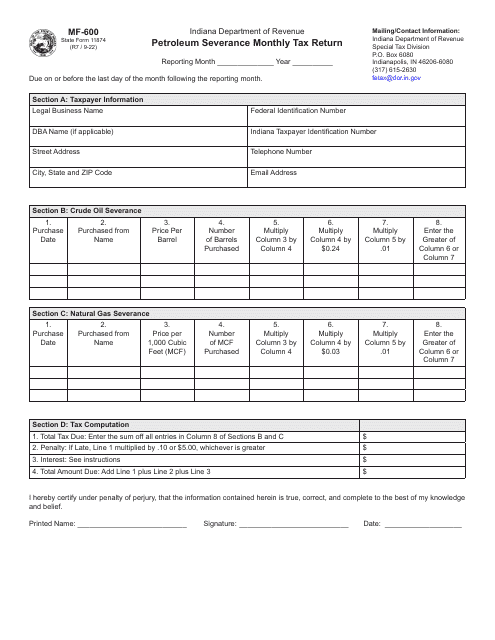

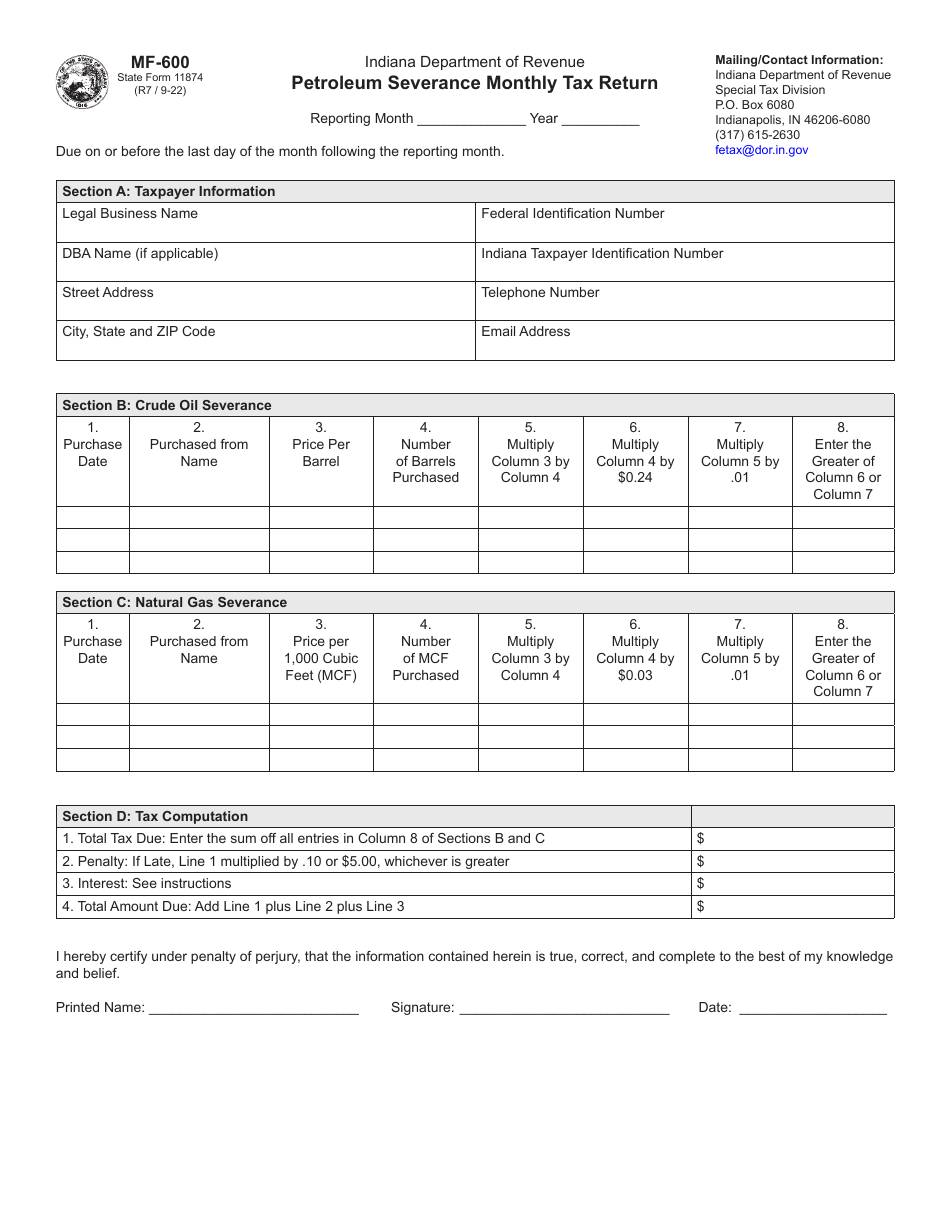

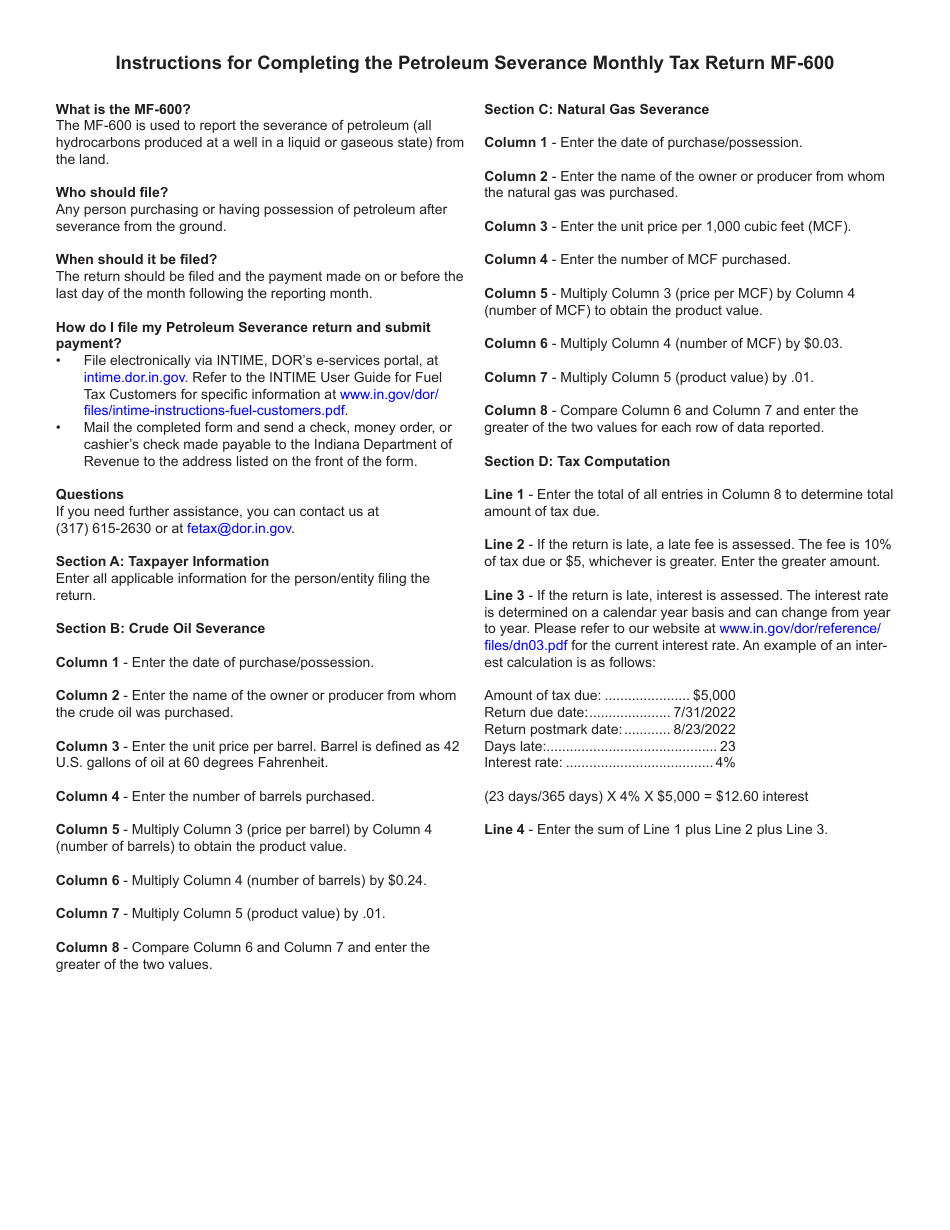

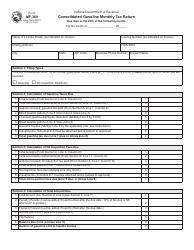

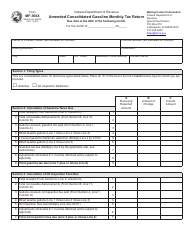

Form MF-600 (State Form 11874) Petroleum Severance Monthly Tax Return - Indiana

What Is Form MF-600 (State Form 11874)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MF-600?

A: Form MF-600 is the Petroleum Severance Monthly Tax Return in Indiana.

Q: What is the purpose of Form MF-600?

A: The purpose of Form MF-600 is to report and pay the monthly petroleum severance tax in Indiana.

Q: Who needs to file Form MF-600?

A: Anyone engaged in the severance of petroleum in Indiana needs to file Form MF-600.

Q: When is Form MF-600 due?

A: Form MF-600 is due on the 20th day of the month following the month of severance.

Q: Is there a penalty for late filing of Form MF-600?

A: Yes, there are penalties for late filing of Form MF-600, including interest charges.

Q: Are there any exemptions or deductions available on Form MF-600?

A: Yes, there are certain exemptions and deductions available on Form MF-600. Consult the instructions for more details.

Q: What supporting documents do I need to submit with Form MF-600?

A: You may need to submit copies of invoices, bills of lading, and other records related to petroleum severance.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MF-600 (State Form 11874) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.