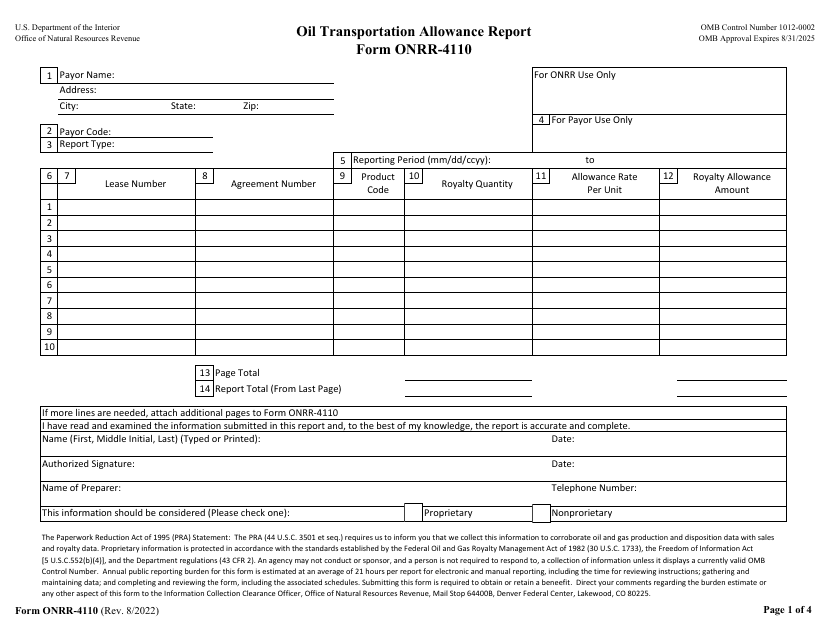

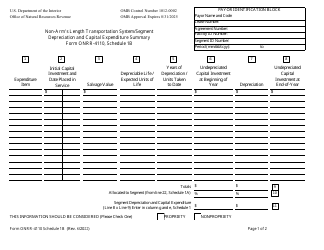

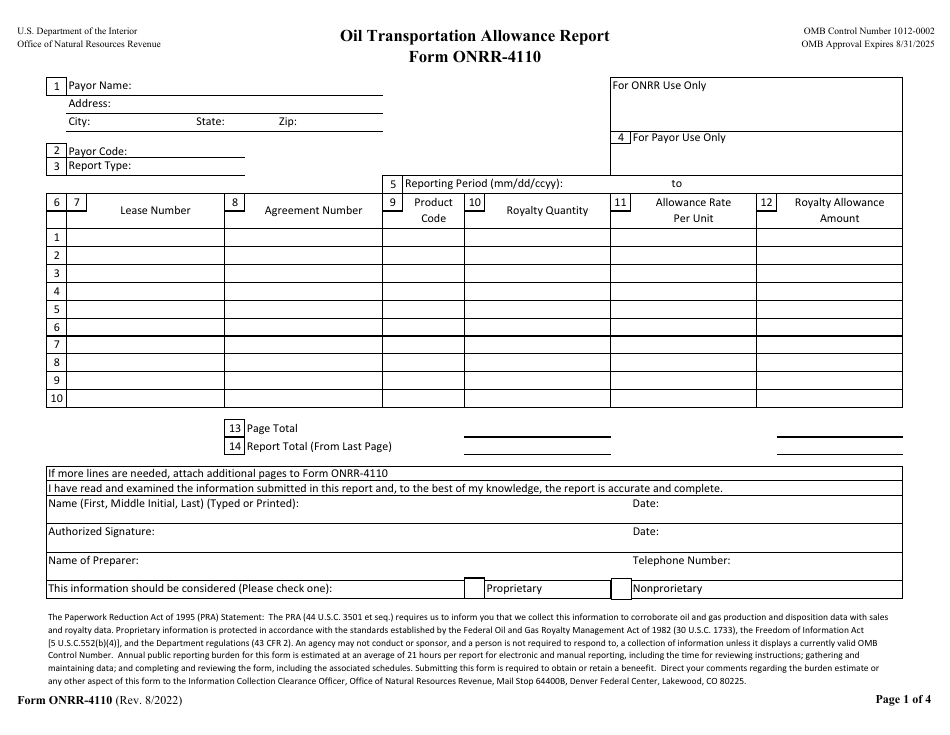

