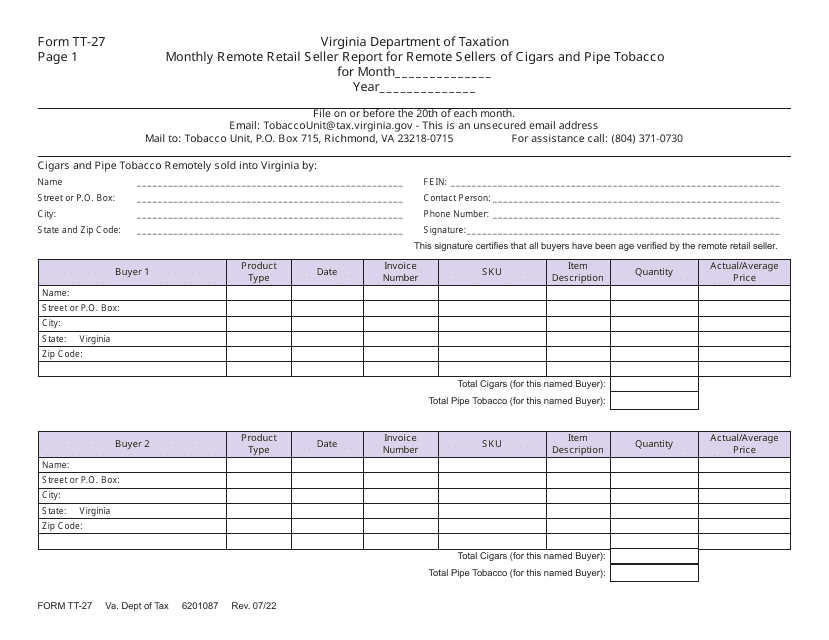

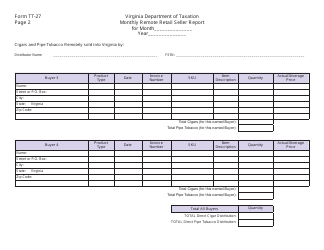

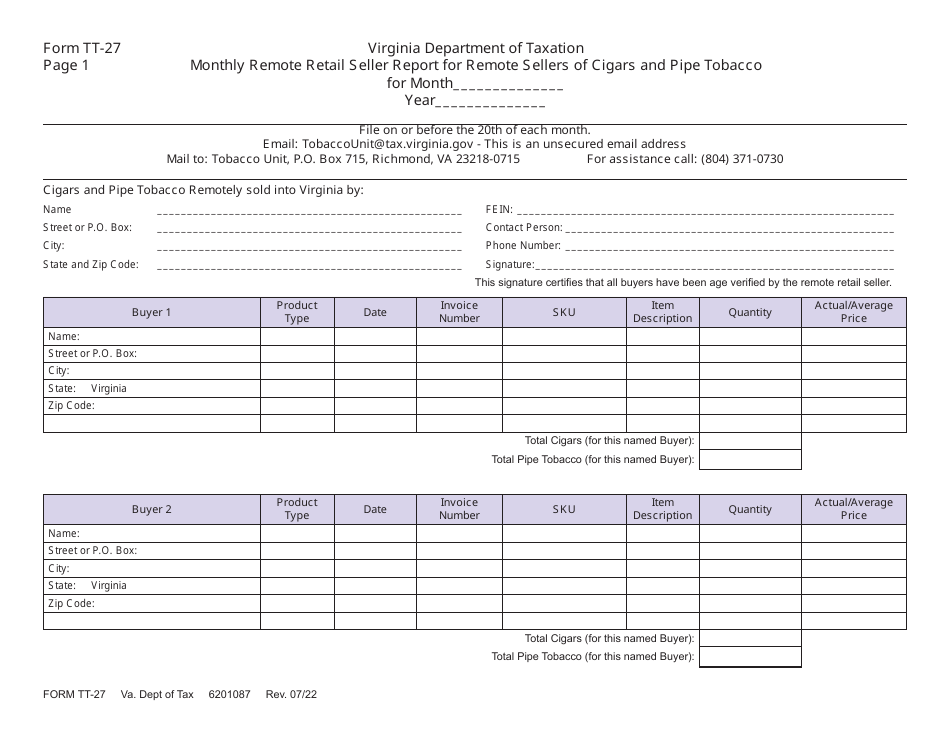

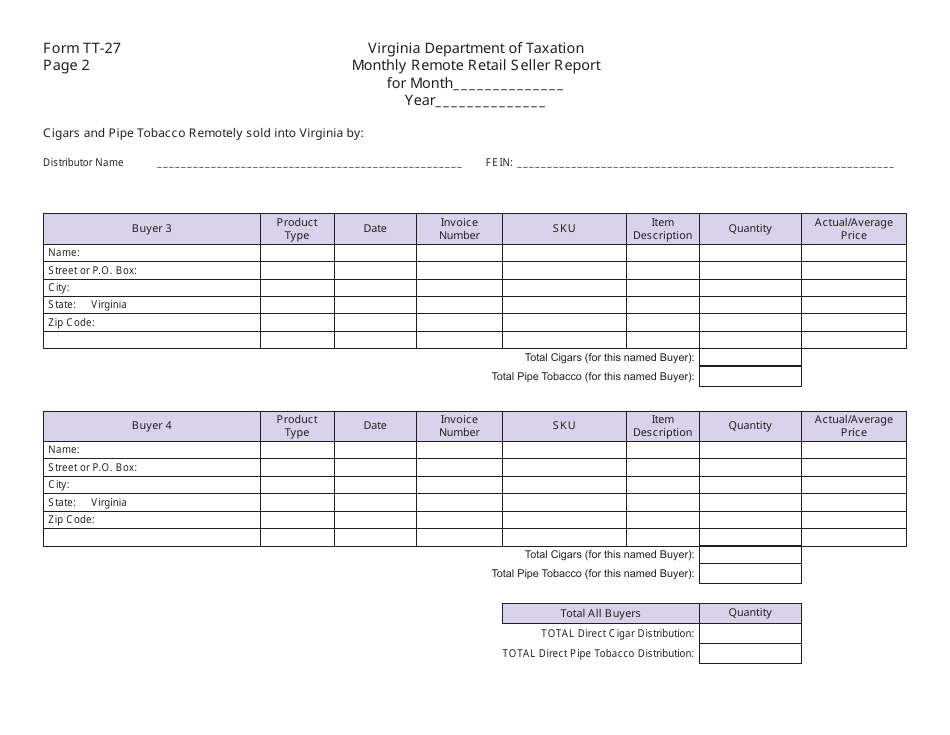

Form TT-27 Monthly Remote Retail Seller Report for Remote Sellers of Cigars and Pipe Tobacco - Virginia

What Is Form TT-27?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TT-27?

A: Form TT-27 is the Monthly Remote Retail Seller Report for remote sellers of cigars and pipe tobacco in Virginia.

Q: Who needs to file Form TT-27?

A: Remote sellers of cigars and pipe tobacco in Virginia need to file Form TT-27.

Q: What is the purpose of Form TT-27?

A: The purpose of Form TT-27 is to report sales of cigars and pipe tobacco made by remote sellers.

Q: How often do I need to file Form TT-27?

A: Form TT-27 needs to be filed on a monthly basis.

Q: Are there any penalties for not filing Form TT-27?

A: Yes, there may be penalties for not filing Form TT-27 or for filing it late.

Q: Is Form TT-27 applicable only to remote sellers?

A: Yes, Form TT-27 is specifically for remote sellers of cigars and pipe tobacco.

Q: Are there any exemptions to filing Form TT-27?

A: There may be exemptions for remote sellers who meet certain criteria. Consult the instructions for Form TT-27 for more information.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TT-27 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.