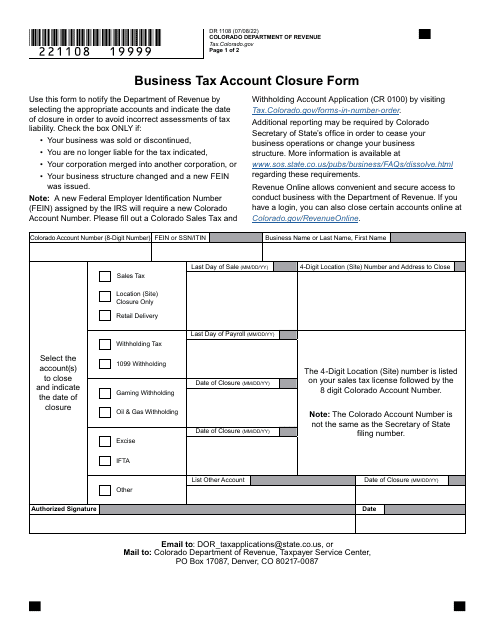

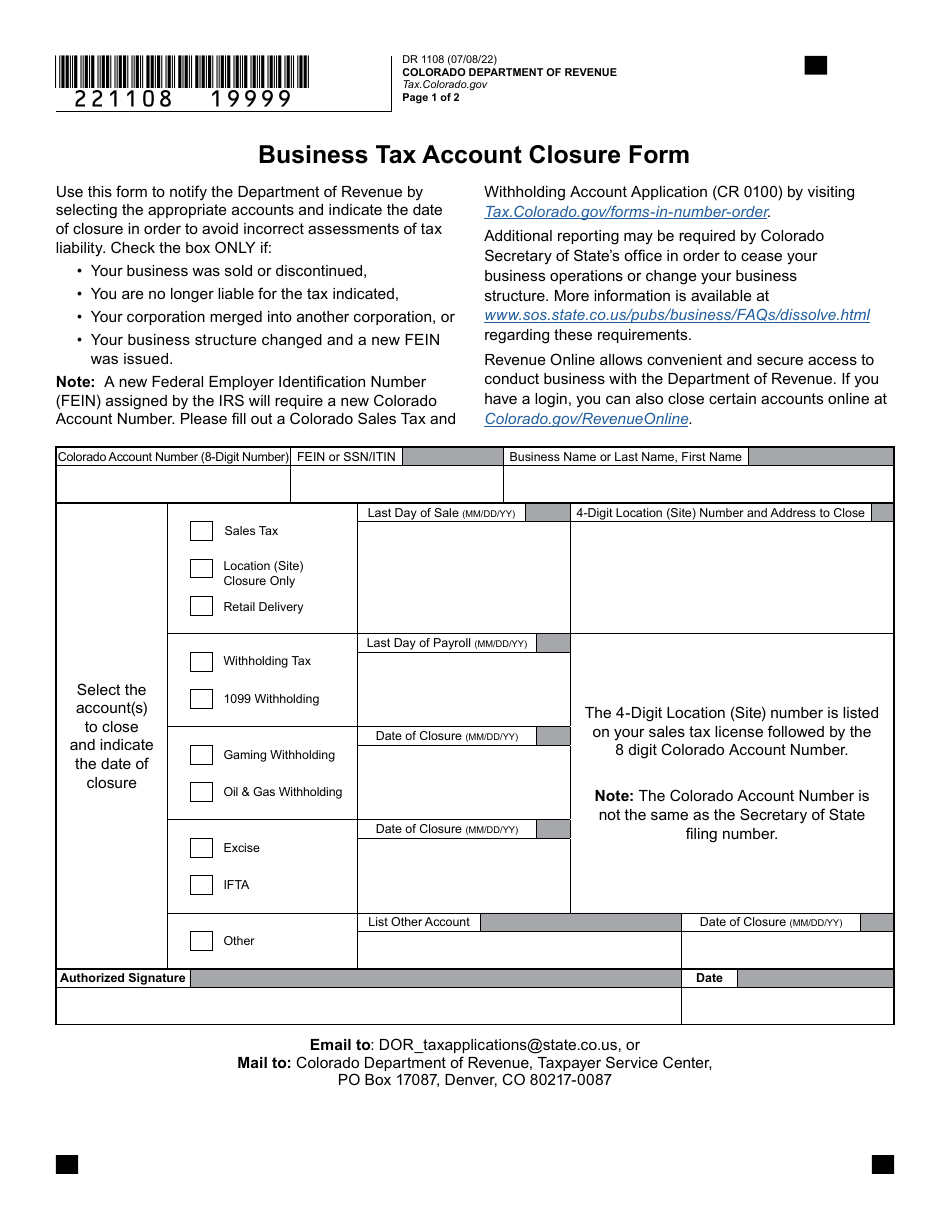

Form DR1108 Business Tax Account Closure Form - Colorado

What Is Form DR1108?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR1108?

