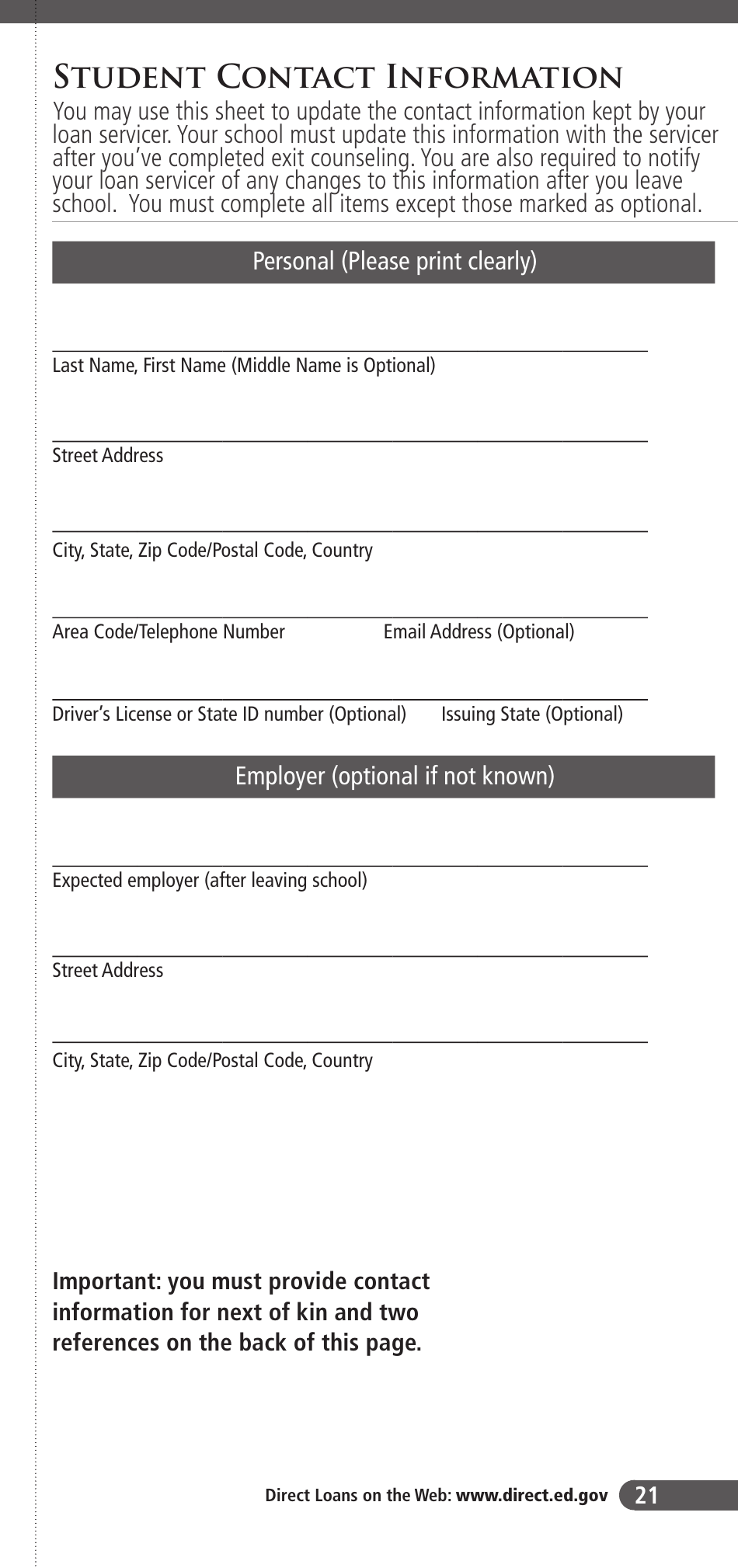

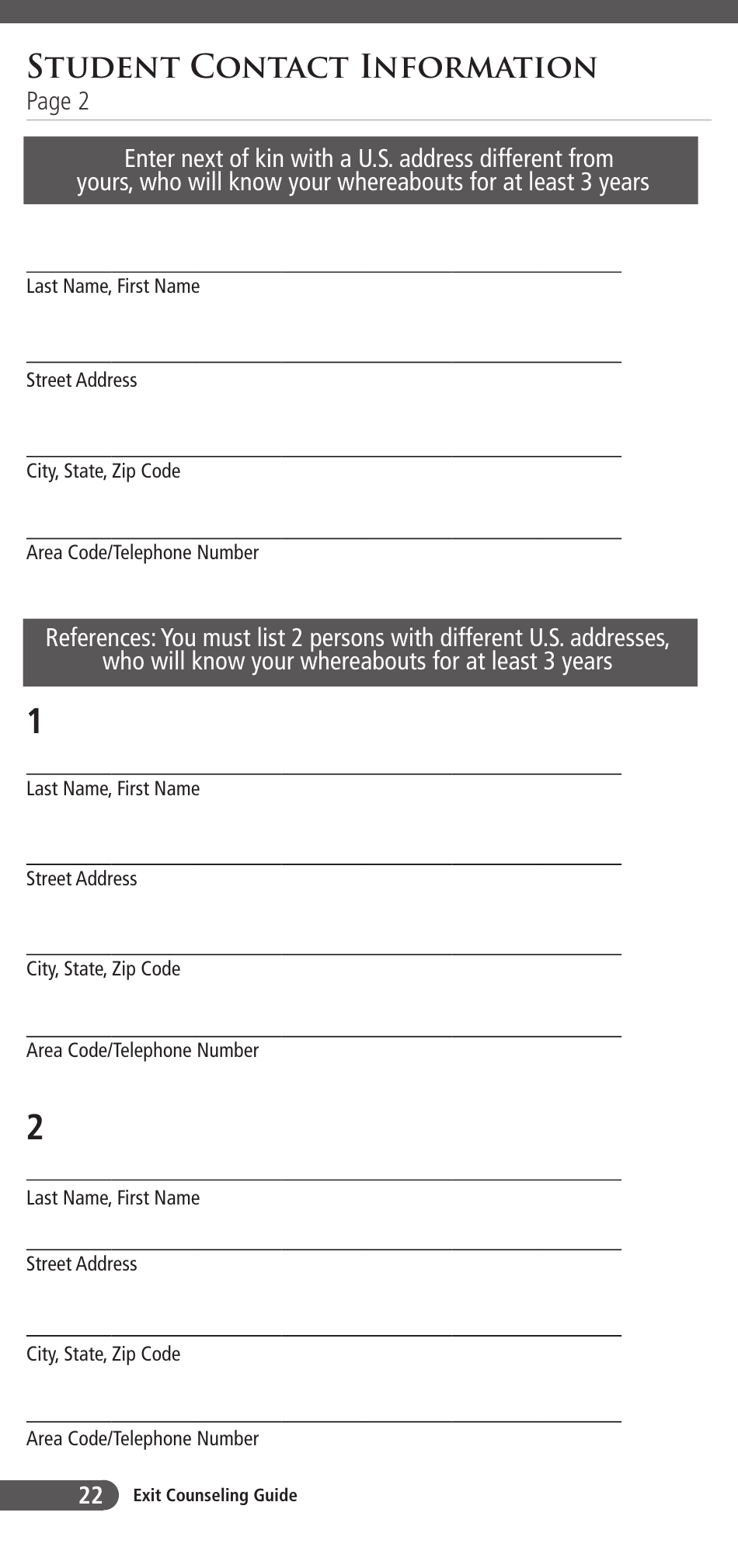

Exit Counseling Guide for Federal Student Loan Borrowers

Exit Counseling Guide for Federal Student Loan Borrowers is a 28-page legal document that was released by the U.S. Department of Education - Federal Student Aid on December 2, 2010 and used nation-wide.

FAQ

Q: When is exit counseling required?

