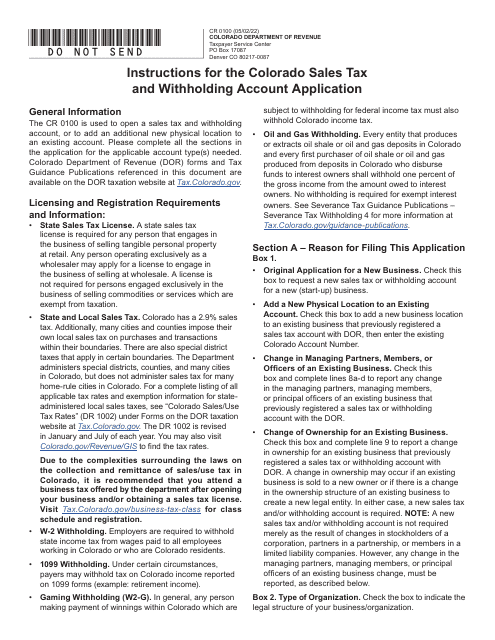

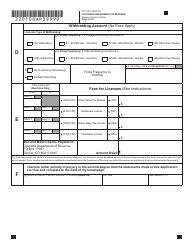

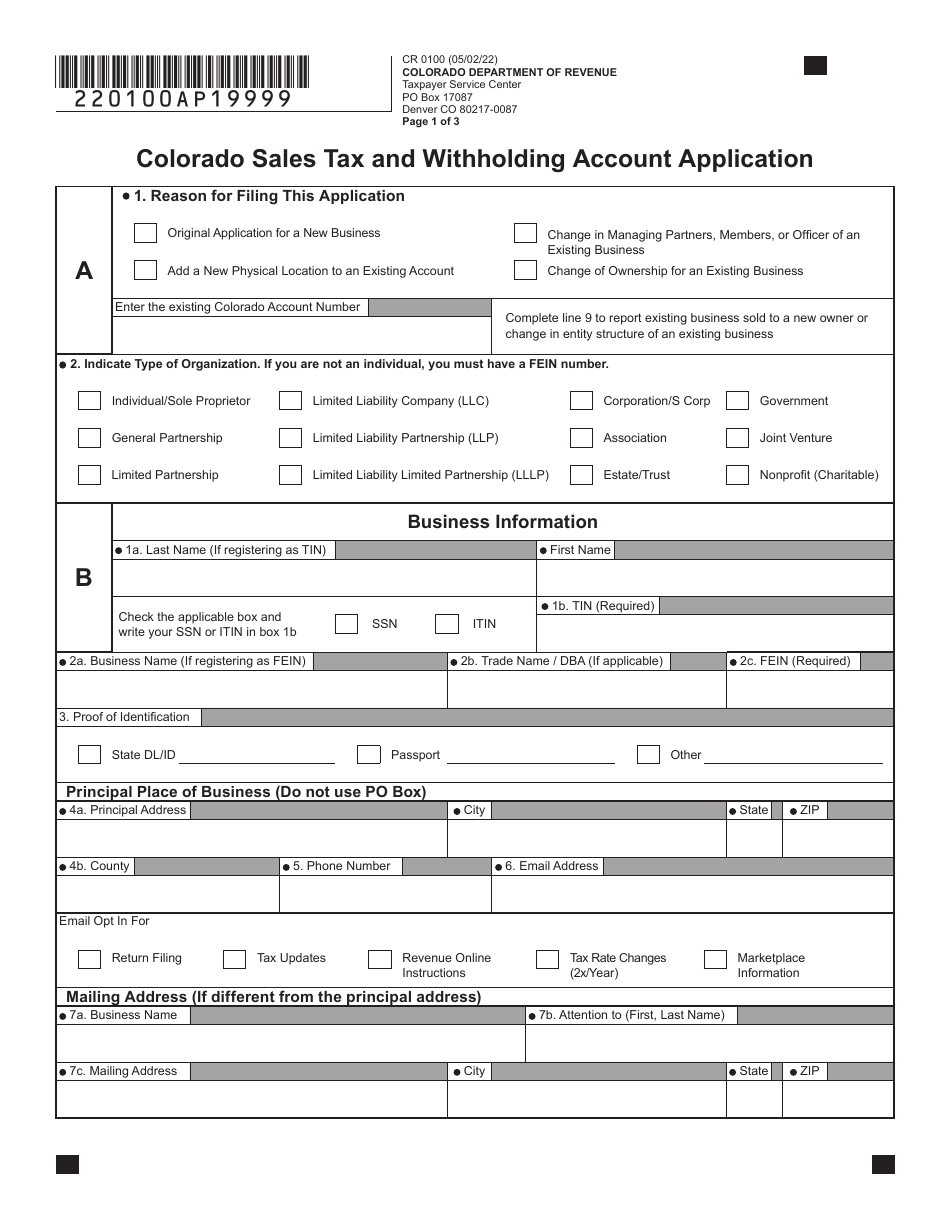

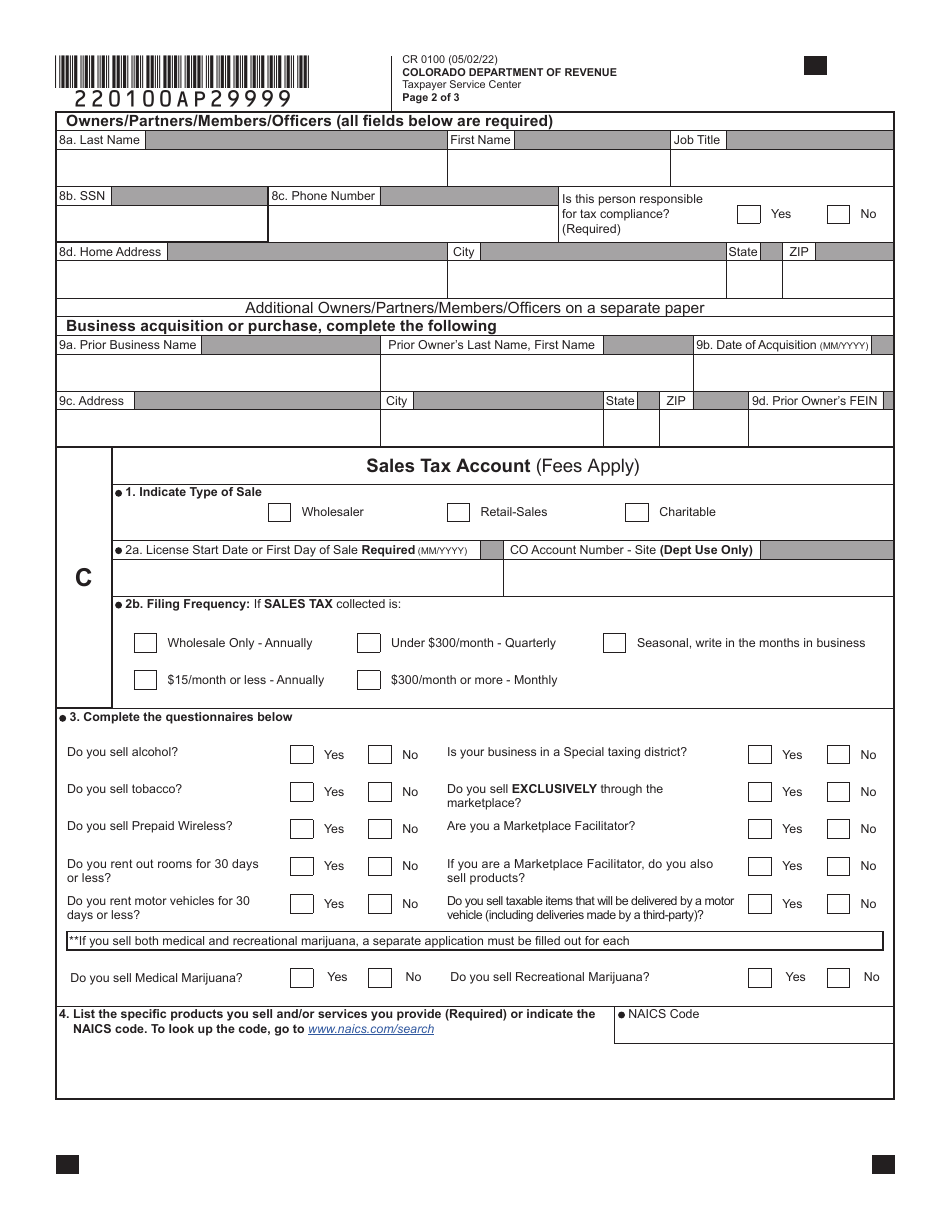

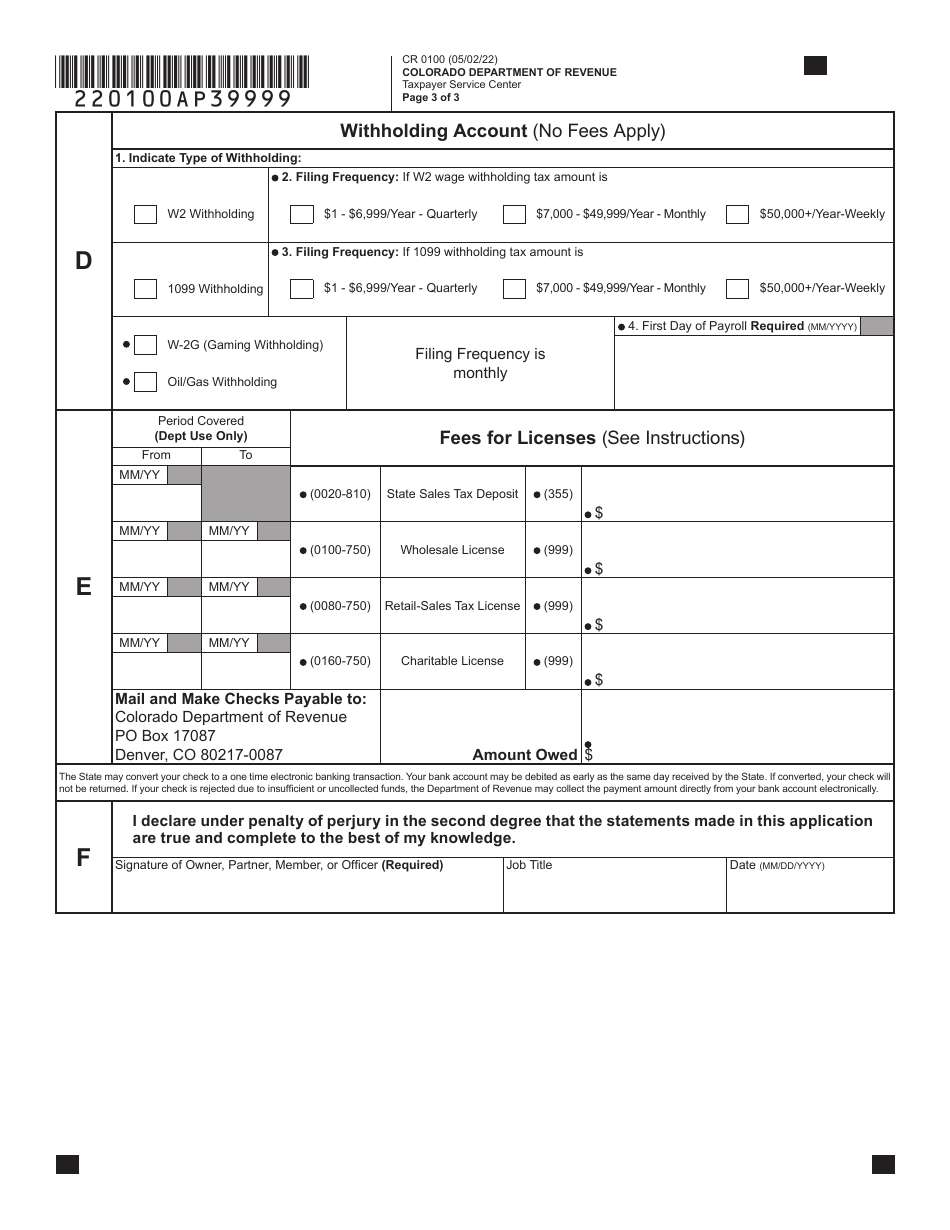

