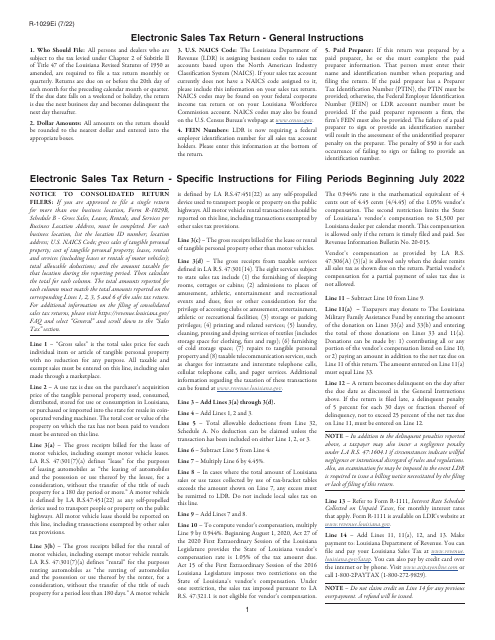

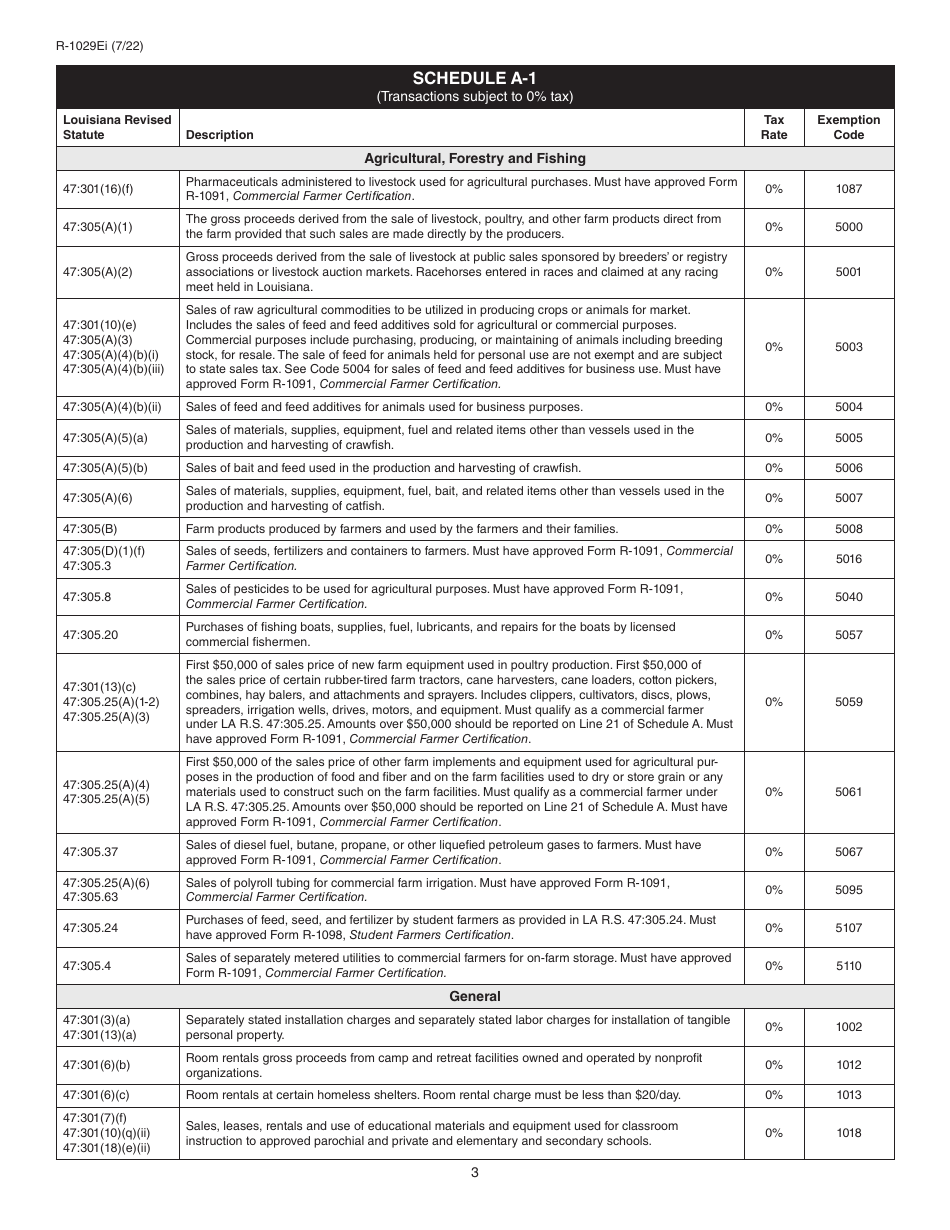

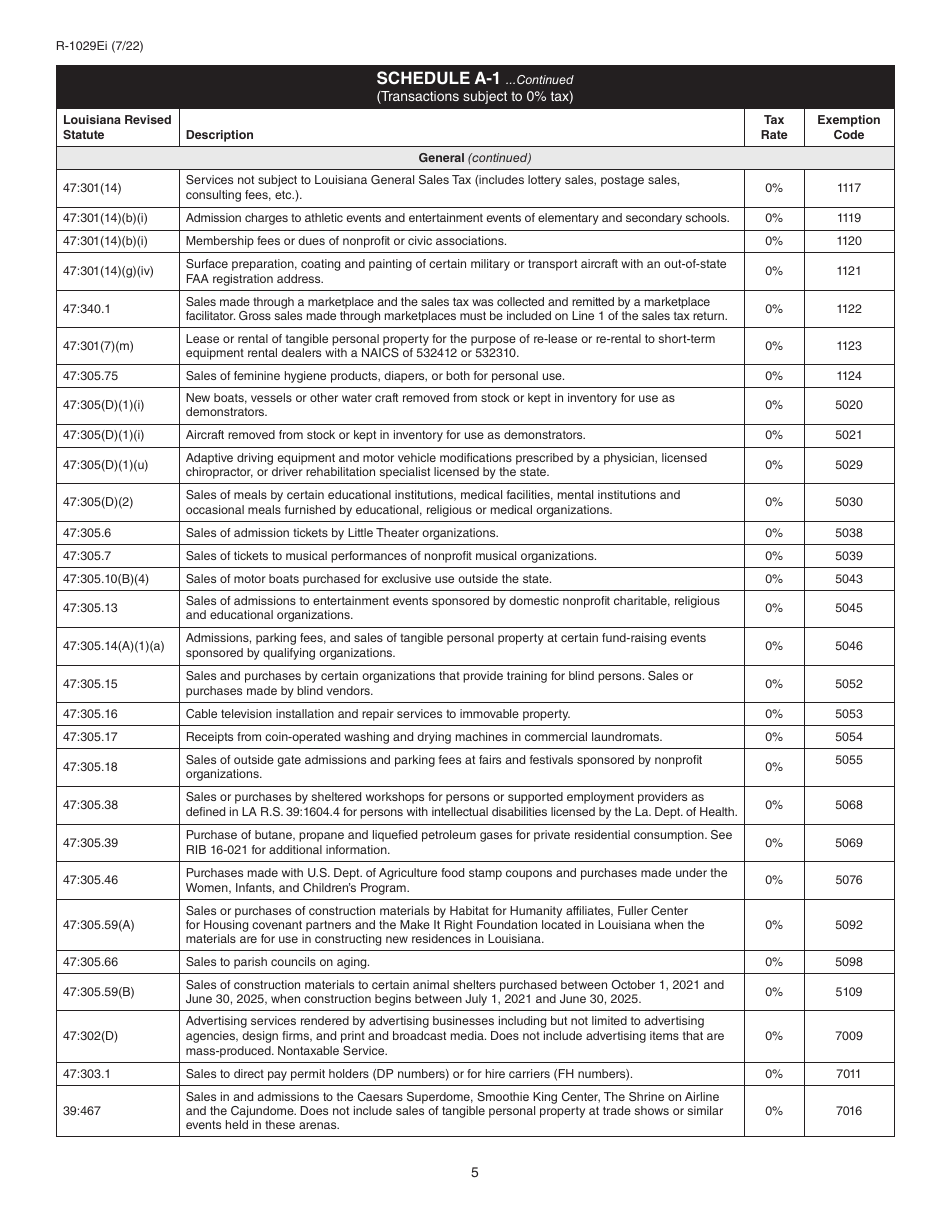

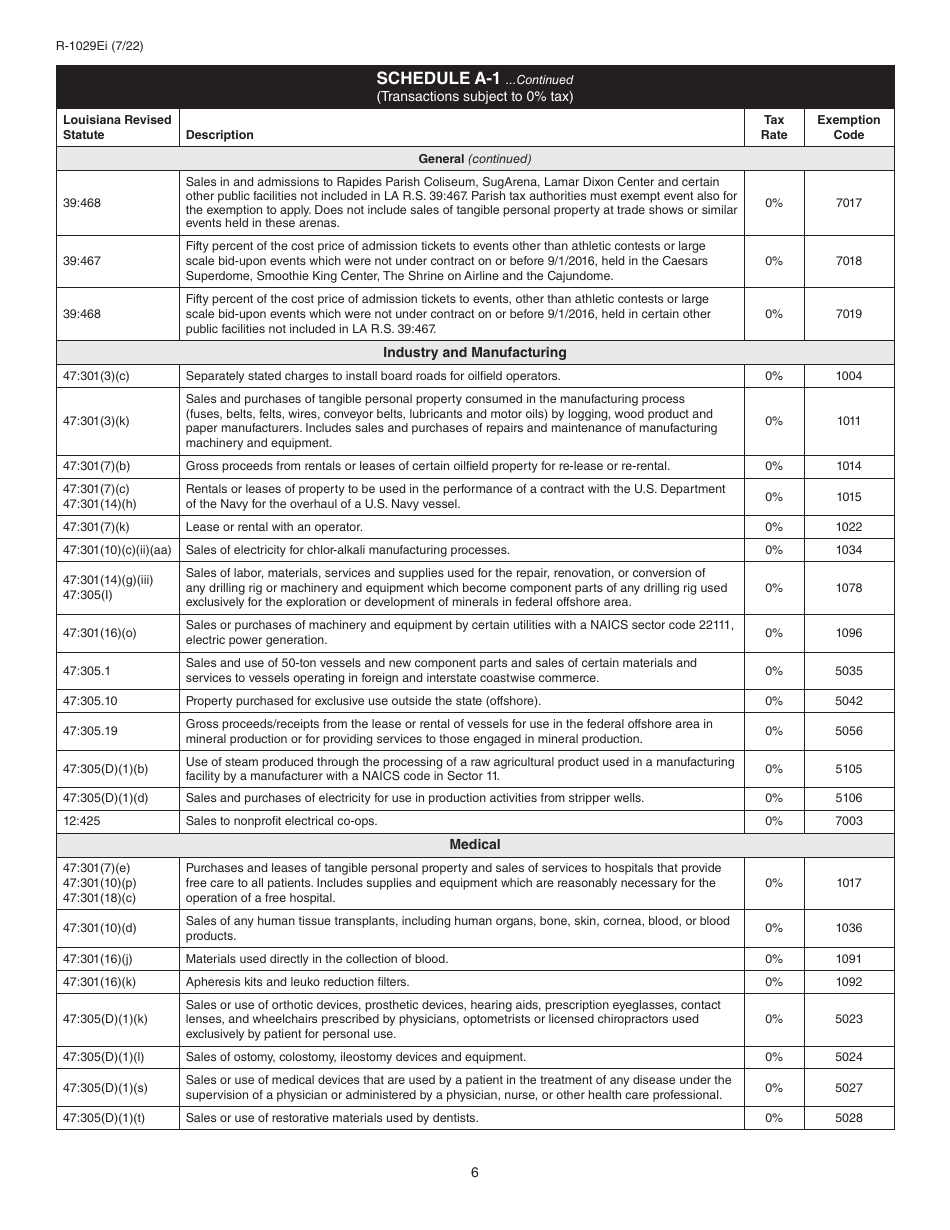

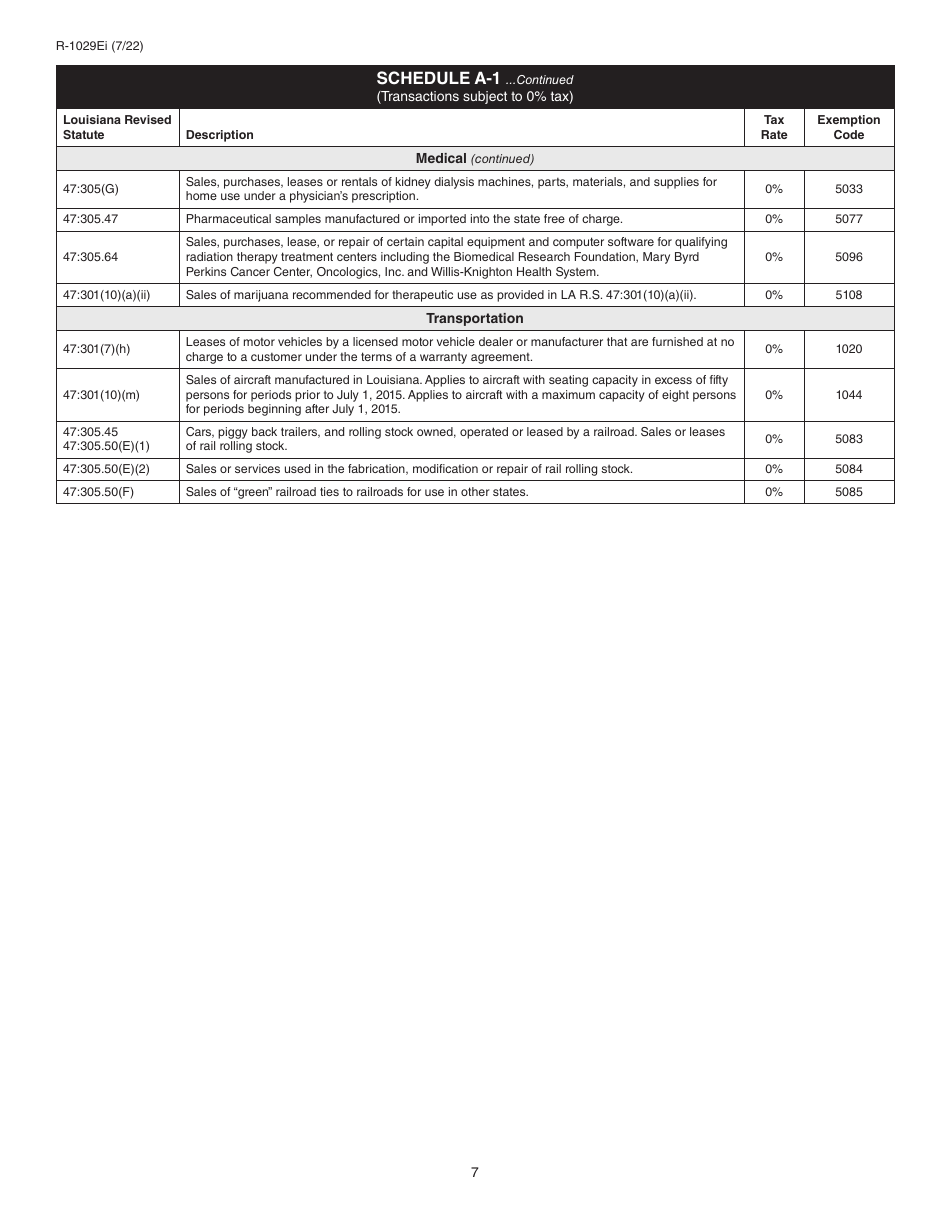

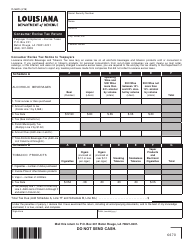

Instructions for Form R-1029E Electronic Sales Tax Return - Louisiana

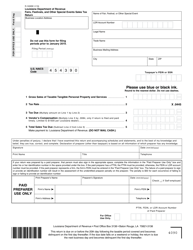

This document contains official instructions for Form R-1029E , Electronic Sales Tax Return - a form released and collected by the Louisiana Department of Revenue.