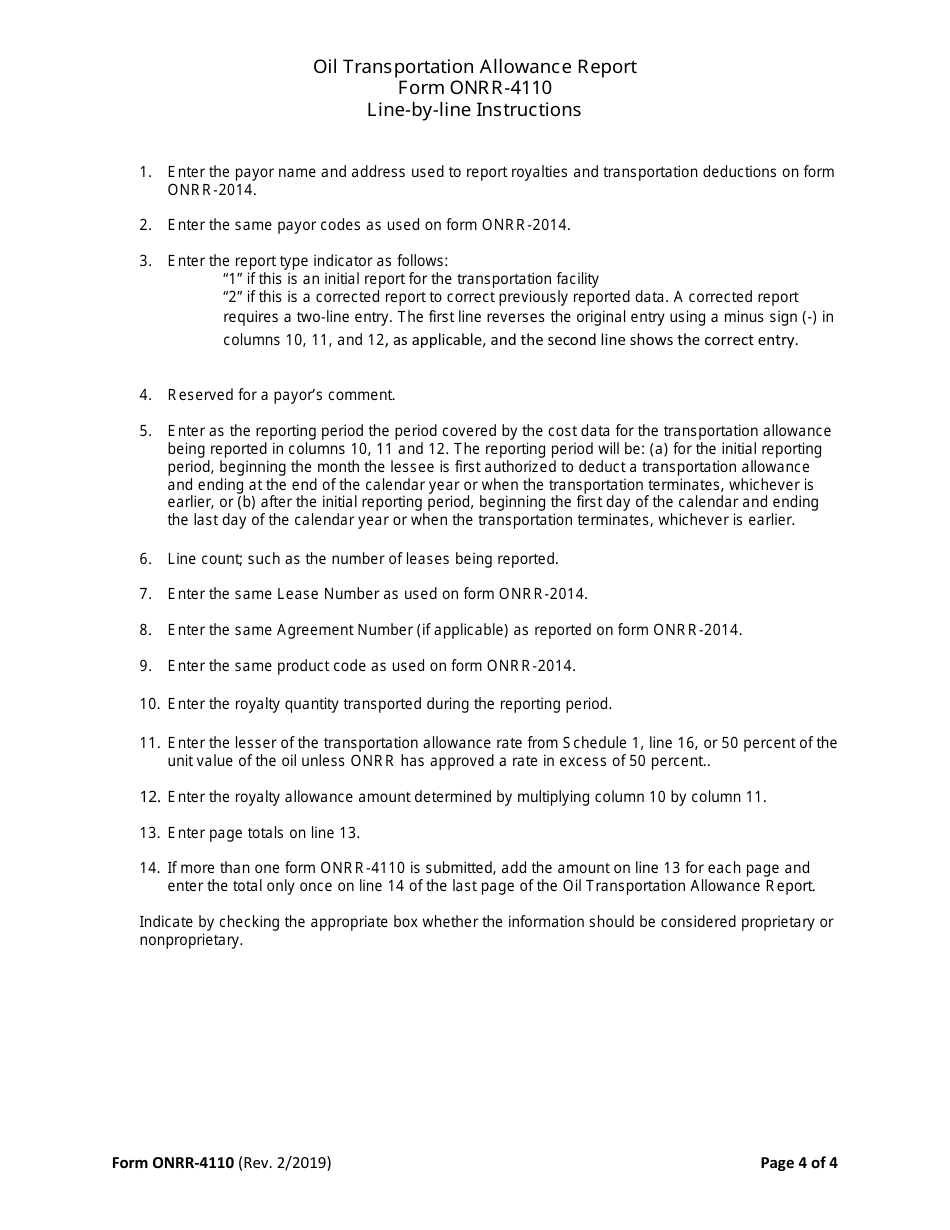

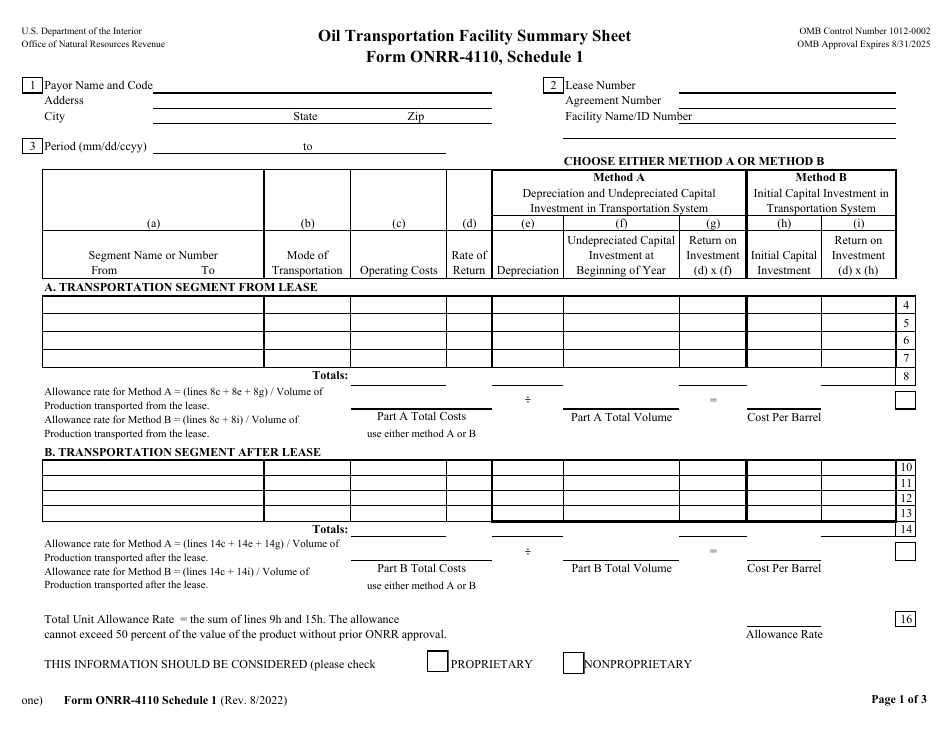