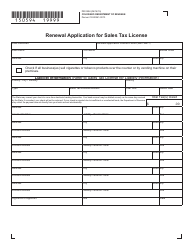

Form CR0100 Colorado Sales Tax and Withholding Account Application - Colorado

What Is Form CR0100?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

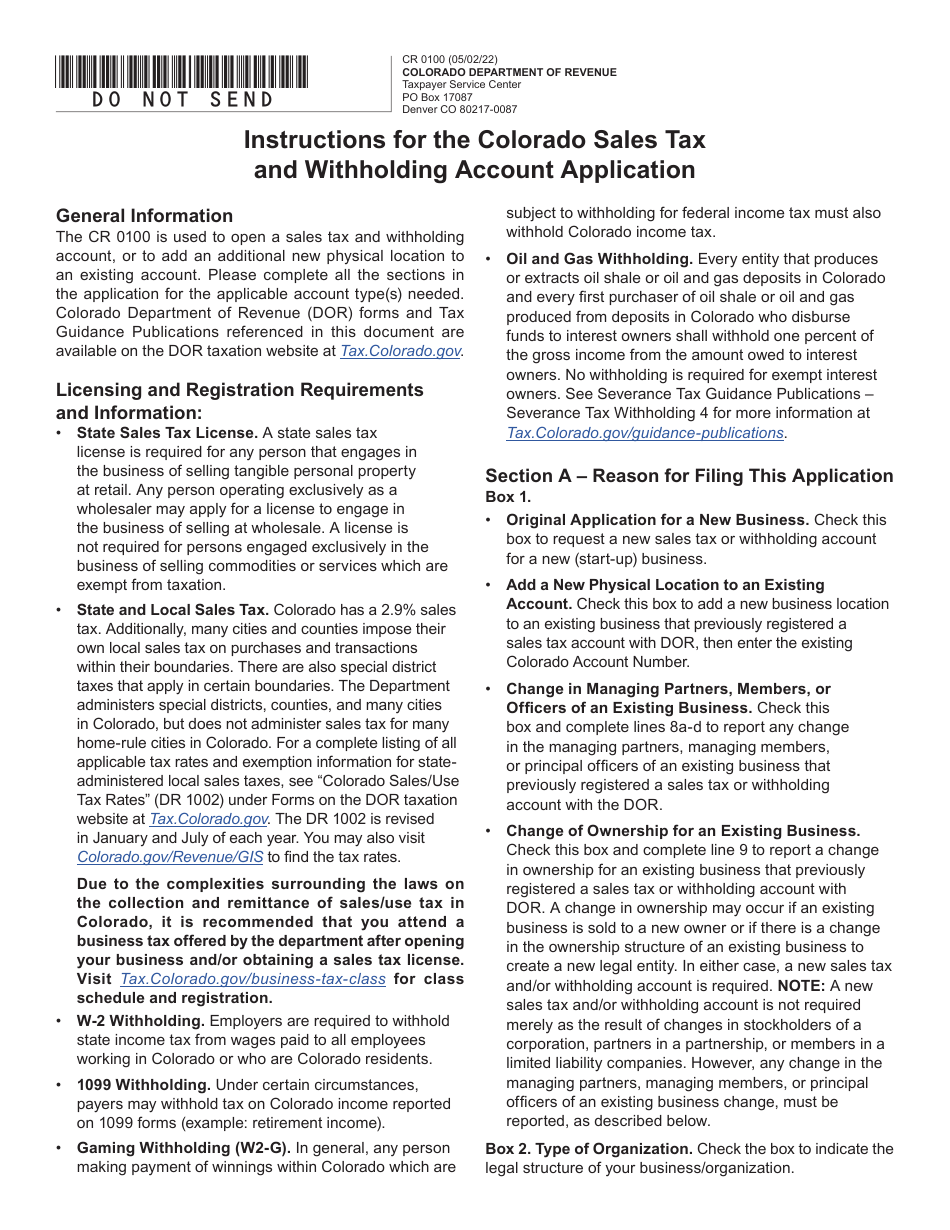

Q: What is Form CR0100?

A: Form CR0100 is the Colorado Sales Tax and Withholding Account Application form.

Q: What is the purpose of Form CR0100?

A: The purpose of Form CR0100 is to apply for a Colorado sales tax and withholding account.

Q: Who needs to file Form CR0100?

A: Any individual or business that wants to collect and remit Colorado sales tax or withhold Colorado income tax is required to file Form CR0100.

