Home Appraisal Checklist

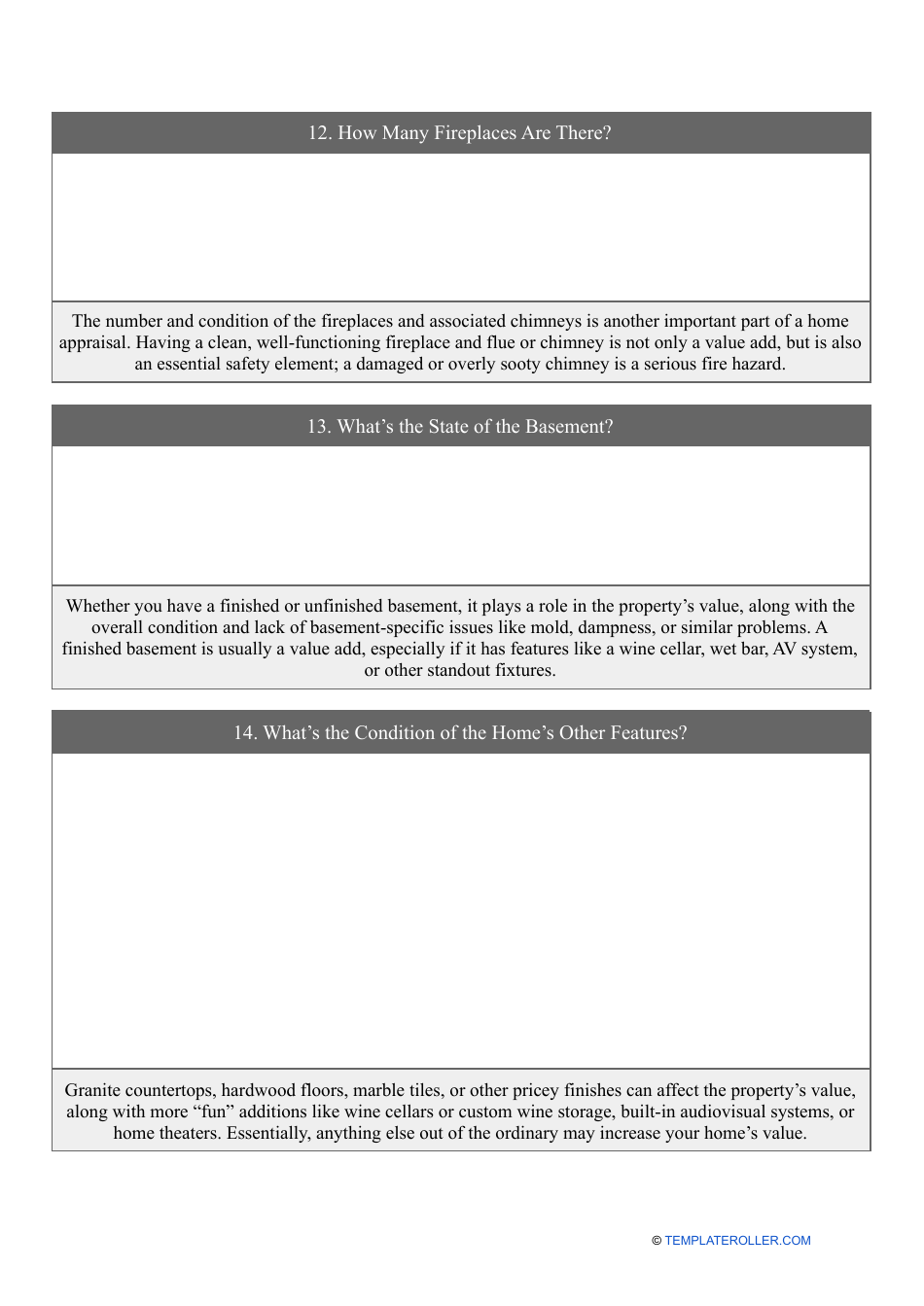

The Home Appraisal Checklist is used to assess the value of a property. It helps determine an accurate value for the property, which can be useful for buying, selling, refinancing, or insuring a home.

The home appraisal checklist is typically filed by the appraiser conducting the evaluation of the property.

FAQ

Q: What is a home appraisal?

A: A home appraisal is an unbiased evaluation of a property's value conducted by a licensed appraiser.

Q: Why is a home appraisal important?

A: A home appraisal is important because it determines the fair market value of a property, which is crucial for mortgage lenders, buyers, and sellers.

Q: How is the value of a home determined during an appraisal?

A: The value of a home is determined by considering factors such as location, size, condition, comparable sales, and market trends.

Q: Do I need a home appraisal when buying or selling a house?

A: In most cases, lenders require a home appraisal before approving a mortgage loan. Sellers may also choose to get an appraisal to determine the asking price.

Q: How long does a home appraisal take?

A: Typically, a home appraisal takes a few hours to complete, but the entire process may take a few days or longer, depending on factors such as property size and availability of comparable sales data.

Q: Who pays for the home appraisal?

A: Generally, the buyer pays for the home appraisal as part of their closing costs, but sometimes the seller may agree to cover the cost.

Q: Can I challenge the results of a home appraisal?

A: If you believe the home appraisal is inaccurate, you may be able to challenge the results by providing additional comparable sales or evidence of property improvements.

Q: Can a home appraisal affect my property taxes?

A: A home appraisal can potentially affect your property taxes if the assessed value of the property changes significantly.

Q: What happens if the home appraisal comes in lower than the agreed-upon price?

A: If the home appraisal comes in lower than the agreed-upon price, it can affect the buyer's ability to secure a mortgage loan or lead to negotiations between the buyer and seller to adjust the purchase price.

Q: Do home appraisers consider renovations or upgrades to the property?

A: Yes, home appraisers consider renovations and upgrades when determining the value of a property. These improvements can positively impact the appraised value.