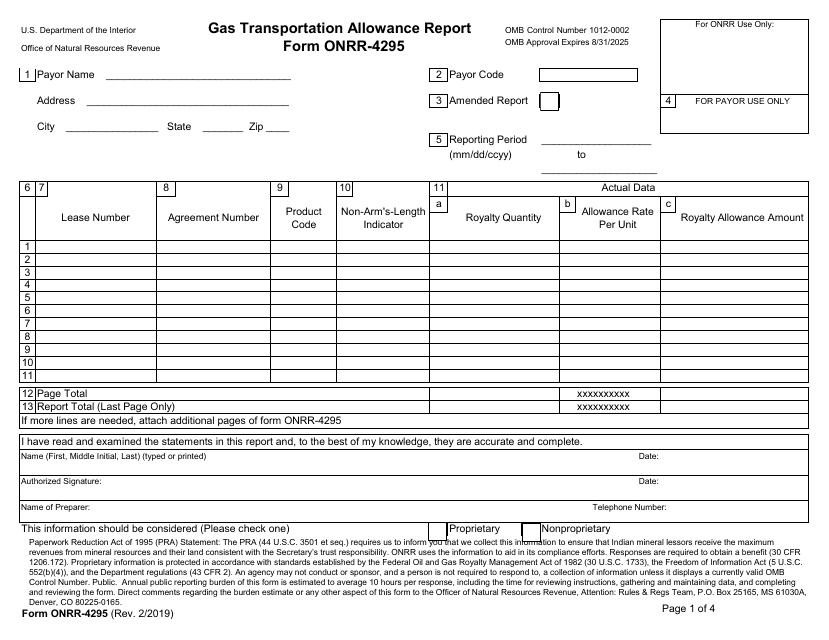

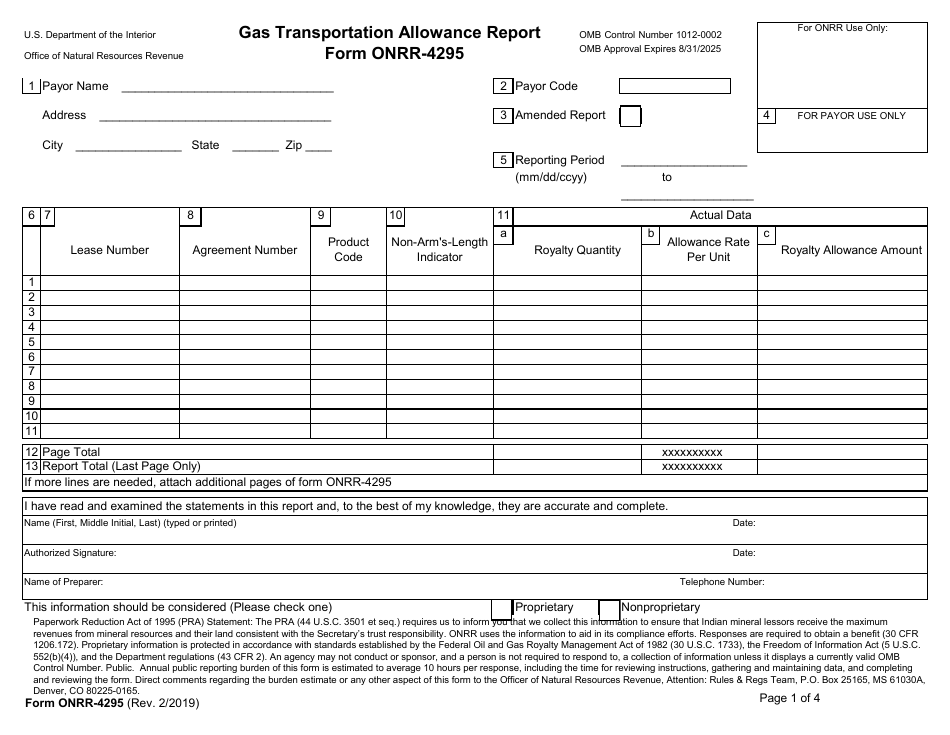

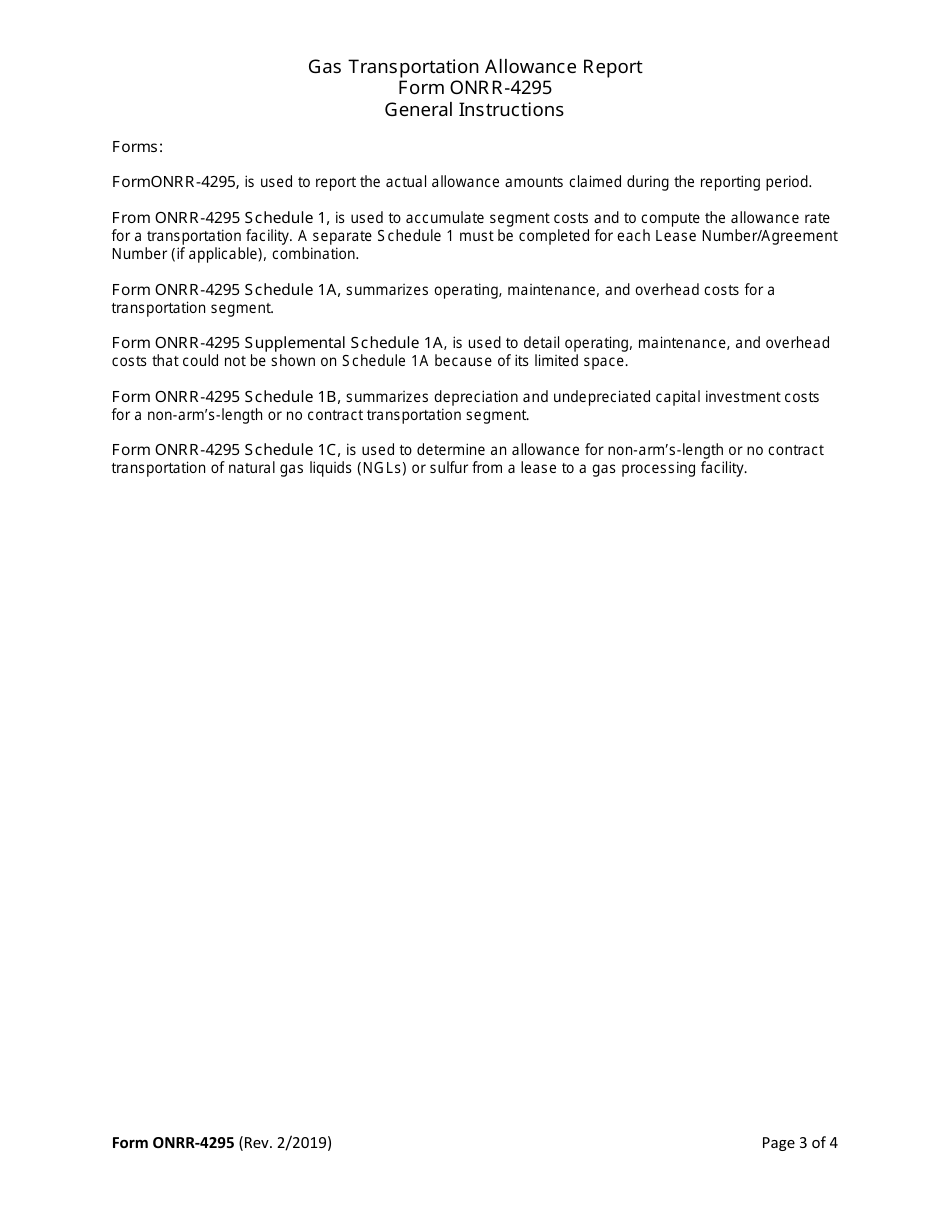

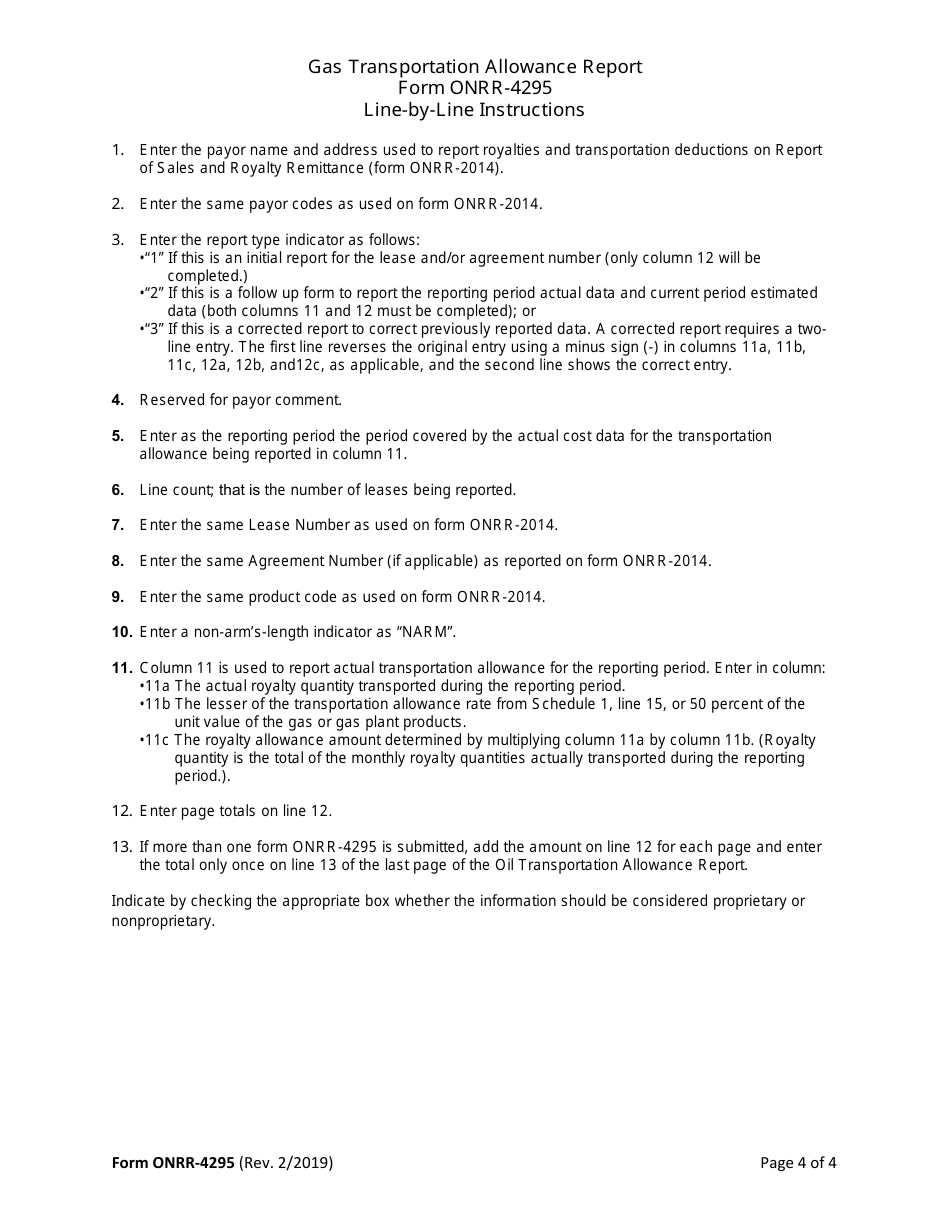

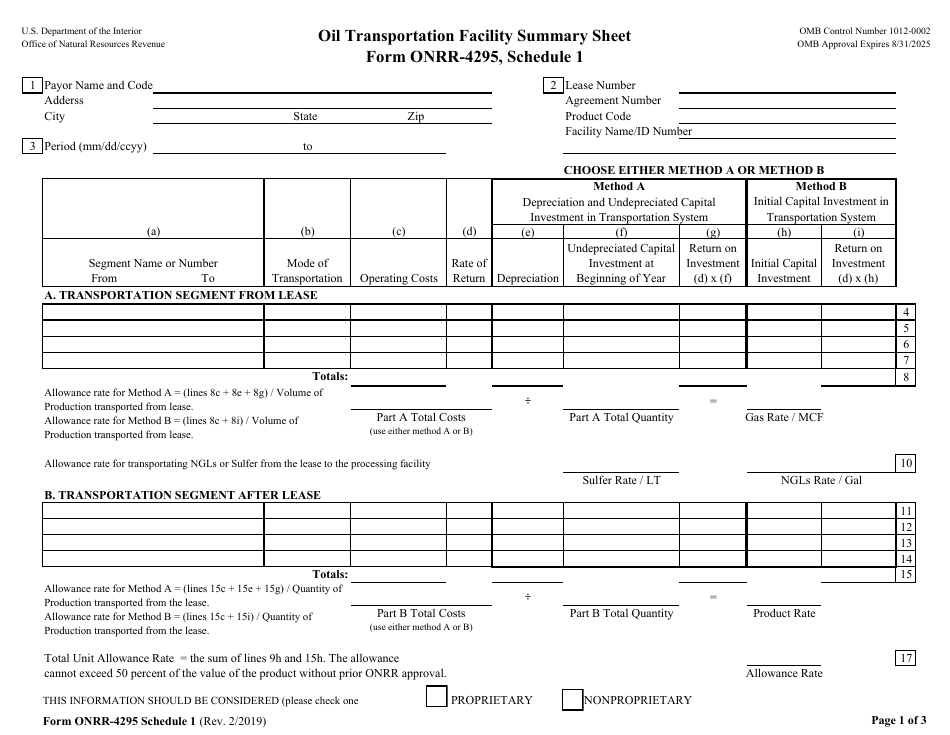

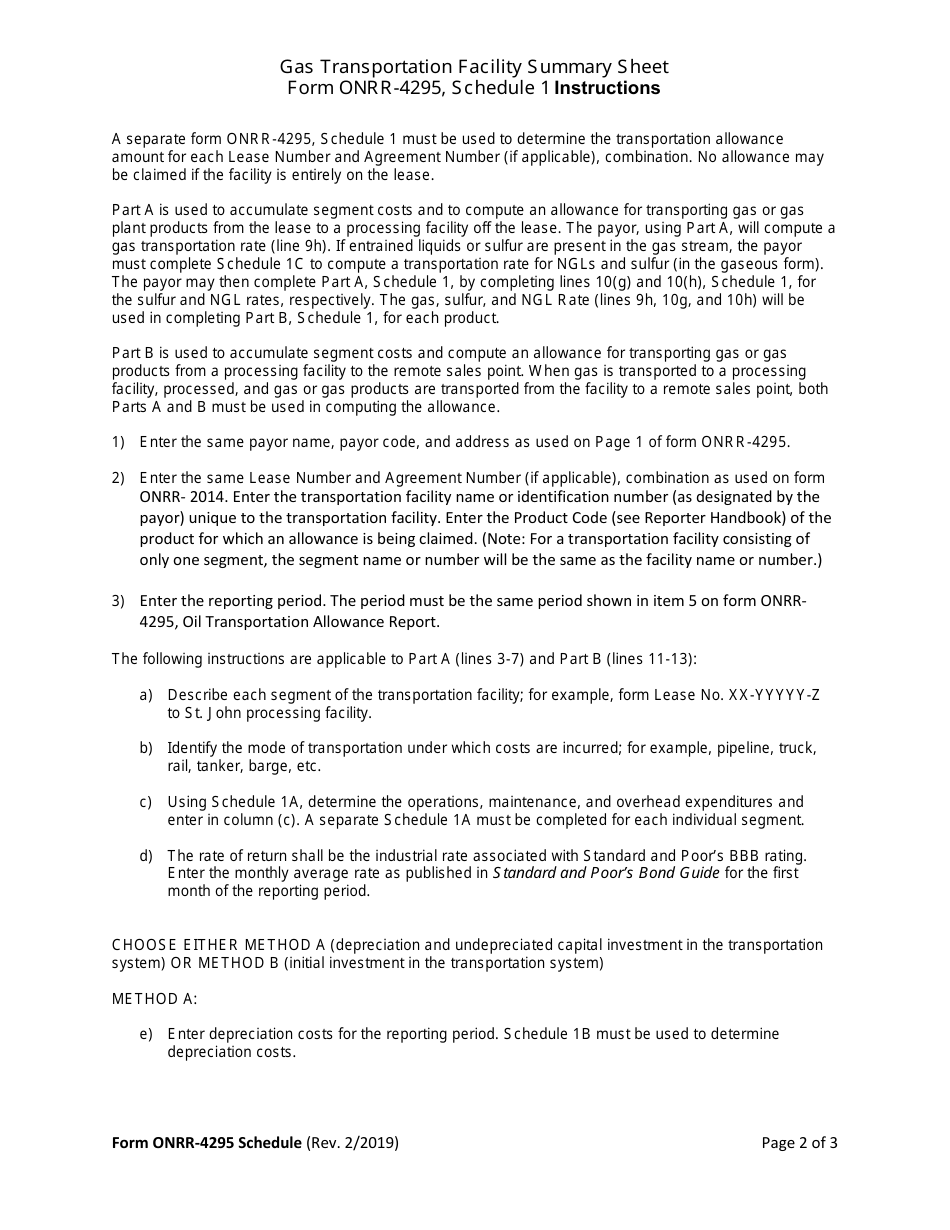

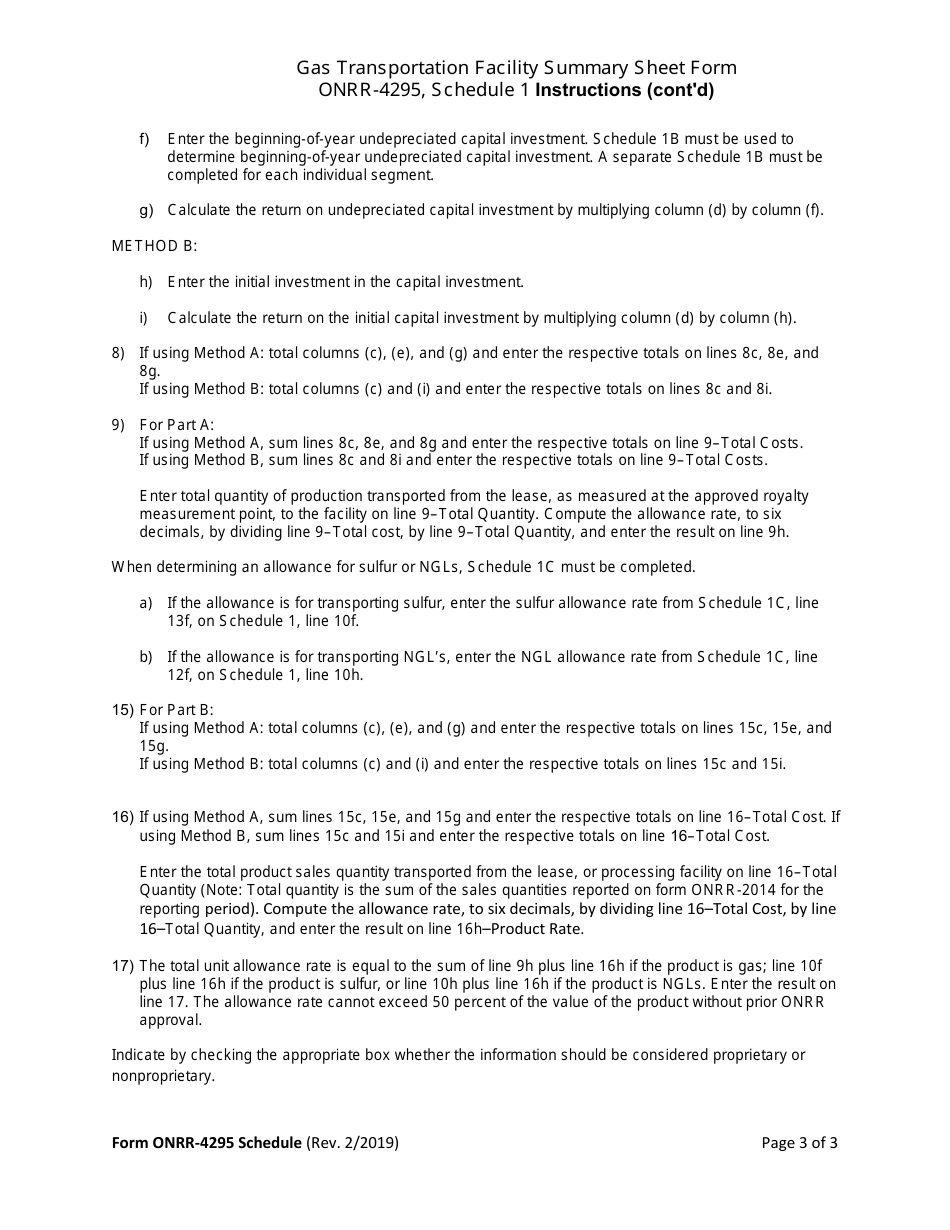

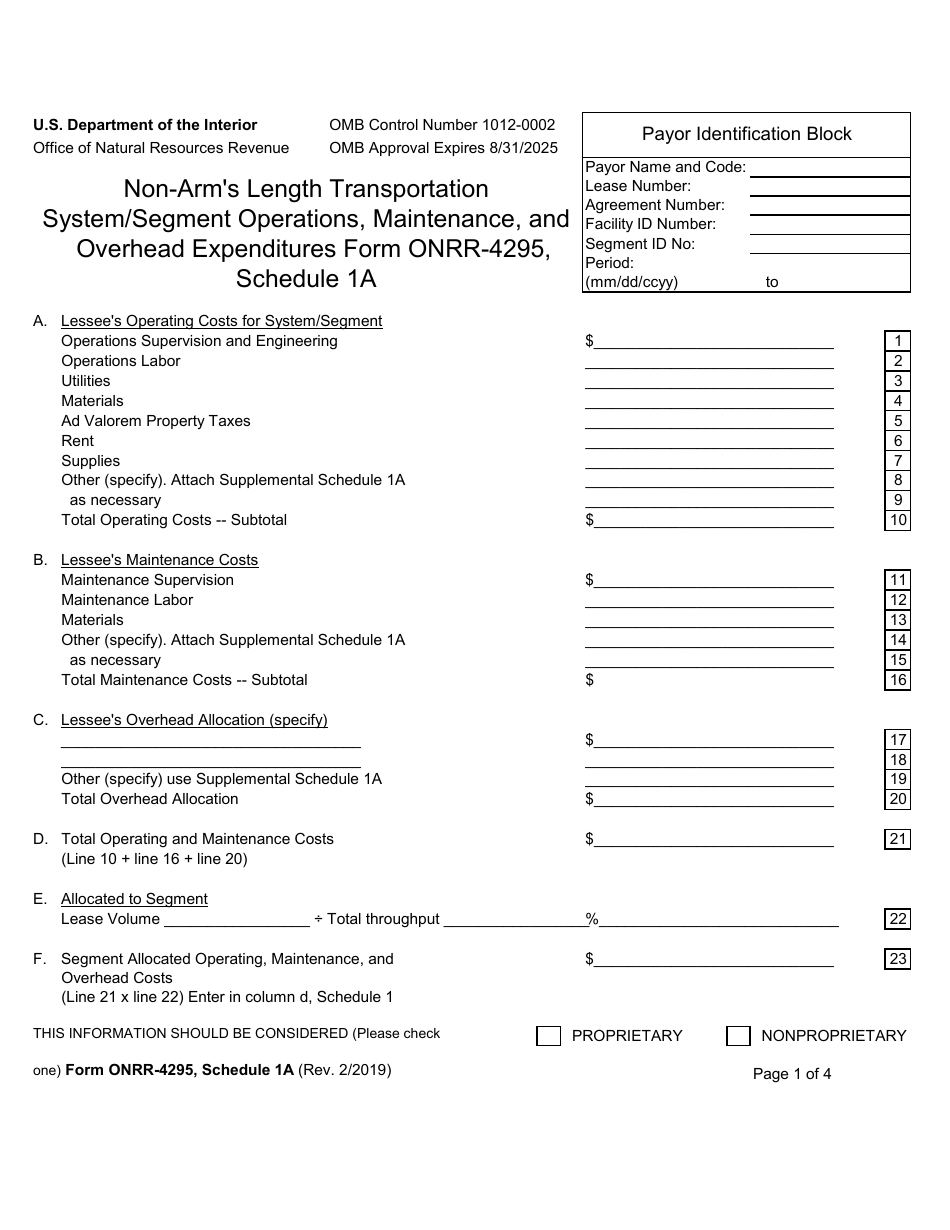