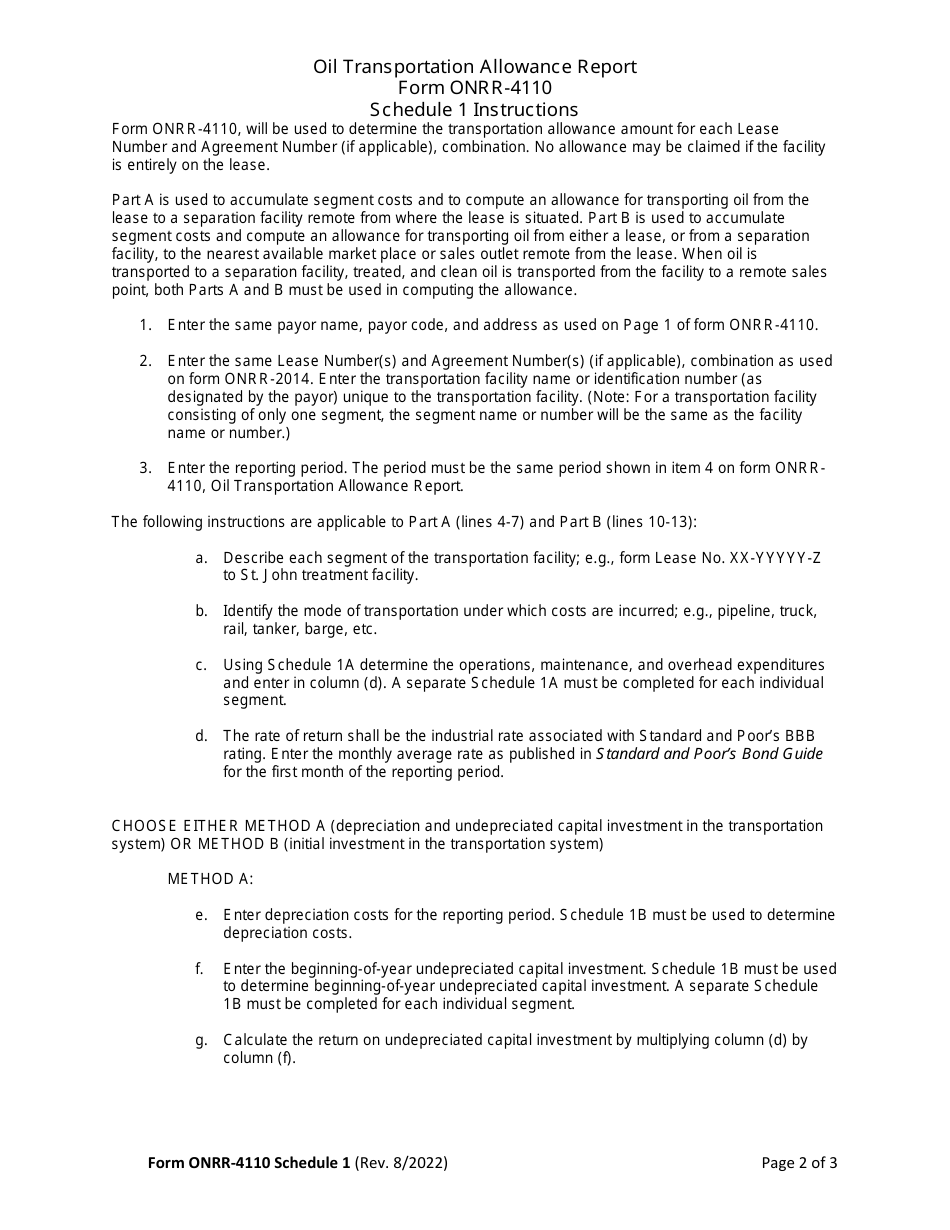

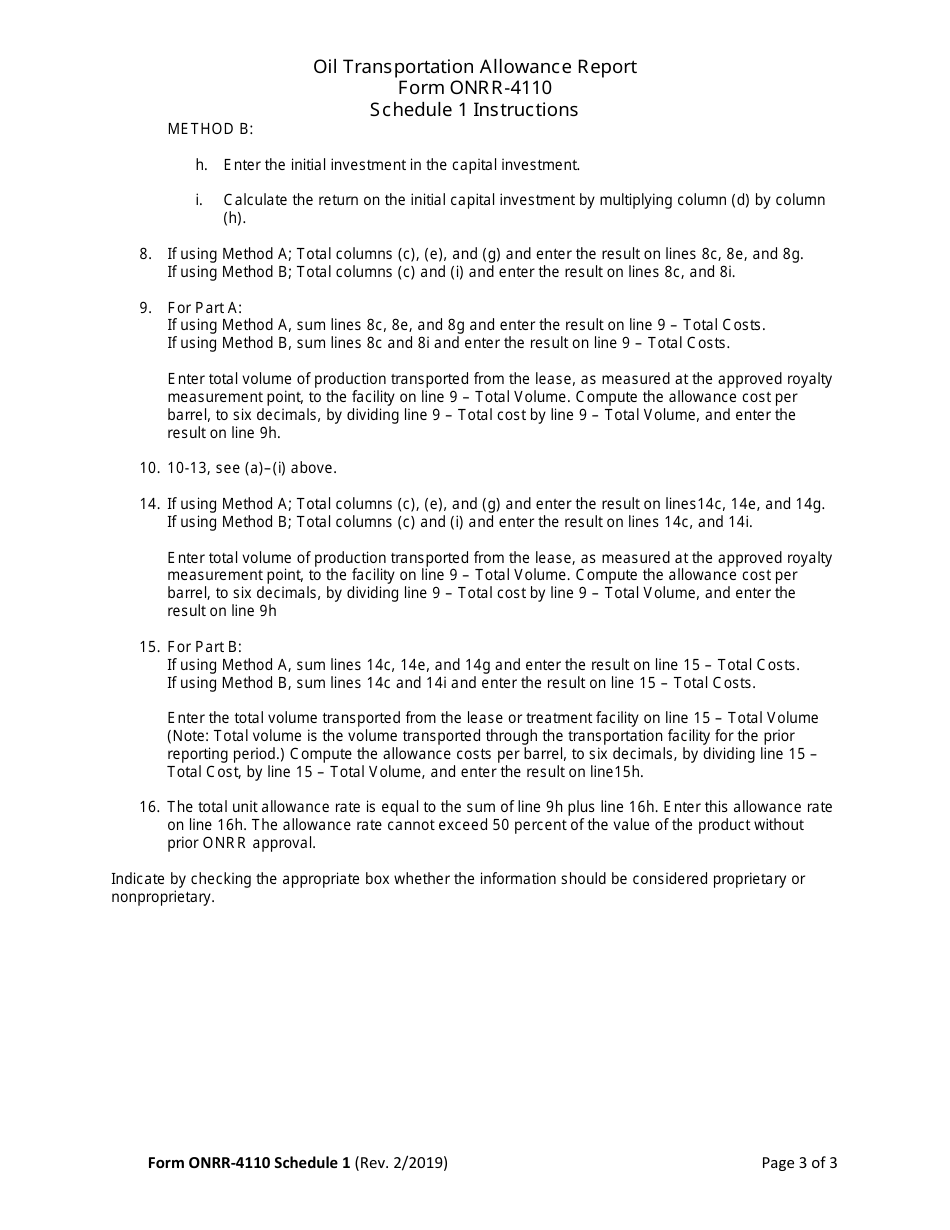

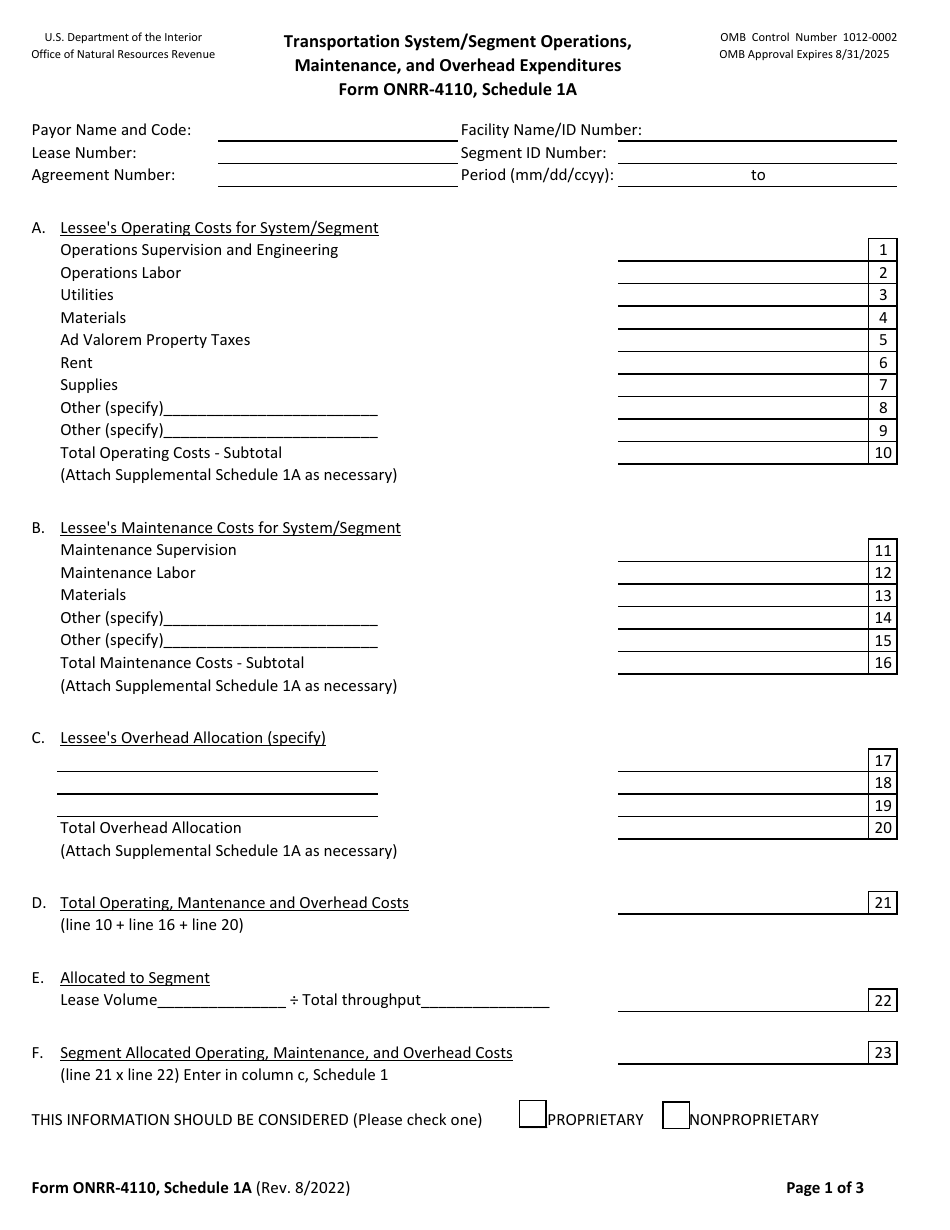

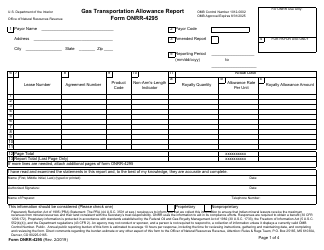

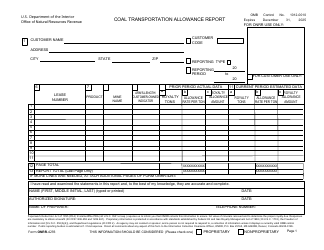

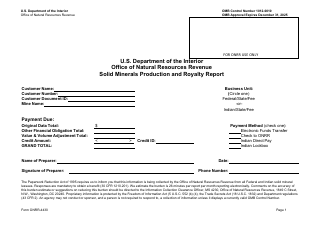

Form ONRR-4110 Oil Transportation Allowance Report

What Is Form ONRR-4110?

