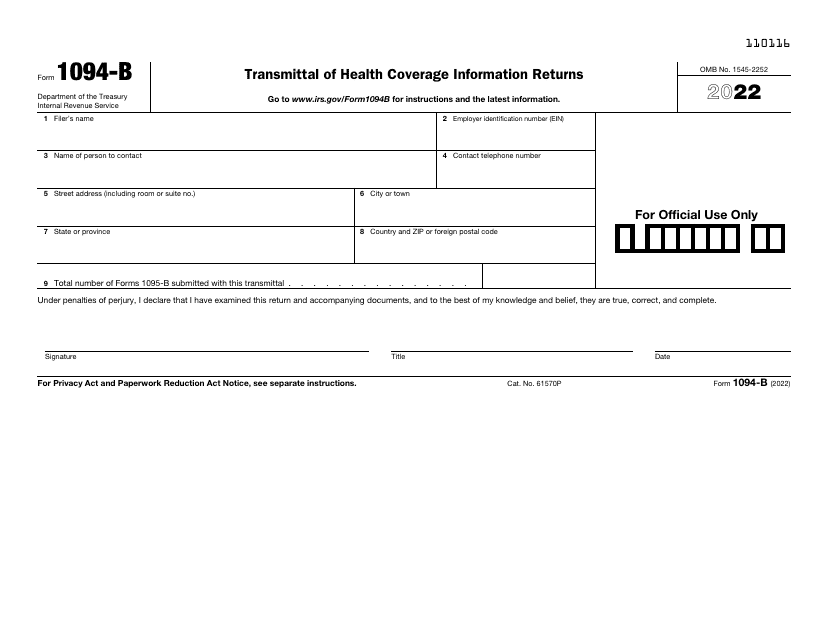

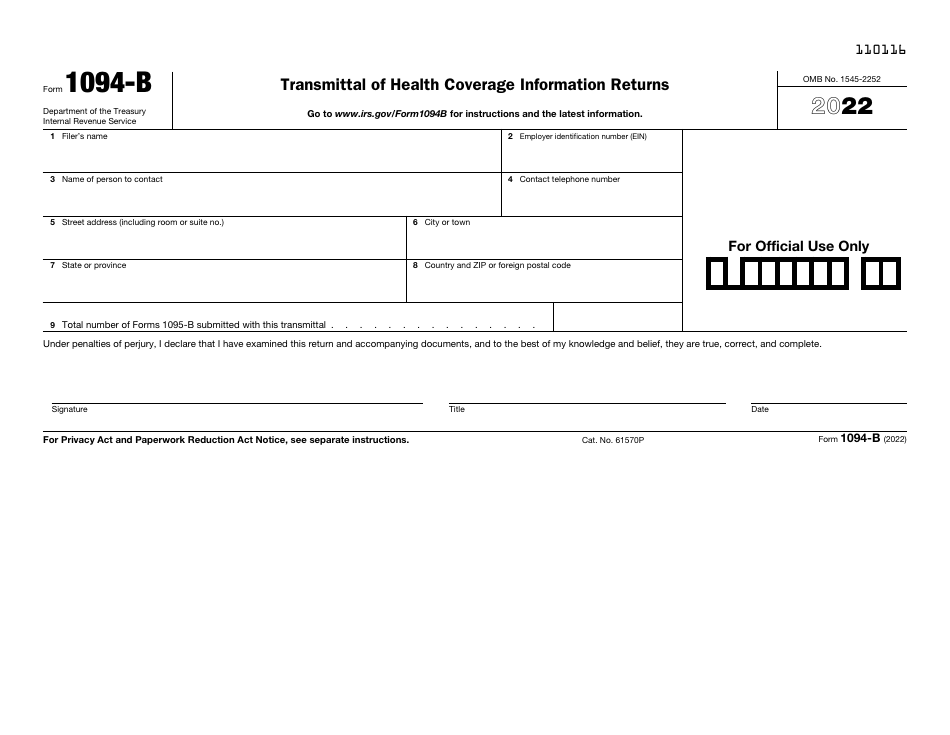

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1094-B

for the current year.

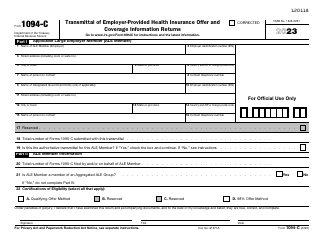

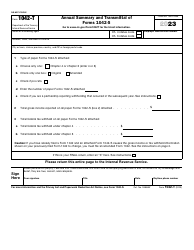

IRS Form 1094-B Transmittal of Health Coverage Information Returns

What Is IRS Form 1094-B?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1094-B?

A: IRS Form 1094-B is a transmittal form used to transmit health coverage information returns to the IRS.

Q: Who needs to file IRS Form 1094-B?

A: Health insurance issuers, self-insured employers, and other providers of minimum essential coverage need to file IRS Form 1094-B.

Q: What is the purpose of filing IRS Form 1094-B?

A: The purpose of filing IRS Form 1094-B is to report information about individuals covered by minimum essential coverage.

Q: When is the deadline to file IRS Form 1094-B?

A: The deadline to file IRS Form 1094-B is usually February 28th, or March 31st if filing electronically.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1094-B through the link below or browse more documents in our library of IRS Forms.