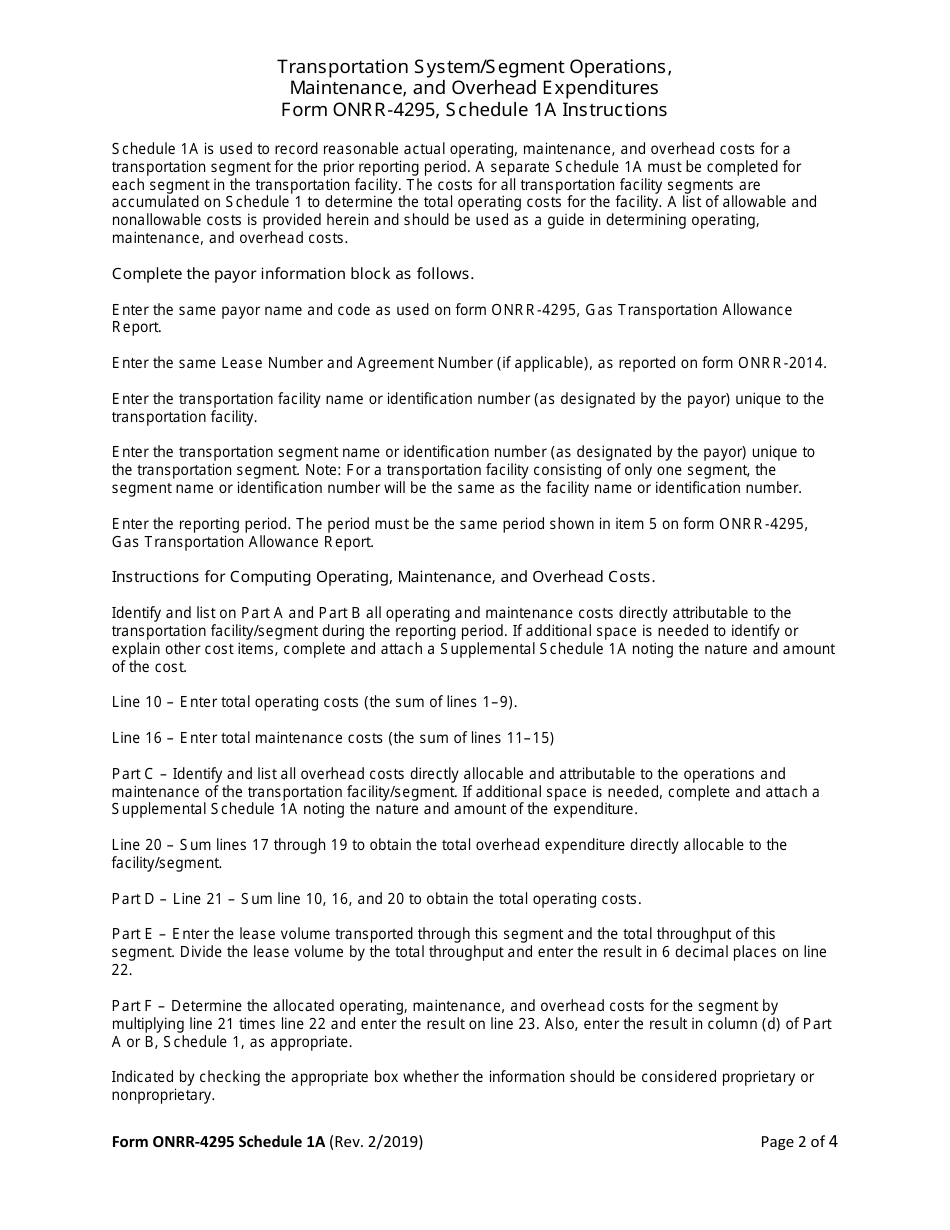

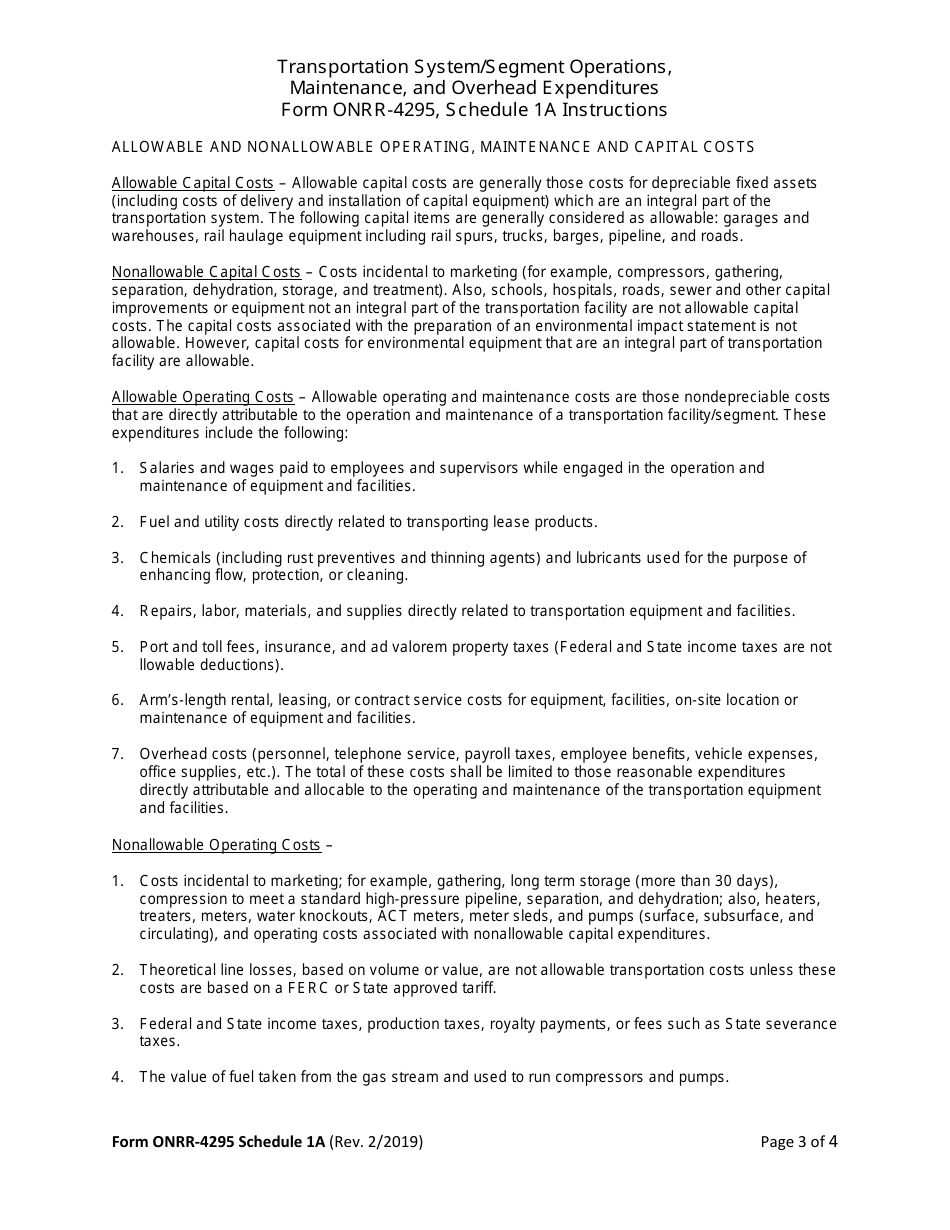

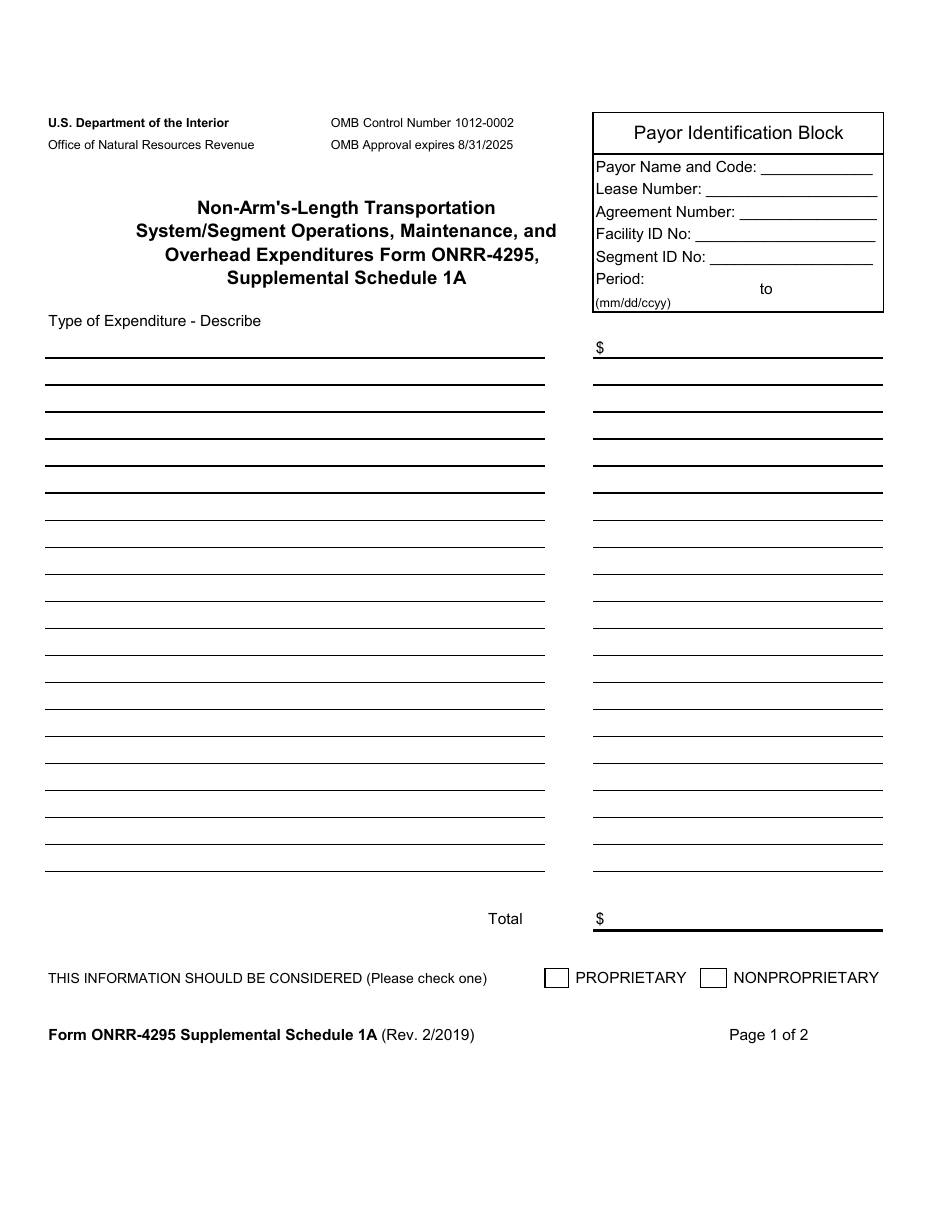

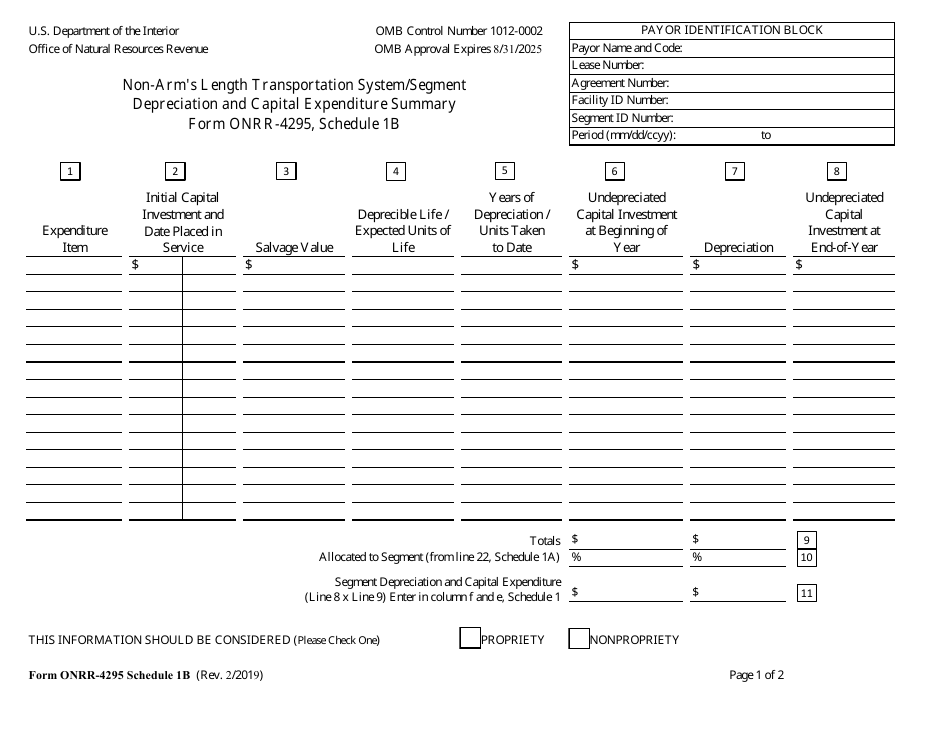

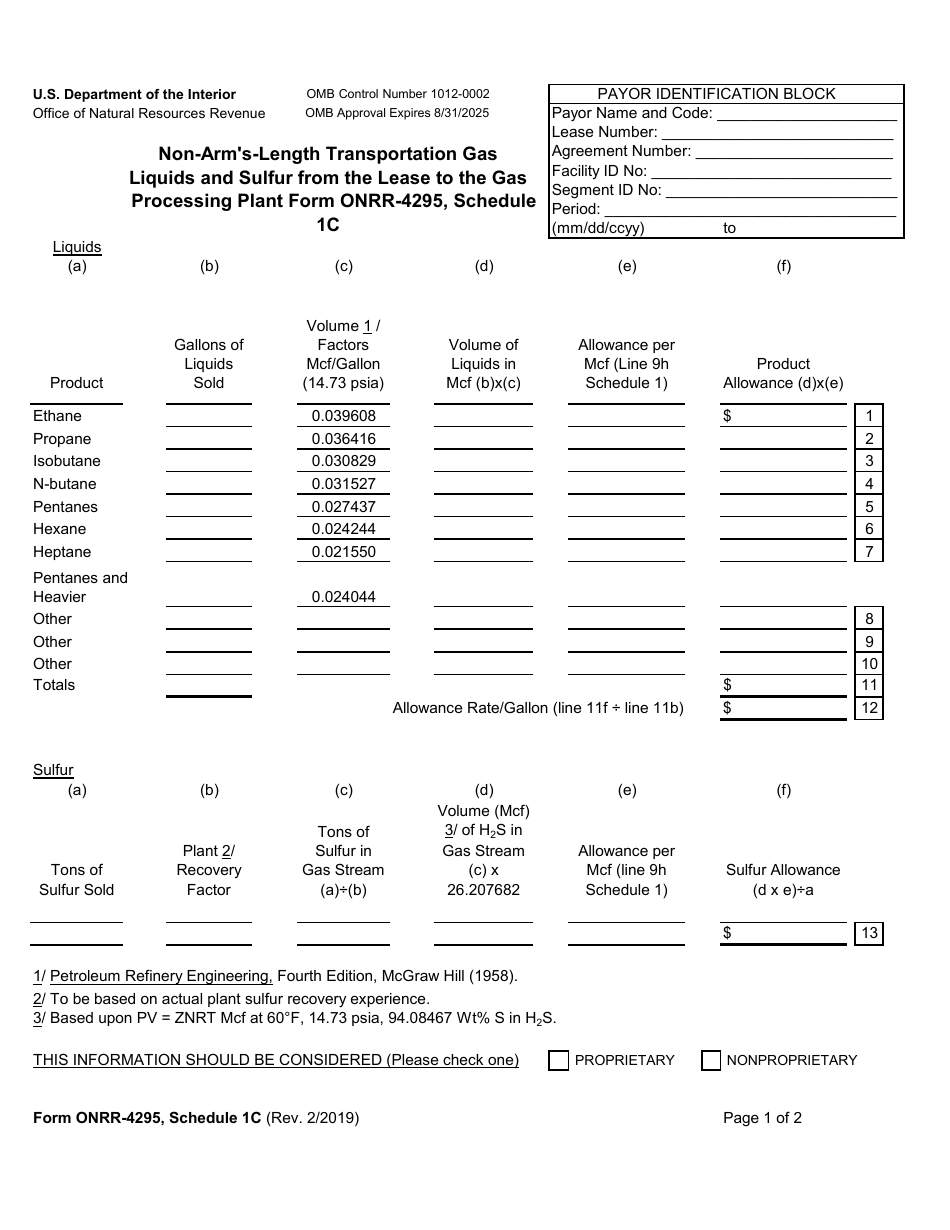

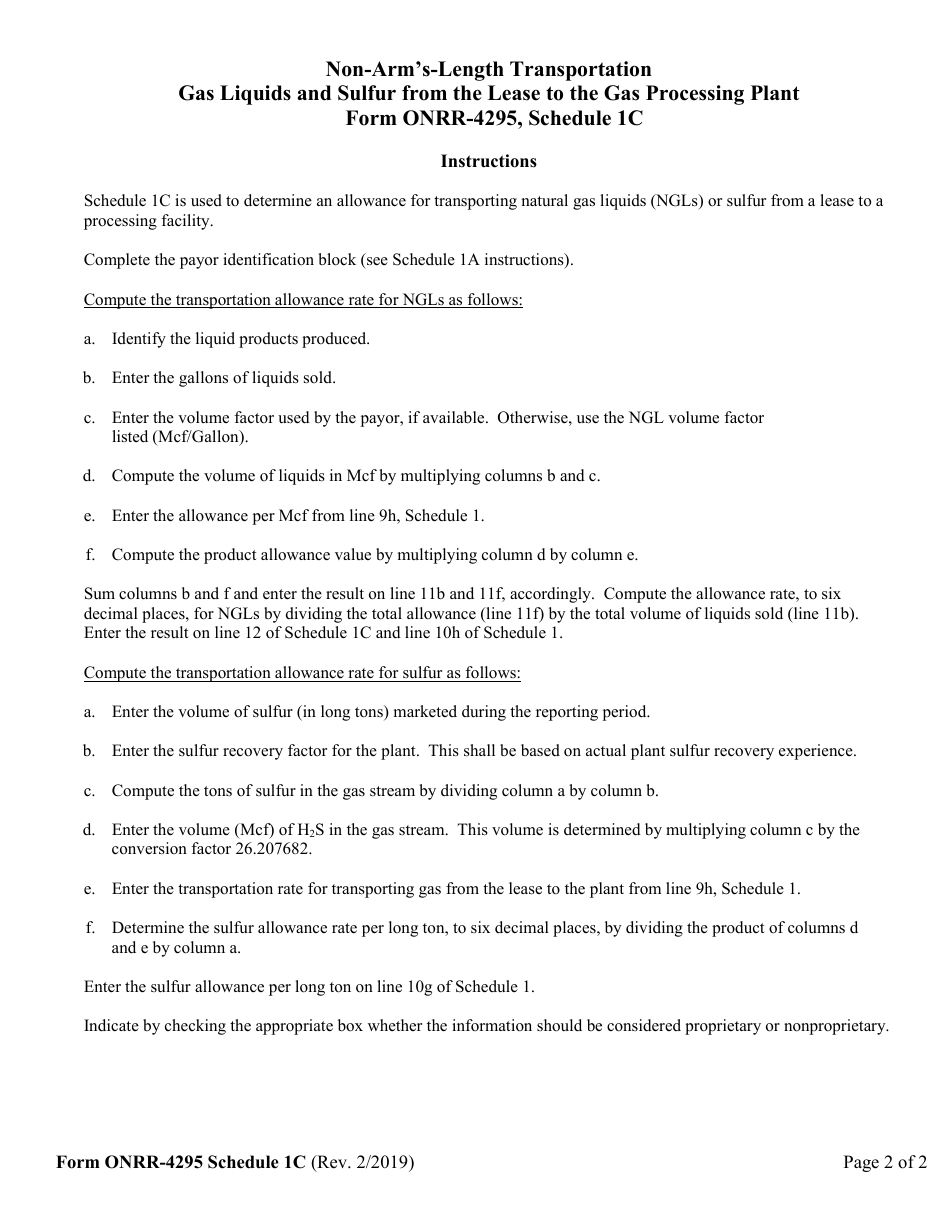

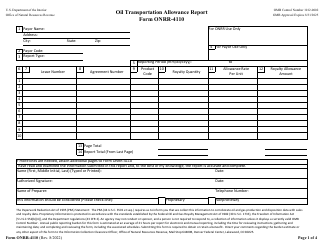

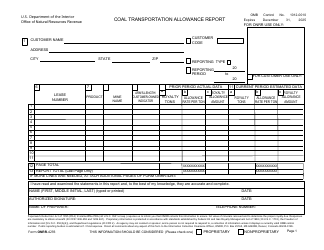

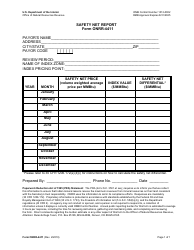

