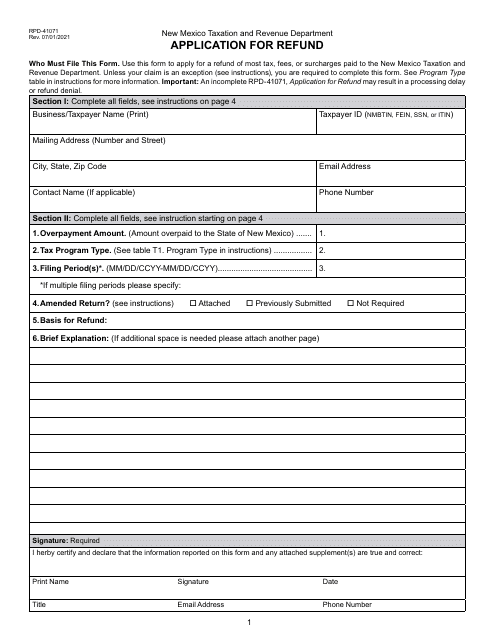

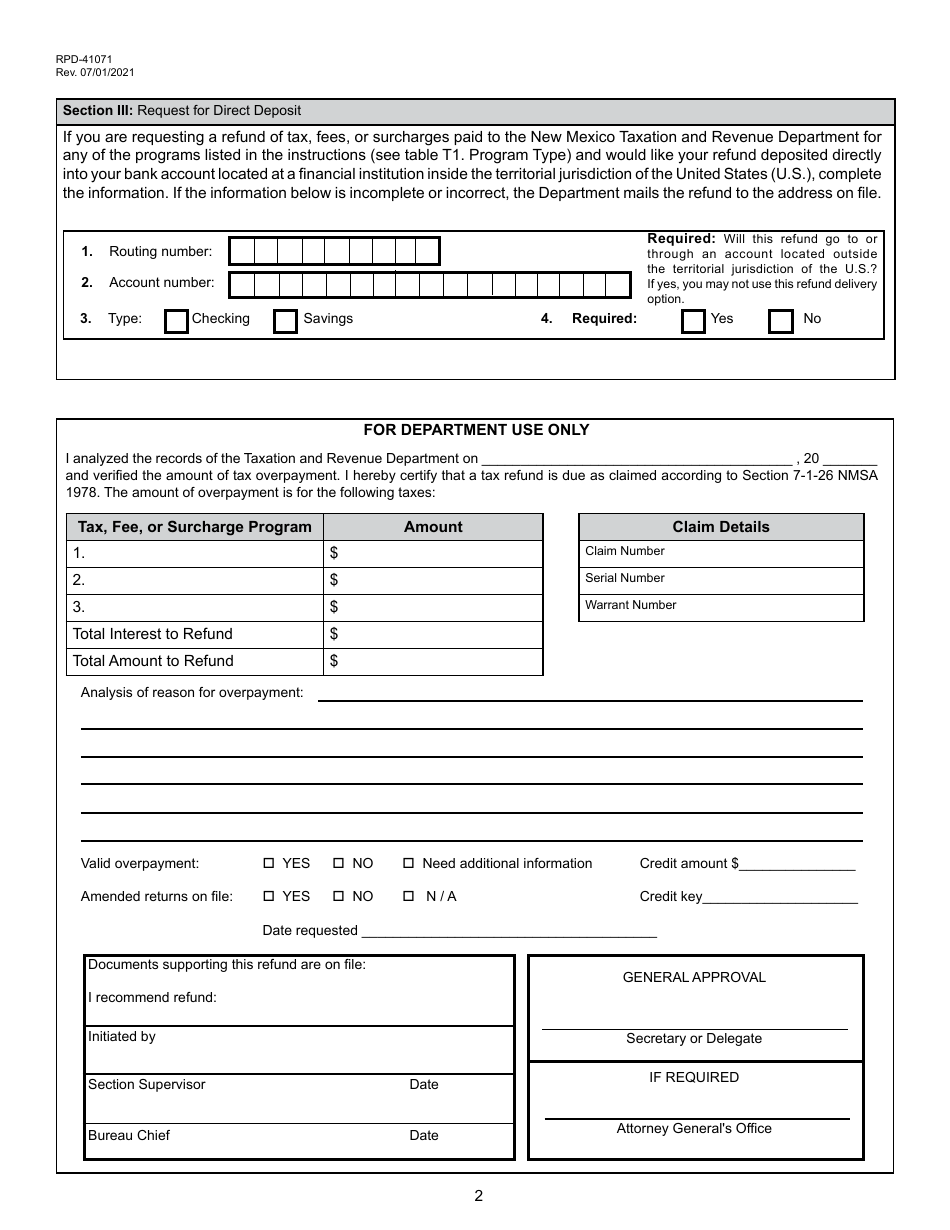

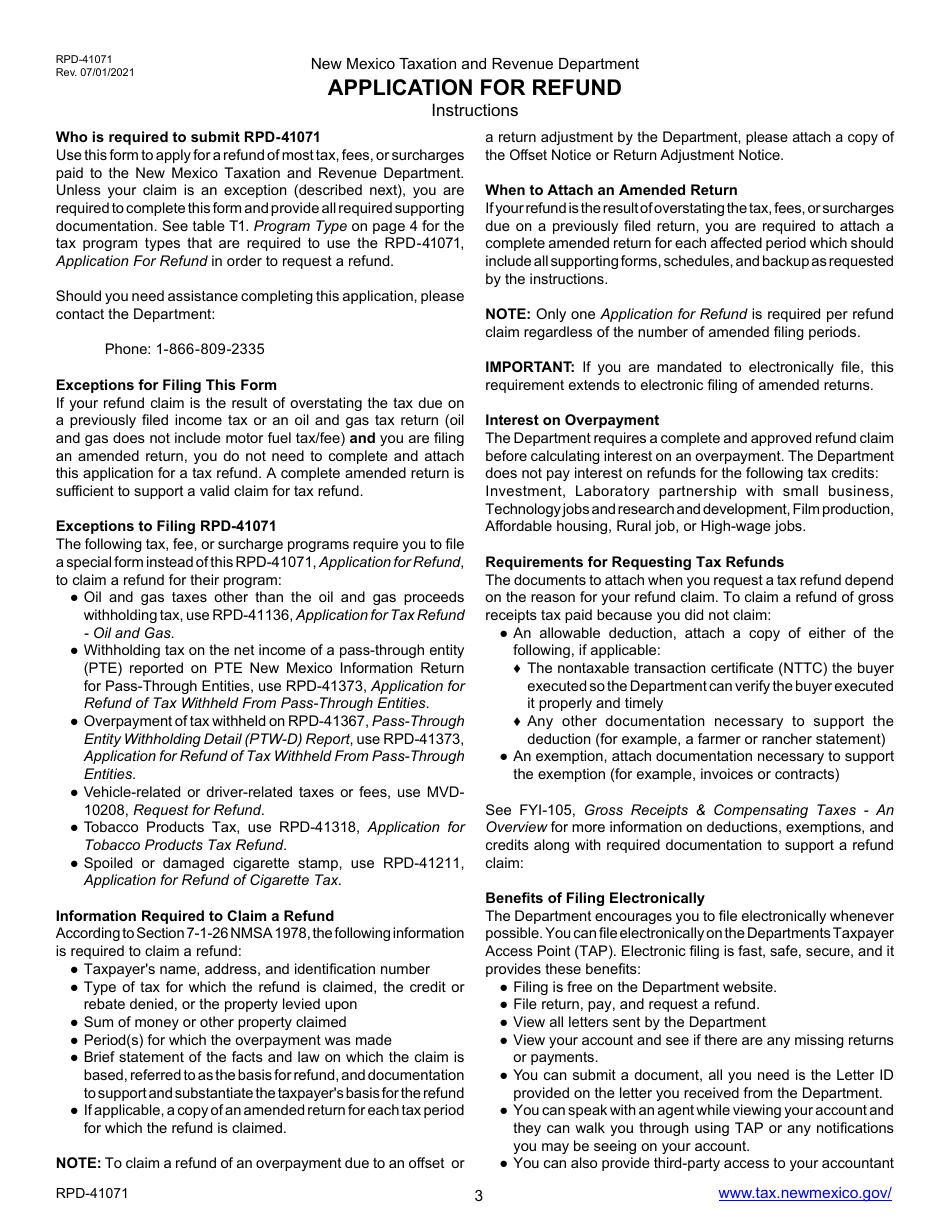

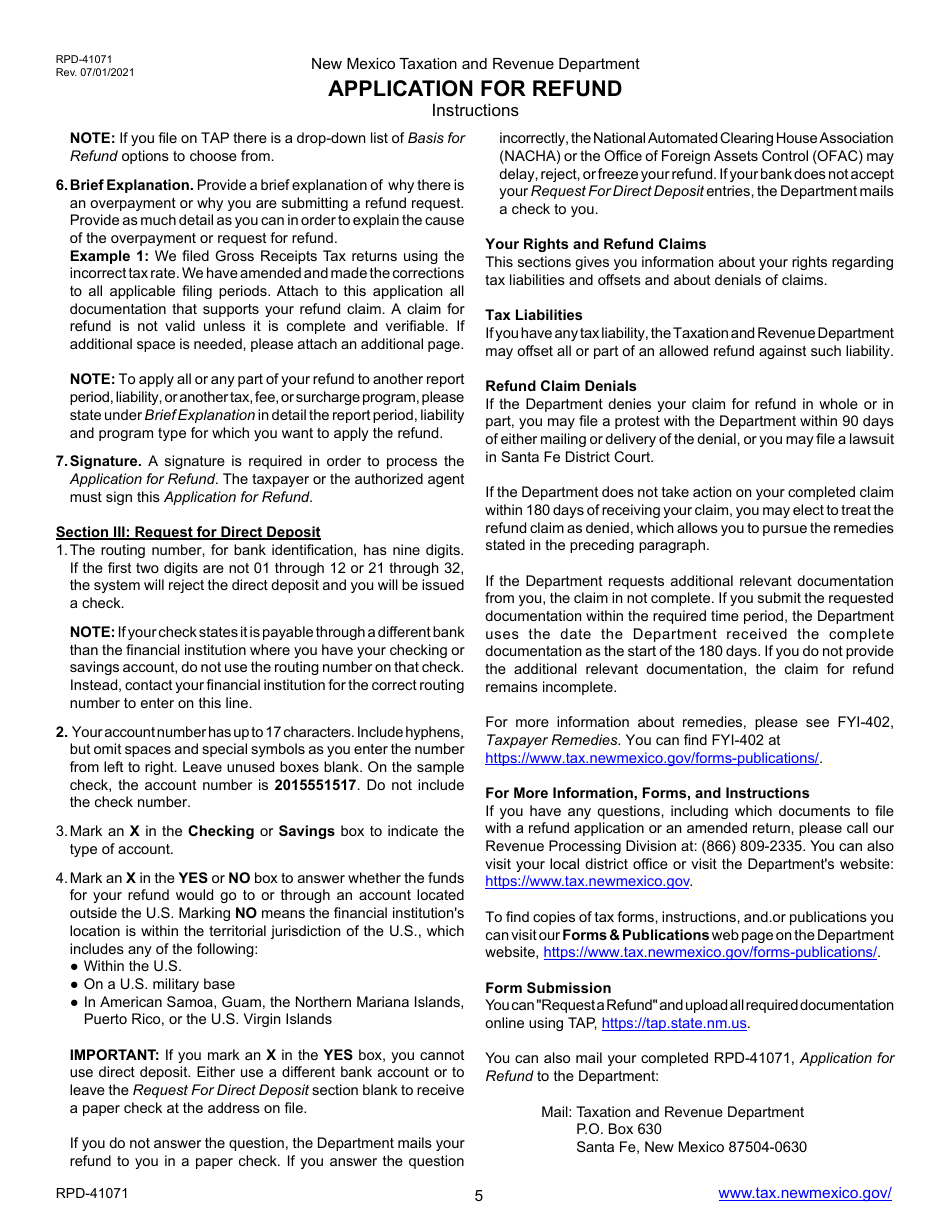

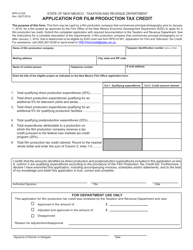

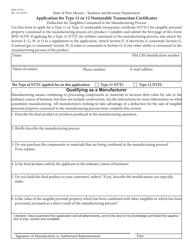

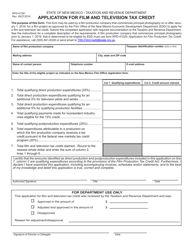

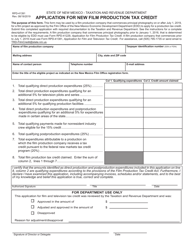

Form RPD-41071 Application for Refund - New Mexico

What Is Form RPD-41071?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RPD-41071?

A: Form RPD-41071 is the Application for Refund in the state of New Mexico.

Q: What is the purpose of Form RPD-41071?

A: The purpose of Form RPD-41071 is to request a refund for taxes paid in the state of New Mexico.

Q: Who needs to fill out Form RPD-41071?

A: Anyone who wishes to request a tax refund for taxes paid in New Mexico needs to fill out Form RPD-41071.

