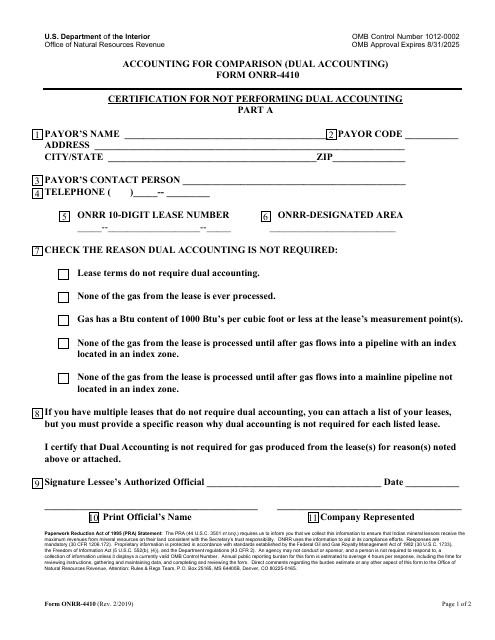

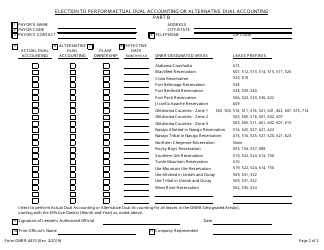

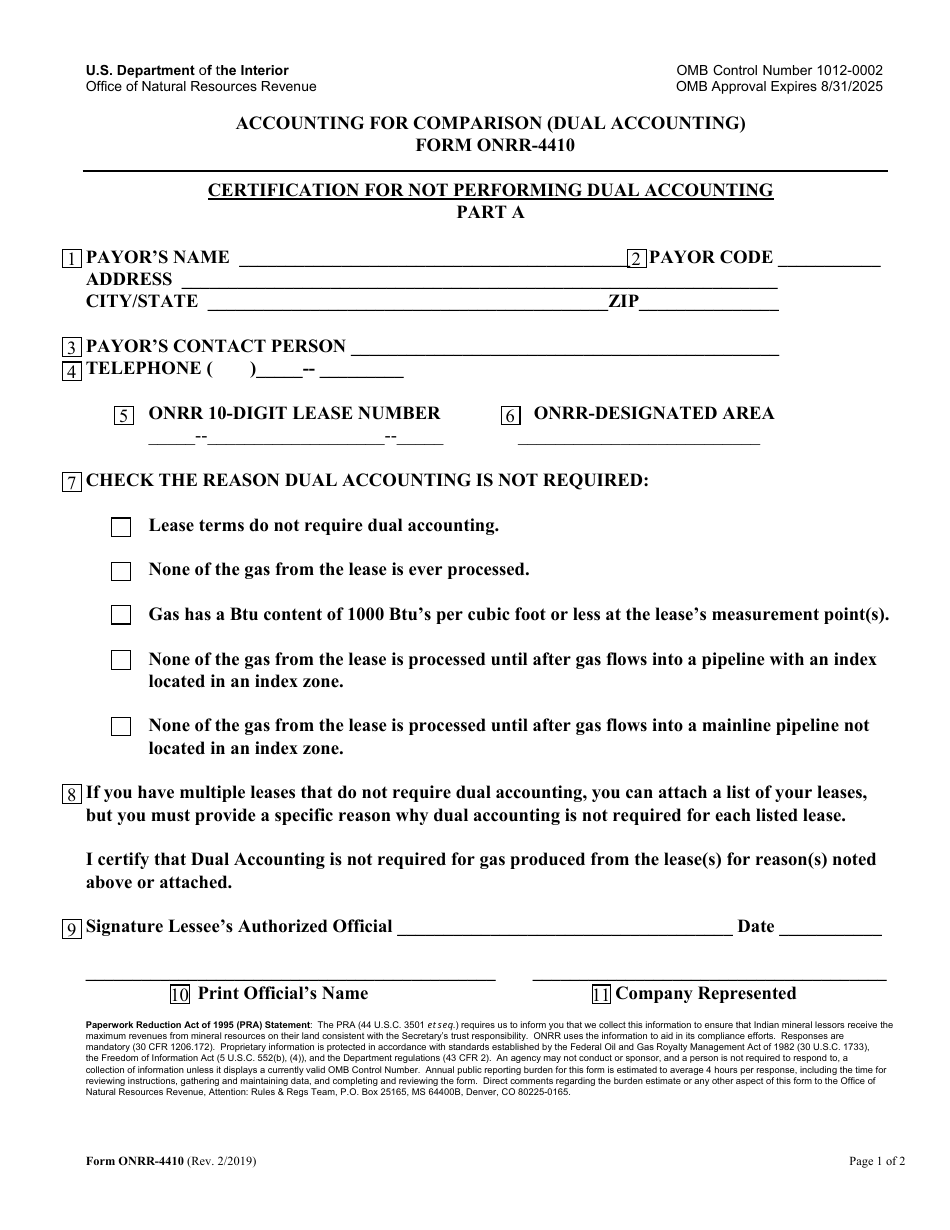

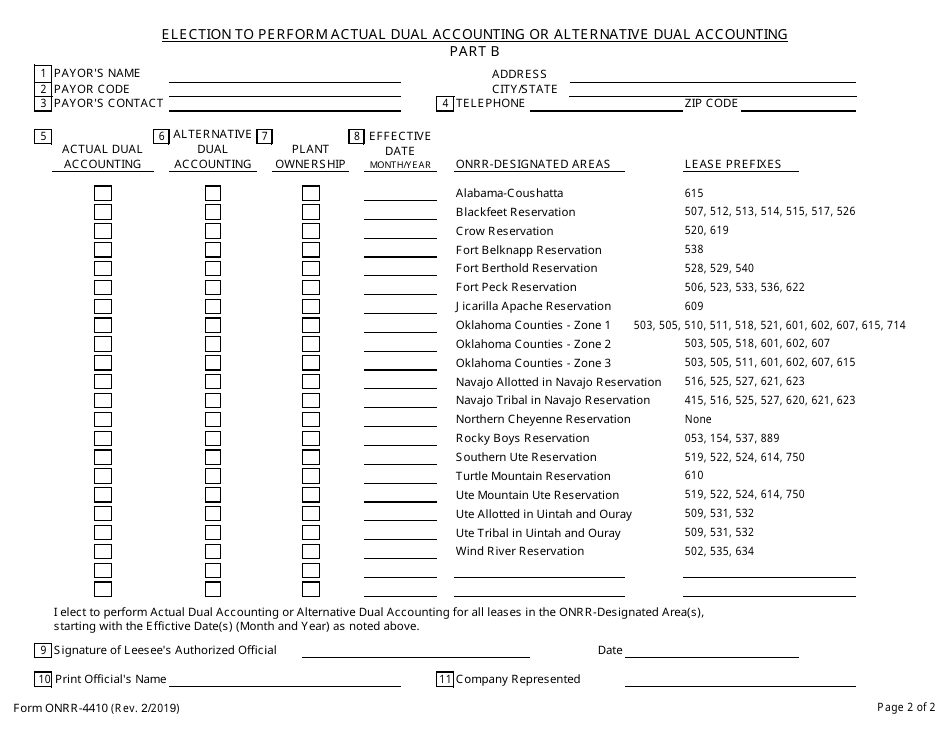

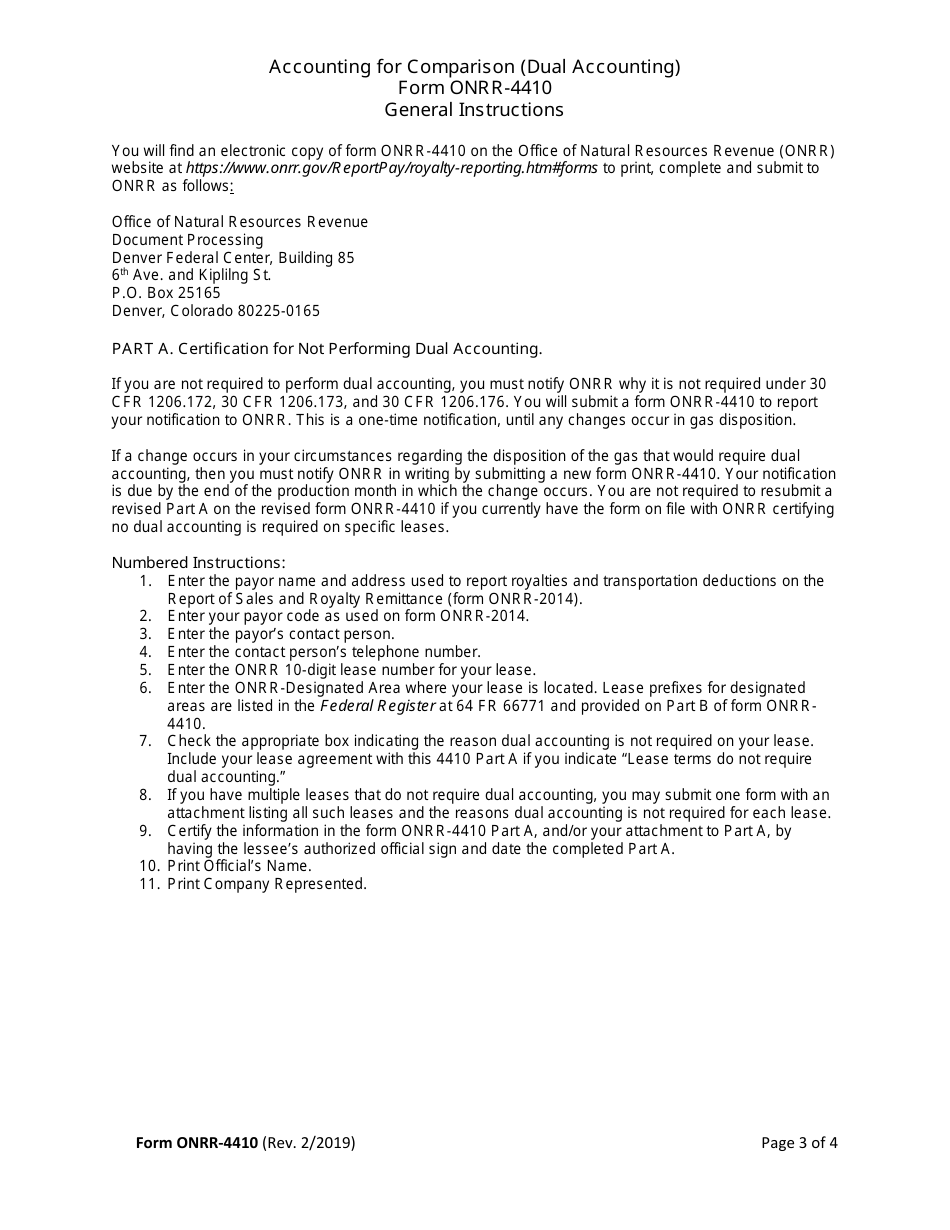

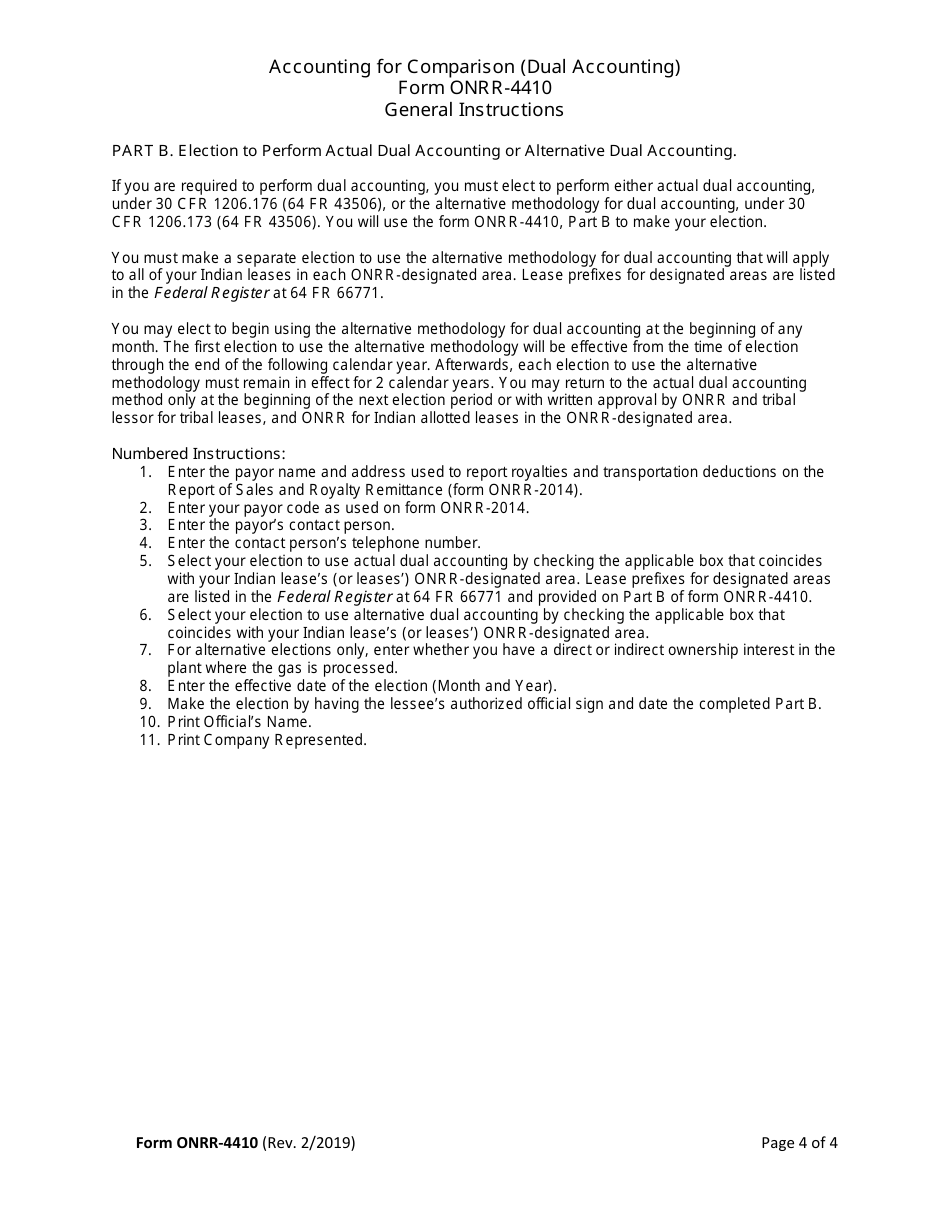

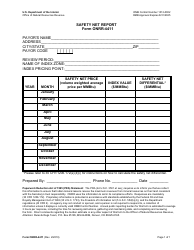

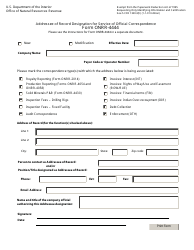

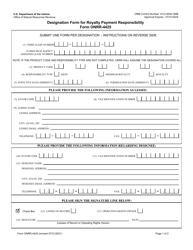

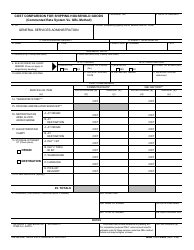

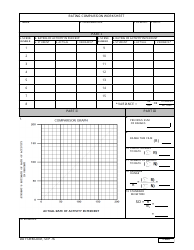

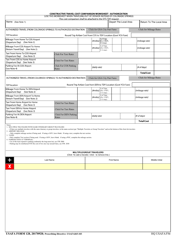

