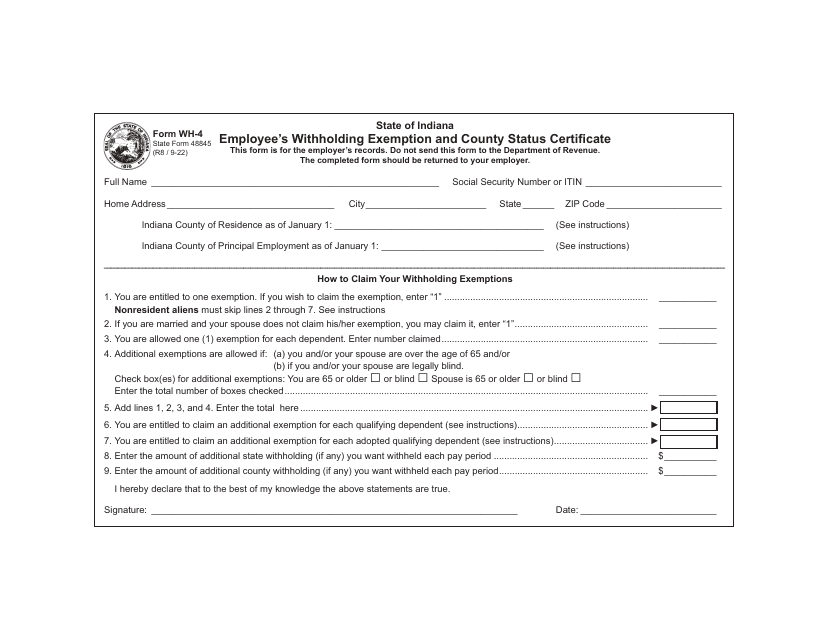

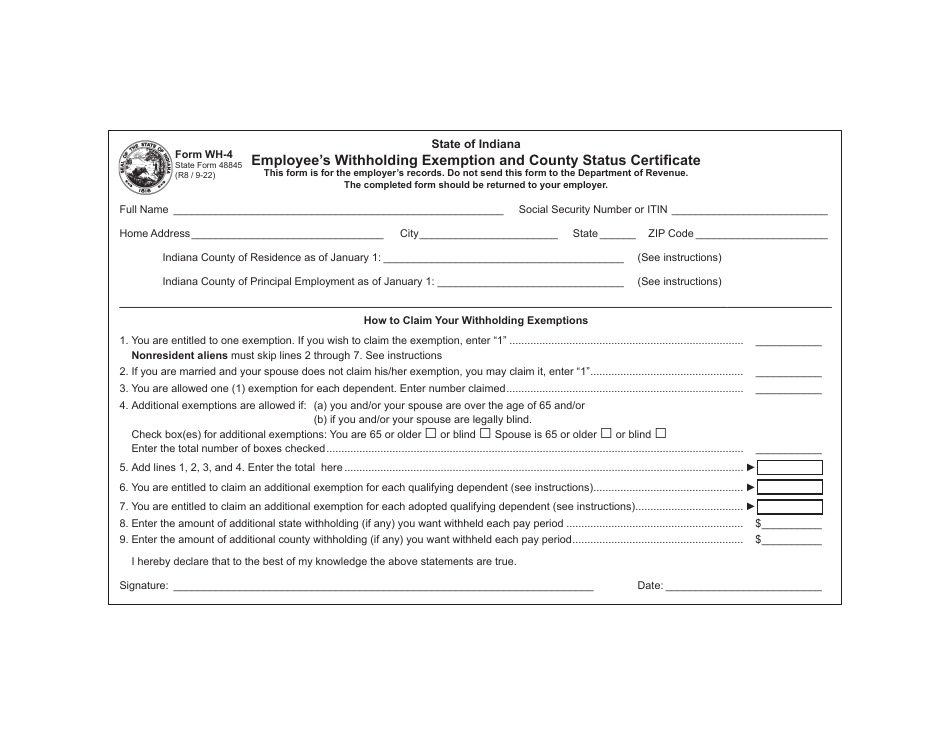

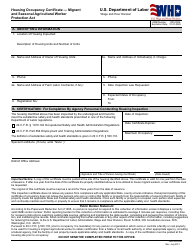

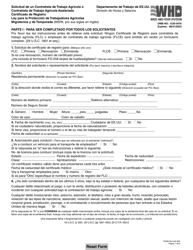

This version of the form is not currently in use and is provided for reference only. Download this version of

Form WH-4 (State Form 48845)

for the current year.

Form WH-4 (State Form 48845) Employee's Withholding Exemption and County Status Certificate - Indiana

What Is Form WH-4 (State Form 48845)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

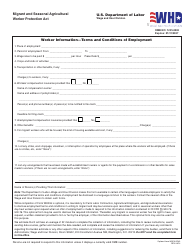

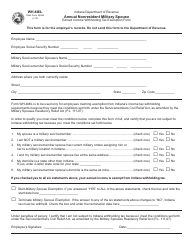

Q: What is Form WH-4?

A: Form WH-4 (State Form 48845) is an Employee's Withholding Exemption and County Status Certificate.

Q: What is the purpose of Form WH-4?

A: The purpose of Form WH-4 is to determine the amount of state income tax to withhold from an employee's wages in Indiana.

Q: What is an Employee's Withholding Exemption?

A: An Employee's Withholding Exemption allows employees to claim exemptions from state income tax withholding based on their personal circumstances.

Q: What is County Status Certificate?

A: County Status Certificate is used to determine the appropriate county tax rate to withhold from an employee's wages based on their county of residence.

Q: When should Form WH-4 be completed?

A: Form WH-4 should be completed when you start a new job or when you want to change your withholding status.

Q: Are employees required to complete Form WH-4?

A: Yes, employees are generally required to complete Form WH-4.

Q: What happens if I don't submit Form WH-4?

A: If you don't submit Form WH-4, your employer will withhold taxes based on the default withholding rate for your filing status.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WH-4 (State Form 48845) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.