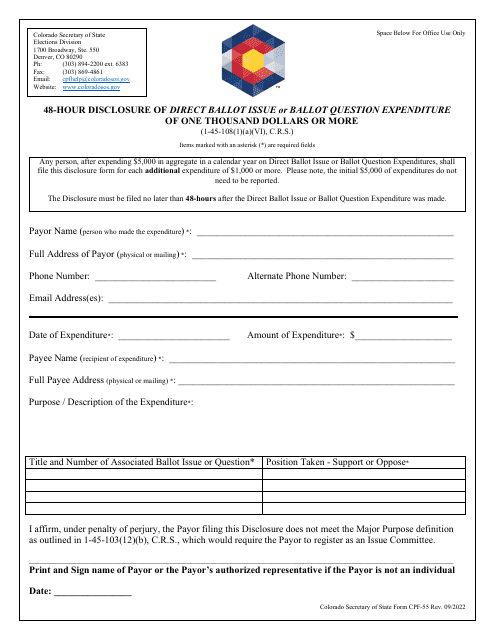

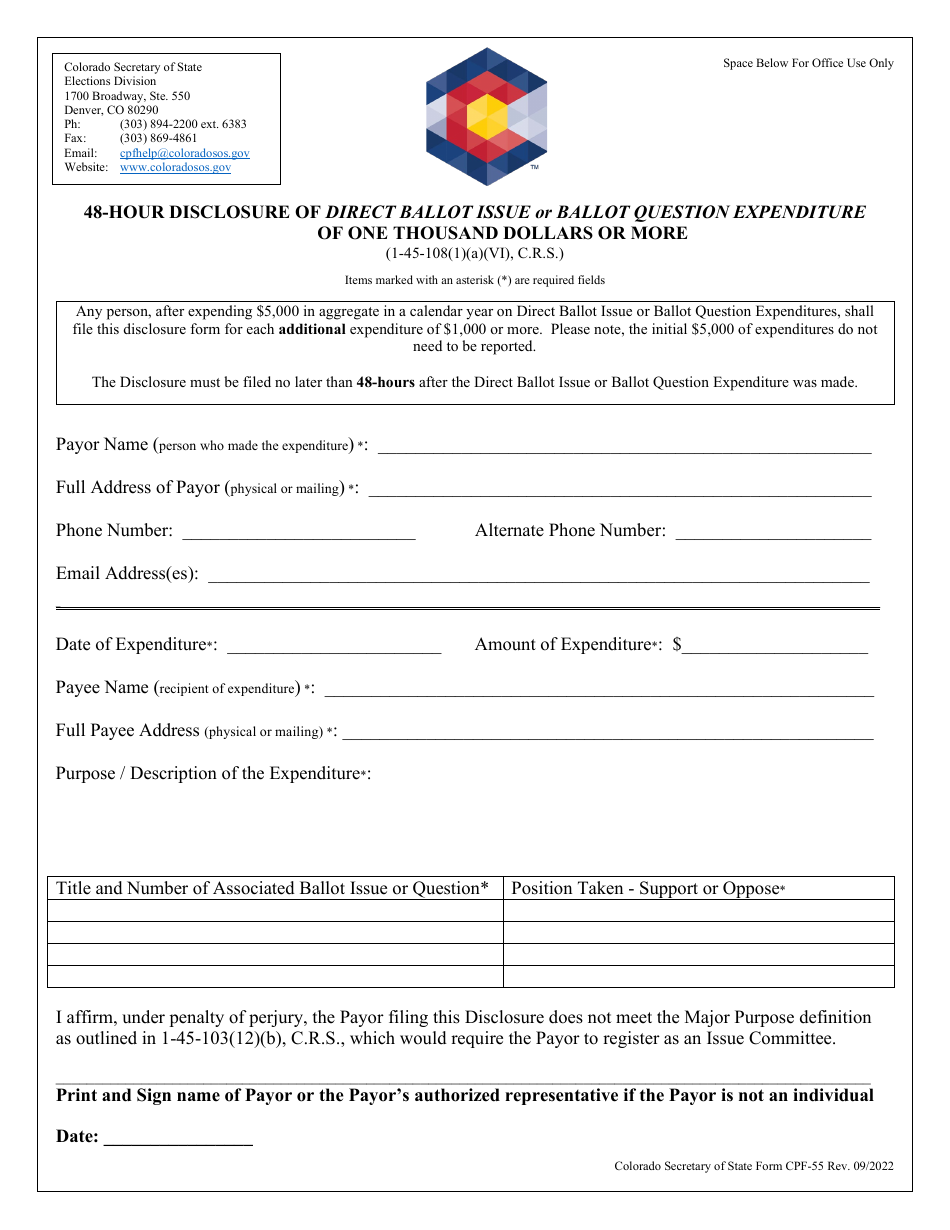

Form CPF-55 48-hour Disclosure of Direct Ballot Issue or Ballot Question Expenditure of One Thousand Dollars or More - Colorado

What Is Form CPF-55?

This is a legal form that was released by the Colorado Secretary of State - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CPF-55?

A: Form CPF-55 is a disclosure form in Colorado for reporting expenditures of one thousand dollars or more related to direct ballot issues or ballot questions.

Q: What is the purpose of Form CPF-55?

A: The purpose of Form CPF-55 is to provide transparency and accountability by disclosing large expenditures made in relation to direct ballot issues or ballot questions.

Q: Who is required to file Form CPF-55?

A: Any person or entity that spends one thousand dollars or more on direct ballot issue or ballot question expenditures in Colorado is required to file Form CPF-55.

Q: When should Form CPF-55 be filed?

A: Form CPF-55 must be filed within 48 hours of reaching or exceeding the one thousand dollar threshold for direct ballot issue or ballot question expenditures.

Q: Are there any penalties for not filing Form CPF-55?

A: Yes, failure to file Form CPF-55 as required may result in penalties and fines.

Q: Is there a deadline to file Form CPF-55?

A: Yes, Form CPF-55 must be filed within 48 hours of reaching or exceeding the one thousand dollar threshold for direct ballot issue or ballot question expenditures.

Q: Is there a fee to file Form CPF-55?

A: No, there is no fee associated with filing Form CPF-55.

Q: What information is required on Form CPF-55?

A: Form CPF-55 requires information such as the name and address of the person making the expenditure, the amount expended, the purpose of the expenditure, and the ballot issue or question to which the expenditure relates.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Colorado Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CPF-55 by clicking the link below or browse more documents and templates provided by the Colorado Secretary of State.