A: Form DR1108 is the Business Tax Account Closure Form used in Colorado.

Q: What is the purpose of Form DR1108?

A: The purpose of Form DR1108 is for taxpayers to request the closure of their business tax account in Colorado.

Q: Who needs to file Form DR1108?

A: Any taxpayer who wants to close their business tax account in Colorado needs to file Form DR1108.

Q: Are there any fees associated with filing Form DR1108?

A: There are no fees associated with filing Form DR1108.

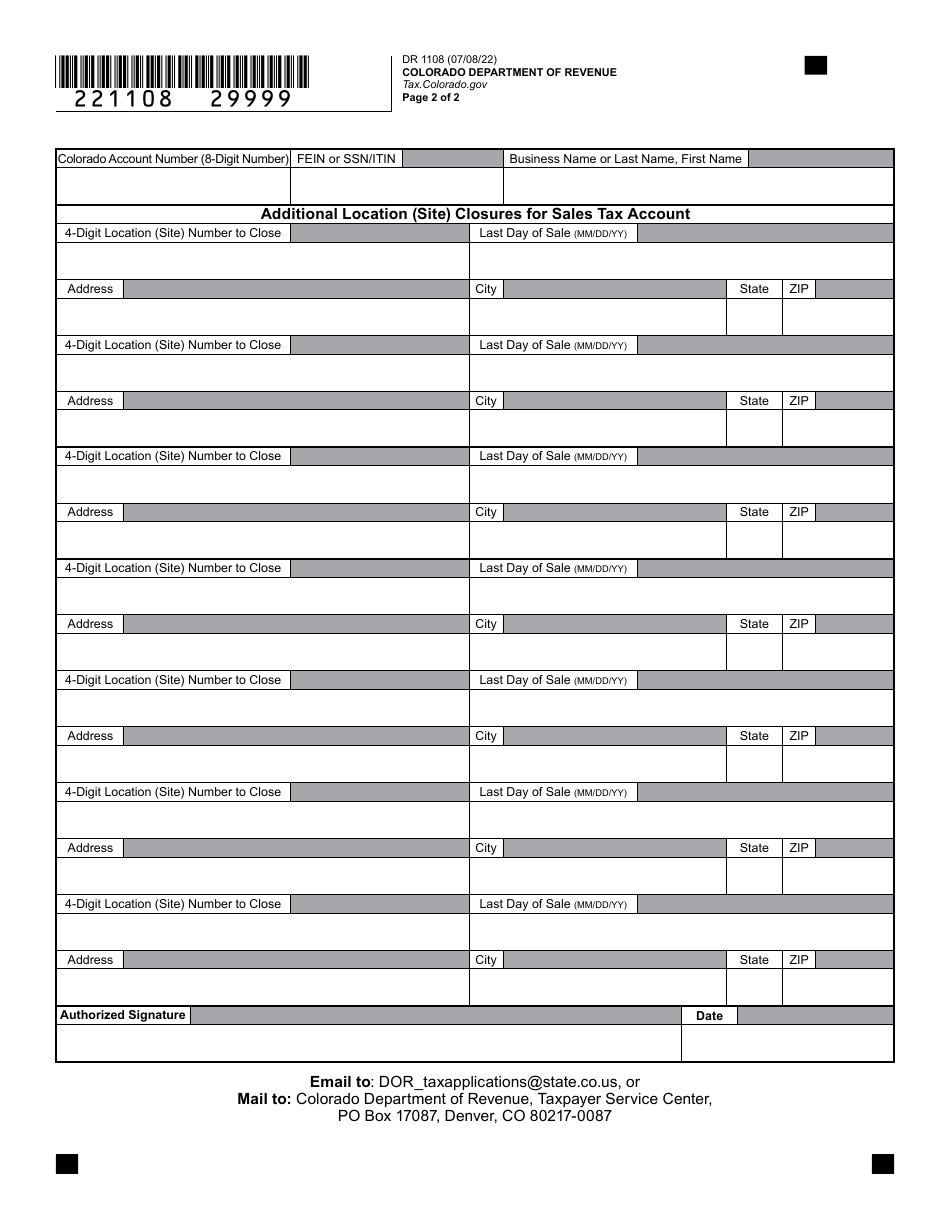

Q: What information do I need to provide on Form DR1108?

A: You will need to provide your business information, account number, reason for closure, and other relevant details.

Q: When should I file Form DR1108?

A: You should file Form DR1108 as soon as you decide to close your business tax account in Colorado.

Q: What happens after I file Form DR1108?

A: After you file Form DR1108, the Colorado Department of Revenue will review your request and process the closure of your business tax account.

Q: Do I need to notify any other agencies about the closure of my business tax account?

A: You may need to notify other state and local agencies about the closure of your business tax account, depending on their requirements.

Form Details:

- Released on July 8, 2022;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR1108 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.