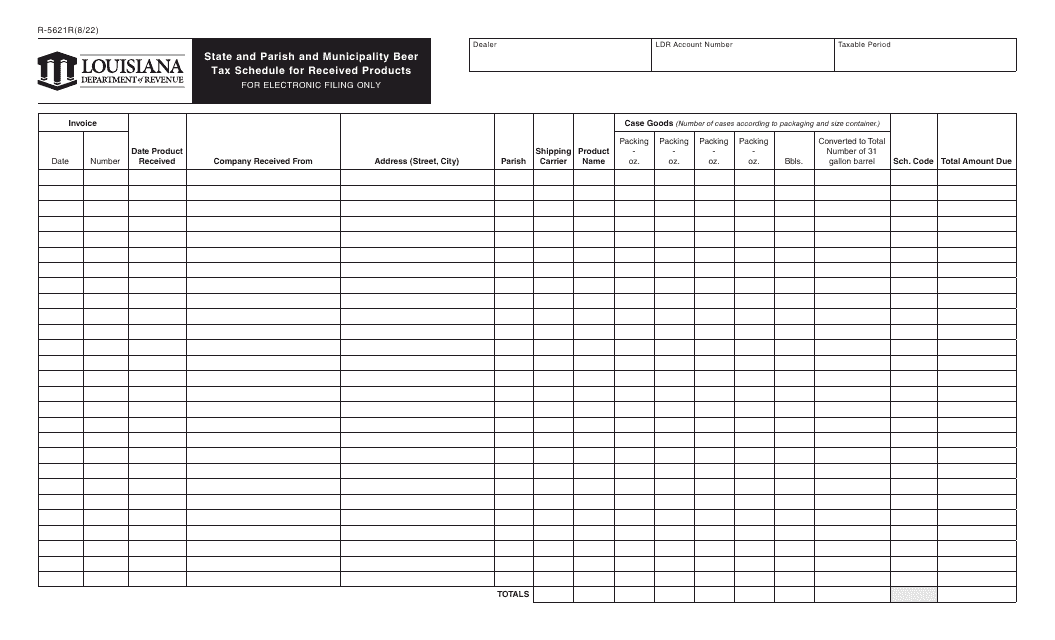

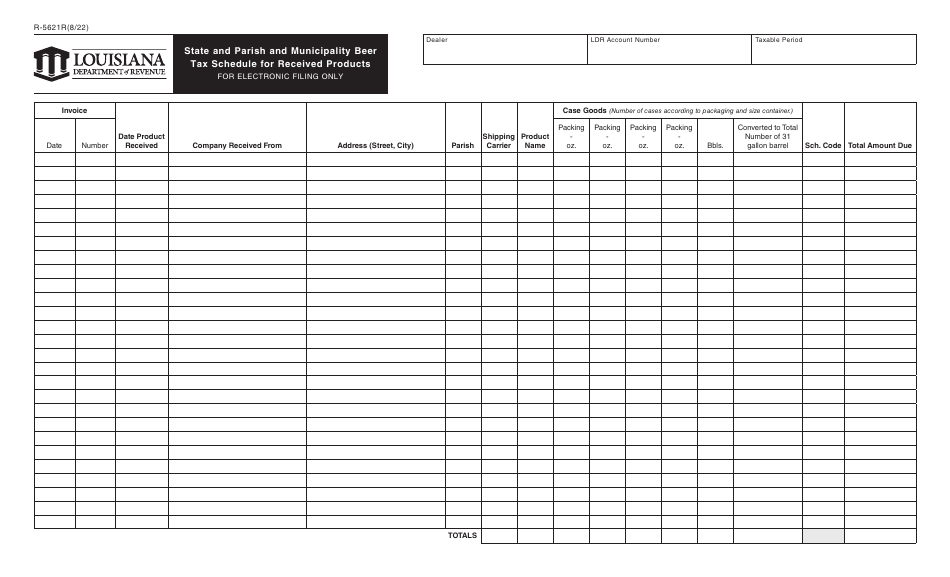

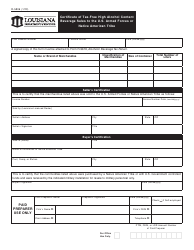

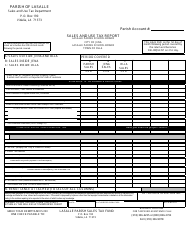

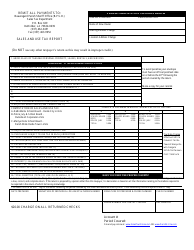

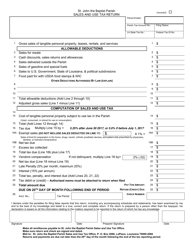

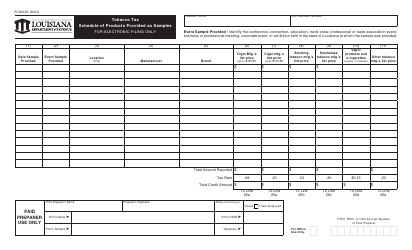

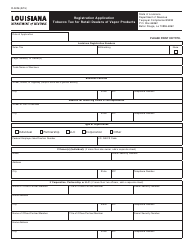

Form R-5621R State and Parish and Municipality Beer Tax Schedule for Received Products - Louisiana

What Is Form R-5621R?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form R-5621R?

A: Form R-5621R is the State and Parish and Municipality Beer Tax Schedule for Received Products in Louisiana.

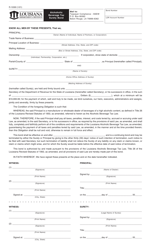

Q: What is the purpose of Form R-5621R?

A: The purpose of Form R-5621R is to report and pay the beer tax for received products in Louisiana.

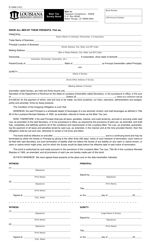

Q: Who needs to fill out Form R-5621R?

A: Businesses or individuals who receive beer products in Louisiana are required to fill out Form R-5621R.

Q: What information is required on Form R-5621R?

A: Form R-5621R requires information about the type and quantity of beer products received, as well as the amount of tax owed.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-5621R by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.