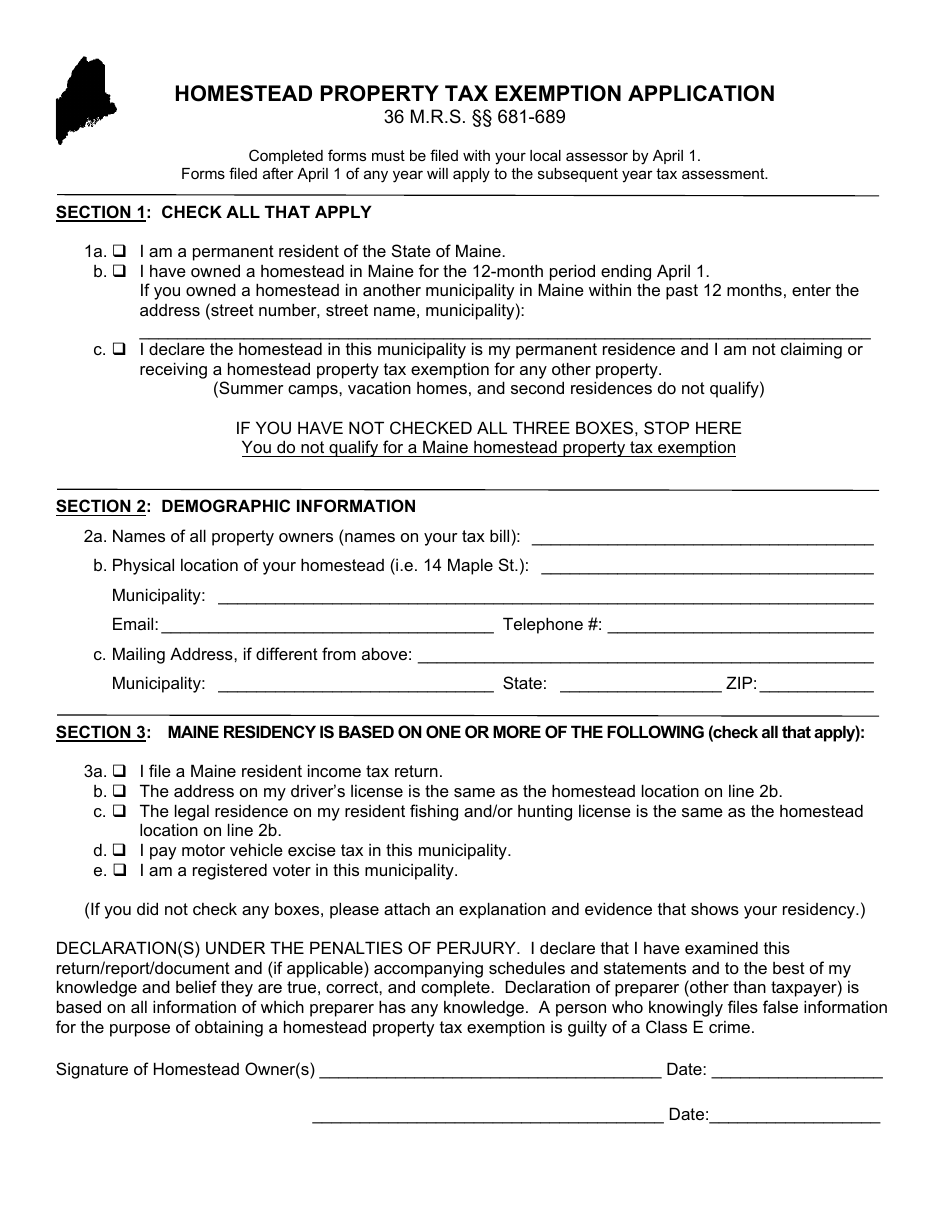

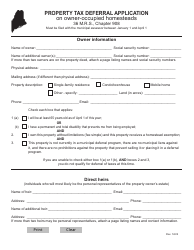

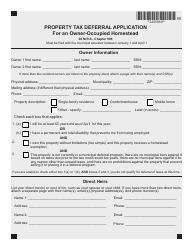

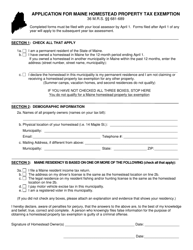

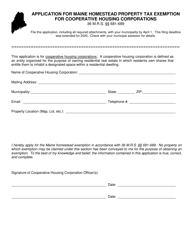

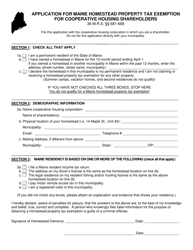

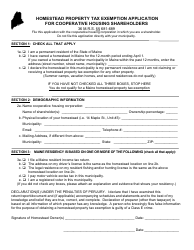

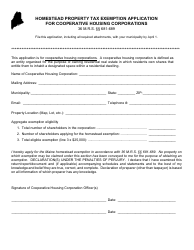

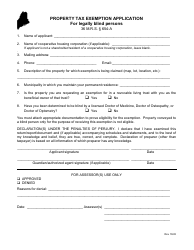

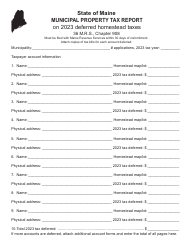

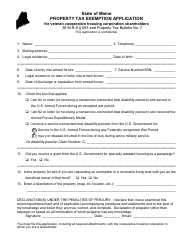

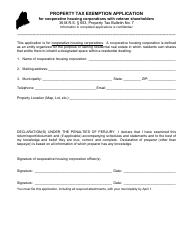

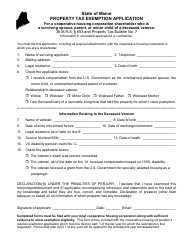

Homestead Property Tax Exemption Application - Maine

Homestead Property Tax Exemption Application is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

Q: What is a homestead property tax exemption?

