This version of the form is not currently in use and is provided for reference only. Download this version of

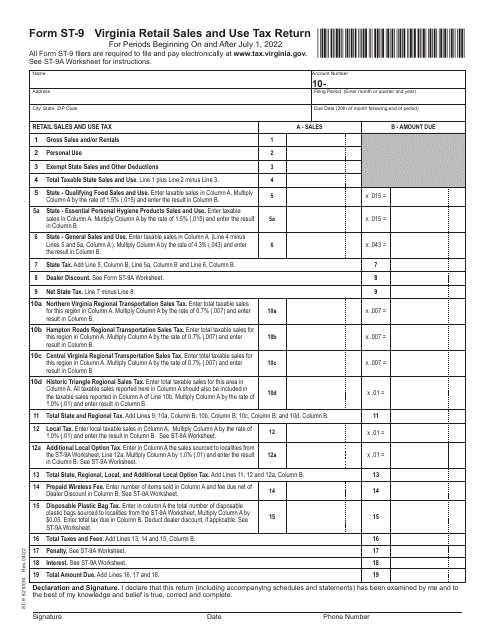

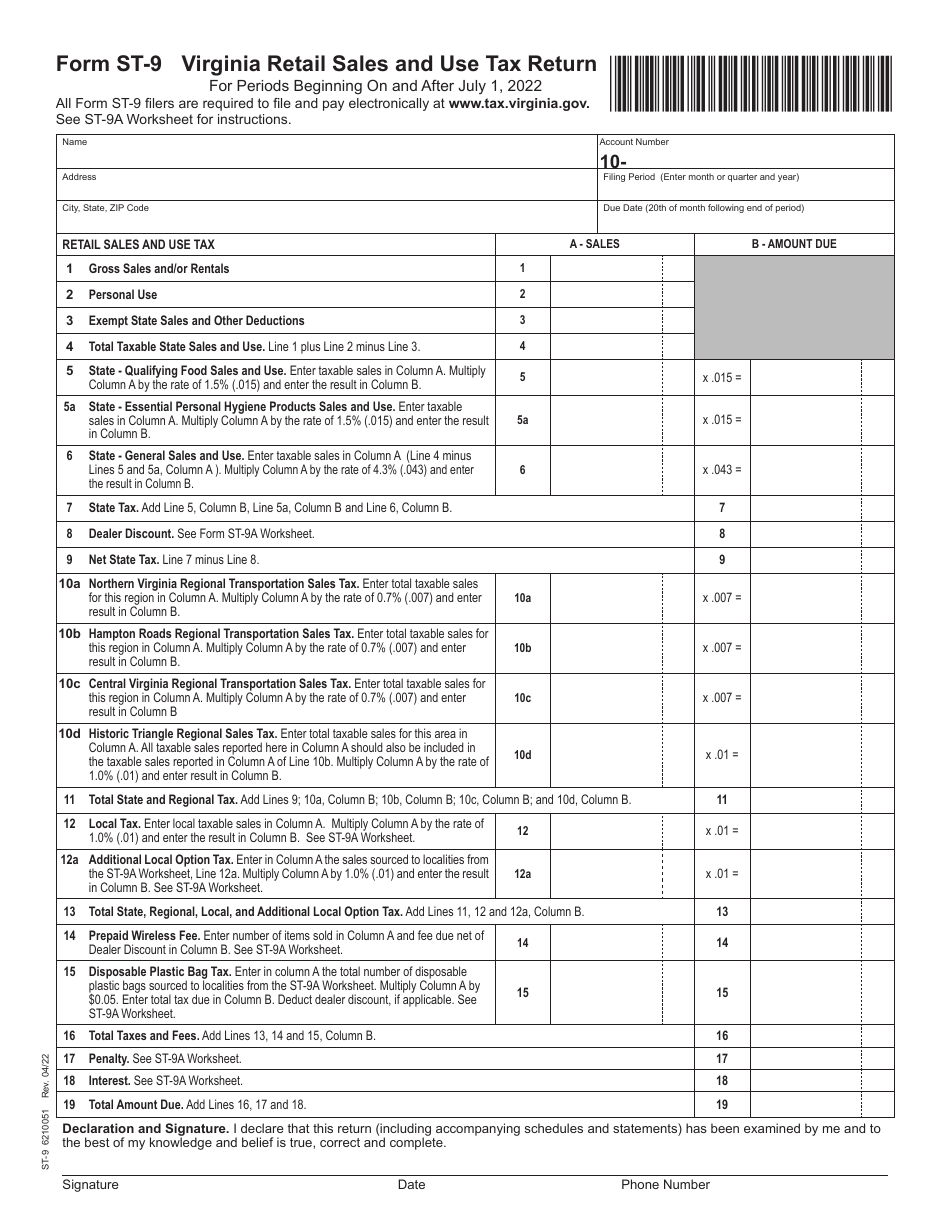

Form ST-9

for the current year.

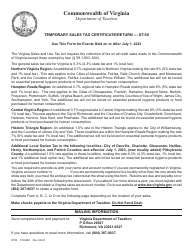

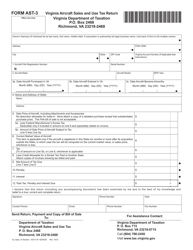

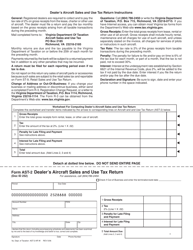

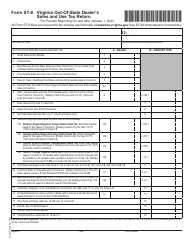

Form ST-9 Virginia Retail Sales and Use Tax Return - Virginia

What Is Form ST-9?

