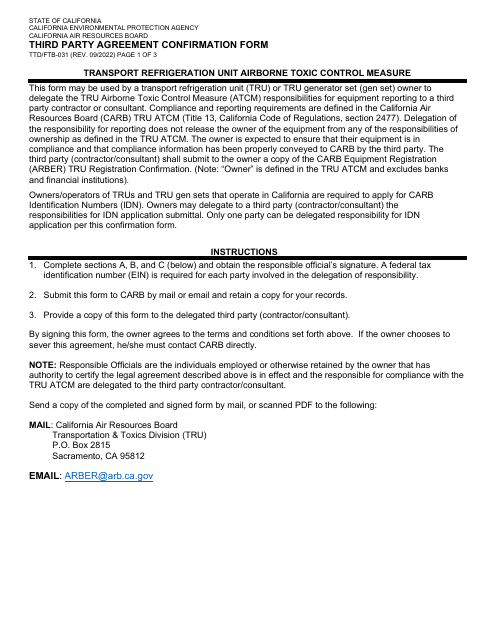

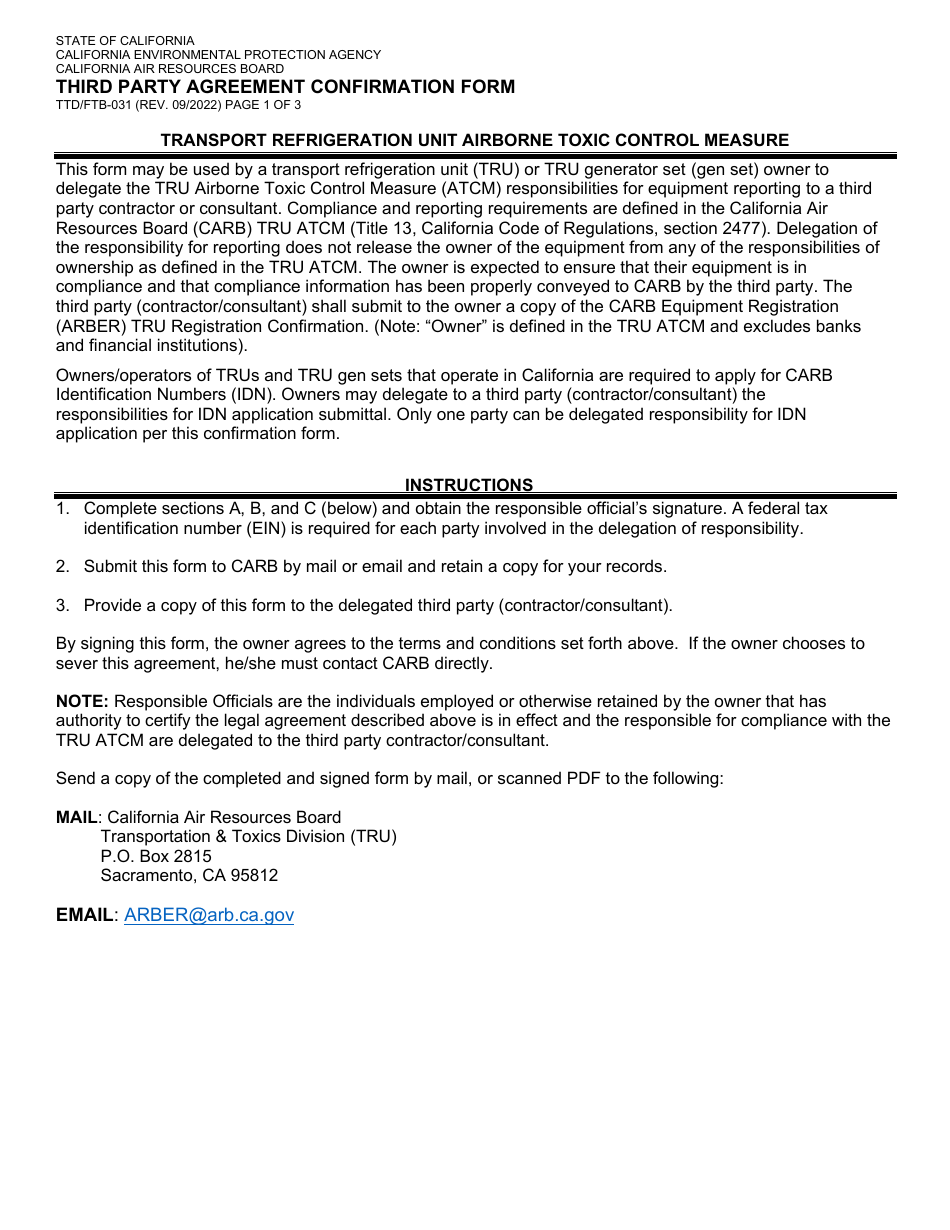

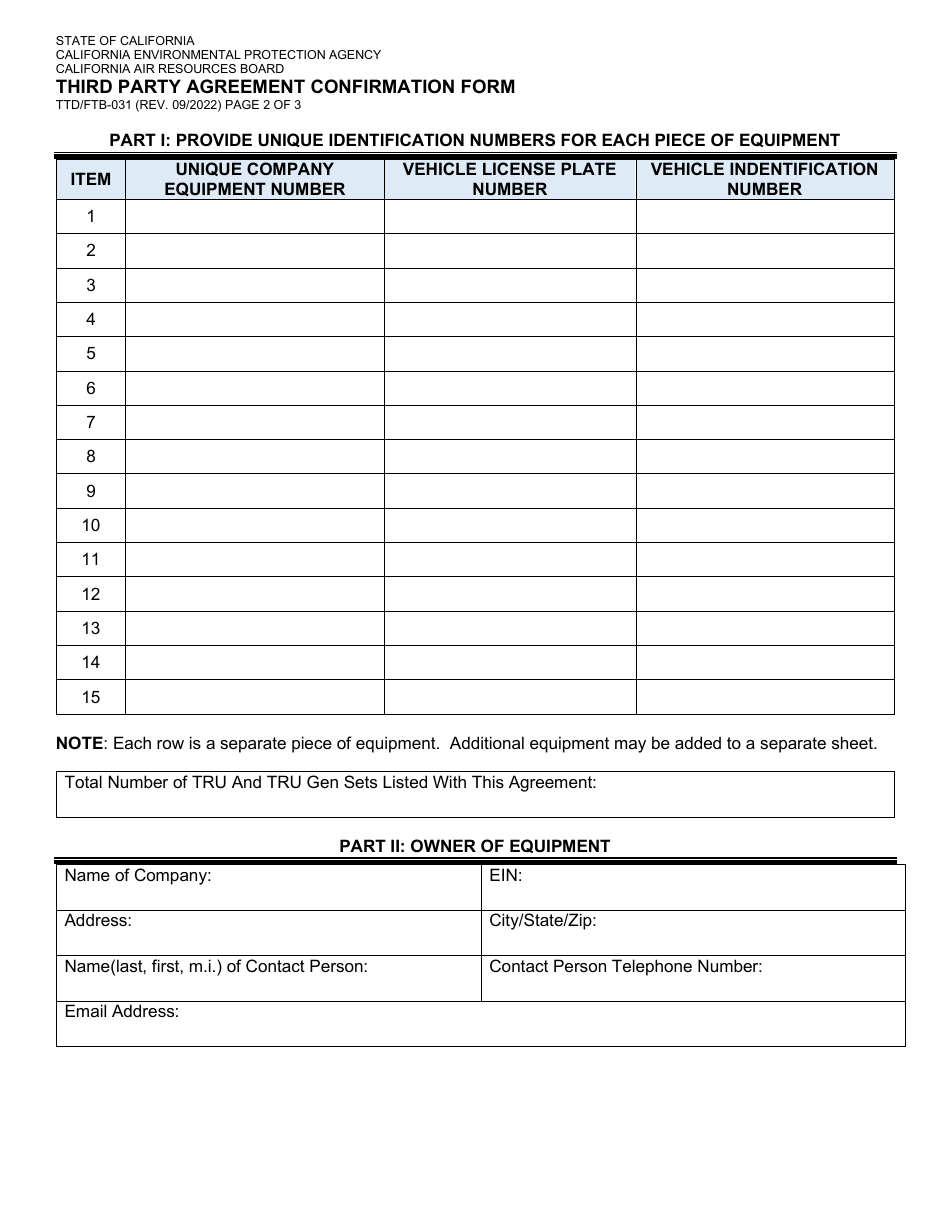

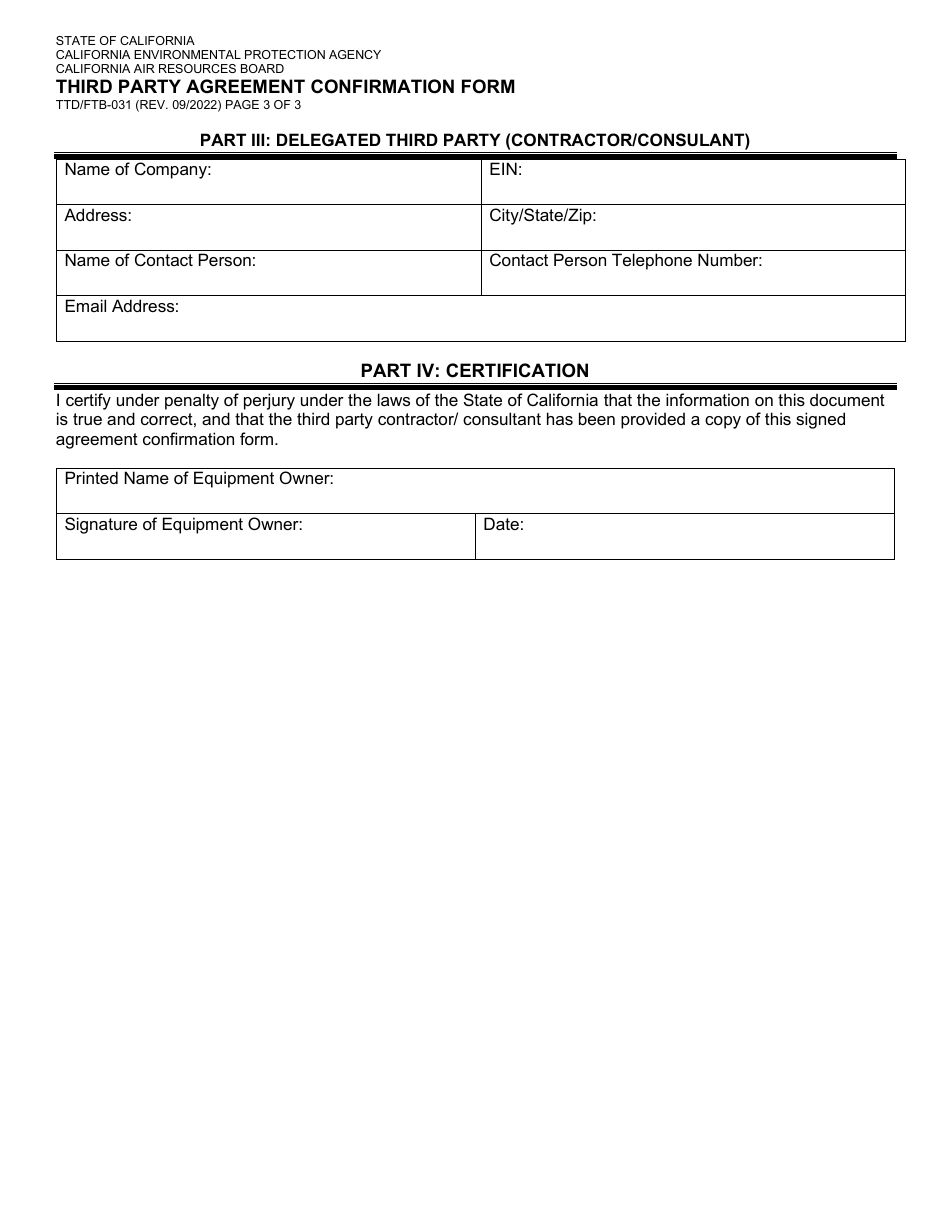

Form TTD / FTB-031 Third Party Agreement Confirmation Form - California

What Is Form TTD/FTB-031?

This is a legal form that was released by the California Air Resources Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TTD/FTB-031?

A: Form TTD/FTB-031 is the Third Party Agreement Confirmation Form in California.

Q: Who needs to file Form TTD/FTB-031?

A: This form needs to be filed by third parties who have entered into an agreement with the California Franchise Tax Board (FTB).

Q: Why do I need to file Form TTD/FTB-031?