FAQ

Q: What is Form R-1029E?

A: Form R-1029E is an electronic sales tax return used in Louisiana.

Q: Who needs to file Form R-1029E?

A: Businesses engaged in selling taxable goods or services in Louisiana must file Form R-1029E.

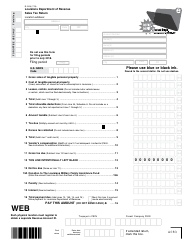

Q: Can I file Form R-1029E manually?

A: No, Form R-1029E can only be filed electronically.

Q: What information do I need to file Form R-1029E?

A: You need your Louisiana account number, gross sales amount, the amount of tax collected, and any credits to be claimed.

Q: What is the deadline to file Form R-1029E?

A: Form R-1029E must be filed monthly and the due date is the 20th of the following month.

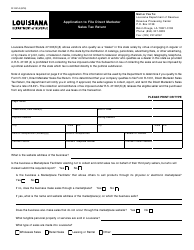

Q: Are there any penalties for late filing of Form R-1029E?

A: Yes, there are penalties for late filing or failure to file Form R-1029E.

Q: Can I make payments along with filing Form R-1029E?

A: Yes, you can make the payment electronically while filing Form R-1029E.

Q: What should I do with Form R-1029E once I file it?

A: Keep a copy of the completed form for your records.

Q: Are there any resources available to help me with filing Form R-1029E?

A: Yes, the Louisiana Department of Revenue provides resources and instructions to help you file Form R-1029E.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Louisiana Department of Revenue.