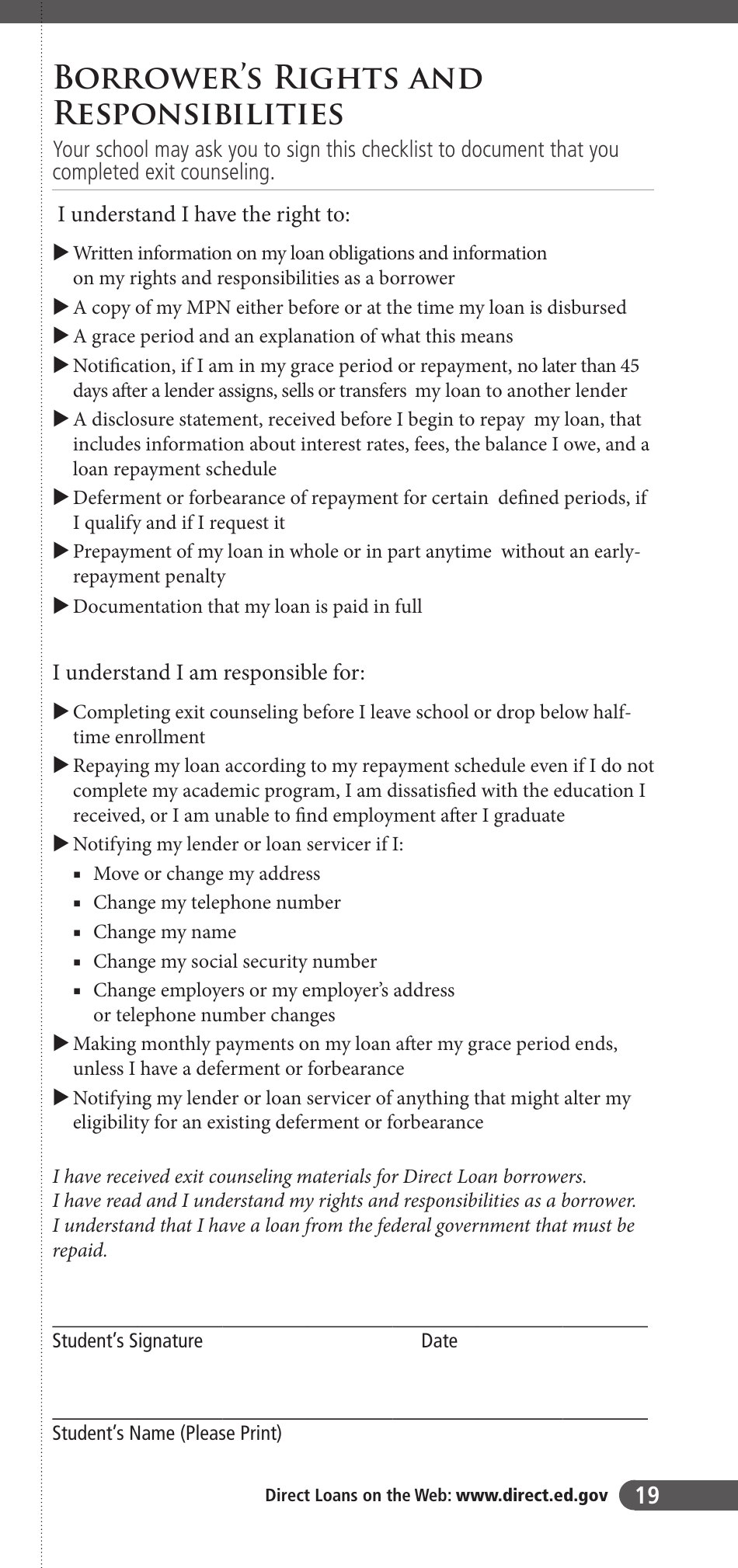

A: Exit counseling is required for borrowers who are graduating, leaving school, or dropping below half-time enrollment.

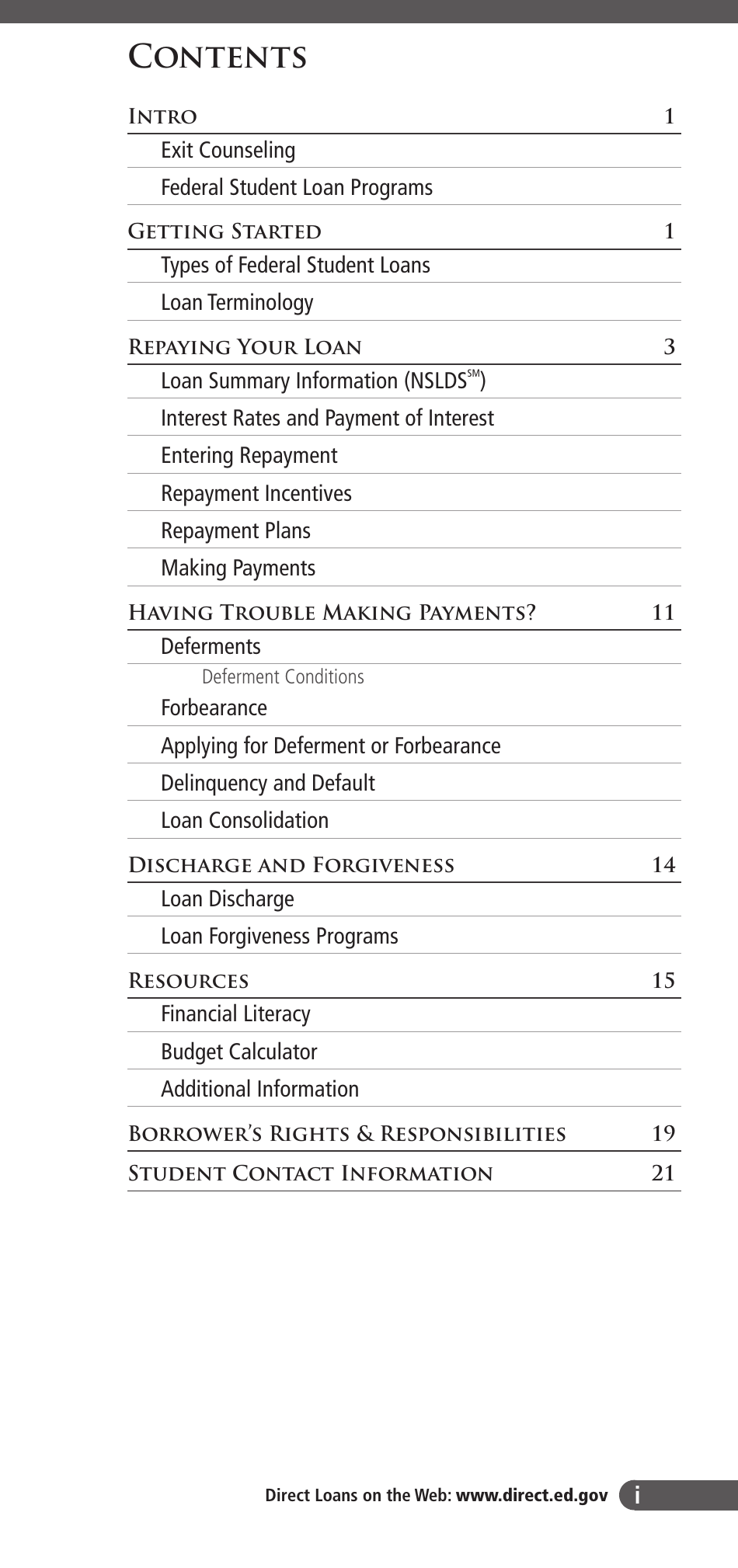

Q: What information is covered in exit counseling?