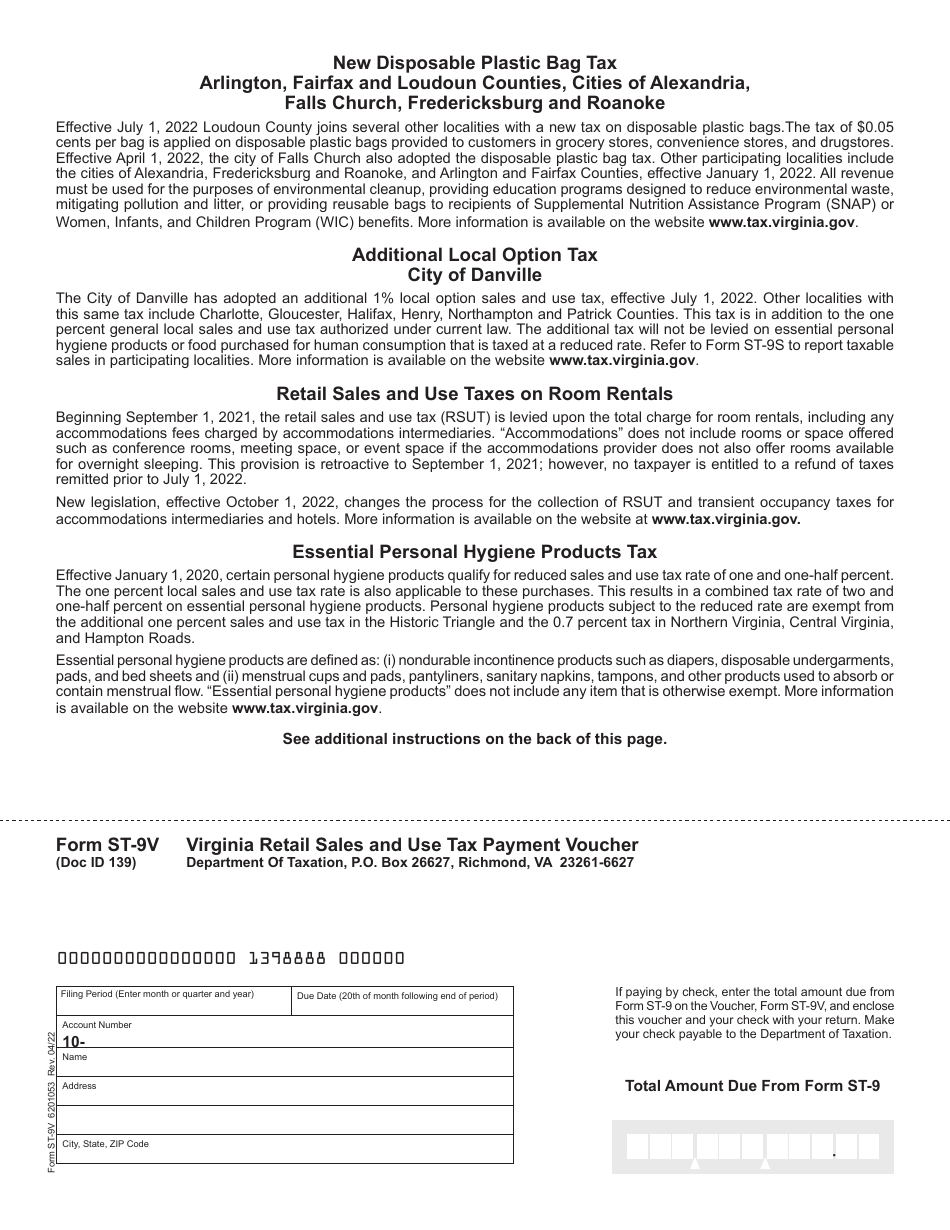

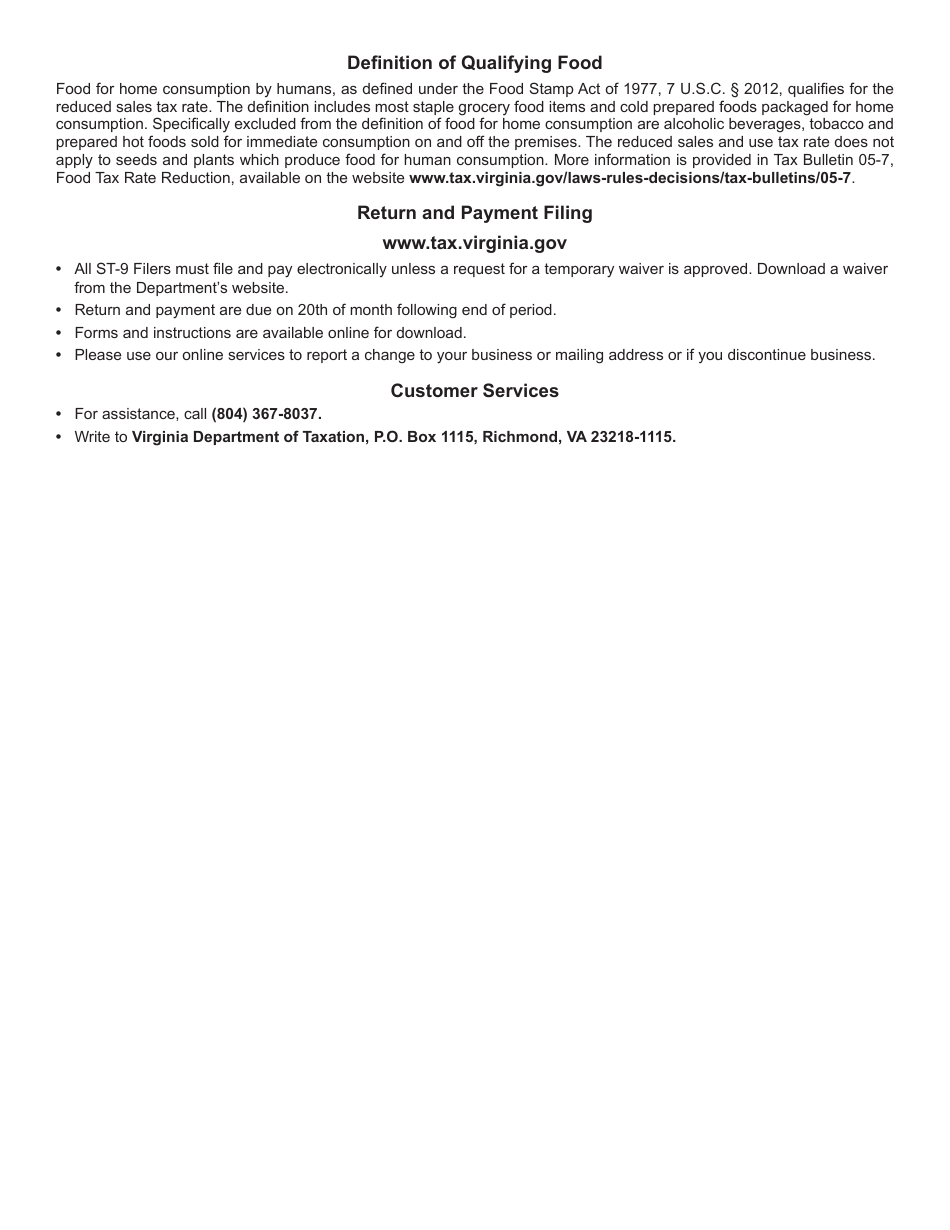

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-9?