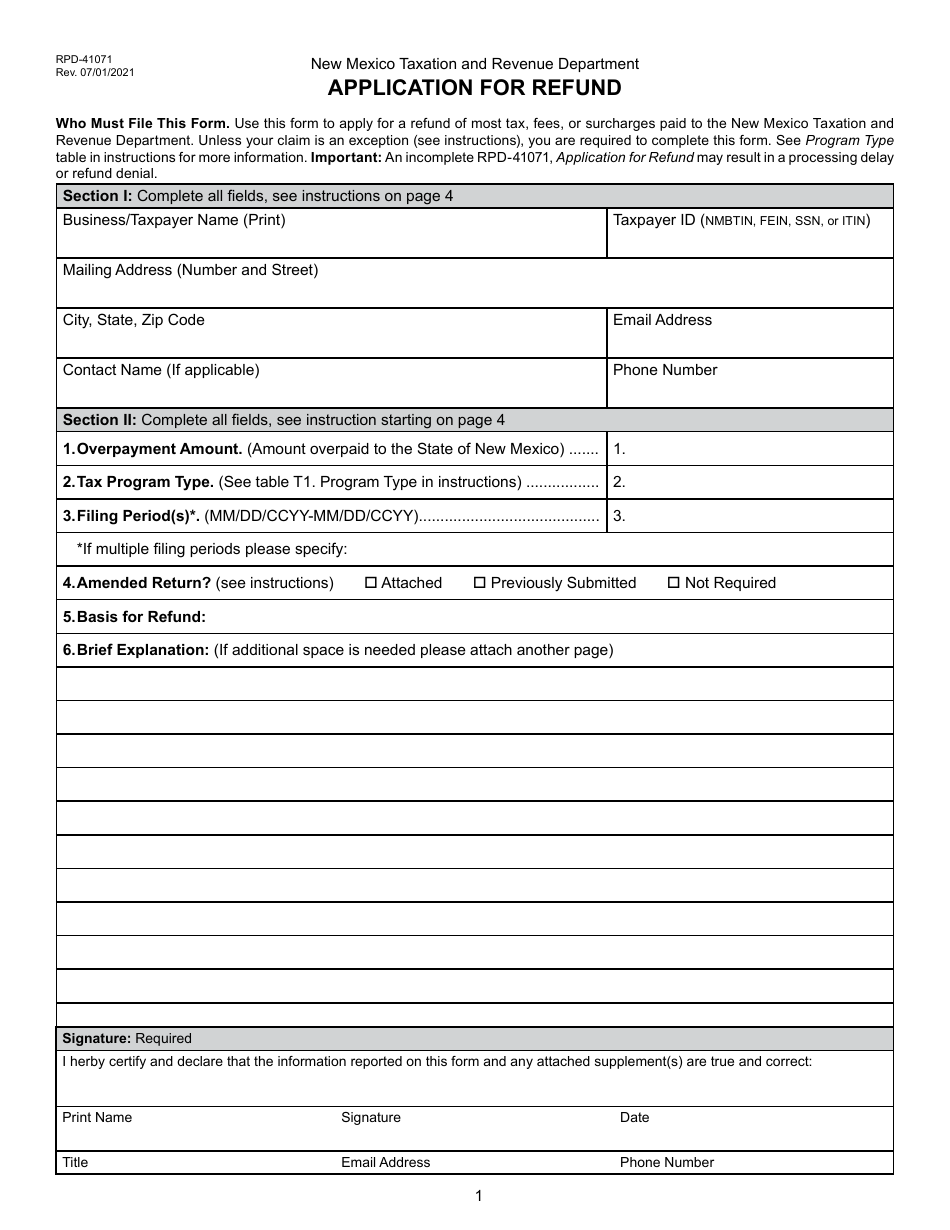

Q: What information is required on Form RPD-41071?

A: Form RPD-41071 requires information such as the taxpayer's name, contact information, tax type, tax period, and a detailed explanation for the refund request.

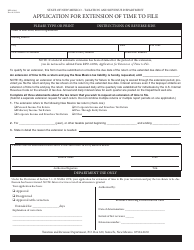

Q: Are there any deadlines for submitting Form RPD-41071?

A: Yes, the deadline for submitting Form RPD-41071 depends on the type of tax being refunded. It is important to check the instructions provided with the form for specific deadlines.

Q: Is there a fee to submit Form RPD-41071?

A: No, there is no fee to submit Form RPD-41071.

Q: How long does it take to process a refund requested on Form RPD-41071?

A: The processing time for refunds requested on Form RPD-41071 varies. It is recommended to allow 8-12 weeks for processing.

Q: What should I do if I have more questions about Form RPD-41071?

A: If you have more questions about Form RPD-41071, you can contact the New Mexico Taxation and Revenue Department for assistance.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RPD-41071 by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.