A: A homestead property tax exemption is a benefit that reduces the amount of property taxes a homeowner has to pay on their primary residence.

Q: Who is eligible for a homestead property tax exemption in Maine?

A: In Maine, homeowners who are resident taxpayers and own a qualifying property may be eligible for a homestead property tax exemption.

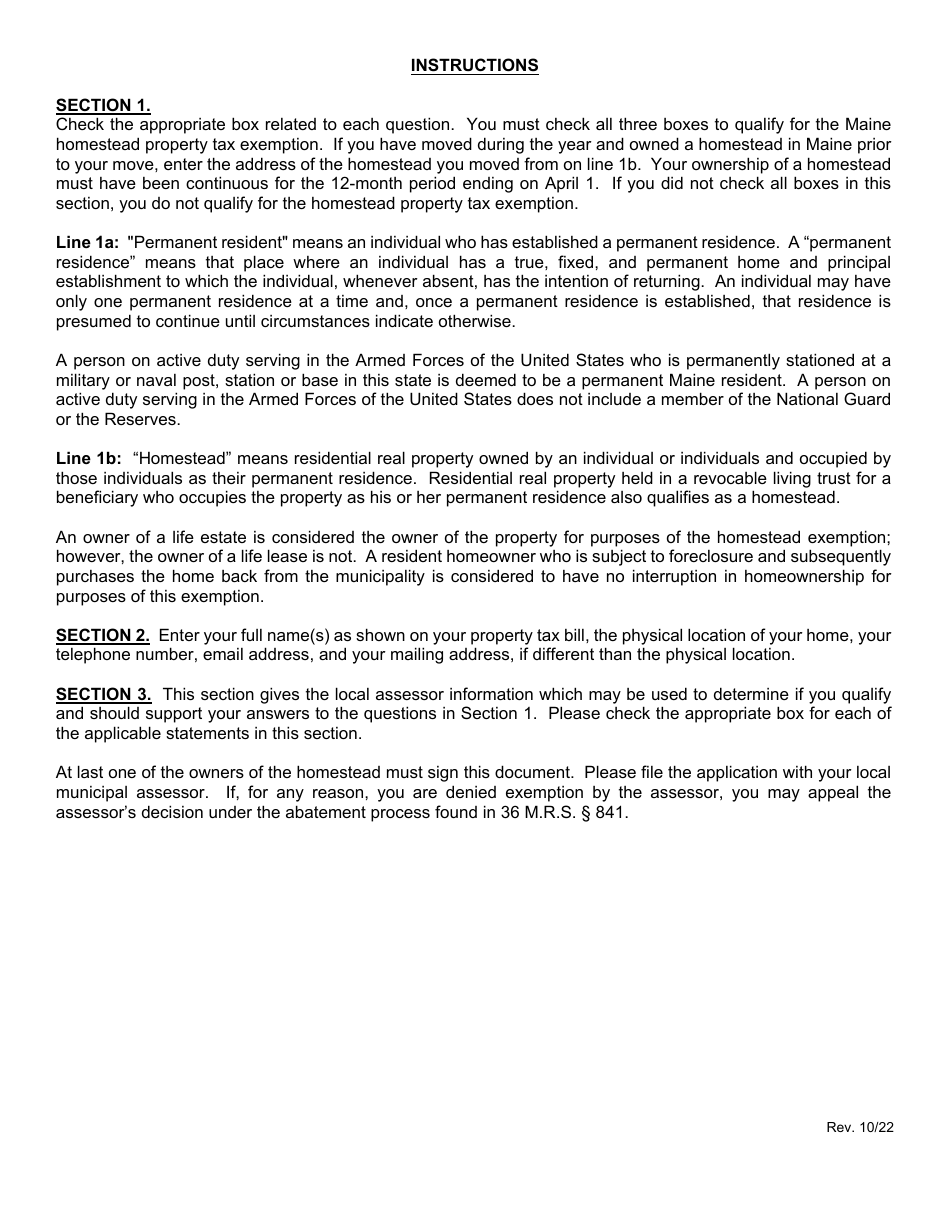

Q: How do I apply for a homestead property tax exemption in Maine?

A: To apply for a homestead property tax exemption in Maine, you need to fill out the Homestead Exemption Application form and submit it to your local tax assessor's office.

Q: What are the benefits of a homestead property tax exemption?

A: The benefits of a homestead property tax exemption include reducing the amount of property taxes you have to pay, potentially saving you money on your annual tax bill.

Q: Are there any requirements or qualifications for the homestead property tax exemption in Maine?

A: Yes, there are requirements and qualifications for the homestead property tax exemption in Maine, including being a resident taxpayer and owning a qualifying property.

Q: Can I apply for a homestead property tax exemption if I rent out part of my home?

A: Generally, you cannot apply for a homestead property tax exemption if you rent out part of your home. The exemption is typically only available for homeowners who use their property as their primary residence.

Form Details:

- Released on October 1, 2022;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.