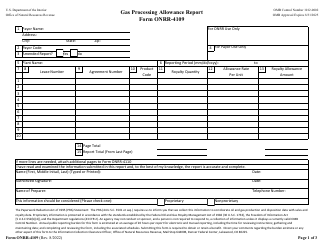

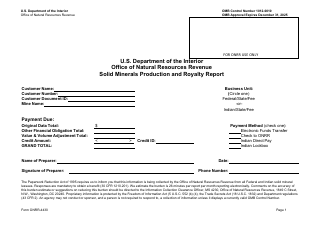

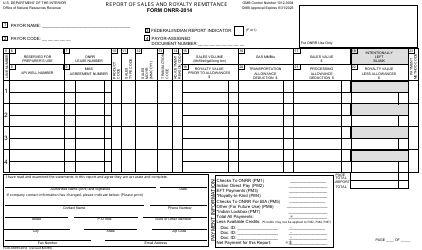

Form ONRR-4295 Gas Transportation Allowance Report

What Is Form ONRR-4295?

This is a legal form that was released by the U.S. Department of the Interior - Office of Natural Resources Revenue on February 1, 2019 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the ONRR-4295 Gas Transportation Allowance Report?

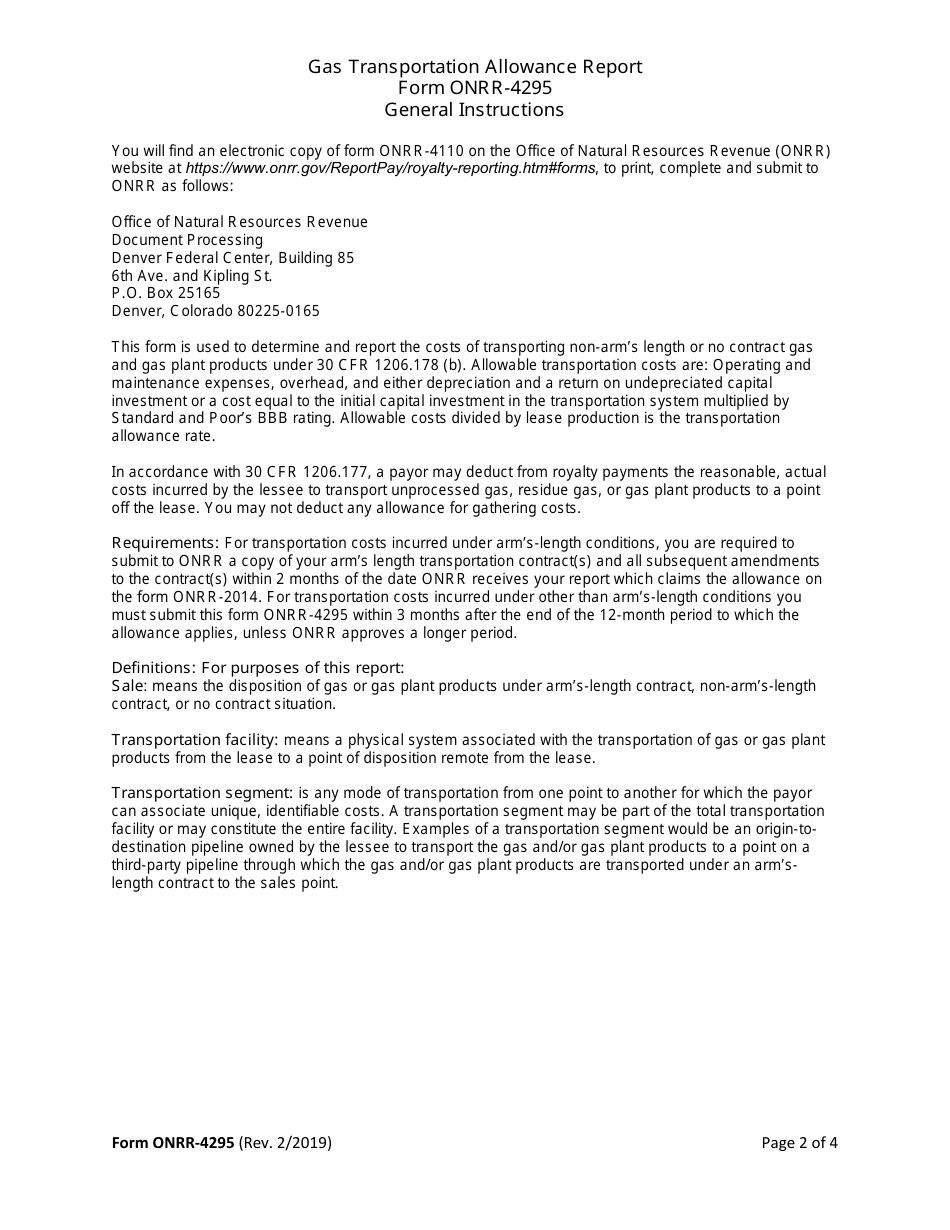

A: The ONRR-4295 Gas Transportation Allowance Report is a form used to report gas transportation costs for royalty calculations.

Q: Who needs to file the ONRR-4295 Gas Transportation Allowance Report?

A: Gas companies transporting gas on Federal leases need to file the ONRR-4295 Gas Transportation Allowance Report.

Q: What is the purpose of the ONRR-4295 Gas Transportation Allowance Report?

A: The purpose of the ONRR-4295 Gas Transportation Allowance Report is to calculate and report transportation costs associated with the production and sale of gas from Federal leases.

Q: When should the ONRR-4295 Gas Transportation Allowance Report be filed?

A: The ONRR-4295 Gas Transportation Allowance Report should be filed on a monthly basis within 30 days after the end of the reporting month.

Q: Is the ONRR-4295 Gas Transportation Allowance Report required for gas transported on state or private leases?

A: No, the ONRR-4295 Gas Transportation Allowance Report is only required for gas transported on Federal leases.

Q: Are there any penalties for not filing the ONRR-4295 Gas Transportation Allowance Report?

A: Yes, failure to file the ONRR-4295 Gas Transportation Allowance Report or filing false or misleading information can result in penalties and enforcement actions.

Form Details:

- Released on February 1, 2019;

- The latest available edition released by the U.S. Department of the Interior - Office of Natural Resources Revenue;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ONRR-4295 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Interior - Office of Natural Resources Revenue.