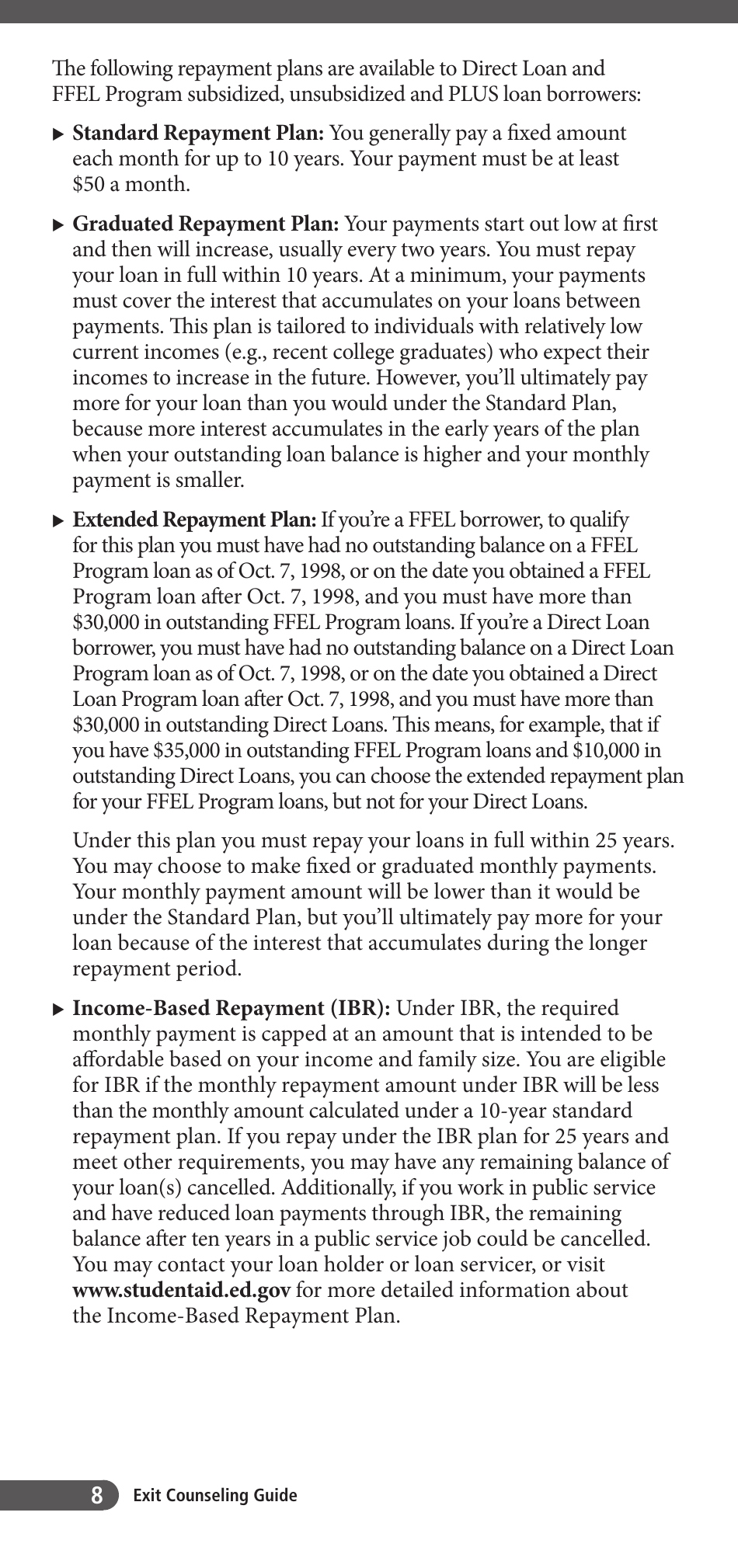

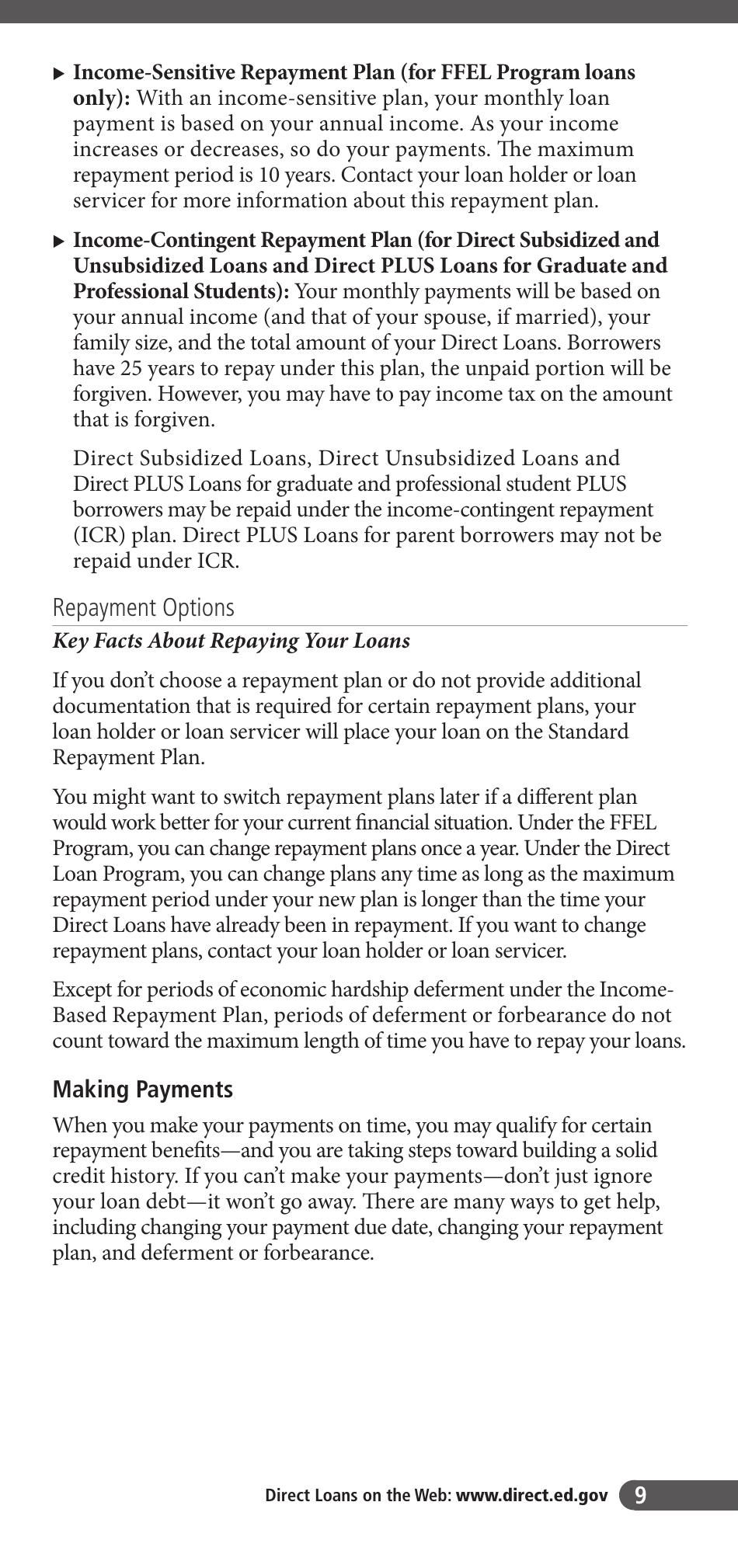

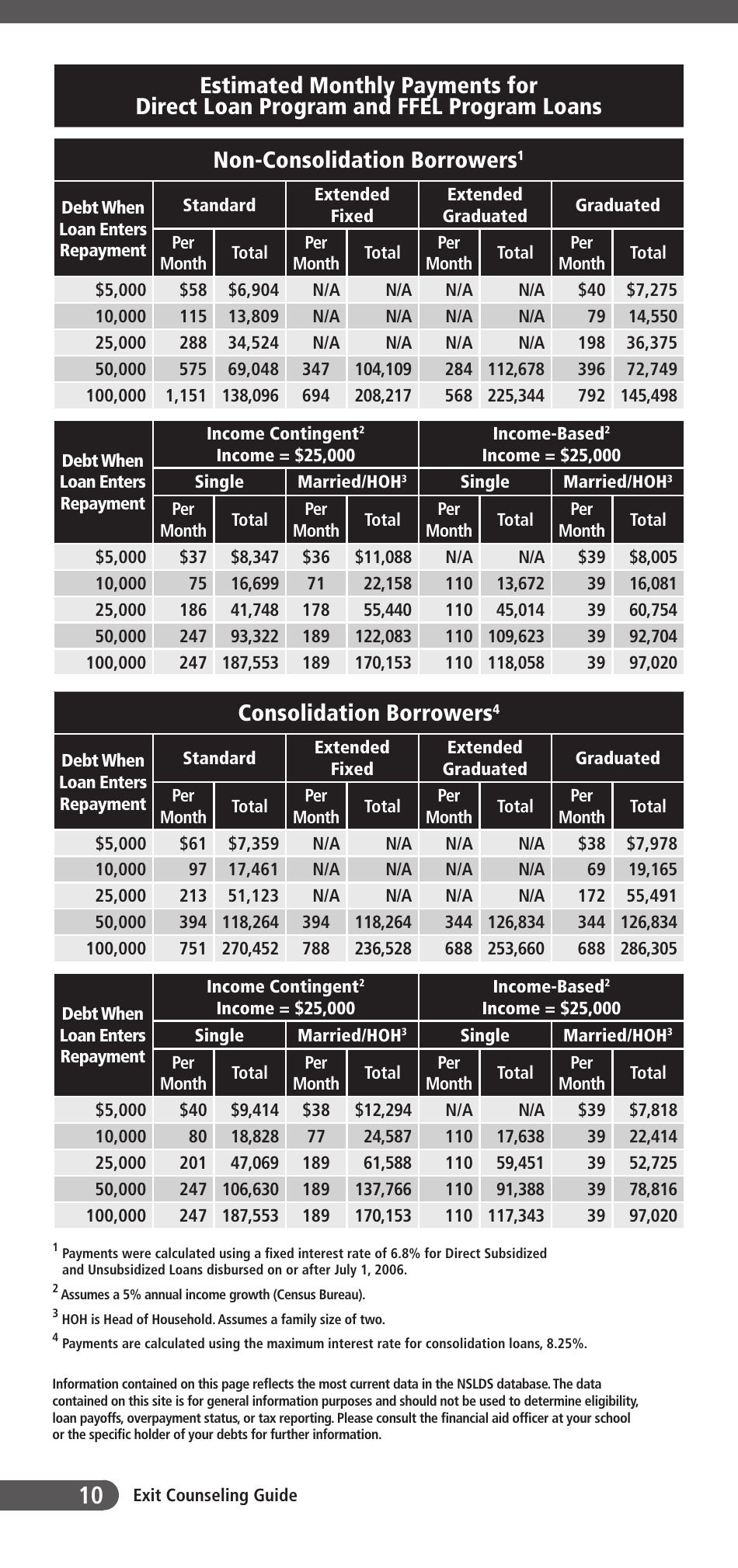

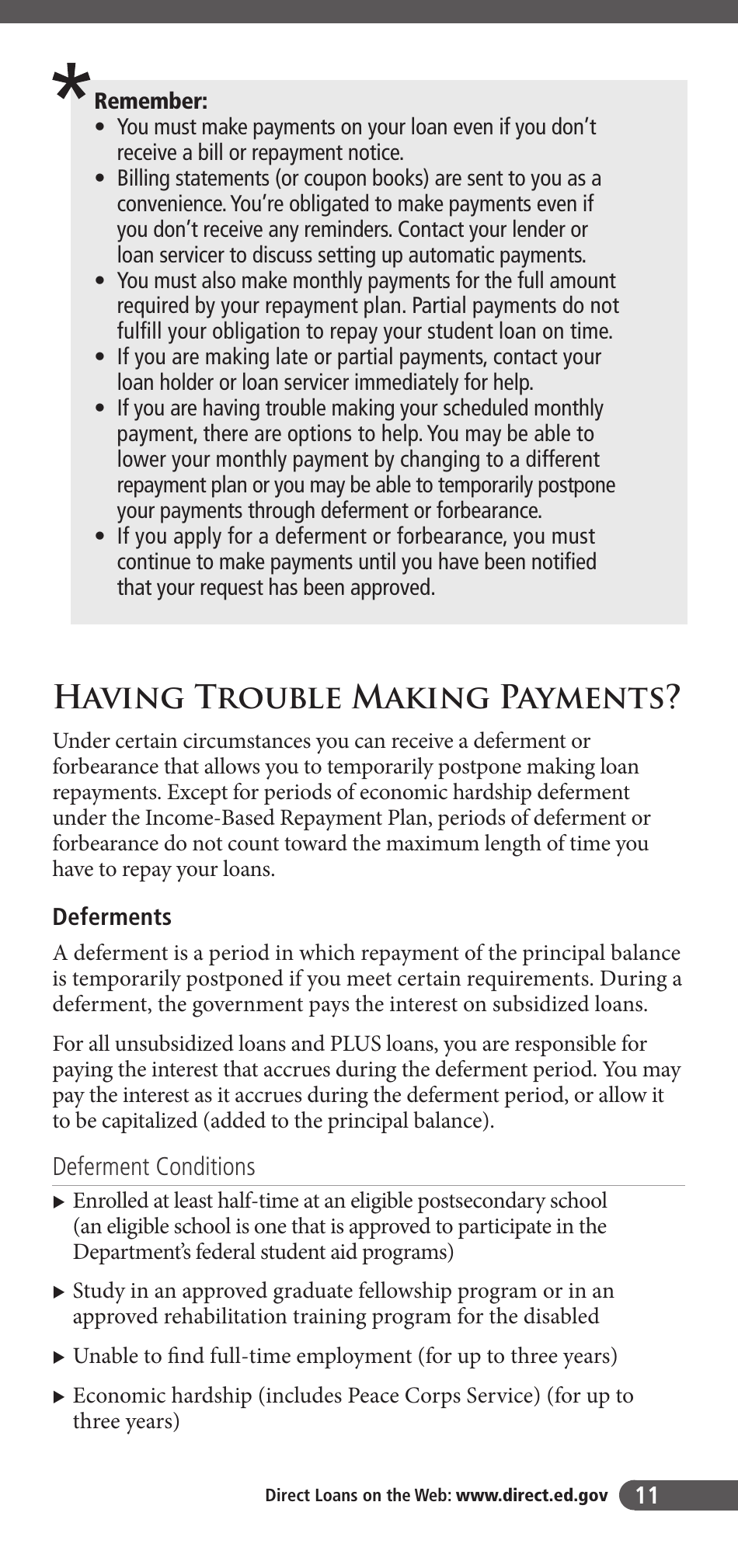

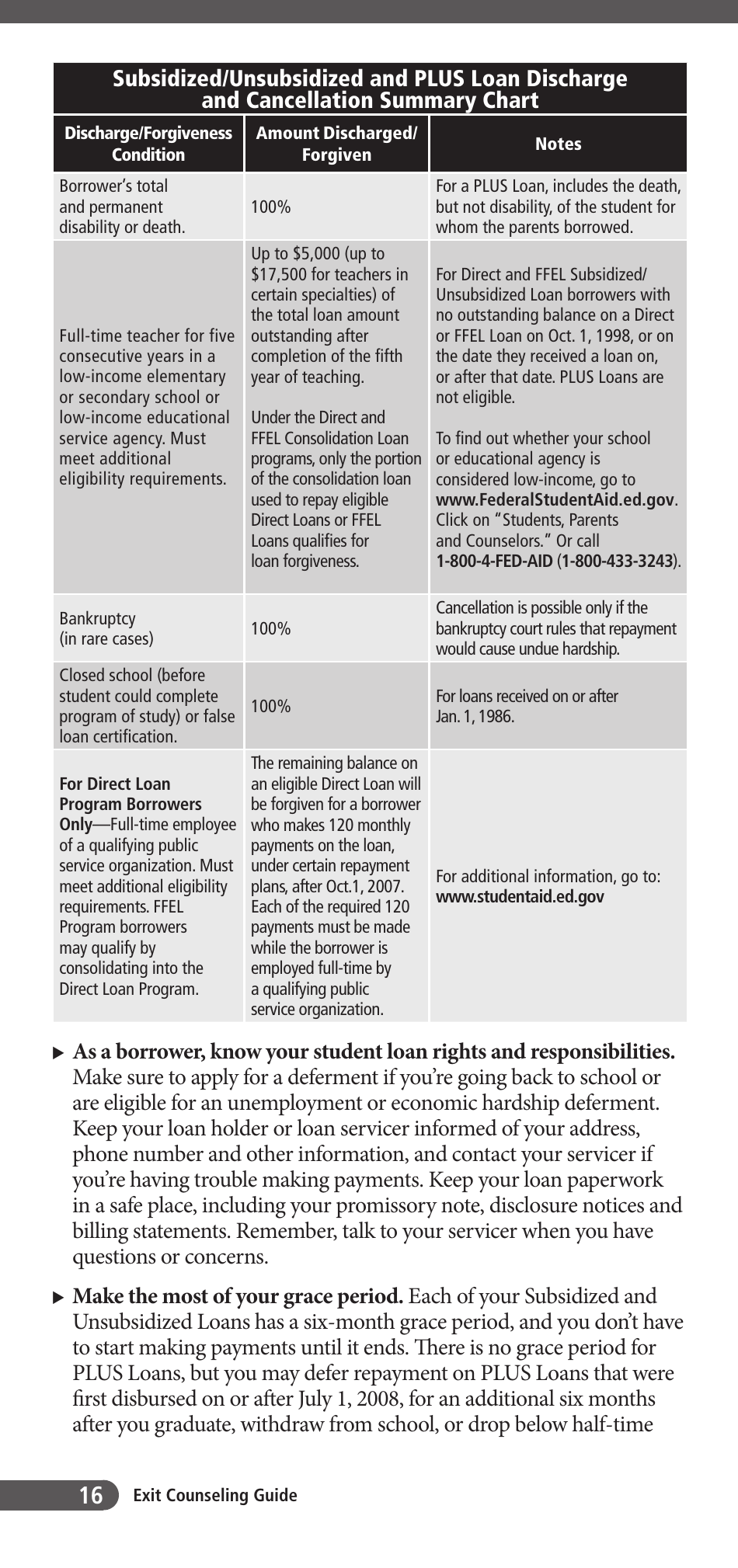

A: Exit counseling covers topics such as repayment options, loan consolidation, grace periods, loan forgiveness, and the consequences of default.

Q: Do I have to complete exit counseling for each of my federal student loans?

A: No, you only need to complete exit counseling once, even if you have multiple federal student loans.

Q: What happens if I don't complete exit counseling?

A: If you fail to complete exit counseling, your school may hold your diploma or transcripts until you fulfill this requirement.

Q: Can I change my repayment plan after completing exit counseling?

A: Yes, you can change your repayment plan at any time by contacting your loan servicer.