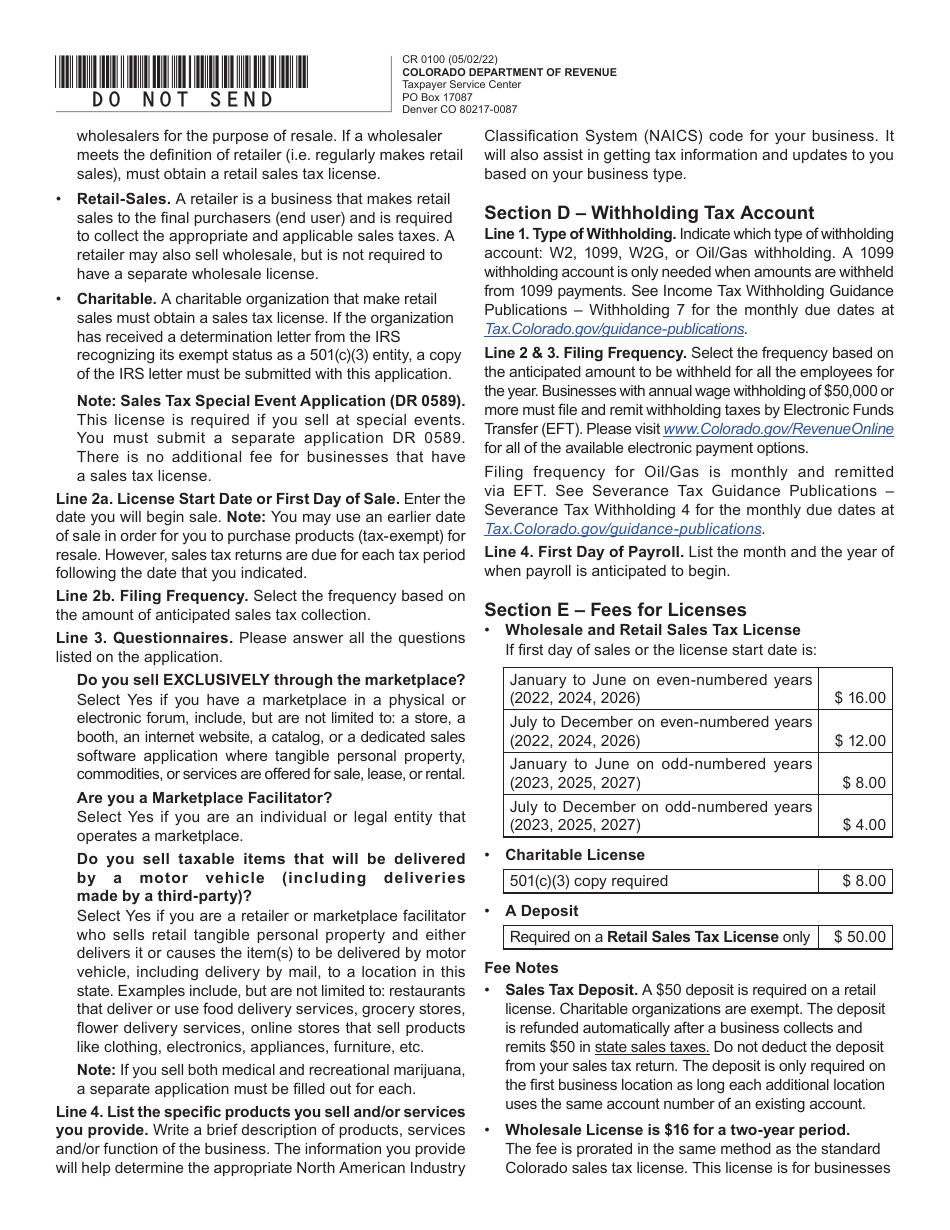

Q: Is there a fee to file Form CR0100?

A: No, there is no fee to file Form CR0100.