A: You need to file this form to confirm that you have entered into an agreement with the FTB as a third party.

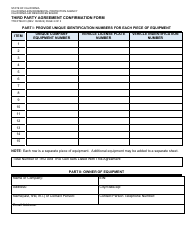

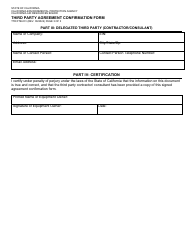

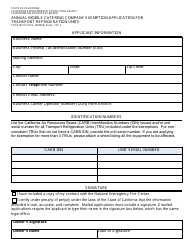

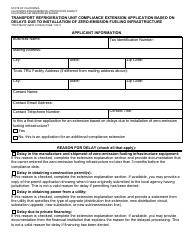

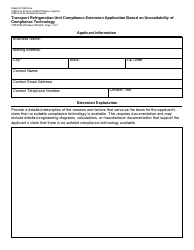

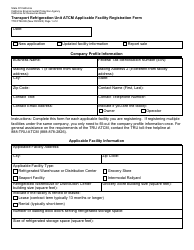

Q: What information is required in Form TTD/FTB-031?

A: Form TTD/FTB-031 requires information such as your name, contact information, agreement details, and signature.

Q: Are there any filing fees for Form TTD/FTB-031?

A: No, there are no filing fees for Form TTD/FTB-031.

Q: What should I do after filing Form TTD/FTB-031?

A: After filing Form TTD/FTB-031, you should keep a copy for your records and submit it to the FTB as instructed in the form.

Q: When is the deadline to file Form TTD/FTB-031?

A: The deadline to file Form TTD/FTB-031 is mentioned in the form or by the FTB.

Q: What happens if I don't file Form TTD/FTB-031?

A: Failure to file Form TTD/FTB-031 may result in penalties or other consequences, as specified by the FTB.

Q: Can I e-file Form TTD/FTB-031?

A: Currently, Form TTD/FTB-031 cannot be e-filed. It must be filed by mail or through other specified methods.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the California Air Resources Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TTD/FTB-031 by clicking the link below or browse more documents and templates provided by the California Air Resources Board.