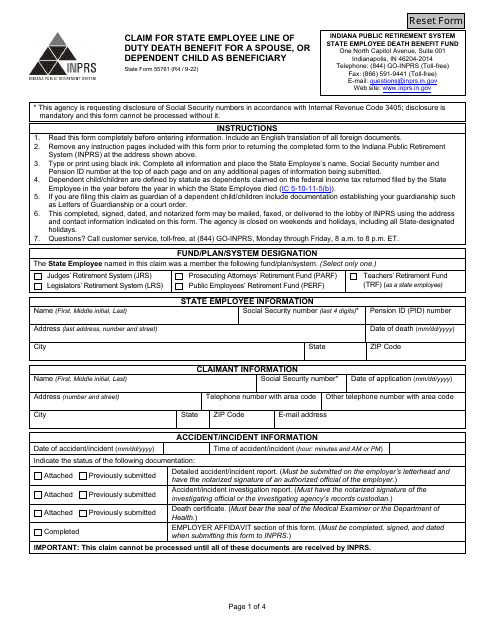

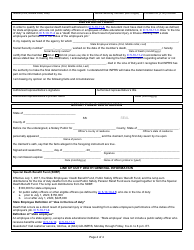

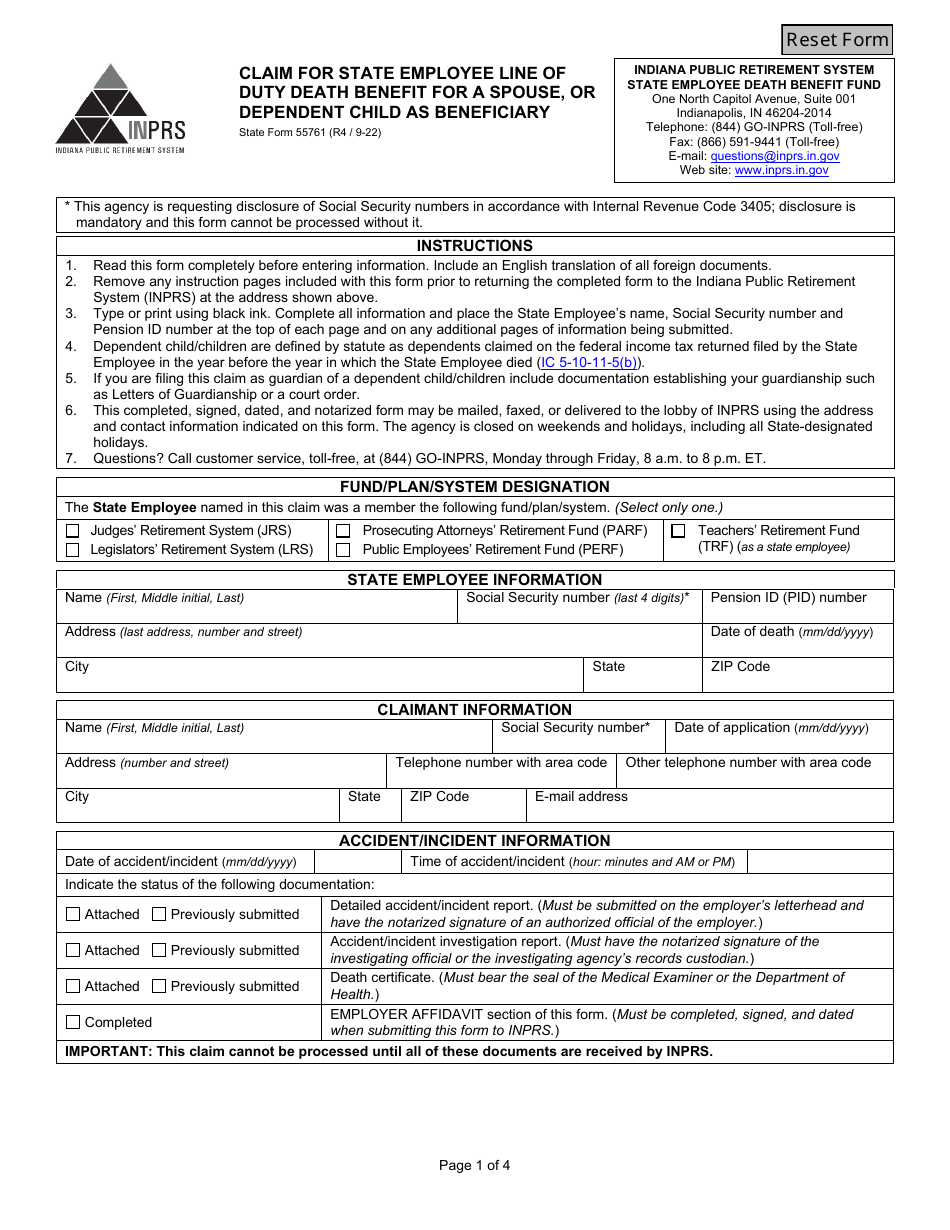

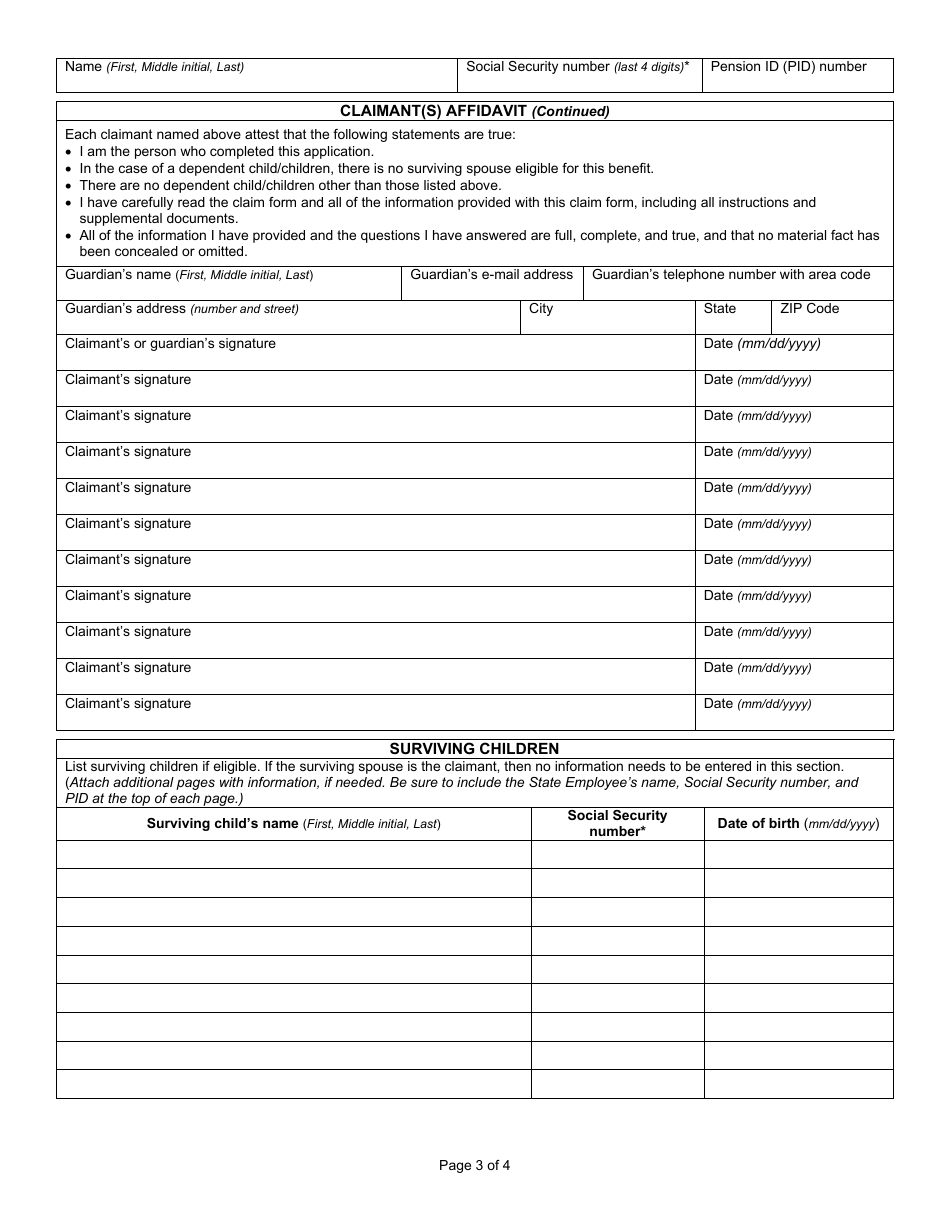

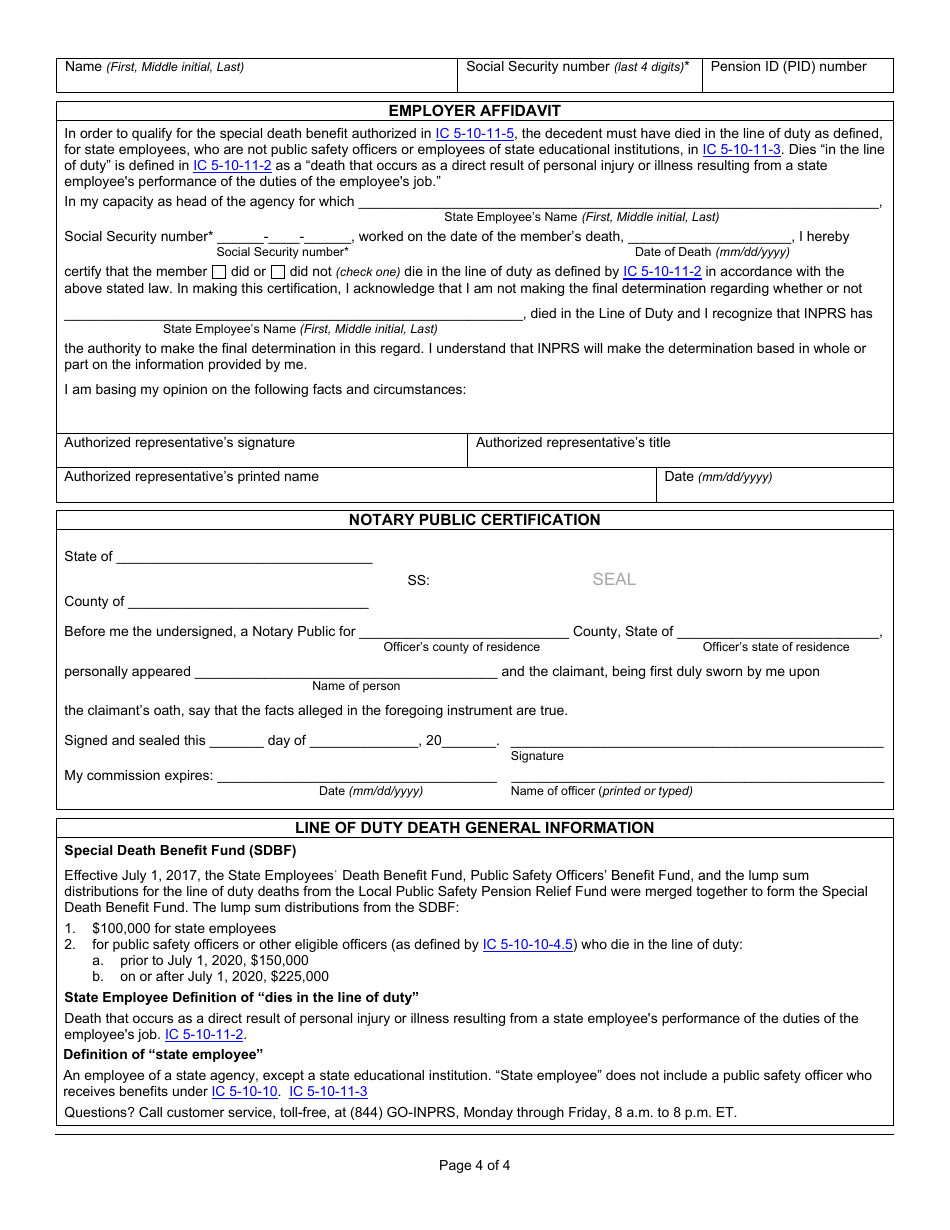

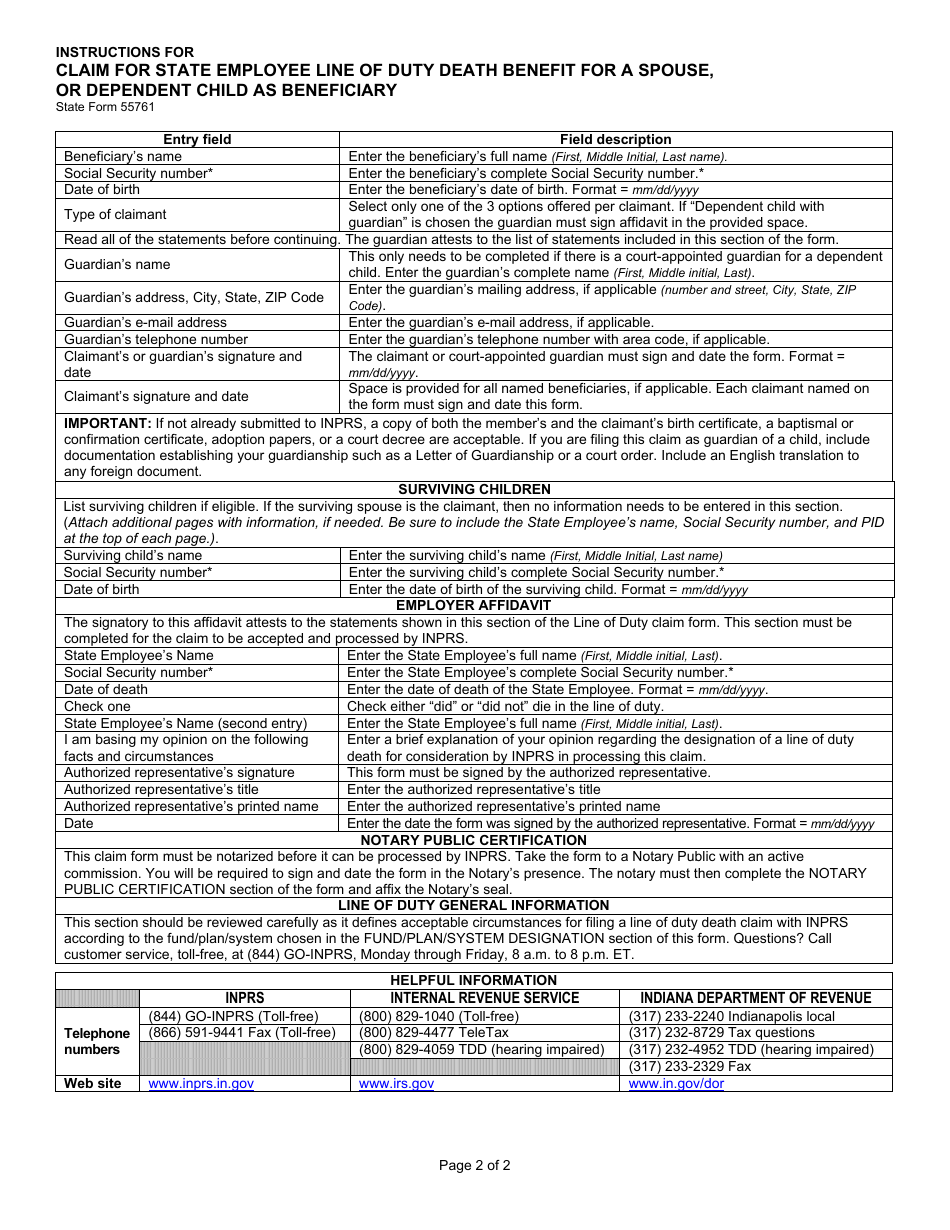

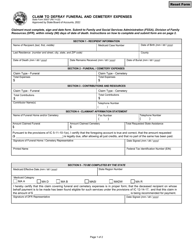

State Form 55761 Claim for State Employee Line of Duty Death Benefit for a Spouse, or Dependent Child as Beneficiary - Indiana

What Is State Form 55761?

This is a legal form that was released by the Indiana Public Retirement System - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 55761?

A: Form 55761 is a claim form for the State Employee Line of Duty Death Benefit for a spouse or dependent child as a beneficiary in Indiana.

Q: Who can use Form 55761?

A: Form 55761 can be used by spouses or dependent children of state employees in Indiana who died in the line of duty.

Q: What is the purpose of Form 55761?

A: The purpose of Form 55761 is to claim the State Employee Line of Duty Death Benefit for a spouse or dependent child as a beneficiary.