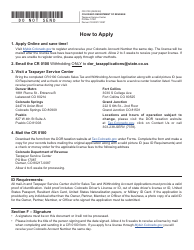

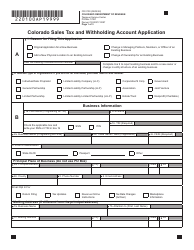

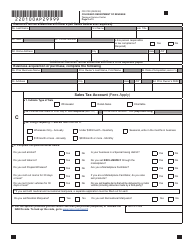

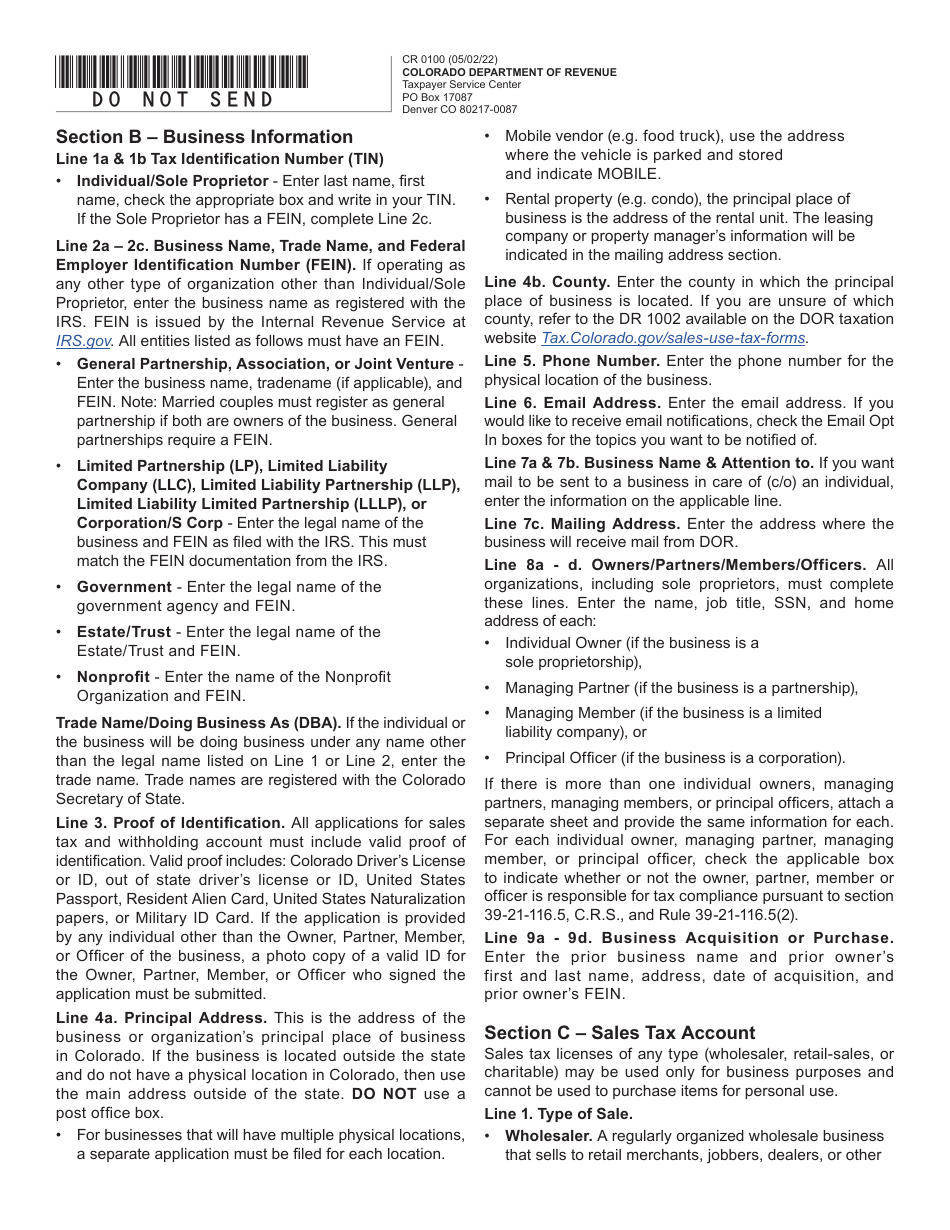

Q: What information is required to complete Form CR0100?

A: You will need to provide information about your business, including your name, address, federal employer identification number (FEIN), and a description of your business activities.

Q: When should I file Form CR0100?

A: Form CR0100 should be filed at least 15 days before you start collecting sales tax or withholding income tax.

Q: What happens after I file Form CR0100?

A: After you file Form CR0100, you will receive a sales tax account number and/or a withholding account number from the Colorado Department of Revenue.

Form Details:

- Released on May 2, 2022;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CR0100 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.