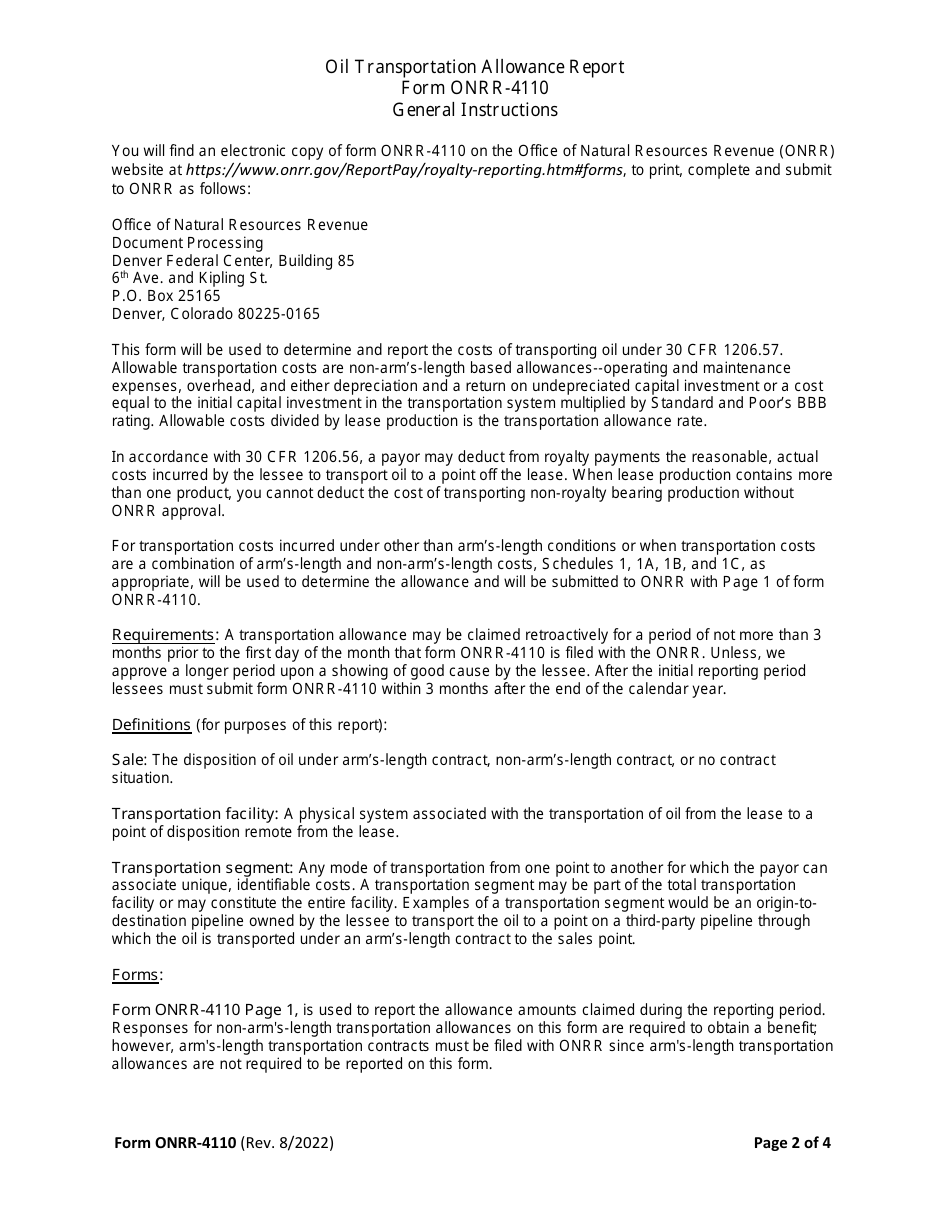

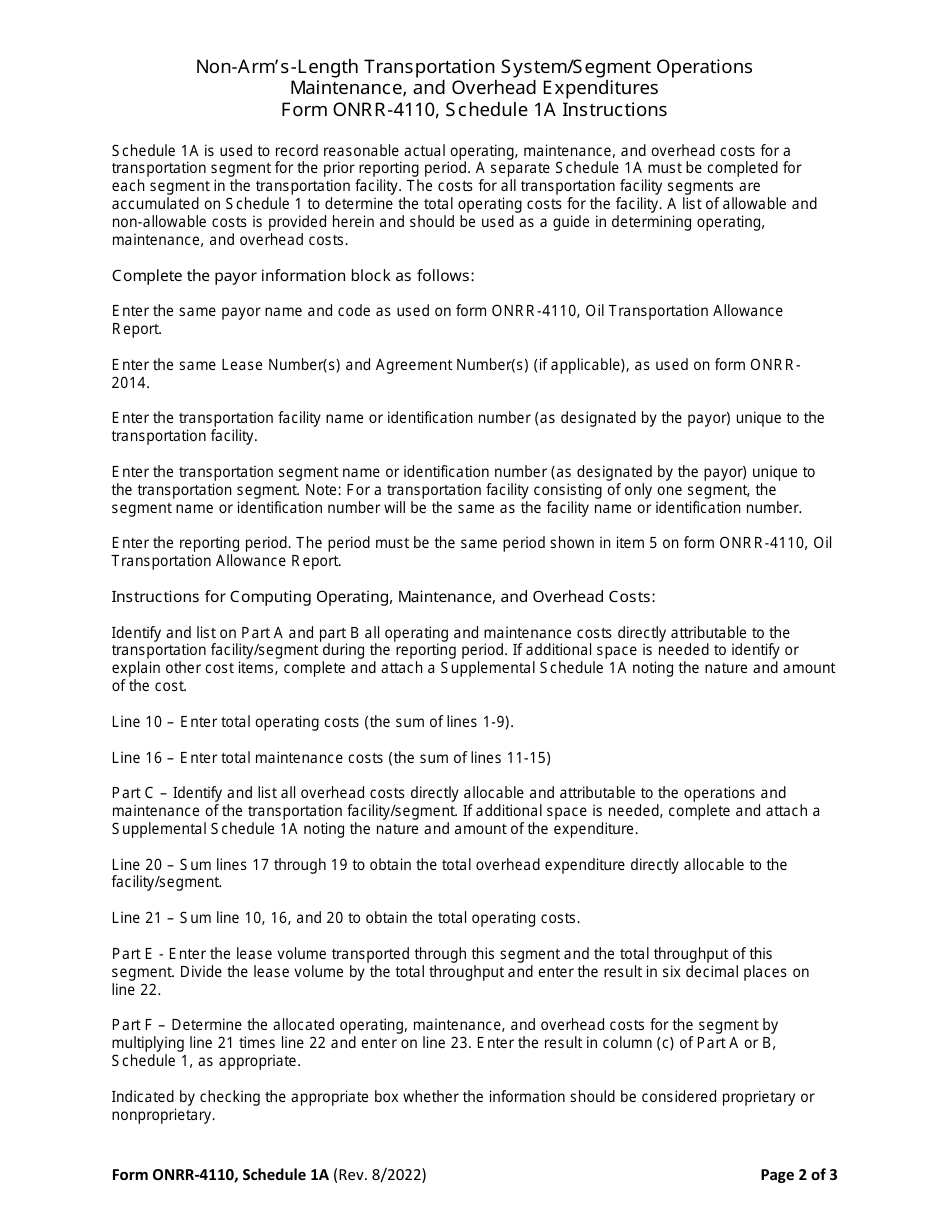

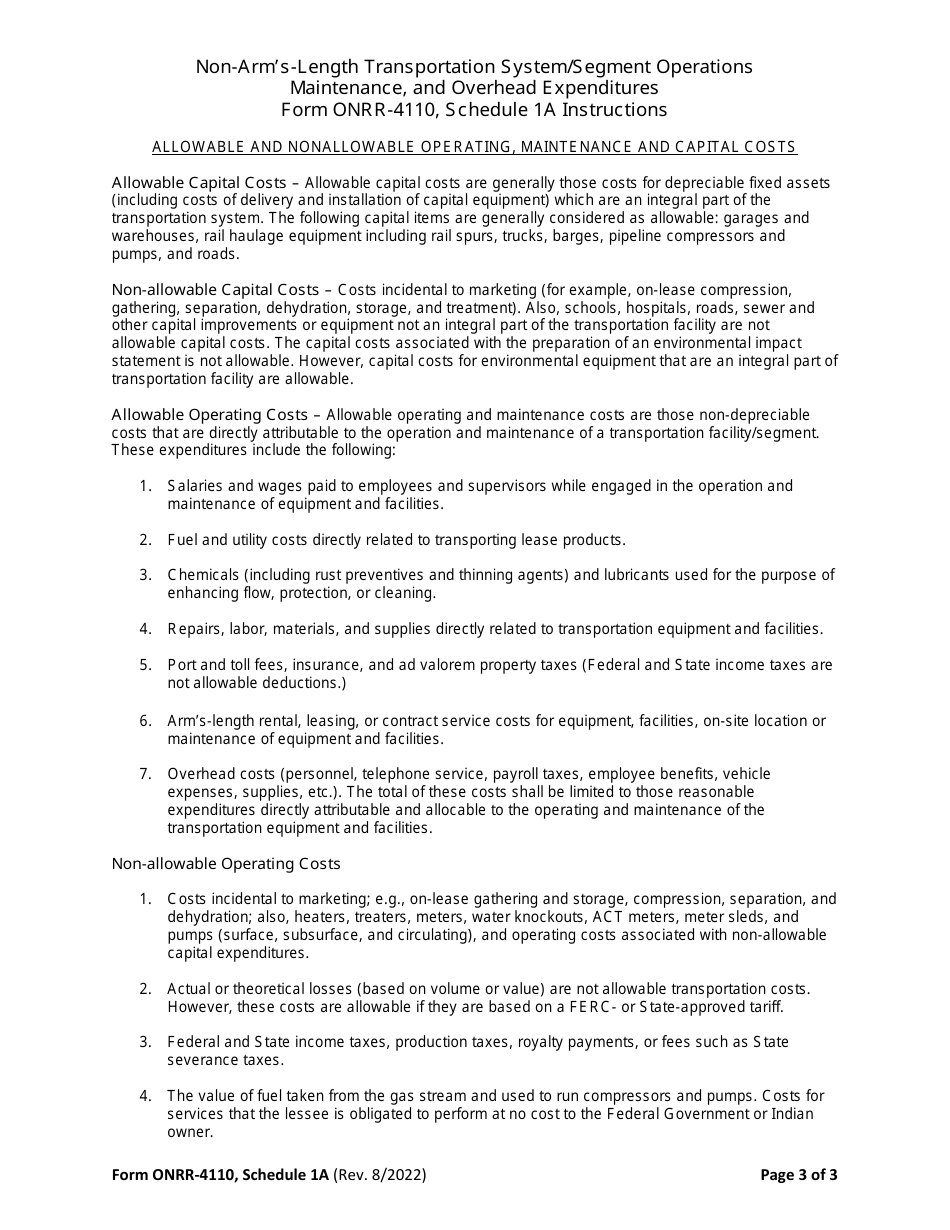

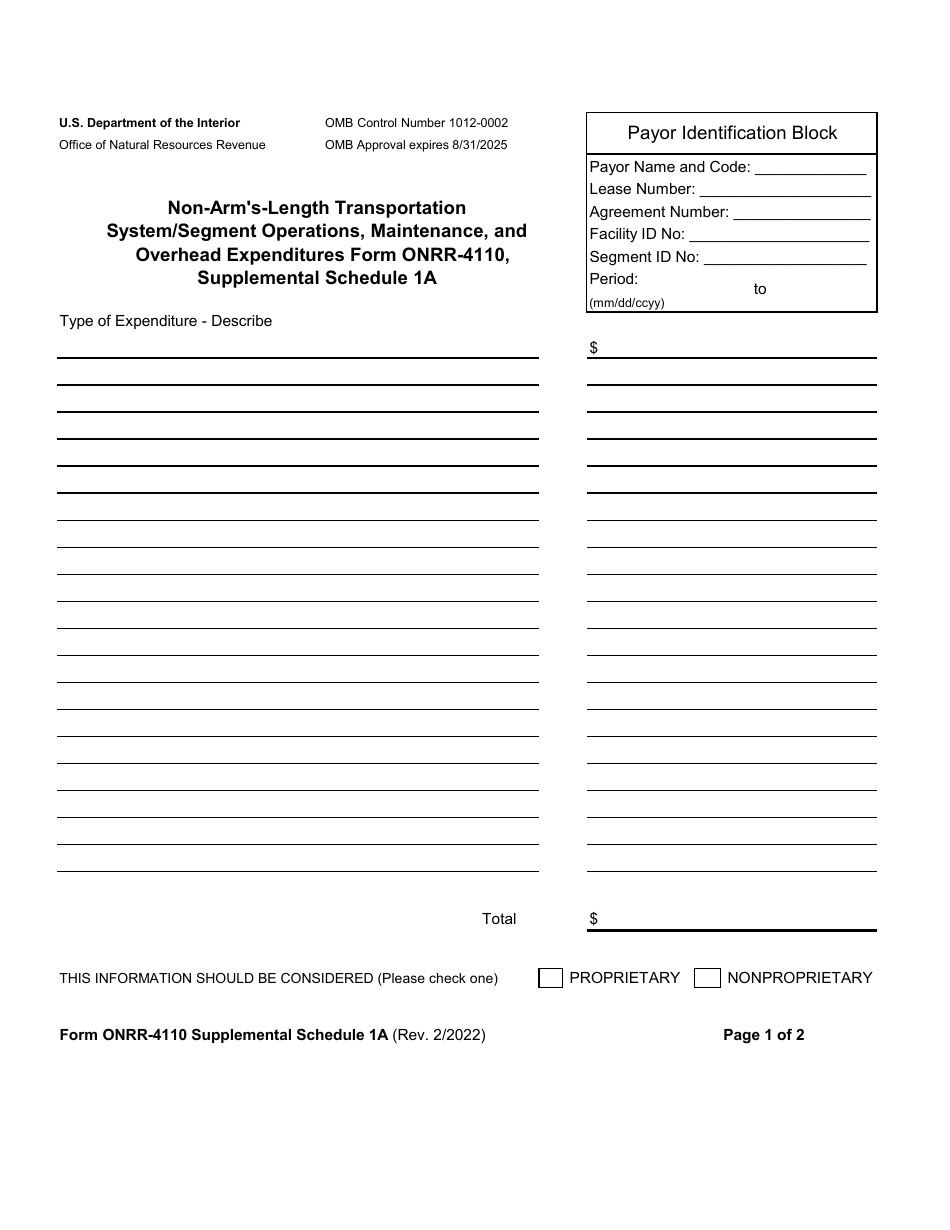

This is a legal form that was released by the U.S. Department of the Interior - Office of Natural Resources Revenue on August 1, 2022 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is ONRR-4110?

A: ONRR-4110 is a form called Oil Transportation Allowance Report.

Q: What is the purpose of ONRR-4110?

A: The purpose of ONRR-4110 is to report oil transportation allowances.

Q: Who needs to file ONRR-4110?

A: Oil transportation companies need to file ONRR-4110.