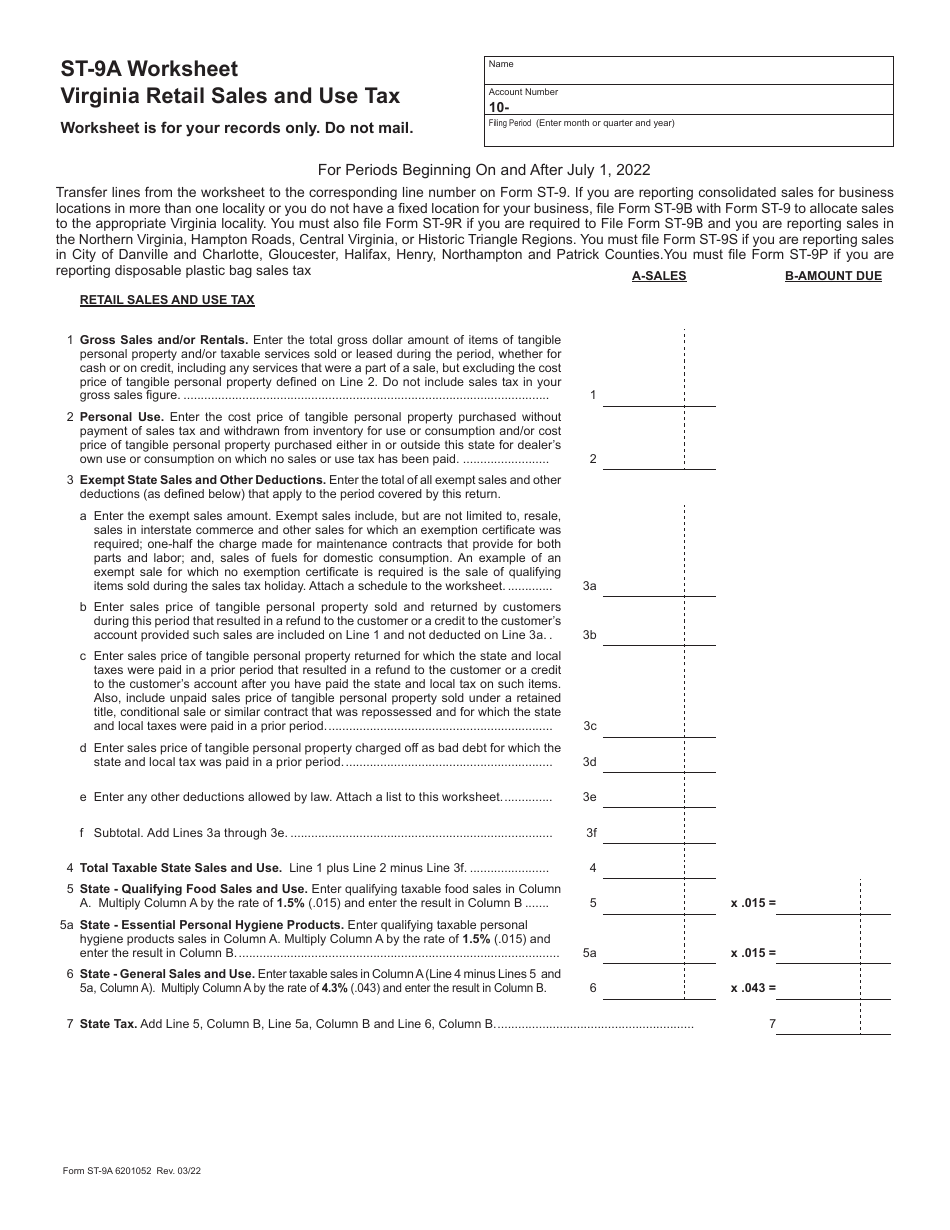

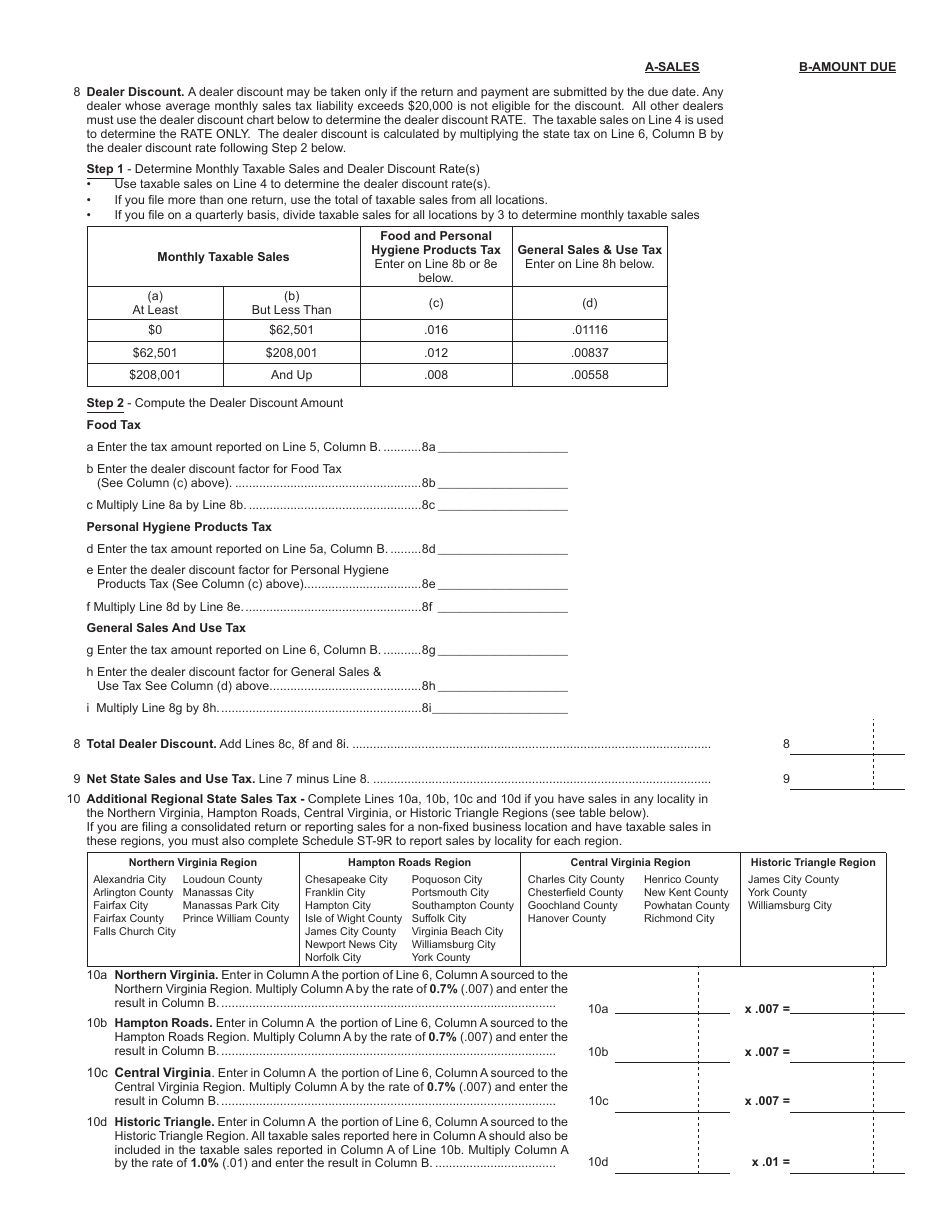

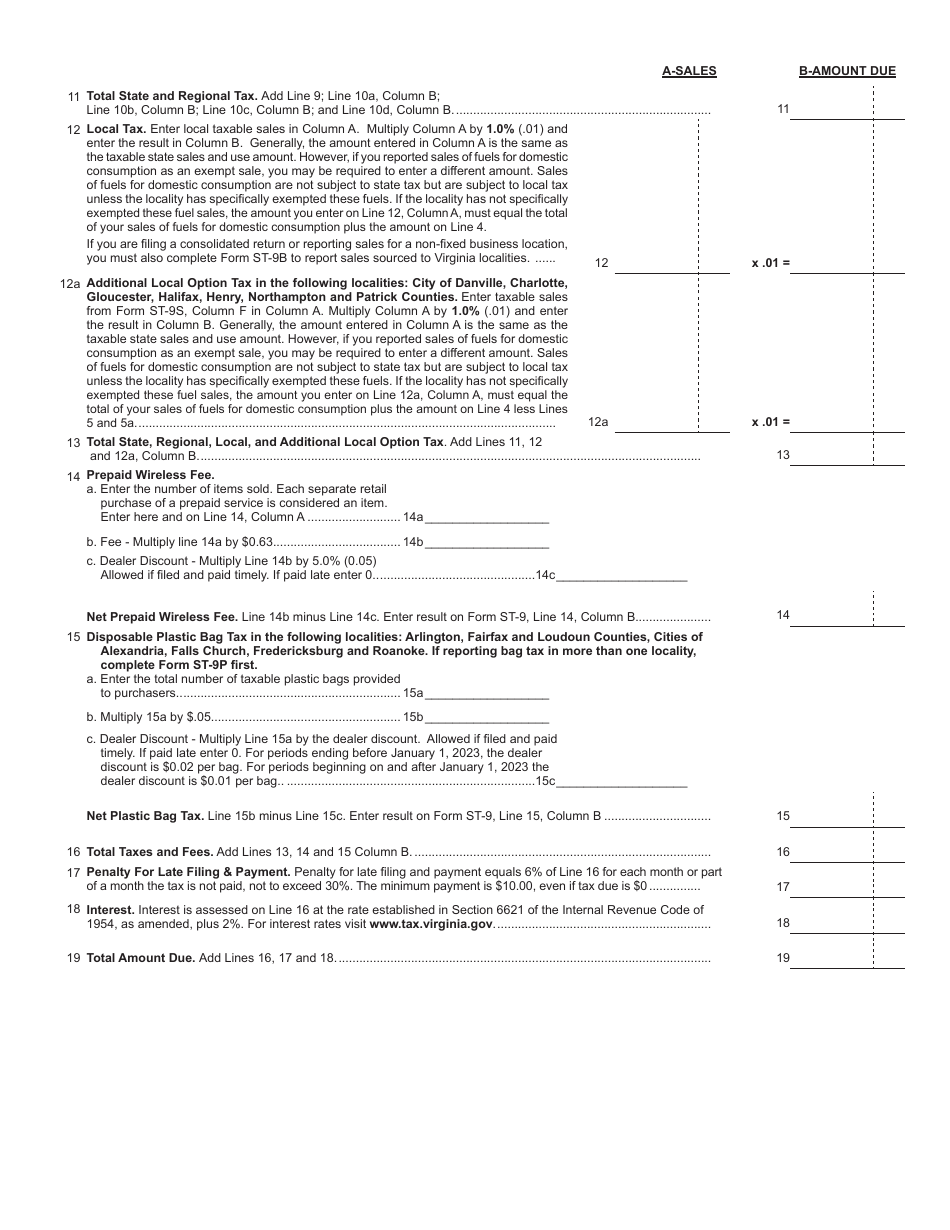

A: Form ST-9 is the Virginia Retail Sales and Use Tax Return.

Q: Who needs to file Form ST-9?

A: Businesses in Virginia that collect retail sales tax or use tax must file Form ST-9.

Q: What is the purpose of Form ST-9?

A: Form ST-9 is used to report and remit sales tax and use tax collected by businesses in Virginia.

Q: When is Form ST-9 due?

A: Form ST-9 is due on or before the 20th day of the month following the reporting period.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing or failure to file Form ST-9.

Q: What should I do if I have questions about Form ST-9?

A: If you have questions about Form ST-9, you should contact the Virginia Department of Taxation for assistance.

Form Details:

- Released on April 1, 2022;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-9 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.