Section-By-Section Summary of the Proposed "protecting Americans From Tax Hikes Act of 2015"

Section-By-Section Summary of the Proposed "protecting Americans From Tax Hikes Act of 2015" is a 20-page legal document that was released by the United States House of Representatives and used nation-wide.

FAQ

Q: What is the 'Protecting Americans From Tax Hikes Act of 2015'?

A: The Protecting Americans From Tax Hikes Act of 2015 is a proposed legislation aimed at preventing tax increases and providing tax relief for American taxpayers and businesses.

Q: What is the purpose of the act?

A: The act aims to protect Americans from tax hikes by extending various tax provisions and providing tax relief for individuals and businesses.

Q: Who does the act benefit?

A: The act benefits American taxpayers and businesses by preventing tax increases and providing tax relief.

Q: What are some key provisions of the act?

A: The act includes provisions for the extension of various tax credits and deductions, such as the child tax credit, the earned income tax credit, and the research and developmenttax credit.

Q: What happens if the act is passed?

A: If the act is passed, it would prevent tax increases and provide tax relief for American taxpayers and businesses.

Q: Is the act currently in effect?

A: No, the Protecting Americans From Tax Hikes Act of 2015 is a proposed legislation and is not currently in effect.

Q: What is the status of the act?

A: The act was proposed in 2015 and has not been enacted as law.

Q: Are there any similar acts in effect?

A: There may be other acts or legislation aimed at similar goals, but the Protecting Americans From Tax Hikes Act of 2015 is specific to its own provisions and scope.

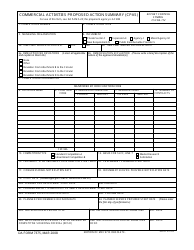

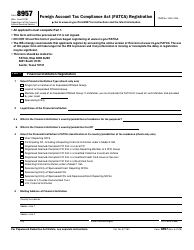

Form Details:

- The latest edition currently provided by the United States House of Representatives;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.