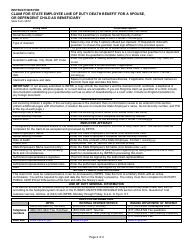

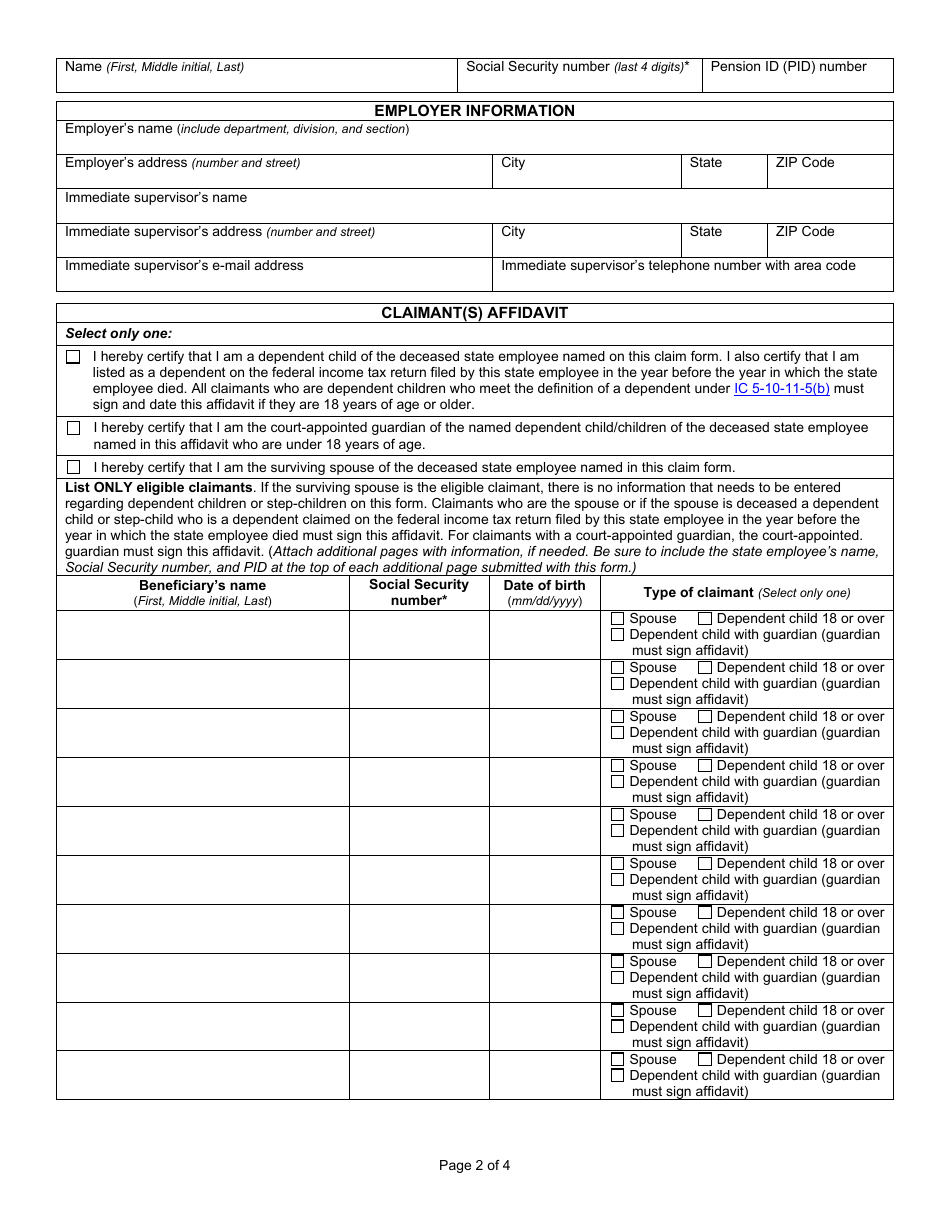

Q: What information is required on Form 55761?

A: Form 55761 requires information such as the deceased state employee's name, date of death, and the beneficiary's relationship to the employee.

Q: Are there any deadlines for submitting Form 55761?

A: Yes, Form 55761 must be submitted within two years of the state employee's death to be eligible for the benefit.

Q: Is there any documentation required with Form 55761?

A: Yes, Form 55761 must be accompanied by a copy of the death certificate and any other relevant supporting documents.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Indiana Public Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 55761 by clicking the link below or browse more documents and templates provided by the Indiana Public Retirement System.