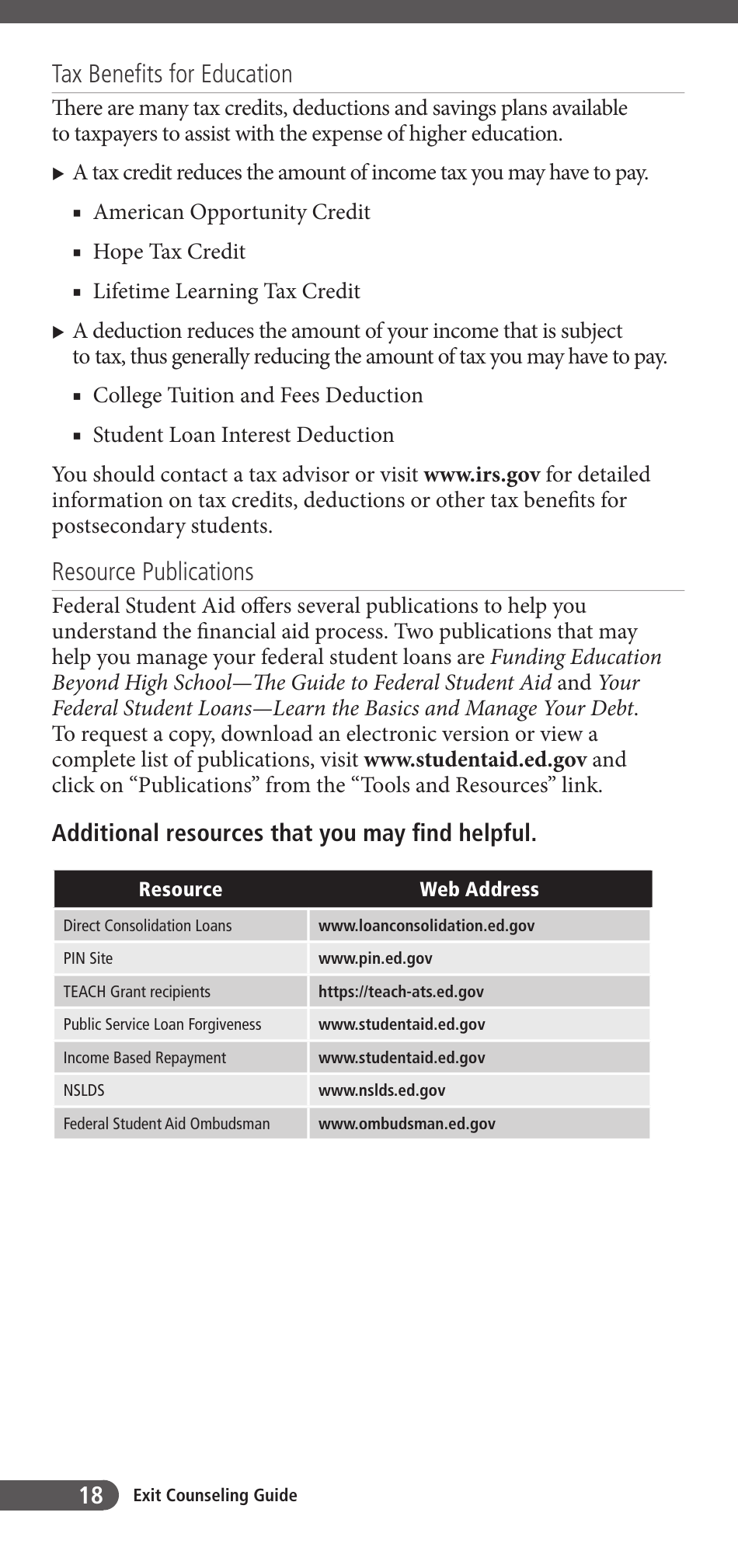

Q: Are there any resources available to help me manage my student loan debt after exit counseling?

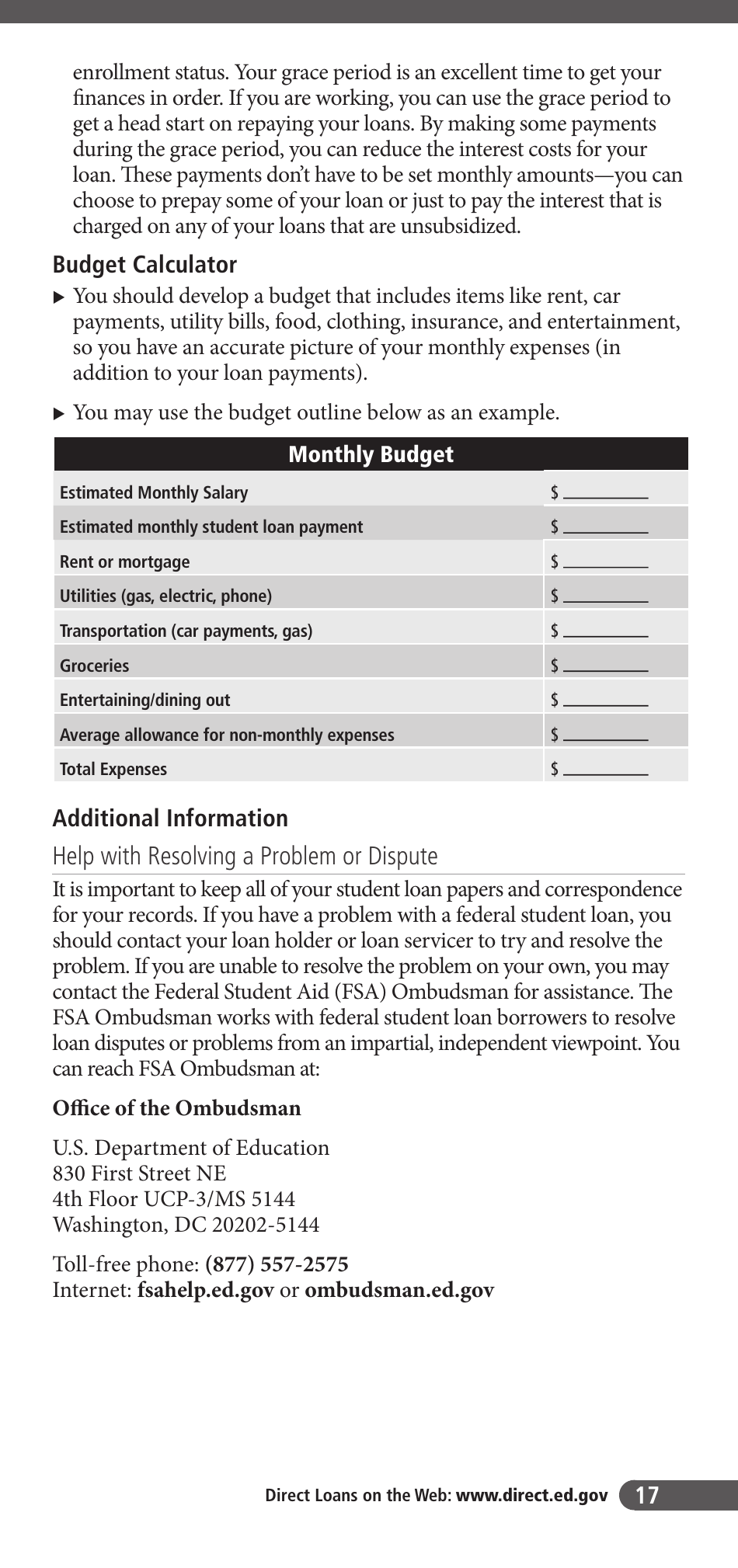

A: Yes, the Department of Education provides resources such as loan calculators, budgeting tools, and information on loan forgiveness programs.

Q: What happens if I default on my federal student loans?

A: Defaulting on your federal student loans can have serious consequences, including damaged credit, wage garnishment, and loss of eligibility for future federal student aid.

Q: Can I pay off my federal student loans early?

A: Yes, you can pay off your federal student loans early without any prepayment penalties.

Form Details:

- The latest edition currently provided by the U.S. Department of Education - Federal Student Aid;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.