Form ONRR-4410 Accounting for Comparison (Dual Accounting)

What Is Form ONRR-4410?

This is a legal form that was released by the U.S. Department of the Interior - Office of Natural Resources Revenue on February 1, 2019 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is ONRR-4410?

A: ONRR-4410 is a form used for accounting for comparison (dual accounting).

Q: What is accounting for comparison?

A: Accounting for comparison, also known as dual accounting, is a process of reconciling two different accounting methods or systems.

Q: What is the purpose of ONRR-4410?

A: The purpose of ONRR-4410 is to provide a standardized form for companies to use when performing dual accounting for their operations.

Q: Who uses ONRR-4410?

A: ONRR-4410 is used by companies in industries such as oil and gas, mining, and other natural resource extraction industries.

Q: How do companies use ONRR-4410?

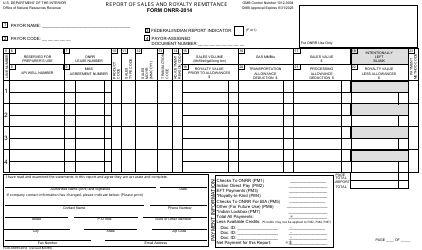

A: Companies use ONRR-4410 to compare their financial results under different accounting methods and ensure accuracy and consistency in their reporting.

Q: Is ONRR-4410 required by law?

A: The use of ONRR-4410 may be required by regulatory agencies or industry standards, depending on the specific industry and jurisdiction.

Form Details:

- Released on February 1, 2019;

- The latest available edition released by the U.S. Department of the Interior - Office of Natural Resources Revenue;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ONRR-4410 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Interior - Office of Natural Resources Revenue.