Q: What is an oil transportation allowance?

A: An oil transportation allowance is a payment made to a company for transporting oil from the well site to a processing facility or market.

Q: What information is required on ONRR-4110?

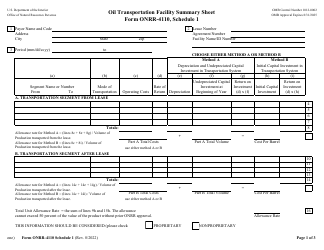

A: ONRR-4110 requires information such as company details, oil production and transportation volumes, and allowance amounts.

Q: How often should ONRR-4110 be filed?

A: ONRR-4110 should be filed on a monthly basis.

Q: Are there any penalties for not filing ONRR-4110?

A: Yes, there may be penalties for not filing ONRR-4110 or for filing it late.

Q: Can ONRR-4110 be filed electronically?

A: Yes, ONRR-4110 can be filed electronically through the ONRR Electronic Reporting System (ERS).

Q: Is there a deadline for filing ONRR-4110?

A: Yes, ONRR-4110 must be filed by the 15th day of the following month

Form Details:

- Released on August 1, 2022;

- The latest available edition released by the U.S. Department of the Interior - Office of Natural Resources Revenue;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ONRR-4110 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Interior - Office of Natural Resources Revenue.